Form 8995 Pdf

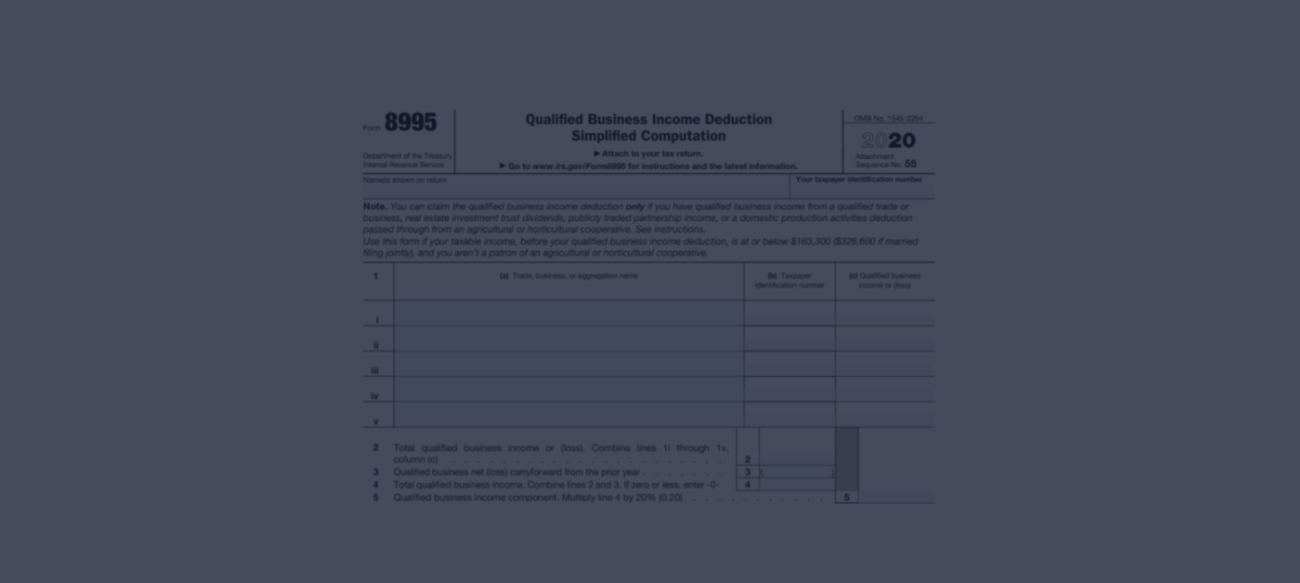

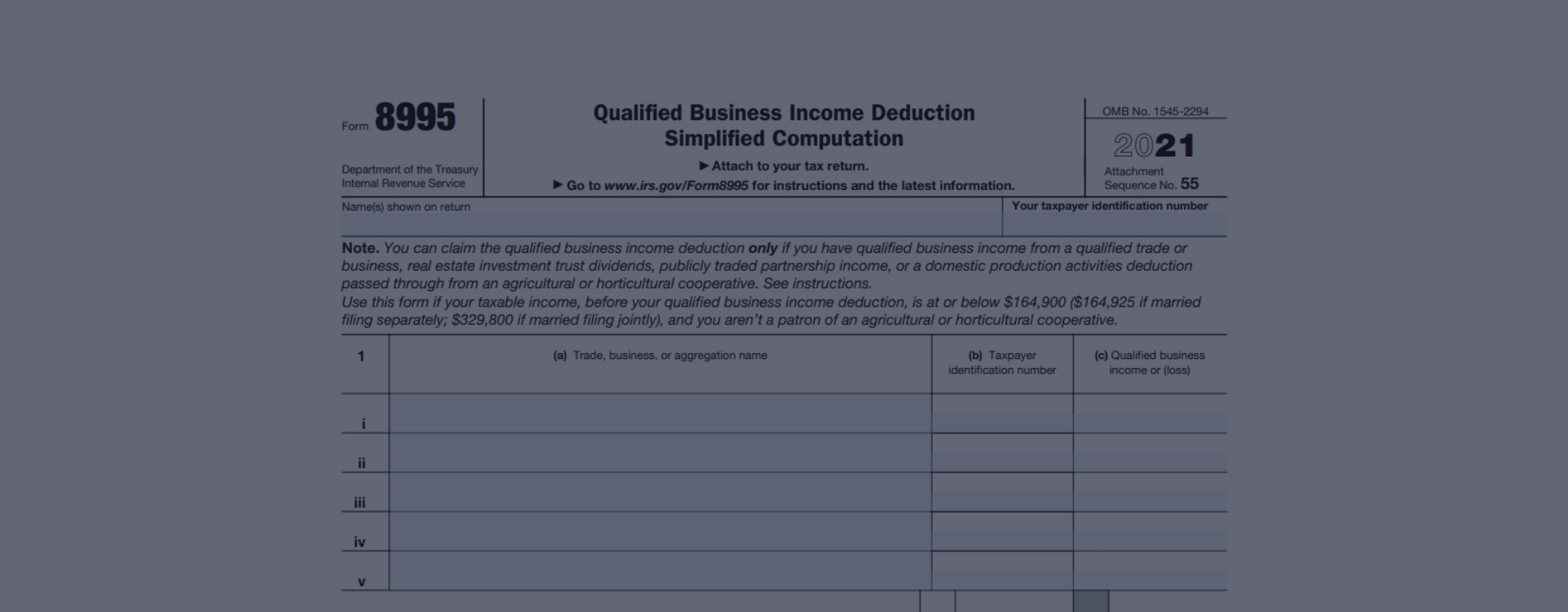

Form 8995 Pdf - Web get 📝 printable 8995 form ☑️ template in pdf, doc & other formats ☑️ fill irs form 8995 with detailed instructions & helpful tips ☑️ online & print version Use form 8995 to figure your qualified business income deduction. — qualified business income deduction simplified computation. Our website offers printable form 8995 in a blank pdf format, making it incredibly easy to obtain and fill out. The newest instructions for business owners & examples. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Go to www.irs.gov/form8995 for instructions and the latest information. For more information please see this irs article. Web to review the automatically generated form 8995 you will need to view the pdf copy of your return.

— qualified business income deduction simplified computation. Go to www.irs.gov/form8995 for instructions and the latest information. Web get the 8995 tax form and fill out qbid for the 2022 year. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. It appears you don't have a pdf plugin for this browser. For more information please see this irs article. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Use form 8995 to figure your qualified business income deduction. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995.

Our website offers printable form 8995 in a blank pdf format, making it incredibly easy to obtain and fill out. Web to review the automatically generated form 8995 you will need to view the pdf copy of your return. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Go to www.irs.gov/form8995 for instructions and the latest information. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995. For more information please see this irs article. — qualified business income deduction simplified computation. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. This can be viewed by selecting summary/print on the left side menu and selecting to prepay to view the pdf. Web get 📝 printable 8995 form ☑️ template in pdf, doc & other formats ☑️ fill irs form 8995 with detailed instructions & helpful tips ☑️ online & print version

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Click to expand the qualified business deduction (qbi) Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form.

Form 8995A Draft WFFA CPAs

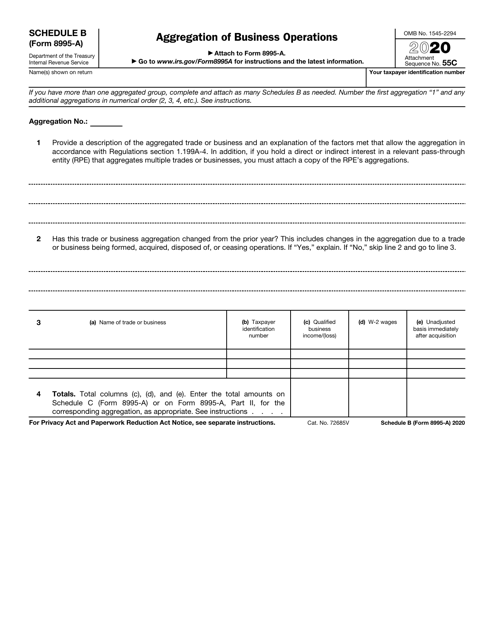

Include the following schedules (their specific instructions are shown later), as appropriate: Go to www.irs.gov/form8995 for instructions and the latest information. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Click to expand the qualified business deduction (qbi) Web overview if your work qualifies you for certain business.

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. — qualified business income deduction simplified computation. Web to review the automatically generated form 8995 you will need to view the pdf copy of your return. Our website offers printable form 8995 in a blank pdf format, making it.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. The newest instructions for business owners & examples. Include the following schedules (their specific instructions are shown later), as appropriate: It appears you don't have a pdf plugin for this browser. Web the form 8995 used to compute.

IRS Form 8825 Rental Real Estate and Expenses of a Partnership

Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995. Web form 8995 department of the treasury.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

The newest instructions for business owners & examples. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995. Web get 📝 printable 8995 form ☑️ template in pdf, doc & other formats ☑️ fill irs form 8995 with.

8995 Fill out & sign online DocHub

Web get the 8995 tax form and fill out qbid for the 2022 year. Include the following schedules (their specific instructions are shown later), as appropriate: Web get 📝 printable 8995 form ☑️ template in pdf, doc & other formats ☑️ fill irs form 8995 with detailed instructions & helpful tips ☑️ online & print version It appears you don't.

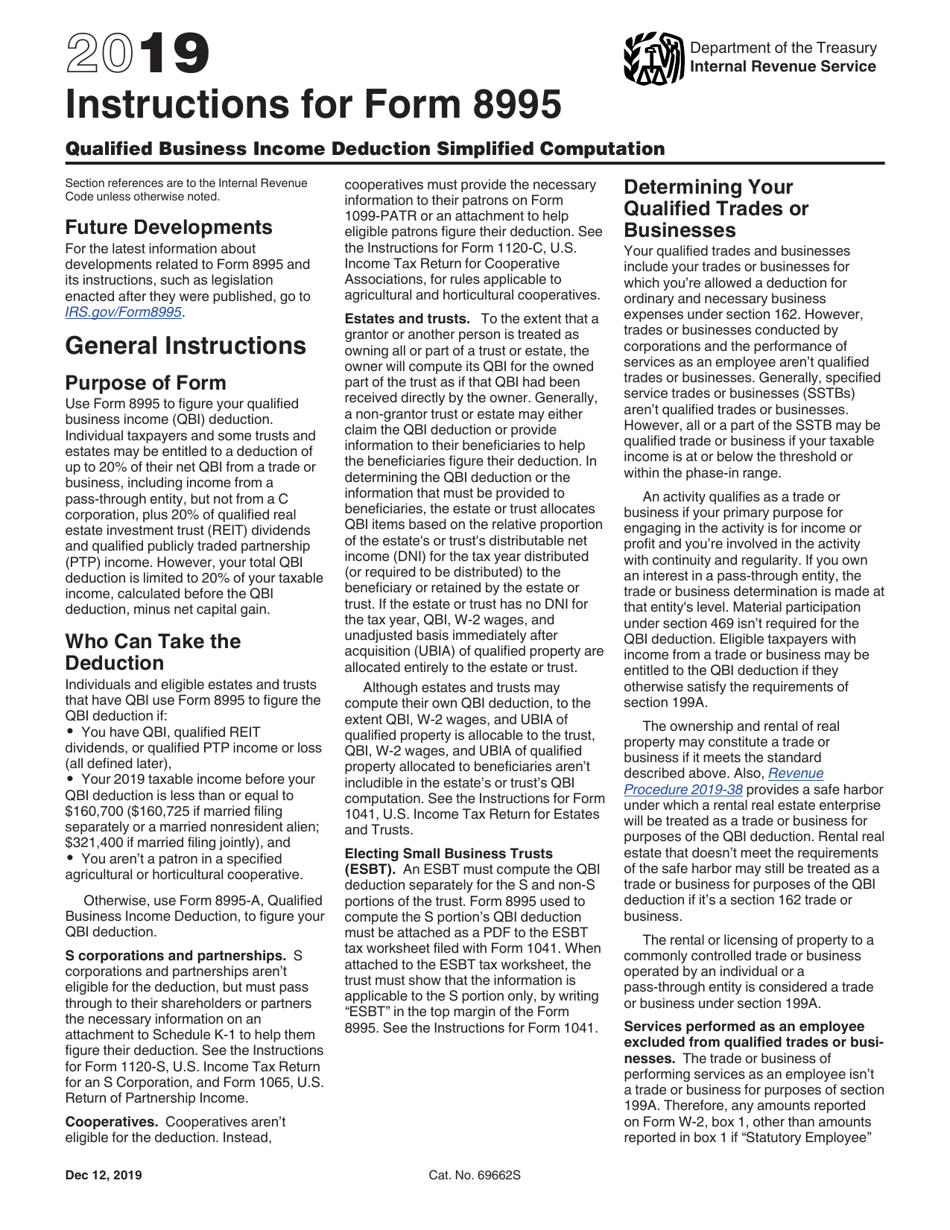

Download Instructions for IRS Form 8995 Qualified Business

Our website offers printable form 8995 in a blank pdf format, making it incredibly easy to obtain and fill out. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. — qualified business income deduction simplified computation. Web form 8995 department of the.

Instructions for Form 8995 (2021) Internal Revenue Service

Use form 8995 to figure your qualified business income deduction. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Our website offers printable form 8995 in a blank pdf format, making it incredibly easy to obtain and fill out. Click to expand the qualified business deduction (qbi) —.

8995 Form 📝 Get IRS Form 8995 With Instructions Printable PDF Sample

For more information please see this irs article. Go to www.irs.gov/form8995 for instructions and the latest information. Web to review the automatically generated form 8995 you will need to view the pdf copy of your return. When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt”.

For More Information Please See This Irs Article.

Use form 8995 to figure your qualified business income deduction. Web get the 8995 tax form and fill out qbid for the 2022 year. It appears you don't have a pdf plugin for this browser. Web to review the automatically generated form 8995 you will need to view the pdf copy of your return.

Include The Following Schedules (Their Specific Instructions Are Shown Later), As Appropriate:

When attached to the esbt tax worksheet, the trust must show that the information is applicable to the s portion only, by writing “esbt” in the top margin of the form 8995. Go to www.irs.gov/form8995 for instructions and the latest information. Click to expand the qualified business deduction (qbi) The newest instructions for business owners & examples.

Web Get 📝 Printable 8995 Form ☑️ Template In Pdf, Doc & Other Formats ☑️ Fill Irs Form 8995 With Detailed Instructions & Helpful Tips ☑️ Online & Print Version

Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Our website offers printable form 8995 in a blank pdf format, making it incredibly easy to obtain and fill out. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. This can be viewed by selecting summary/print on the left side menu and selecting to prepay to view the pdf.

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Attach To Your Tax Return.

Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. — qualified business income deduction simplified computation.