Form 8843 Instruction

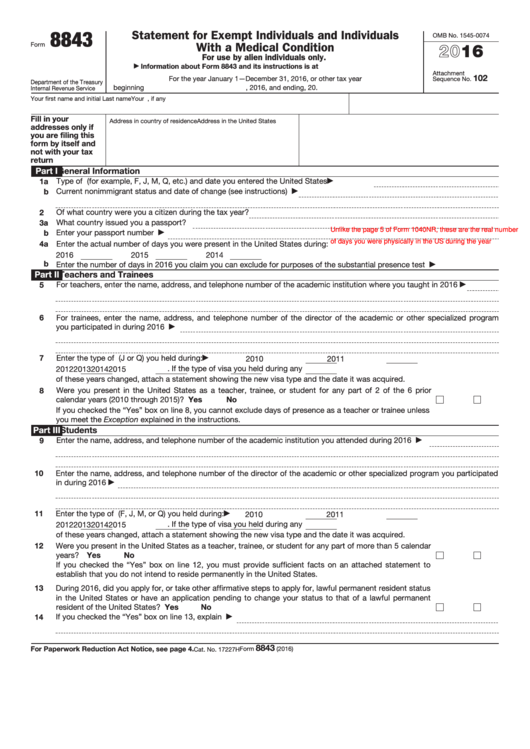

Form 8843 Instruction - How do i complete form 8843? Source income in the prior calendar year, year, this is the only form needed. Web form 8843 must be filed if an individual is: Web form 8843 filing instructions. It is a simplified version of the irs instructions found on pp. For foreign nationals who had no u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. Deadlines, filing instructions, penalty for not filing form 8843. If you have dependent family Web form 8843 is not a u.s.

Web you must file form 8843 by june 15, 2022. • present in the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. For any day during 2021. If you have dependent family Web form 8843 filing instructions. The irs also has additional guidance on completing form 8843. For more information, please refer to irs instructions for form 8843 Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. It is an informational statement required by the irs for nonresidents for tax purposes.

For any day during 2021. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. Web instructions for form 8843. Alien individuals use form 8843 to explain excluded days of presence in the u.s. For the substantial presence test. 2 of what country or countries were you a citizen during the tax year? The irs also has additional guidance on completing form 8843. Web what is form 8843 and who should file it with the irs?

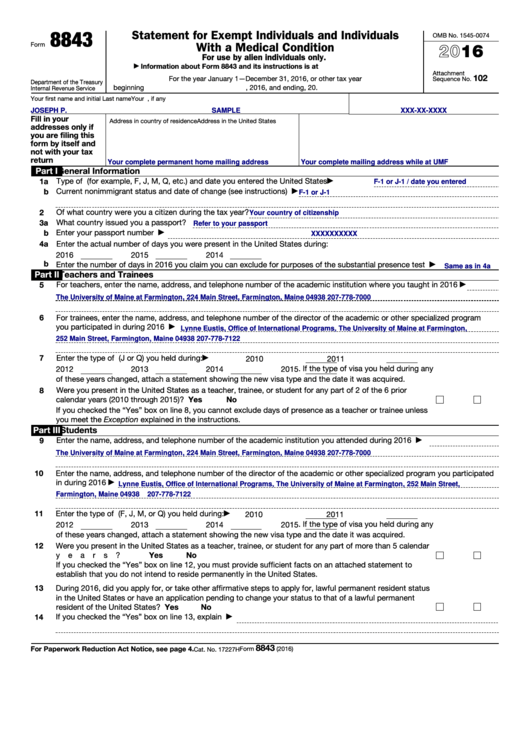

IRS Form 8843 Editable and Printable Statement to Fill out

Web form 8843 filing instructions. 3a what country or countries issued you a passport? The irs also has additional guidance on completing form 8843. For any day during 2021. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s.

Form 8843 Statement for Exempt Individuals and Individuals with a

Source income in the prior calendar year, year, this is the only form needed. For foreign nationals who had no u.s. 3a what country or countries issued you a passport? Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore.

Fillable Form 8843 Statement For Exempt Individuals And Individuals

Web instructions for form 8843. How do i complete form 8843? Web you must file form 8843 by june 15, 2022. The irs also has additional guidance on completing form 8843. If you have dependent family

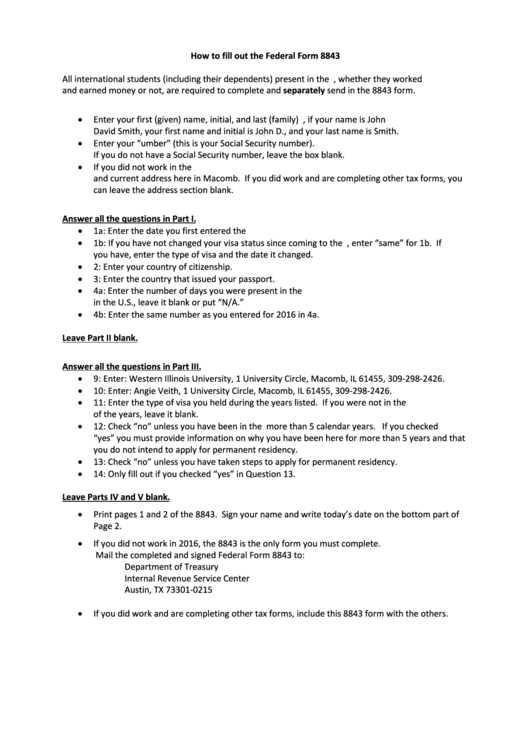

How To Fill Out The Federal Form 8843 printable pdf download

It is a straightforward form with simple instructions outlined below. 3a what country or countries issued you a passport? Web instructions for form 8843. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s. It is a simplified version of the irs instructions found on pp.

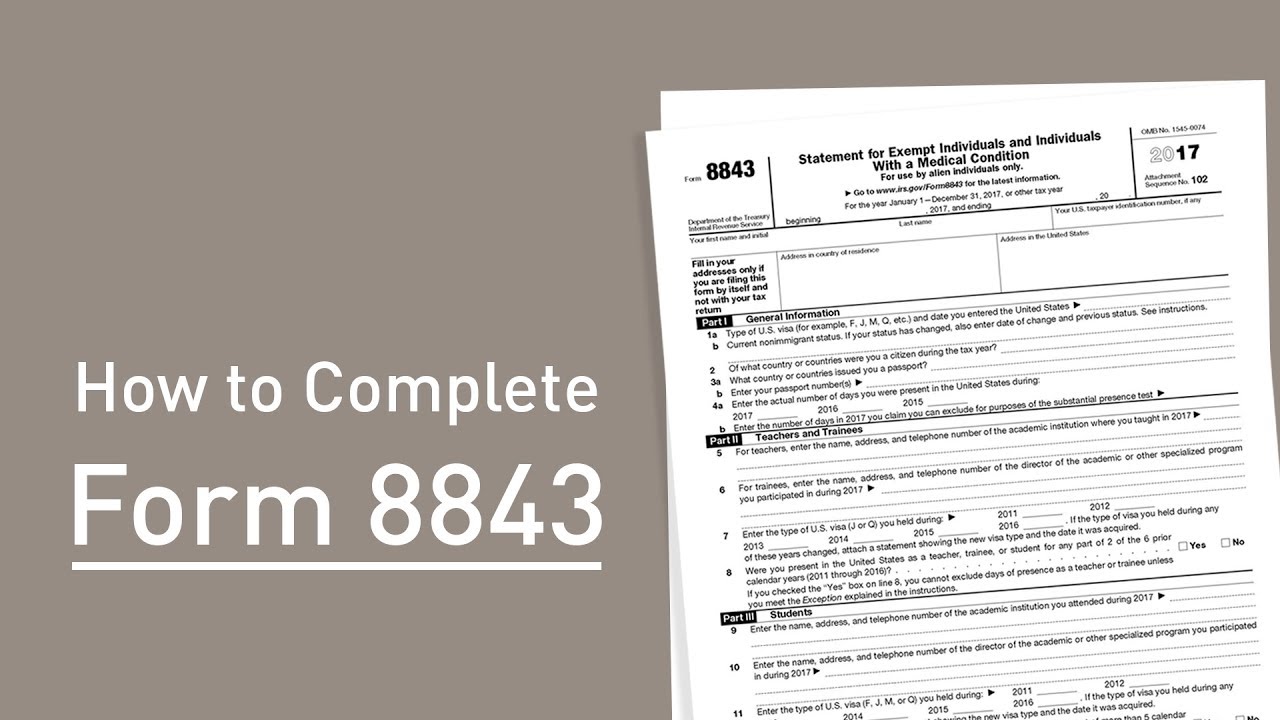

Form 8843 YouTube

It is a simplified version of the irs instructions found on pp. For more information, please refer to irs instructions for form 8843 It is an informational statement required by the irs for nonresidents for tax purposes. How to fill out form 8843 easily online with sprintax. For any day during 2021.

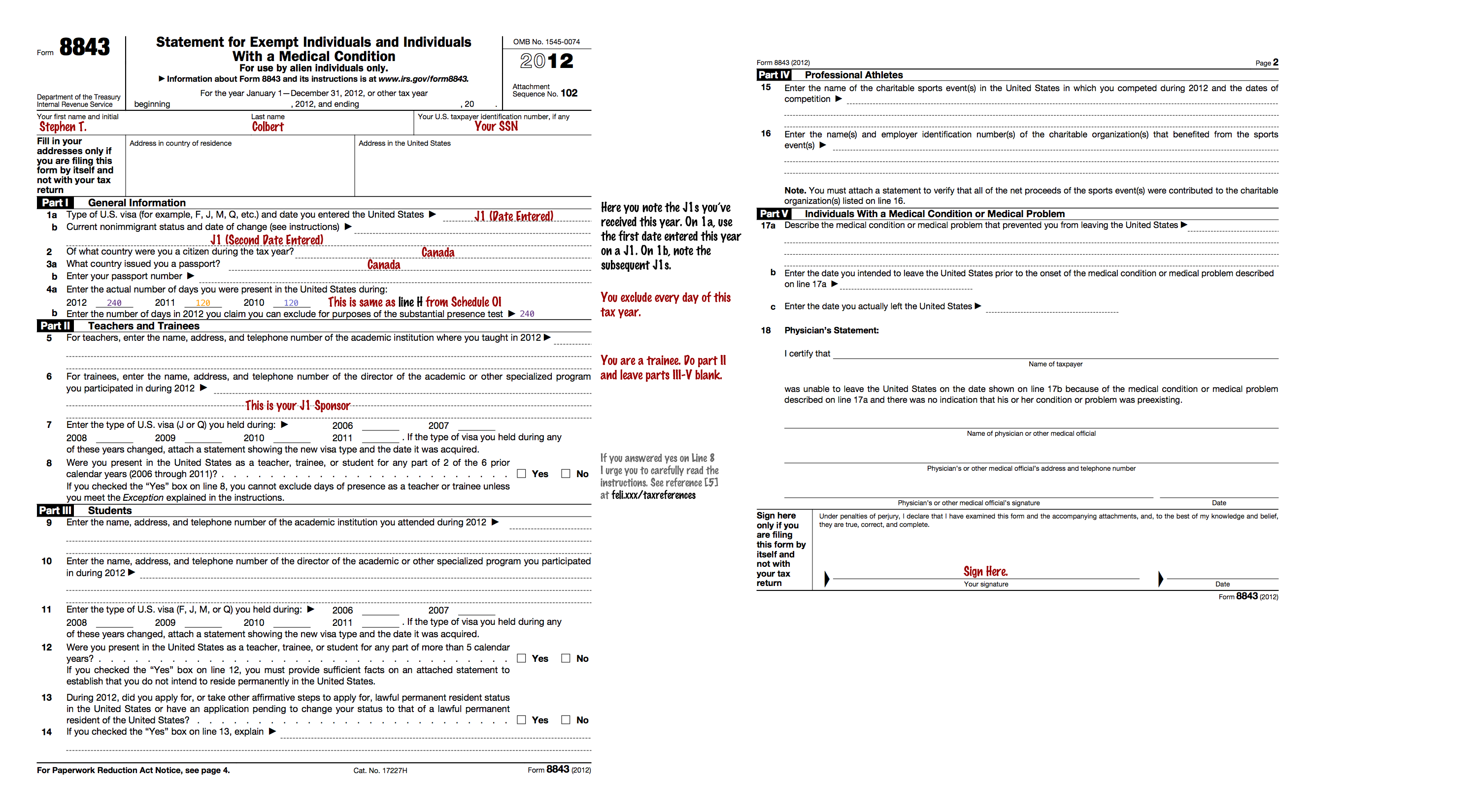

Unofficial UWaterloo Intern USA Tax Guide

It is a straightforward form with simple instructions outlined below. It is an informational statement required by the irs for nonresidents for tax purposes. For more information, please refer to irs instructions for form 8843 Web if you did not receive any taxable income last year, you can file the 8843 form by hand. 2 of what country or countries.

8843 Form Tutorial YouTube

Web form 8843 is not a u.s. The purpose of form 8843 is to demonstrate to the u.s. Web you must file form 8843 by june 15, 2022. • present in the u.s. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file.

Tax how to file form 8843 (1)

For any day during 2021. Web form 8843 filing instructions. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. • present in the u.s. It is an informational statement required by the irs for nonresidents for tax purposes.

Form 8843 Draft Statement For Exempt Individuals And Individuals With

Web you must file form 8843 by june 15, 2022. This guide has been created to assist you in completing the form 8843. 2 of what country or countries were you a citizen during the tax year? Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. Web if you did not receive any.

What is Form 8843 and How Do I File it? Sprintax Blog

The irs also has additional guidance on completing form 8843. How do i complete form 8843? The purpose of form 8843 is to demonstrate to the u.s. Deadlines, filing instructions, penalty for not filing form 8843. Web form 8843 filing instructions.

This Guide Has Been Created To Assist You In Completing The Form 8843.

Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. The purpose of form 8843 is to demonstrate to the u.s. • present in the u.s.

Web Instructions For Form 8843.

If you have dependent family Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. Source income in the prior calendar year, year, this is the only form needed. Web if you did not receive any taxable income last year, you can file the 8843 form by hand.

How To Fill Out Form 8843 Easily Online With Sprintax.

How do i complete form 8843? It is a simplified version of the irs instructions found on pp. Web form 8843 must be filed if an individual is: Web form 8843 filing instructions.

3A What Country Or Countries Issued You A Passport?

2 of what country or countries were you a citizen during the tax year? For more information, please refer to irs instructions for form 8843 The irs also has additional guidance on completing form 8843. Web what is form 8843 and who should file it with the irs?