What Is Form 3921

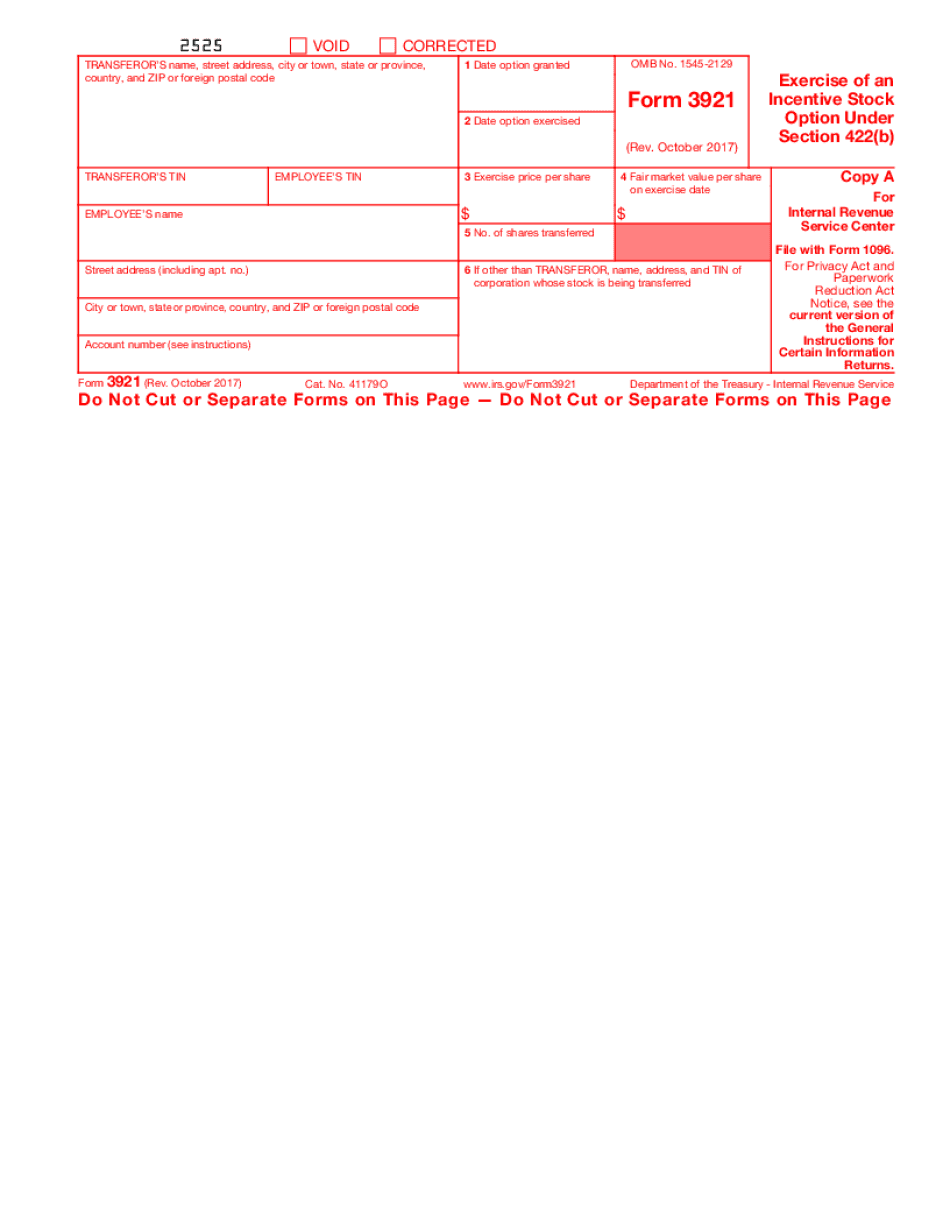

What Is Form 3921 - Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. One form needs to be filed for each transfer of stock that. Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web form 3921 is a form that companies must file with the irs when a specified employee exercises an incentive stock option (iso). Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos).

Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web this form documents to the irs that you have exercised stock options from your employer, and reports any unrealized losses and gains affiliated with those stocks. One form needs to be filed for each transfer of stock that. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. This form has to be filled. The form is filed with the internal. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web incentive stock options (isos) are a type of employee compensation in the form of stock rather than cash. Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section.

Web this form documents to the irs that you have exercised stock options from your employer, and reports any unrealized losses and gains affiliated with those stocks. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web incentive stock options (isos) are a type of employee compensation in the form of stock rather than cash. Web if you sold some or all of the stock then you can use the form 3921 to help determine the basis of the stock when you enter the sale via the stocks, mutual funds,. The form is filed with the internal. This form must be filed for the. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso.

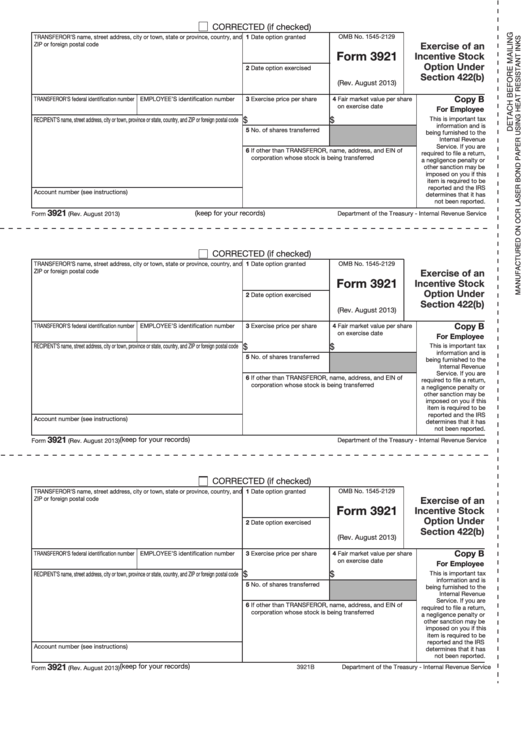

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web form 3921 is a form that companies must file with the irs when a specified employee exercises an incentive stock option (iso). Although this information is not taxable unless. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Web.

What do I do with Form 3921? (Exercise of ISO) r/tax

Web form 3921 is a form that companies must file with the irs when a specified employee exercises an incentive stock option (iso). Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web every corporation which in any calendar year transfers.

Learn About ISO If You Have Stock Options, You Need Tax Form 3921

Web if you sold some or all of the stock then you can use the form 3921 to help determine the basis of the stock when you enter the sale via the stocks, mutual funds,. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Your employer.

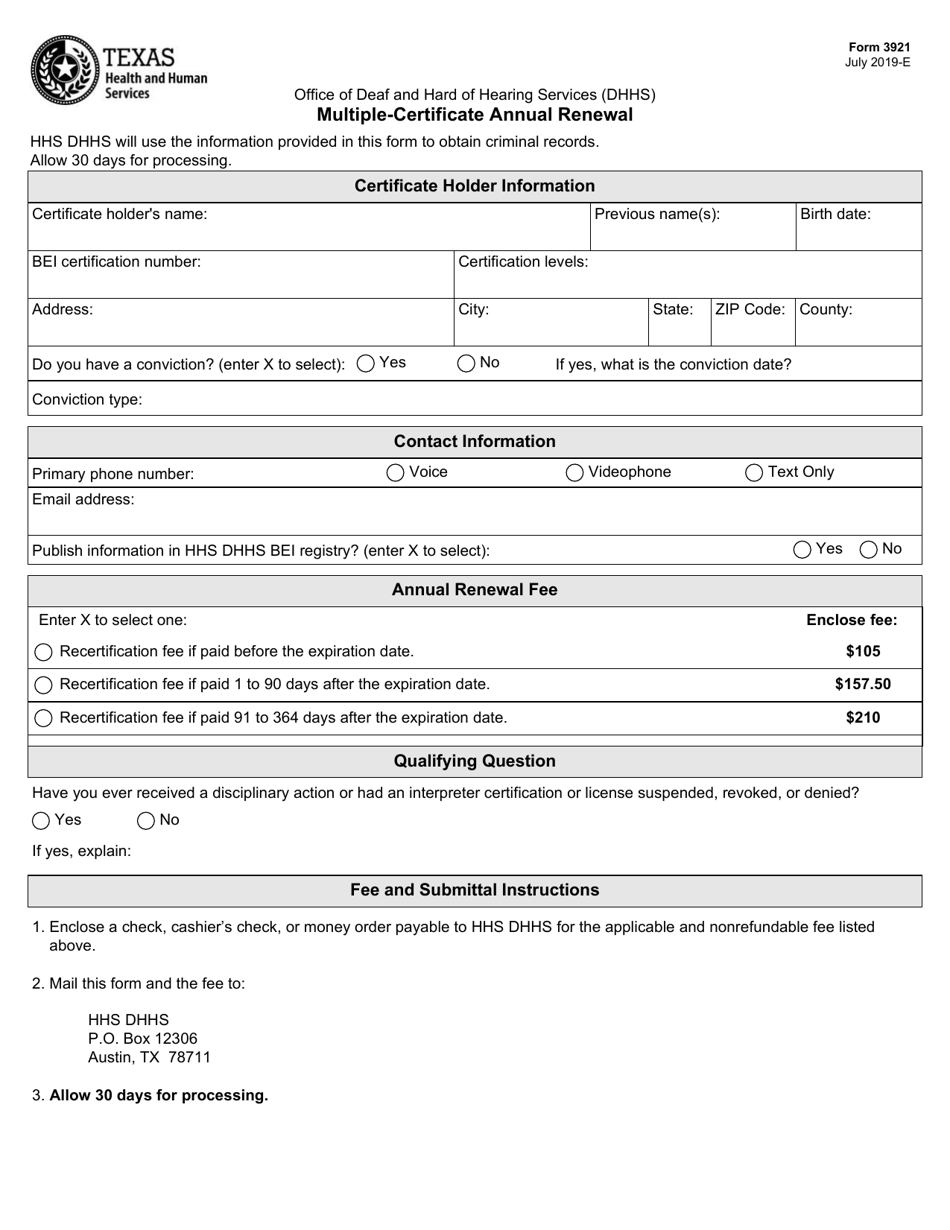

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web if you sold some or all of the stock then you can use the form 3921 to help determine the basis of the stock when you enter the sale via the.

Requesting your TCC for Form 3921 & 3922

Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Note that iso’s.

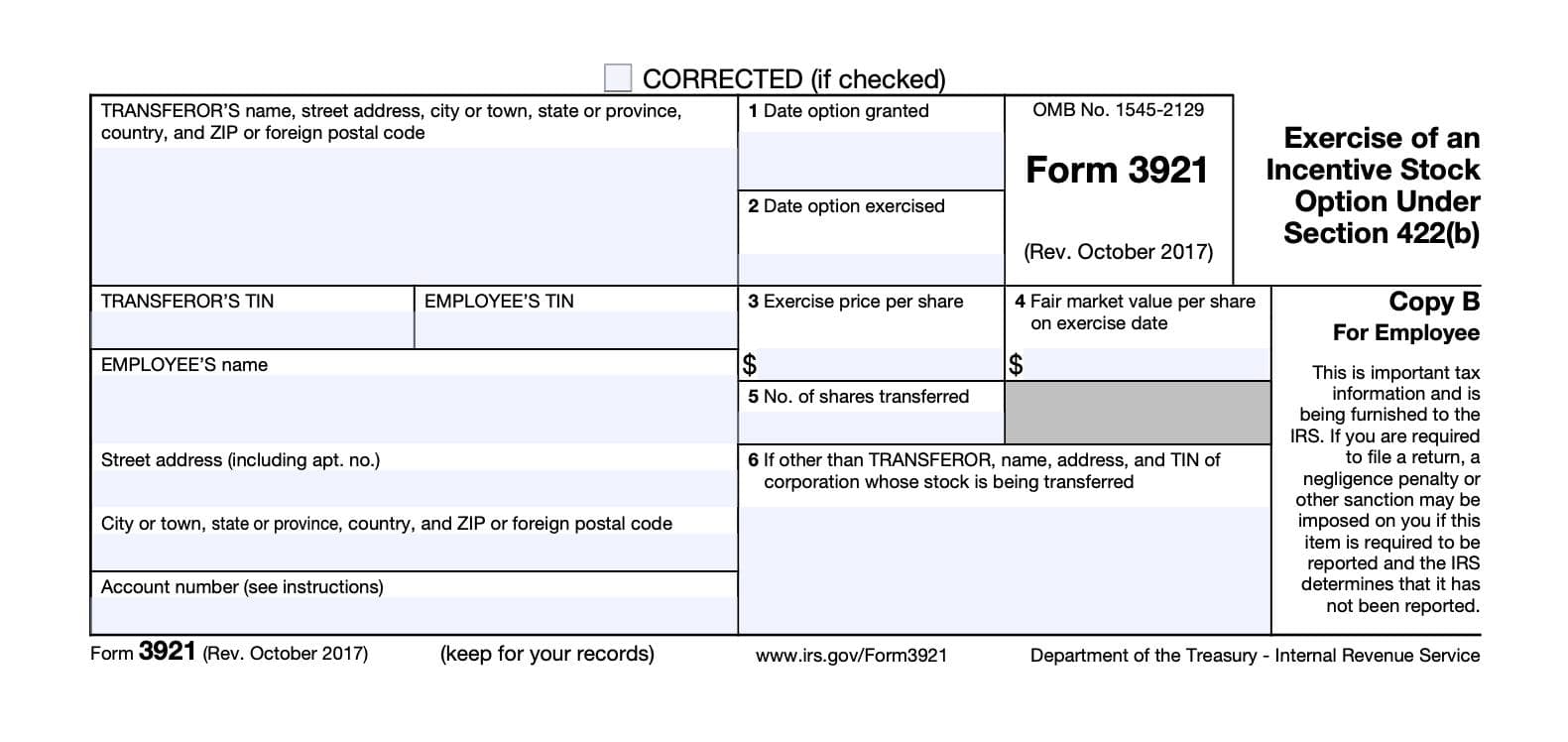

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web who must file. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Note that iso’s can only be issued to startup employees, not contractors. Your employer grants you an option to purchase stock in. Web form 3921 is a.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Web form 3921 is an irs form that is used by companies to report when a specific employee exercises an incentive stock option (iso). Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web form 3921 is a form that companies.

What Are a Company's Tax Reporting Obligations for Incentive Stock

Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web who must file. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive. Web every corporation which in any calendar year.

Form 3921 Everything you need to know

One form needs to be filed for each transfer of stock that. Your employer grants you an option to purchase stock in. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web this form documents to the irs that you have exercised stock options from your employer, and reports any.

Form 3921 Download Printable PDF Template

Web form 3921 is an informational form that helps the irs (as well as the employee exercising the options) verify what those implications might be. Web form 3921 is a form that companies must file with the irs when a specified employee exercises an incentive stock option (iso). One form needs to be filed for each transfer of stock that..

Web Form 3921 Is A Form That Companies Must File With The Irs When A Specified Employee Exercises An Incentive Stock Option (Iso).

One form needs to be filed for each transfer of stock that. Your employer grants you an option to purchase stock in. Web incentive stock options (isos) are a type of employee compensation in the form of stock rather than cash. Although this information is not taxable unless.

Web Form 3921 Is Generally Informational Unless Stock Acquired Through An Incentive Stock Option Is Sold Or Otherwise Disposed.

Web this form documents to the irs that you have exercised stock options from your employer, and reports any unrealized losses and gains affiliated with those stocks. The form is filed with the internal. Web who must file. This form must be filed for the.

Web Form 3921 Is An Informational Form That Helps The Irs (As Well As The Employee Exercising The Options) Verify What Those Implications Might Be.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted. Web form 3921 is an irs form that reports the exercise of an employee incentive stock option (isos). Web form 3921 is an irs form that is used by companies to report when a specific employee exercises an incentive stock option (iso).

Web Form 3921 Is A Tax Form That Is Required To Be Filed With The Internal Revenue Service (Irs) When An Employee Exercises Isos Or Incentive Stock Options (Isos).

Note that iso’s can only be issued to startup employees, not contractors. This form has to be filled. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive.