When Is Form 5500 Due With Extension

When Is Form 5500 Due With Extension - The irs form 5558, application for. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Your form 5500 entries will be initially screened electronically. For more information, see the instructions for electronic. Web for those with a due date of april 15 th, the extended due date is october 15 th. Web in section 1, new employees presenting an ead automatically extended by an individual notice must: An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of. Select “a noncitizen authorized to work until;” and. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application for an extension of time to file either form 5500 series. Web the agencies published a notice of proposed forms revisions in september 2021.

The irs form 5558, application for. Web for those with a due date of april 15 th, the extended due date is october 15 th. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain. Select “a noncitizen authorized to work until;” and. Web the income tax department today said a new milestone of itr filing has been achieved this year. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application for an extension of time to file either form 5500 series. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. For more information, see the instructions for electronic. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web the agencies published a notice of proposed forms revisions in september 2021.

Web in section 1, new employees presenting an ead automatically extended by an individual notice must: An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of. Web the agencies published a notice of proposed forms revisions in september 2021. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application for an extension of time to file either form 5500 series. A separate federal register notice was published in december 2021. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web the income tax department today said a new milestone of itr filing has been achieved this year. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain. Select “a noncitizen authorized to work until;” and. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan;

Retirement plan 5500 due date Early Retirement

Till 30th july (6.30 pm), more than 6 crore returns have been. Web (efast2), you must electronically file your 2019 form 5500. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. For more information, see the instructions for electronic. Web on october 5,.

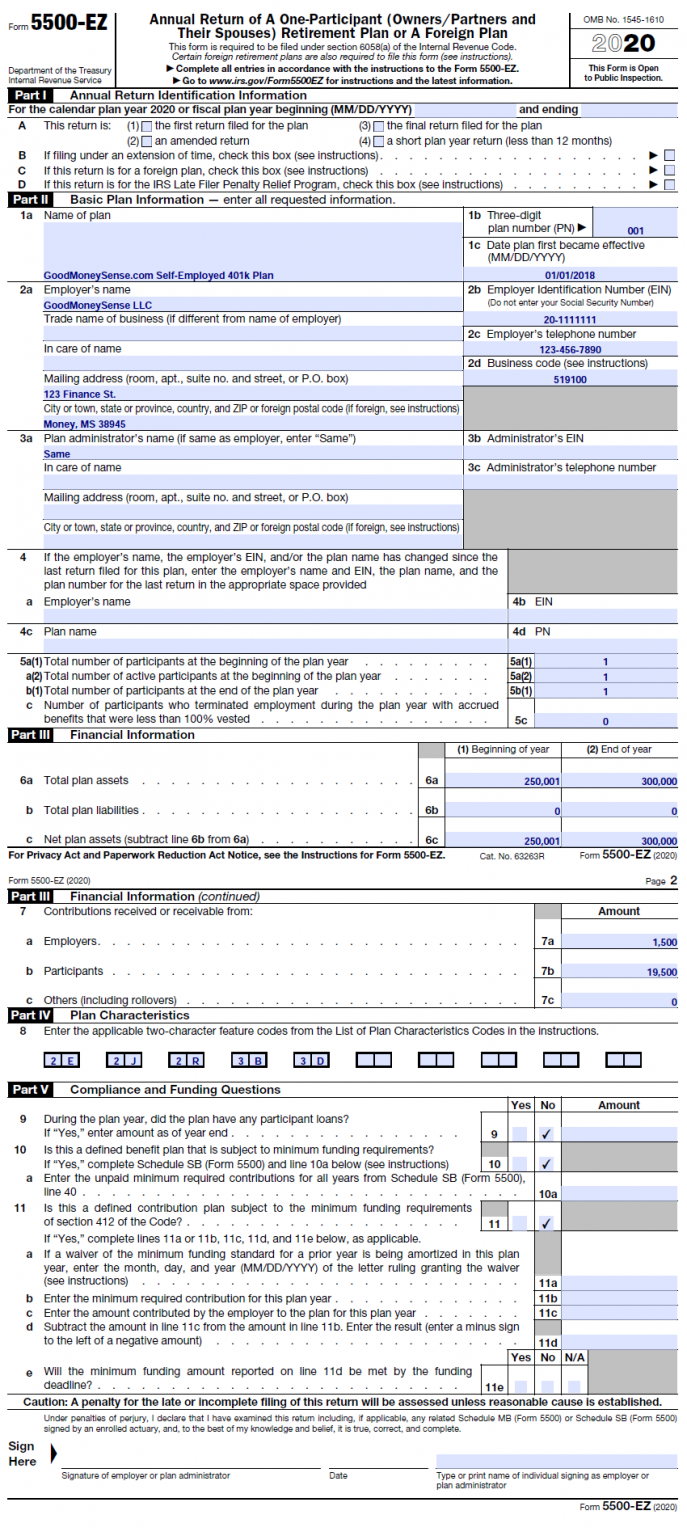

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Till 30th july (6.30 pm), more than 6 crore returns have been. Web for those with a due date of april 15 th, the extended due date is october 15 th. A separate federal.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web (efast2), you must electronically file your 2019 form 5500. Web in section 1, new employees presenting an ead automatically extended by an individual notice must: Web the income tax department today said a new milestone of itr filing has been achieved this year. Filing form 5558 the form 5558 is used specifically to extend the filing deadlines for certain..

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Web for those with a due date of april 15 th, the extended due date is october 15 th. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web typically, the form 5500 is due by july 31st for calendar year plans, with.

August 1st Form 5500 Due Matthews, Carter & Boyce

Web for plans that follow a calendar year, form 5500 for the prior year is due july 31, or oct. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan;.

5500 Extension Due To COVID 19 B3PA

Select “a noncitizen authorized to work until;” and. For more information, see the instructions for electronic. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain..

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. The irs form 5558, application for. Select “a noncitizen authorized to work until;” and. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application.

How to File Form 5500EZ Solo 401k

Till 30th july (6.30 pm), more than 6 crore returns have been. For more information, see the instructions for electronic. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web the income tax department today said a new milestone of itr filing has been achieved this year. Select “a.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

The irs form 5558, application for. Web for those with a due date of april 15 th, the extended due date is october 15 th. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application for an extension of time to file either form 5500 series. Select “a noncitizen authorized.

Form 5500 Instructions 5 Steps to Filing Correctly

An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of. Web for those with a due date of april 15 th, the extended due date is october 15 th. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application.

Filing Form 5558 The Form 5558 Is Used Specifically To Extend The Filing Deadlines For Certain.

Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Your form 5500 entries will be initially screened electronically. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain.

An Extension For Filing Form 5500 (Annual Return/Report Of Employee Benefit Plan) Is Obtained By Filing Form 5558 (Application For Extension Of.

For more information, see the instructions for electronic. 15th, but if the filing due date falls on a saturday, sunday or. Web the agencies published a notice of proposed forms revisions in september 2021. Web (efast2), you must electronically file your 2019 form 5500.

Web For Plans That Follow A Calendar Year, Form 5500 For The Prior Year Is Due July 31, Or Oct.

A separate federal register notice was published in december 2021. Web the income tax department today said a new milestone of itr filing has been achieved this year. The irs form 5558, application for. Web in section 1, new employees presenting an ead automatically extended by an individual notice must:

Web For Those With A Due Date Of April 15 Th, The Extended Due Date Is October 15 Th.

Select “a noncitizen authorized to work until;” and. Till 30th july (6.30 pm), more than 6 crore returns have been. Web understanding your cp216h notice what this notice is about we send the cp216h notice when we deny your application for an extension of time to file either form 5500 series. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)