Where To Mail Form 9465

Where To Mail Form 9465 - Then, mail the form to the irs. Instead, call dec 23, 2021 cat. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Visit tax help from form 9465 for more information on paper filing. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. If you are filing form 9465 with your return, attach it to the front of your return when you file. If you owe $50,000 or less in taxes, penalties, and interest, you might be able to submit an online installment agreement application through the irs website. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. December 2018) department of the treasury internal revenue service.

Instead, call dec 23, 2021 cat. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. If you are filing this form with your tax return, attach it to the front of the return. No street address is needed. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Visit tax help from form 9465 for more information on paper filing. Web where to get form 9465: December 2018) department of the treasury internal revenue service. Where to mail form 9465

All pages of form 9465 are available on the irs website. Web how to file form 9465 & address to send to. If the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client address. Instead, call dec 23, 2021 cat. Then, mail the form to the irs. Where to mail form 9465 Web where to get form 9465: For instructions and the latest information. If you are filing form 9465 with your return, attach it to the front of your return when you file. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your.

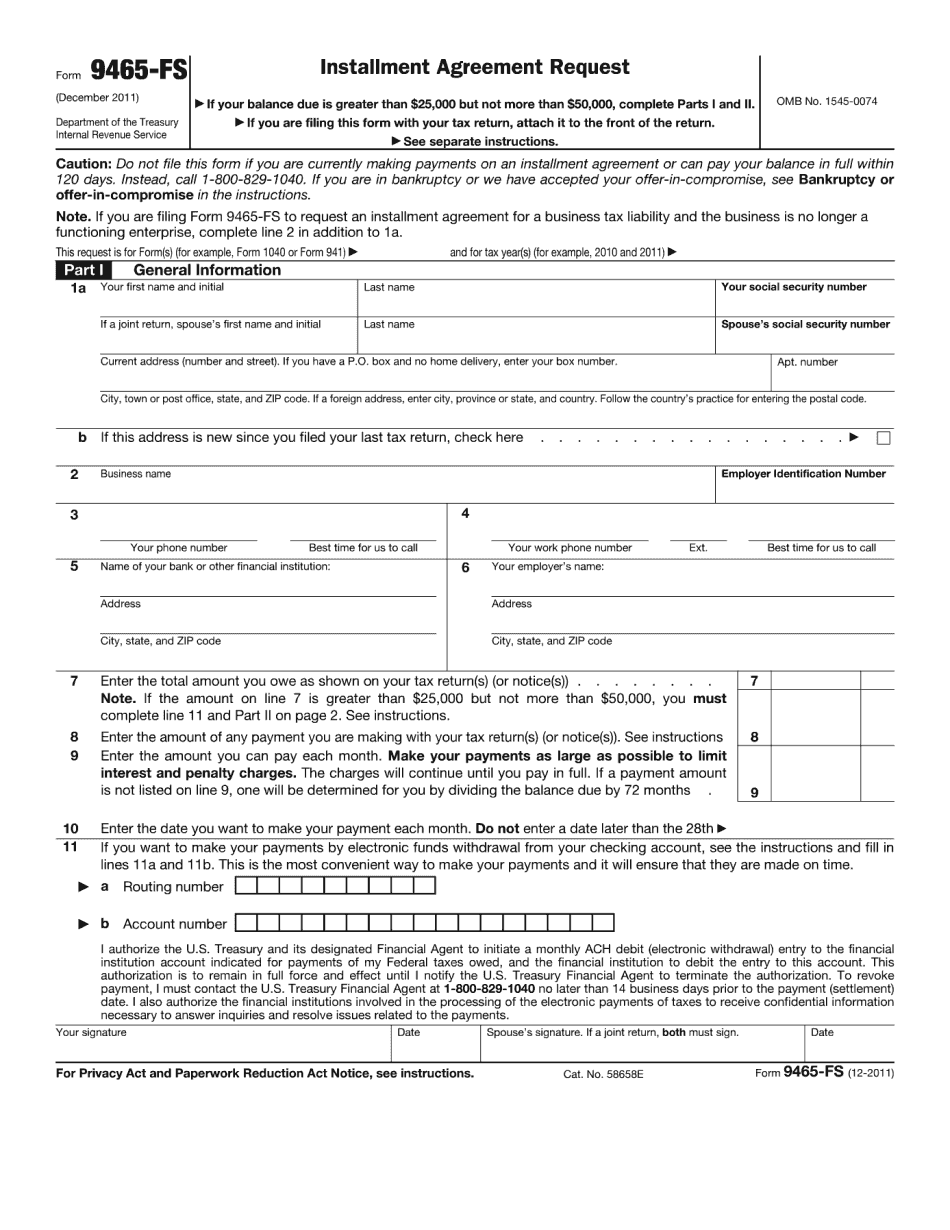

IRS Form 9465 Installment Agreement Request

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Web where to get form 9465: For instructions and the latest information. Web find out where.

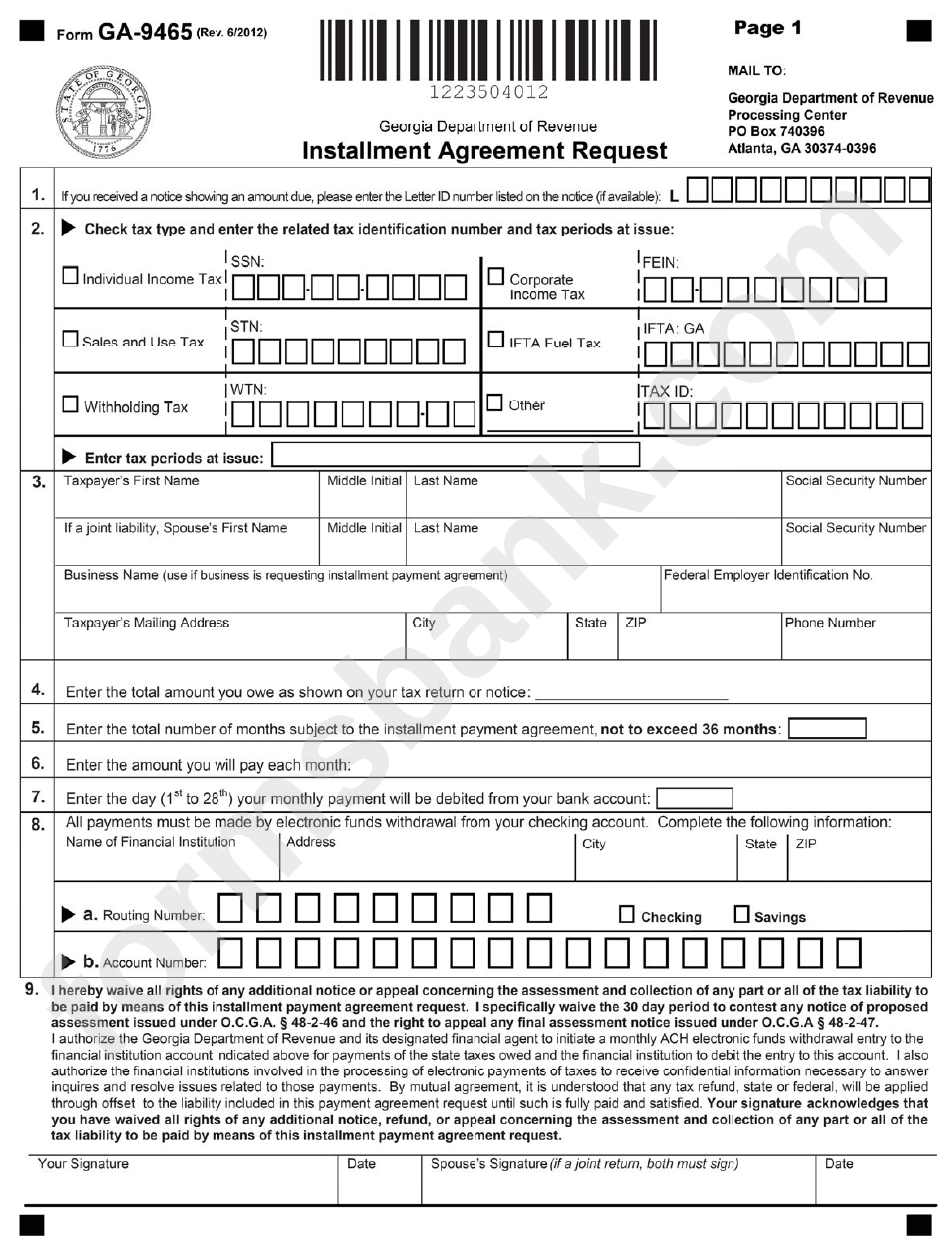

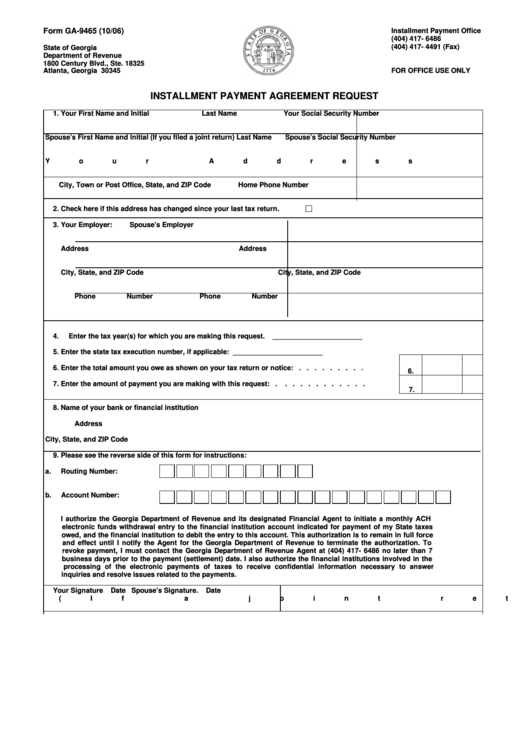

Form Ga9465 Installment Agreement Request printable pdf download

Where to mail form 9465 Visit tax help from form 9465 for more information on paper filing. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Web how to file form 9465 electronically. Web attach form 9465 to the.

Where To Mail Irs Installment Agreement Form 433 D Form Resume

If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web how to file form 9465 & address to send to. No street address is needed. If you have already.

Imágenes de Where Do I Mail Irs Installment Agreement Payments

If the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client address. Web how to file form 9465 & address to send to. Then, mail the form to the irs. If you are filing form 9465 with your return, attach it.

Form Ga9465 Installment Payment Agreement Request printable pdf download

No street address is needed. Web where to get form 9465: Where to mail form 9465 Web if the return is filed after march 31, it may take the irs longer to reply. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

If you are filing form 9465 with your return, attach it to the front of your return when you file. Then, mail the form to the irs. Visit tax help from form 9465 for more information on paper filing. If you owe $50,000 or less in taxes, penalties, and interest, you might be able to submit an online installment agreement.

IRS Form 9465 Instructions for How to Fill it Correctly

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. For instructions and the latest information. Where to mail form 9465 If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Visit tax help from form 9465 for more information.

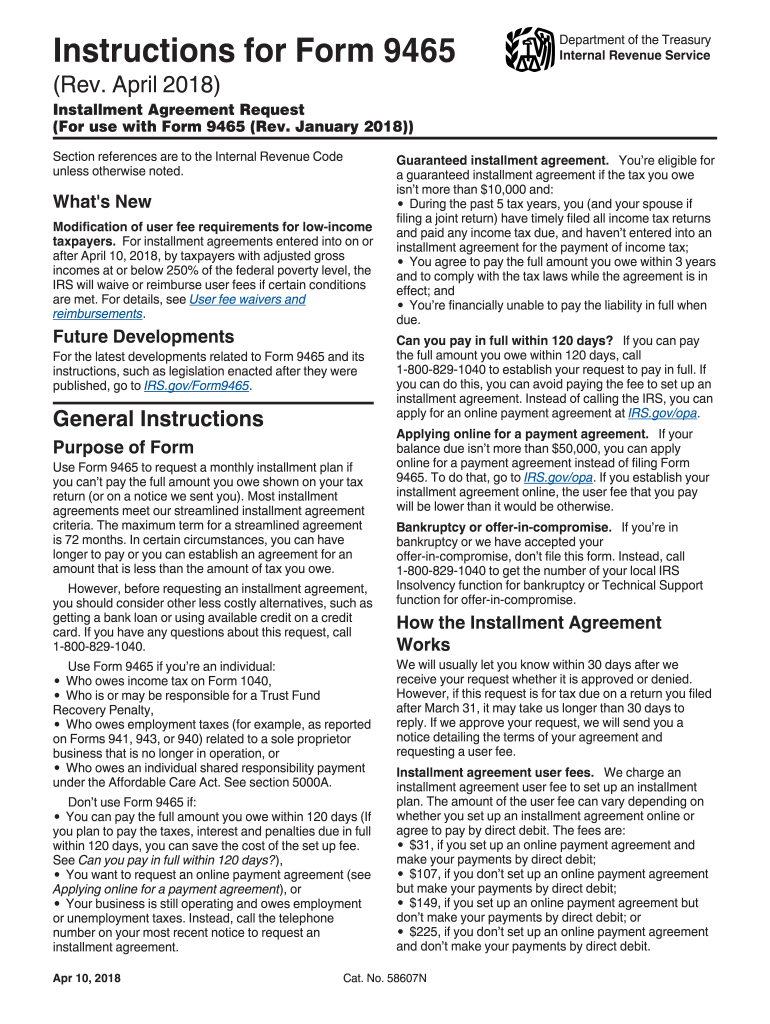

Instructions for Form 9465 Rev April Instructions for Form 9465

If the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client address. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you are filing this form with.

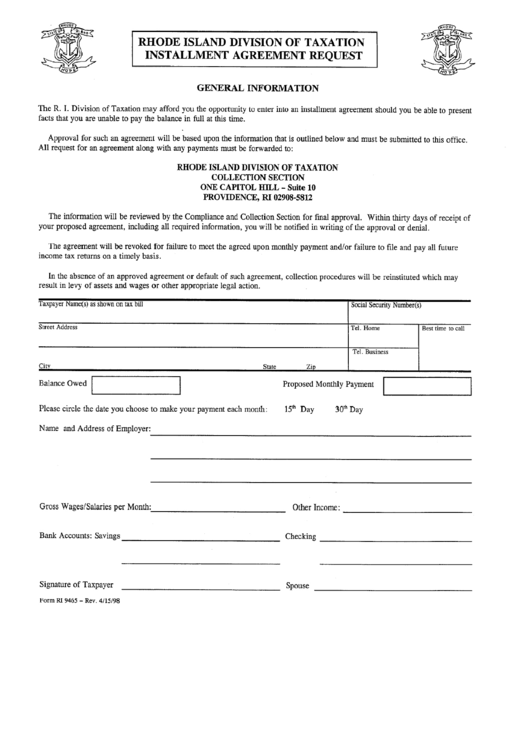

Form Ri 9465 Installment Agreement Request printable pdf download

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. For instructions and the latest information. December 2018) department of the treasury internal revenue service. If you have.

Irs Form 9465 Fillable and Editable PDF Template

You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If the return has already been filed or you're filing this.

If The Return Has Already Been Filed Or You're Filing This Form In Response To A Notice, Mail It To The Internal Revenue Service Center Address Shown Below The Client Address.

If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Web how to file form 9465 & address to send to.

Web Find Out Where To Mail Your Completed Form.

Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Instead, call dec 23, 2021 cat. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. No street address is needed.

Web Information About Form 9465, Installment Agreement Request, Including Recent Updates, Related Forms And Instructions On How To File.

All pages of form 9465 are available on the irs website. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If you are filing this form with your tax return, attach it to the front of the return. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you.

Then, Mail The Form To The Irs.

Web if the return is filed after march 31, it may take the irs longer to reply. For instructions and the latest information. Web where to get form 9465: Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/ecommerce-payment-pay-money-buy-form-9465-instructions-pb.jpg)