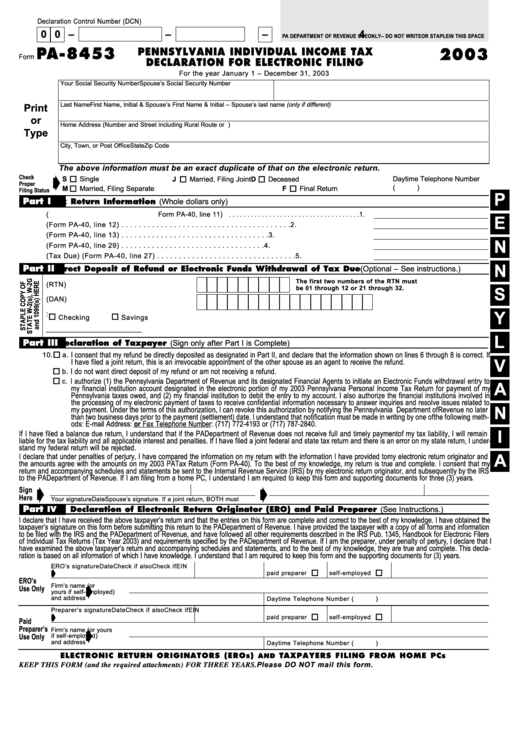

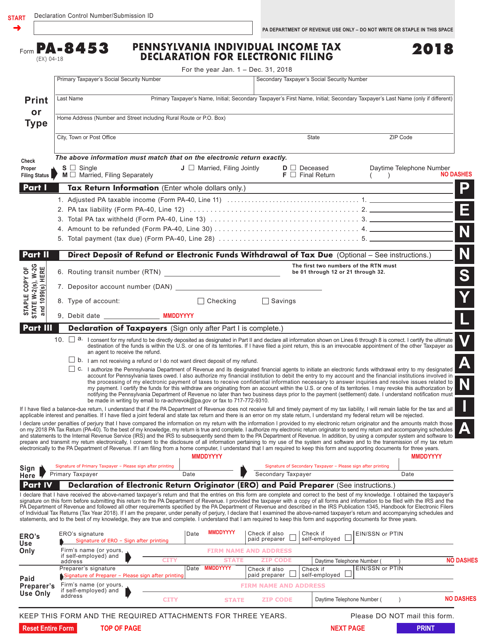

Pa Form 8453

Pa Form 8453 - Easily fill out pdf blank, edit, and sign them. You are suppose to sign the form and then just keep it for your records for three years. Web pa form 8453 has an odd requirement. If the ero makes changes to the electronic return after the. Individual income tax transmittal for an irs. Persons with respect to certain foreign partnerships. Web español use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form (do not send forms. Department of the treasury internal revenue service. You do not actually send the form. This form is for income earned in tax year 2022, with tax returns.

Persons with respect to certain foreign partnerships. Web pa form 8453 has an odd requirement. Web español use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form (do not send forms. Web follow the simple instructions below: Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa. You are suppose to sign the form and then just keep it for your records for three years. Form 8865, return of u.s. The ero must provide the estate or trust fiduciary with a copy of this form. Individual income tax transmittal for an irs. This form is for income earned in tax year 2022, with tax returns.

Web español use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form (do not send forms. Web report error it appears you don't have a pdf plugin for this browser. You are suppose to sign the form and then just keep it for your records for three years. If the ero makes changes to the electronic return after the. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa. You are suppose to sign the form and then just keep it for your records for three years. This form is for income earned in tax year 2022, with tax returns. Web pa form 8453 has an odd requirement.

PA8453F 2015 PA Fiduciary Tax Declaration for Electronic

You are suppose to sign the form and then just keep it for your records for three years. If the ero makes changes to the electronic return after the. Web español use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form (do not send forms. Web report.

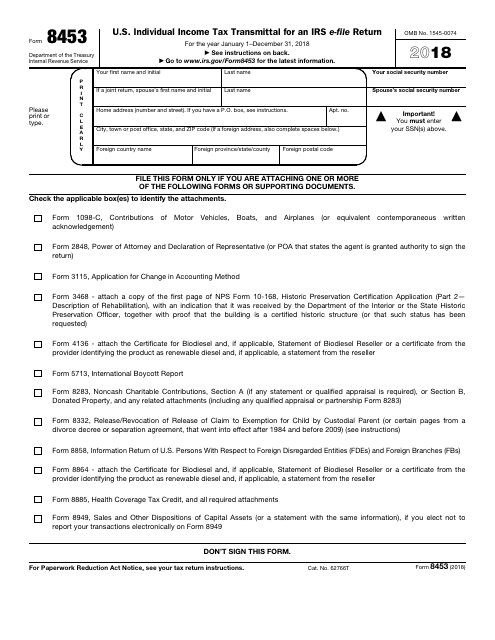

IRS Form 8453 Download Fillable PDF or Fill Online U.S. Individual

Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns. Web pa form 8453 has an odd requirement. If the ero makes changes to the electronic return after the. Web follow the simple instructions below:

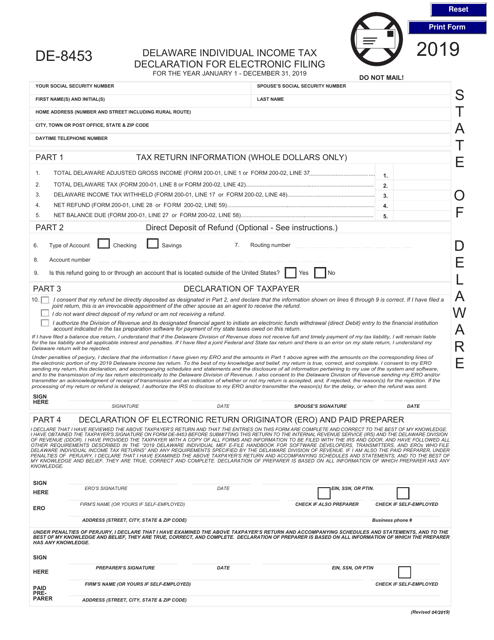

Form DE8453 Download Fillable PDF or Fill Online Delaware Individual

Web solved • by intuit • lacerte tax • updated july 14, 2022. The ero must provide the estate or trust fiduciary with a copy of this form. Save or instantly send your ready documents. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa. Department of the treasury.

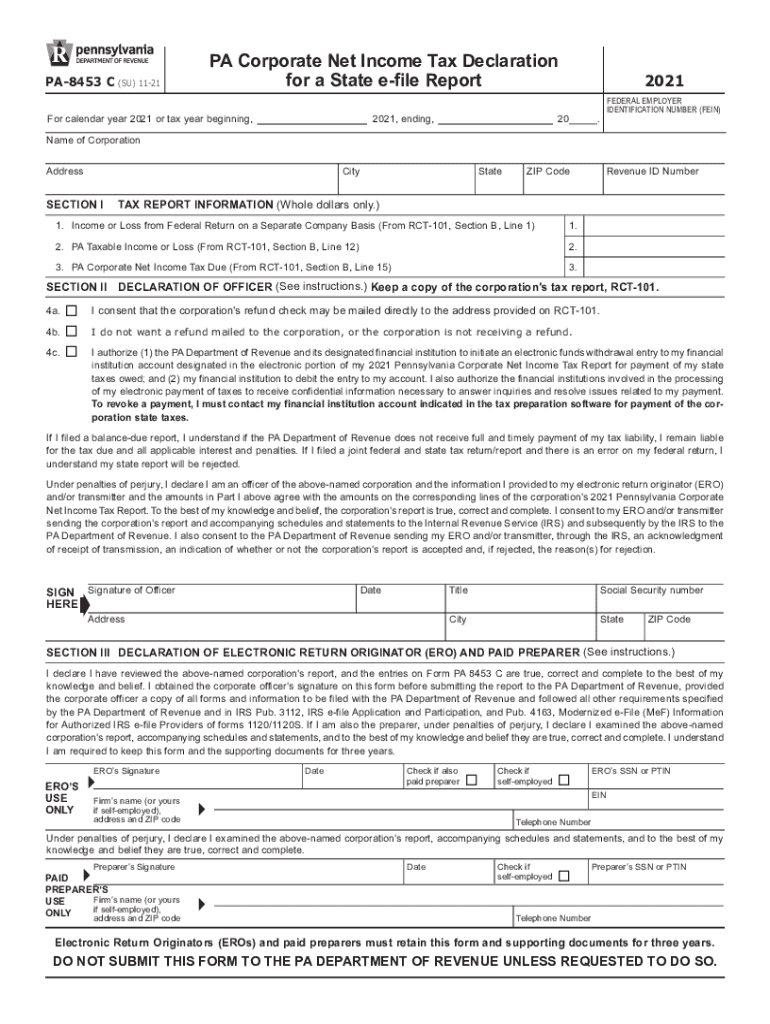

20212023 PA Form PA8453 C Fill Online, Printable, Fillable, Blank

Save or instantly send your ready documents. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa. You are suppose to sign the form and then just keep it for your records for three years. Web solved • by intuit • lacerte tax • updated july 14, 2022. The.

Form Va 8453 Fill Online, Printable, Fillable, Blank pdfFiller

You are suppose to sign the form and then just keep it for your records for three years. Form 8865, return of u.s. If the ero makes changes to the electronic return after the. Individual income tax transmittal for an irs. Web pa form 8453 has an odd requirement.

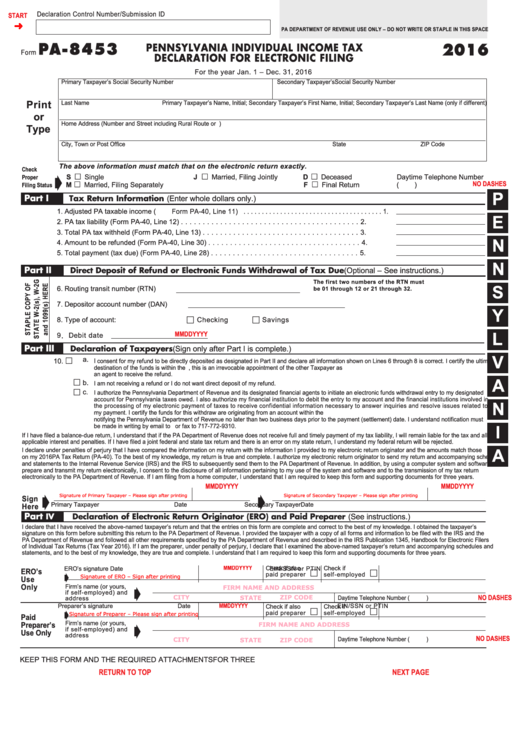

Fillable Form Pa8453 Pennsylvania Individual Tax Declaration

Web pa form 8453 has an odd requirement. You are suppose to sign the form and then just keep it for your records for three years. You do not actually send the form. This form is for income earned in tax year 2022, with tax returns. Web follow the simple instructions below:

PA8453 2011 Individual Tax Declaration for Electronic Filing

Web report error it appears you don't have a pdf plugin for this browser. The ero must provide the estate or trust fiduciary with a copy of this form. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa. Web español use this form to send any required paper.

PA8453P 2015 PA S Corporation/Partnership Information Return Free

You do not actually send the form. This form is for income earned in tax year 2022, with tax returns. Web solved • by intuit • lacerte tax • updated july 14, 2022. Save or instantly send your ready documents. Web follow the simple instructions below:

Form Pa8453 Pennsylvania Individual Tax Declaration For

Web pa form 8453 has an odd requirement. This form is for income earned in tax year 2022, with tax returns. Web report error it appears you don't have a pdf plugin for this browser. Form 8865, return of u.s. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a.

Form PA8453 Download Fillable PDF or Fill Online Pennsylvania

The ero must provide the estate or trust fiduciary with a copy of this form. Web follow the simple instructions below: Web pa form 8453 has an odd requirement. Save or instantly send your ready documents. Web español use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the.

Web Español Use This Form To Send Any Required Paper Forms Or Supporting Documentation Listed Next To The Checkboxes On The Front Of The Form (Do Not Send Forms.

Persons with respect to certain foreign partnerships. The ero must provide the estate or trust fiduciary with a copy of this form. Web solved • by intuit • lacerte tax • updated july 14, 2022. If the ero makes changes to the electronic return after the.

Web Pa Form 8453 Has An Odd Requirement.

Web pa form 8453 has an odd requirement. Web follow the simple instructions below: Easily fill out pdf blank, edit, and sign them. Choosing a authorized professional, making an appointment and going to the business office for a private meeting makes doing a pa.

You Are Suppose To Sign The Form And Then Just Keep It For Your Records For Three Years.

Web report error it appears you don't have a pdf plugin for this browser. Individual income tax transmittal for an irs. You are suppose to sign the form and then just keep it for your records for three years. Save or instantly send your ready documents.

Form 8865, Return Of U.s.

You do not actually send the form. Department of the treasury internal revenue service. This form is for income earned in tax year 2022, with tax returns. You do not actually send the form.