Nj Rent Rebate Form

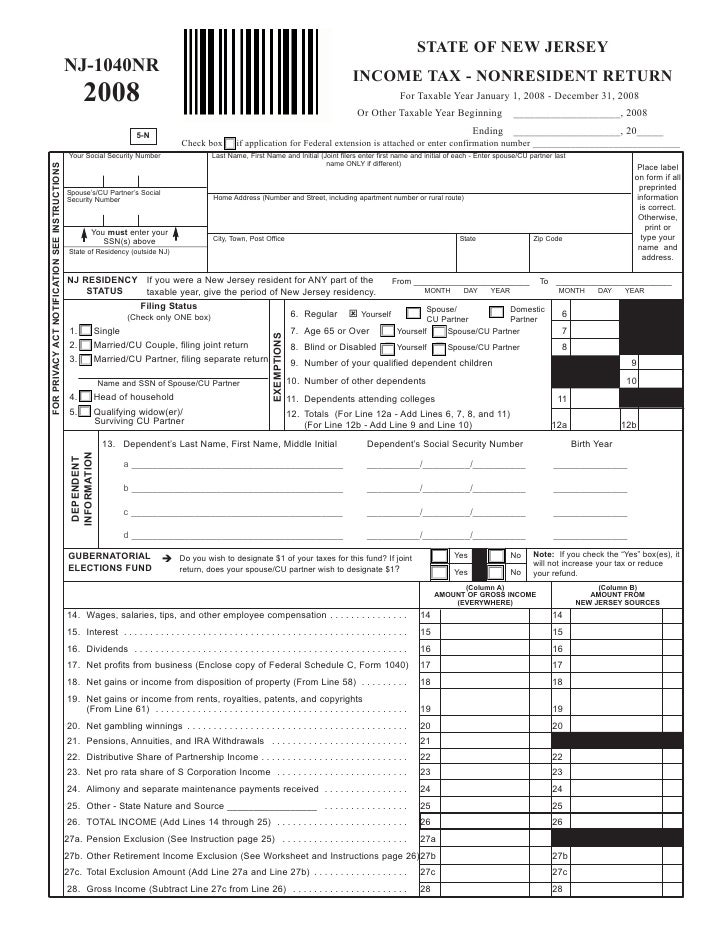

Nj Rent Rebate Form - Role of the municipal tax collector under the tenants' property tax. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web download the nj rent rebate form from the official new jersey department of community affairs website. Web homeowners gross income: Web rent now do not have to rebate any property tax savings they gain from a successful tax assessment appeal. Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average $700 rebate in the first year, and renters making. If you were a new. Web you can find the current year’s income limits on the nj division of taxation website; Web a tenant who is not required to file a new jersey income tax return (because of income below the minimum filing threshold) and meets the qualifications for a tenant homestead. Married, filing separate return 6.

Only rent paid during the previous year is. Web a tenant who is not required to file a new jersey income tax return (because of income below the minimum filing threshold) and meets the qualifications for a tenant homestead. Applications for the homeowner benefit are not available on this site for printing. Provide your personal information, including. Web rent now do not have to rebate any property tax savings they gain from a successful tax assessment appeal. Web for new jersey homeowners making up to $250,000, rebates would be applied as a percentage of property taxes paid up to $10,000. Web purpose this program is designed to freeze the burden of increasing real estate taxes for qualified applicants by establishing a base year of eligibility and comparing that “base”. If you were a new. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web homeowners making $250,000 or less would have received an average rebate in the first year of $700, which would have ramped up to $1,150 by fiscal year.

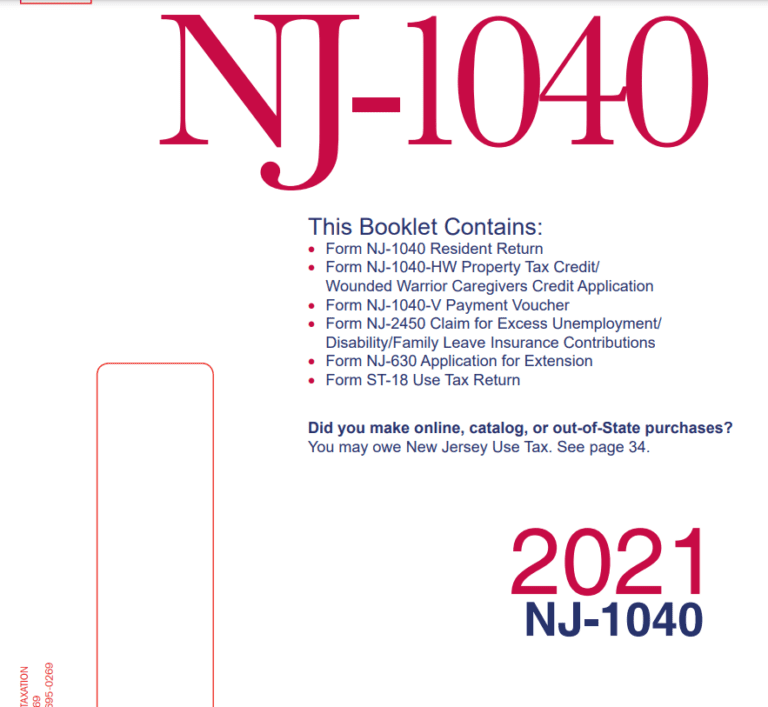

If you were a new. Web property tax relief forms. Web homeowners making $250,000 or less would have received an average rebate in the first year of $700, which would have ramped up to $1,150 by fiscal year. Only rent paid during the previous year is. Web homeowners and renters who are eligible and file anchor applications will automatically receive their property tax credits with their anchor benefits. Web new jersey homeowners and renters now have until jan. Web download the nj rent rebate form from the official new jersey department of community affairs website. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Applications for the homeowner benefit are not available on this site for printing. Web about two million new jersey homeowners and renters will get property tax rebates in the coming year under a new $2 billion property tax relief program included in.

NJ Property Tax Relief Program Updates Access Wealth

Web you can find the current year’s income limits on the nj division of taxation website; Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web a tenant who is not required to file a new jersey income tax return (because of income below.

2019 Rent Rebate Form Missouri justgoing 2020

Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average $700 rebate in the first year, and renters making. Web for new jersey homeowners making up to $250,000, rebates would be applied as a percentage of property taxes paid up to $10,000. Web new jersey homeowners and renters now have until.

Tenant Homestead Rebate Instructions

Web homeowners making $250,000 or less would have received an average rebate in the first year of $700, which would have ramped up to $1,150 by fiscal year. Web you can find the current year’s income limits on the nj division of taxation website; Or • your income is more than $20,000, excluding social security income ($10,000 if filing status.

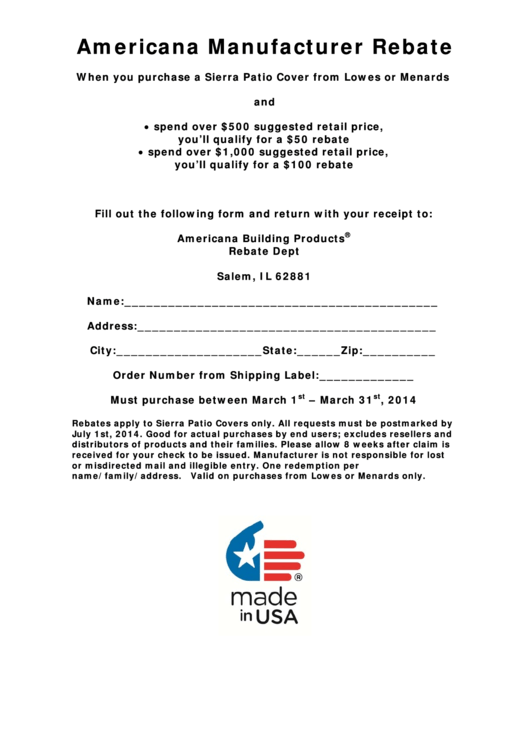

Top Samples Rebate Forms And Templates free to download in PDF format

Only rent paid during the previous year is. Web homeowners making $250,000 or less would have received an average rebate in the first year of $700, which would have ramped up to $1,150 by fiscal year. If you were a new. Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average.

What do i need to do to get my missouri renters rebate back

31 to apply for relief, and renters who were previously ineligible because their unit is under a payment. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Determine if your rent is eligible; How much will i receive if i am eligible? Web purpose.

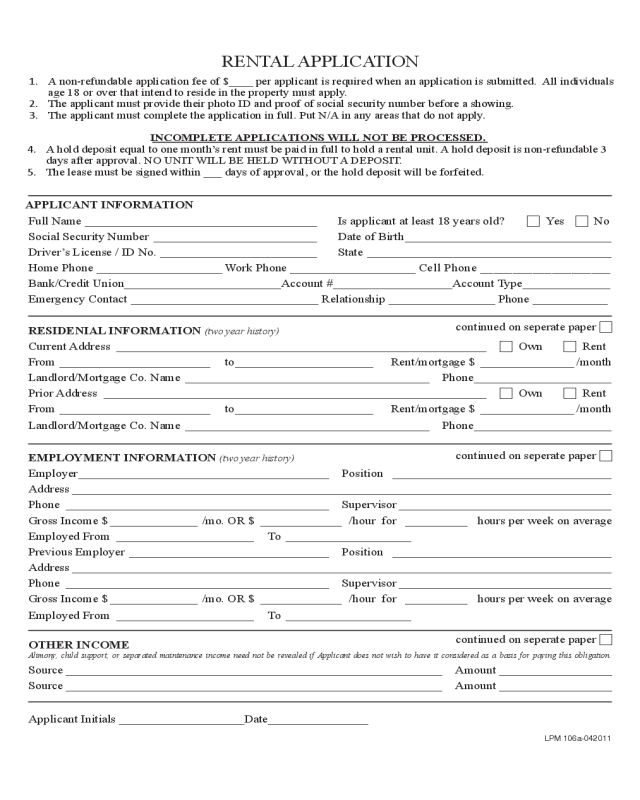

2022 Rental Application Form Fillable, Printable PDF & Forms Handypdf

Web you can find the current year’s income limits on the nj division of taxation website; Those who are not eligible. Applications for the homeowner benefit are not available on this site for printing. How much will i receive if i am eligible? Married, filing separate return 6.

2022 Rent Rebate Form Fillable, Printable PDF & Forms Handypdf

How much will i receive if i am eligible? Web rent now do not have to rebate any property tax savings they gain from a successful tax assessment appeal. Web homeowners gross income: Provide your personal information, including. Determine if your rent is eligible;

Property Tax, Rent Rebate Deadline Extended Franklin County Freepress

Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average $700 rebate in the first year, and renters making. Applications for the homeowner benefit are not available on this site for printing. Provide your personal information, including. Web purpose this program is designed to freeze the burden of increasing real estate.

R.I.P. property tax and rent rebate The Money Edge Biz The Maine Edge

Web about two million new jersey homeowners and renters will get property tax rebates in the coming year under a new $2 billion property tax relief program included in. Web property tax relief forms. Determine if your rent is eligible; Web purpose this program is designed to freeze the burden of increasing real estate taxes for qualified applicants by establishing.

NJ Home Rebate 2023 Printable Rebate Form

Provide your personal information, including. Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average $700 rebate in the first year, and renters making. Role of the municipal tax collector under the tenants' property tax. Web homeowners and renters who are eligible and file anchor applications will automatically receive their property.

Web You Can Find The Current Year’s Income Limits On The Nj Division Of Taxation Website;

Web rent now do not have to rebate any property tax savings they gain from a successful tax assessment appeal. Determine if your rent is eligible; Only rent paid during the previous year is. Web purpose this program is designed to freeze the burden of increasing real estate taxes for qualified applicants by establishing a base year of eligibility and comparing that “base”.

Web Property Tax Relief Forms.

Web new jersey homeowners and renters now have until jan. Applications for the homeowner benefit are not available on this site for printing. Web homeowners making $250,000 or less would have received an average rebate in the first year of $700, which would have ramped up to $1,150 by fiscal year. Web about two million new jersey homeowners and renters will get property tax rebates in the coming year under a new $2 billion property tax relief program included in.

Web For New Jersey Homeowners Making Up To $250,000, Rebates Would Be Applied As A Percentage Of Property Taxes Paid Up To $10,000.

If you were a new. Those who are not eligible. Web homeowners gross income: 31 to apply for relief, and renters who were previously ineligible because their unit is under a payment.

Web Homeowners And Renters Who Are Eligible And File Anchor Applications Will Automatically Receive Their Property Tax Credits With Their Anchor Benefits.

Provide your personal information, including. Web under the new program, new jersey homeowners making up to $250,000 would be eligible to receive an average $700 rebate in the first year, and renters making. How much will i receive if i am eligible? Role of the municipal tax collector under the tenants' property tax.