2024 W2 Form

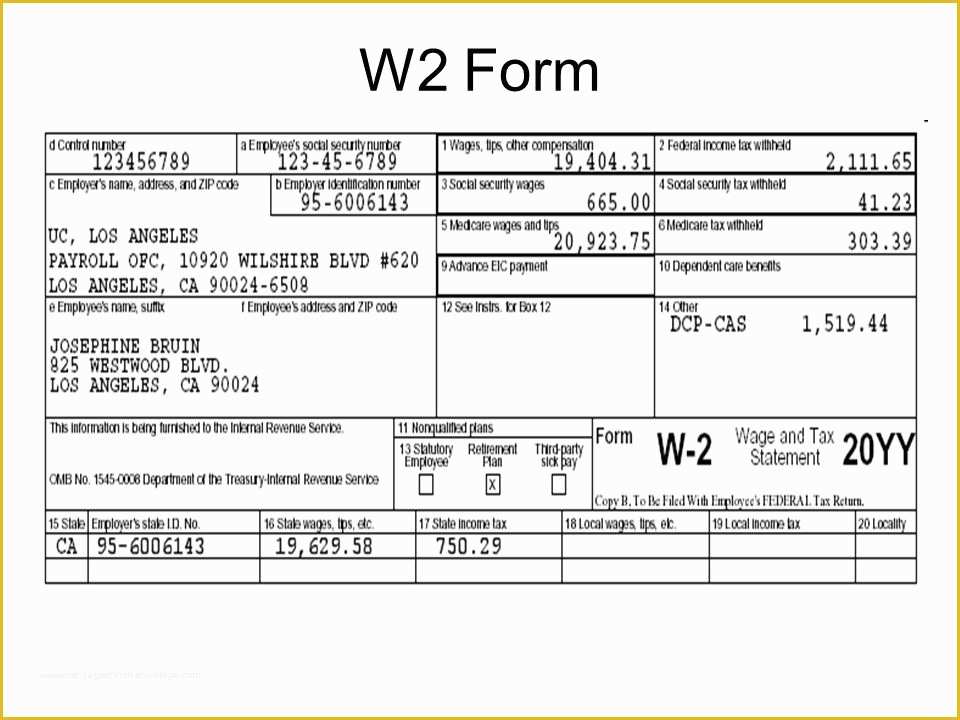

2024 W2 Form - Wage and income transcripts are available for up to 10 years but current. The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. 08/01/23)” to comply with their employment eligibility verification responsibilities. Web for 2023, 2024, workers should expect to receive their w2 by january 31st at the latest, as businesses have the responsibility to provide these tax documents to all employees for their income tax returns. It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. Web a w2 is a tax form that documents money paid to you and money withheld from your paycheck. Web if the total is at least 10 returns, they must file them all electronically. This document has all of the information you will need to fill out the financial information for your personal taxes. Until final regulations are issued, however, the number remains. The draft includes a new code ii for box 12, for medicare waiver payments.

The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. Web for 2023, 2024, workers should expect to receive their w2 by january 31st at the latest, as businesses have the responsibility to provide these tax documents to all employees for their income tax returns. Most requests will be processed within 10 business days from the irs received date. Wage and income transcripts are available for up to 10 years but current. Web a w2 is a tax form that documents money paid to you and money withheld from your paycheck. Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. 08/01/23)” to comply with their employment eligibility verification responsibilities. It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. The version date is located in the bottom corner of the form. This document has all of the information you will need to fill out the financial information for your personal taxes.

The version date is located in the bottom corner of the form. 08/01/23)” to comply with their employment eligibility verification responsibilities. The draft includes a new code ii for box 12, for medicare waiver payments. Government regulations also require companies to send out w2 forms by this deadline. Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. Most requests will be processed within 10 business days from the irs received date. Web a w2 is a tax form that documents money paid to you and money withheld from your paycheck. Until final regulations are issued, however, the number remains. Web if the total is at least 10 returns, they must file them all electronically. The new threshold is effective for information returns required to be filed in calendar years beginning with 2024.

W2 Form 2020 Online Print and Download Stubcheck

The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. Until final regulations are issued, however, the number remains. Most requests will be processed within 10 business days from the irs received date. The.

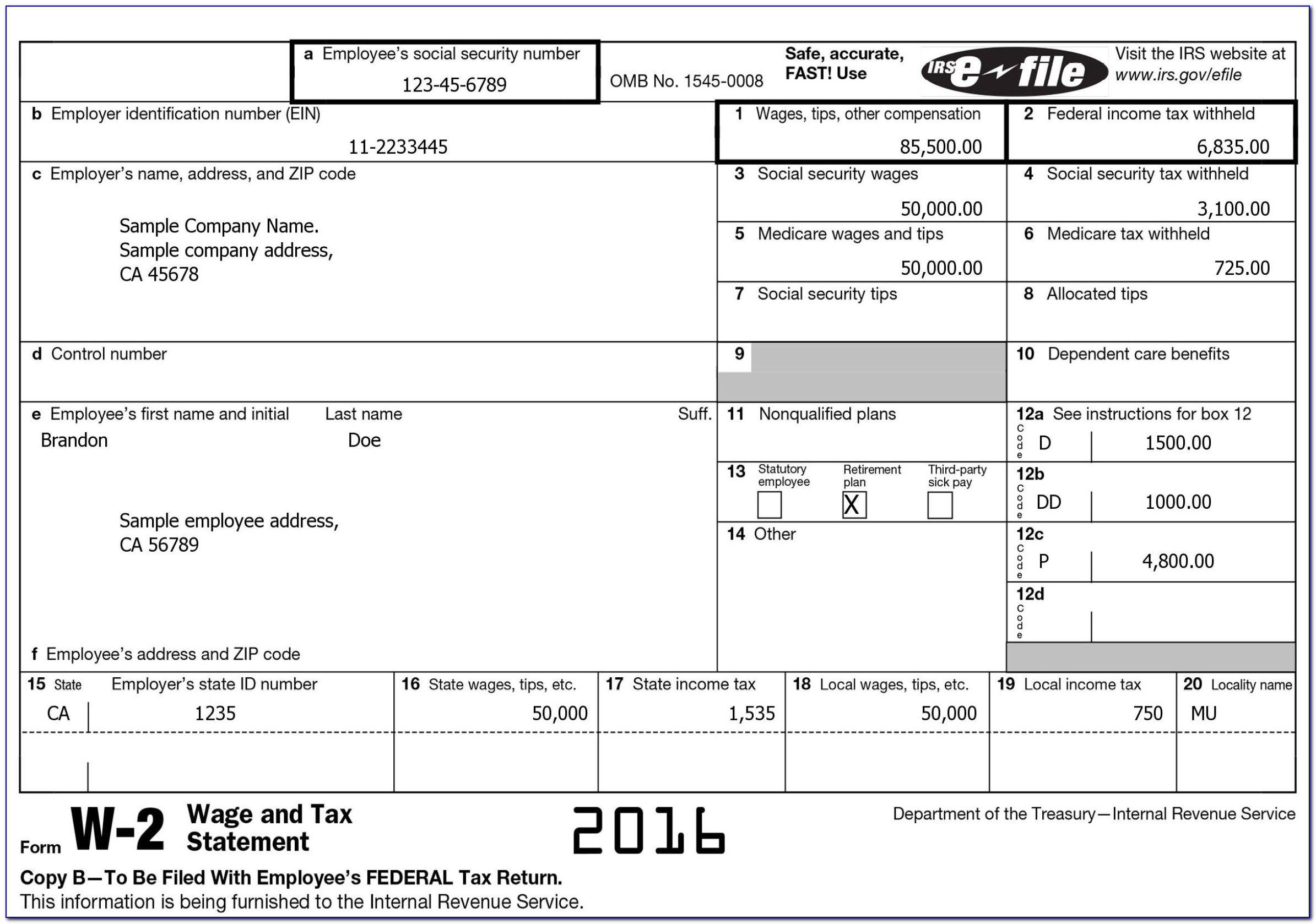

ezAccounting Payroll How to Print Form W2

Wage and income transcripts are available for up to 10 years but current. The draft includes a new code ii for box 12, for medicare waiver payments. Web for 2023, 2024, workers should expect to receive their w2 by january 31st at the latest, as businesses have the responsibility to provide these tax documents to all employees for their income.

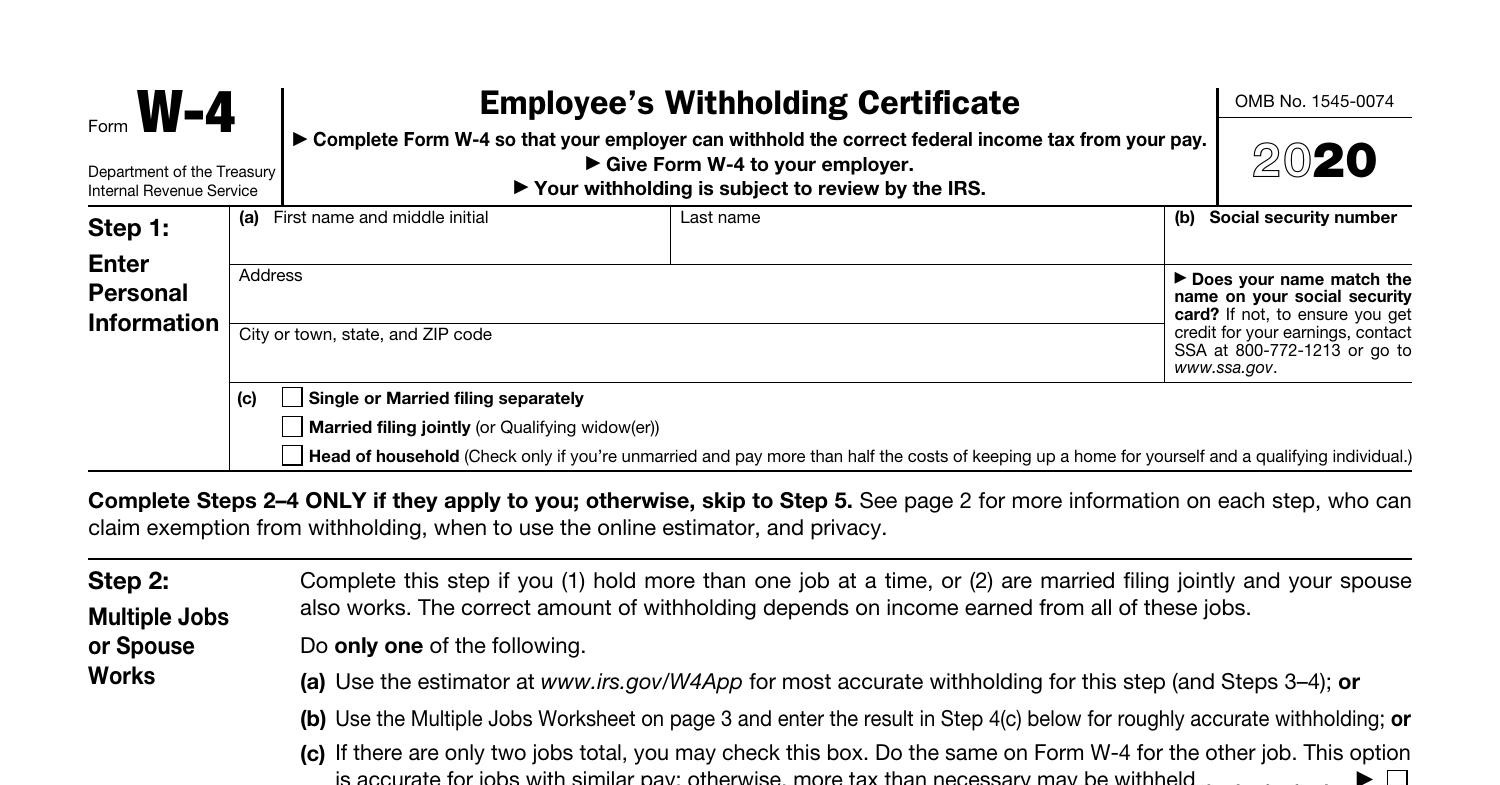

Form W4 2020.pdf DocDroid

Until final regulations are issued, however, the number remains. The version date is located in the bottom corner of the form. Wage and income transcripts are available for up to 10 years but current. It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. Web for 2023, 2024, workers should.

Free W2 Template Of Fake Std Test Results form forms 6993

Government regulations also require companies to send out w2 forms by this deadline. The draft includes a new code ii for box 12, for medicare waiver payments. Most requests will be processed within 10 business days from the irs received date. Web if the total is at least 10 returns, they must file them all electronically. This document has all.

W2 Form Fillable 2016 Form Resume Examples qQ5M09XDXg

Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. Until final regulations are issued, however, the number remains. The version date is located in the bottom corner of the form. Web a w2 is a tax form that documents money paid to you and money withheld from your paycheck. Most requests.

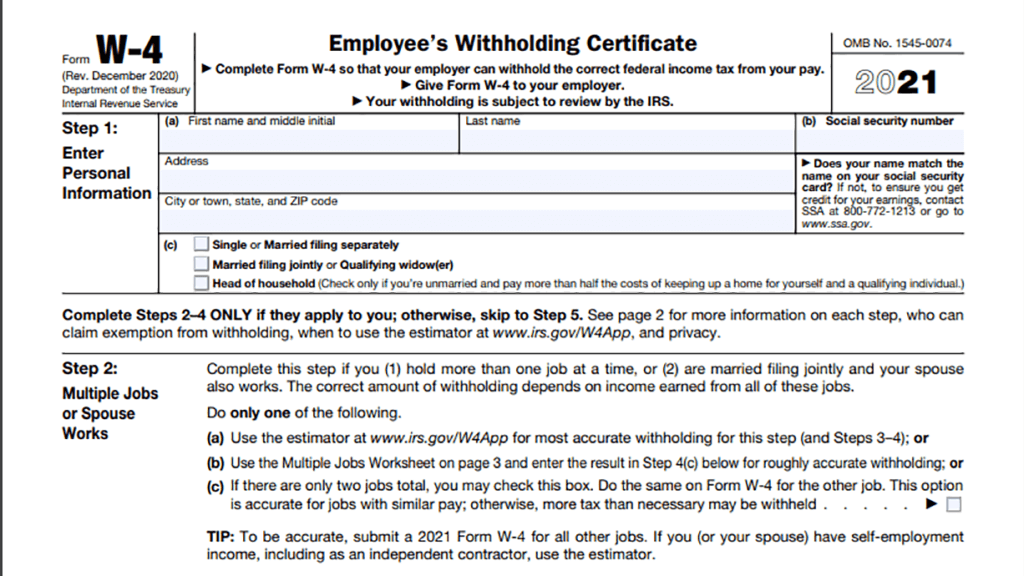

MO W4 2020 Fill out Tax Template Online US Legal Forms

It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. The version date is located in the bottom corner of the form. Government regulations also require companies to send out w2 forms by this deadline. Web a w2 is a tax form that documents money paid to you and money.

Tax Refund Calculator 2020 Cheap Supplier, Save 69 jlcatj.gob.mx

Web for 2023, 2024, workers should expect to receive their w2 by january 31st at the latest, as businesses have the responsibility to provide these tax documents to all employees for their income tax returns. 08/01/23)” to comply with their employment eligibility verification responsibilities. The new threshold is effective for information returns required to be filed in calendar years beginning.

What you should know about the new Form W4 Atlantic Payroll Partners

The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. Government regulations also require companies to send out w2 forms by this deadline. Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. Web for 2023, 2024, workers should expect to receive their w2.

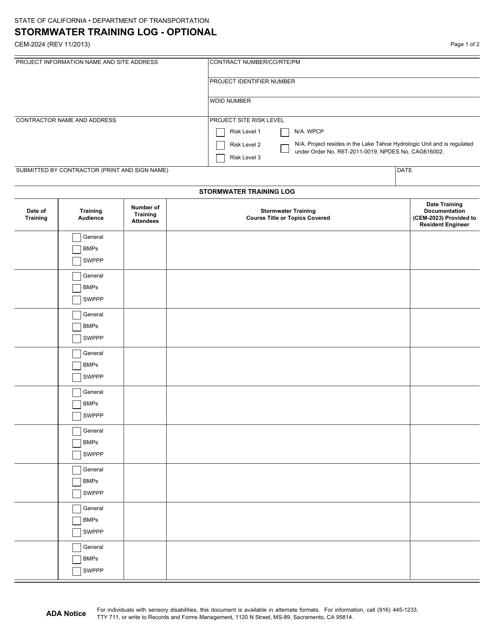

Form CEM2024 Download Fillable PDF or Fill Online Stormwater Training

08/01/23)” to comply with their employment eligibility verification responsibilities. Web if the total is at least 10 returns, they must file them all electronically. Most requests will be processed within 10 business days from the irs received date. It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. This document.

Treasury and IRS unveil new Form W4 for 2020 Tax Pro Today

Most requests will be processed within 10 business days from the irs received date. Web for 2023, 2024, workers should expect to receive their w2 by january 31st at the latest, as businesses have the responsibility to provide these tax documents to all employees for their income tax returns. Web a w2 is a tax form that documents money paid.

Web For 2023, 2024, Workers Should Expect To Receive Their W2 By January 31St At The Latest, As Businesses Have The Responsibility To Provide These Tax Documents To All Employees For Their Income Tax Returns.

Until final regulations are issued, however, the number remains. 08/01/23)” to comply with their employment eligibility verification responsibilities. It includes your commissions, tips, wages, and the taxes withheld from your income for federal, state, and social security purposes. Government regulations also require companies to send out w2 forms by this deadline.

The New Threshold Is Effective For Information Returns Required To Be Filed In Calendar Years Beginning With 2024.

The version date is located in the bottom corner of the form. Web a w2 is a tax form that documents money paid to you and money withheld from your paycheck. Tax returns required to be filed in 2024, we will post an article at irs.gov/formw2 explaining the change. Most requests will be processed within 10 business days from the irs received date.

Web If The Total Is At Least 10 Returns, They Must File Them All Electronically.

Wage and income transcripts are available for up to 10 years but current. This document has all of the information you will need to fill out the financial information for your personal taxes. The draft includes a new code ii for box 12, for medicare waiver payments.