Backdoor Ira Tax Form

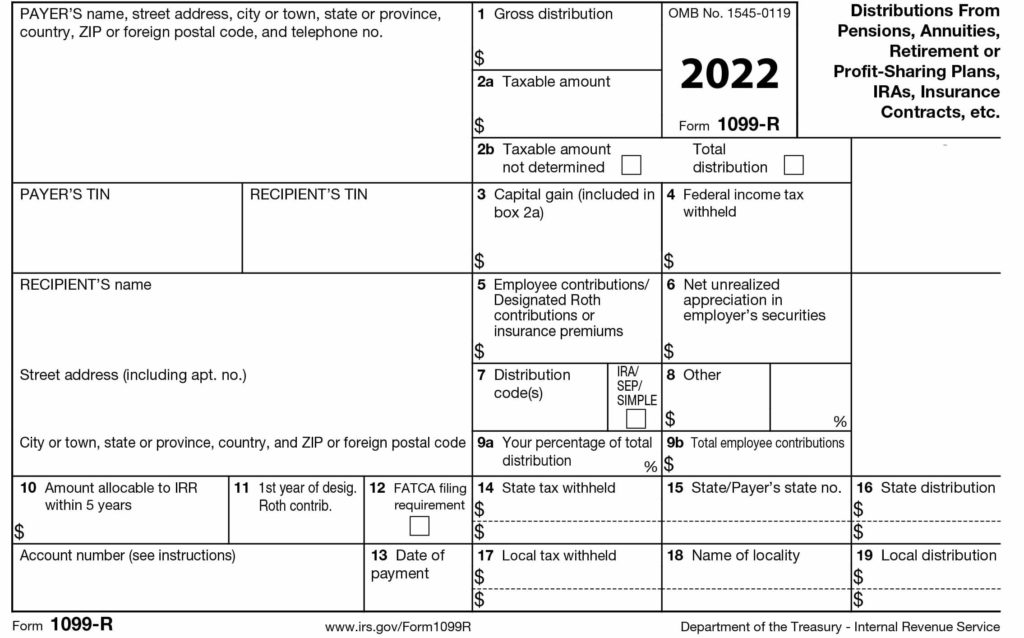

Backdoor Ira Tax Form - Distributions from traditional, sep, or simple iras, if you have ever made. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Use this address if you are not enclosing a payment use this. Nondeductible contributions you made to traditional iras. Web how can we help you? This ira has no income limits preventing you from. Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes. For people with a modified adjusted. File your taxes for free. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs.

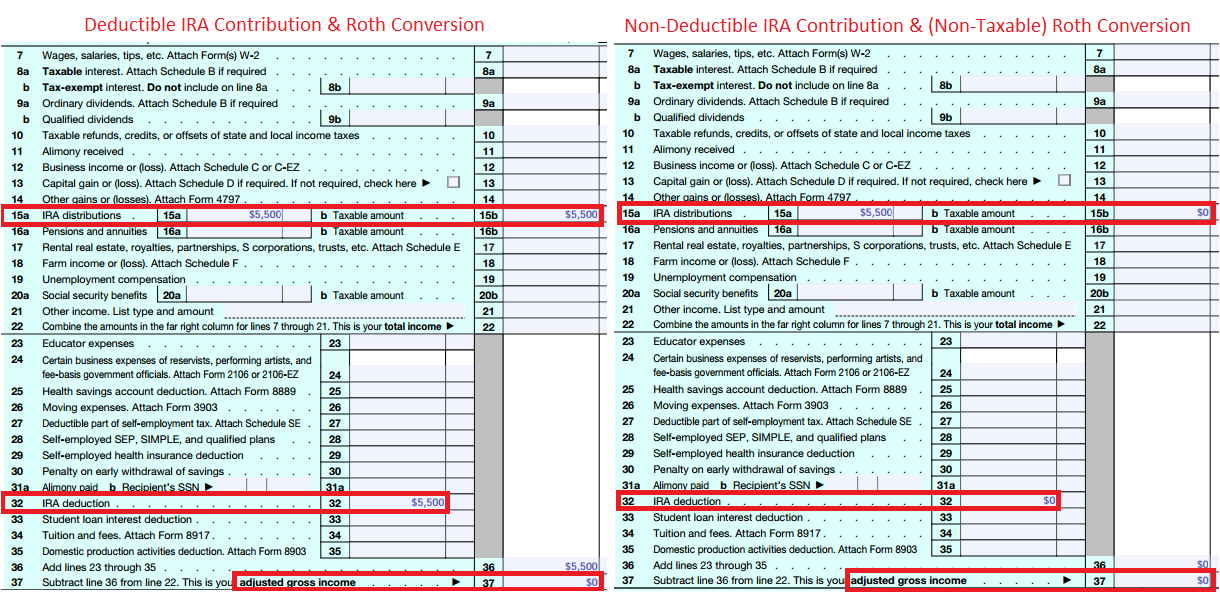

File your taxes for free. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. If your conversion contains contributions made in 2022 for 2021 if your conversion. Sign in to your account. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Distributions from traditional, sep, or simple iras, if you have ever made. Web you can use a back door roth ira by completing these steps: Web to check the results of your backdoor roth ira conversion, see your form 1040: Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Note that there's no tax benefit for the year you establish a.

Web to check the results of your backdoor roth ira conversion, see your form 1040: Make a nondeductible contribution to a traditional ira. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. Here’s the recipe i recommend using to report the backdoor roth ira. The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. Web the contribution is considered nondeductible once you fill out irs form 8606 and complete your tax return. Web you can use a back door roth ira by completing these steps: File your taxes for free. Distributions from traditional, sep, or simple iras, if you have ever made. Note that there's no tax benefit for the year you establish a.

Information About Congress Ending the Backdoor IRA Conversion

Web how can we help you? The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older. File your taxes for free. Note that there's no tax benefit for the year you establish a. Web use form 8606 to report:

Backdoor Roth A Complete HowTo

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web to check the results of your backdoor roth ira conversion, see your form 1040: Web as you'll see on form 8606 itself (link opens a pdf), whenever you.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web use form 8606 to report: Here’s the recipe i recommend using to report the backdoor roth ira. For people with a modified adjusted. Web how can we help.

5 Essential Backdoor Roth IRA Facts That You Need to Know Tony Florida

This ira has no income limits preventing you from. Note that there's no tax benefit for the year you establish a. Web backdoor roth ira contribution limit. Web use form 8606 to report: Web you can use a back door roth ira by completing these steps:

How to report a backdoor Roth IRA contribution on your taxes Merriman

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Use this application to open an investor, a, c or advisor class traditional, roth or rollover ira using a financial professional. Note that there's no tax benefit for the.

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

If your conversion contains contributions made in 2022 for 2021 if your conversion. Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Web the contribution is considered nondeductible once you fill out irs form 8606 and complete your tax return. Make a nondeductible contribution to a traditional ira. Web form 8606.

Backdoor Roth IRA steps Roth ira, Ira, Roth ira contributions

Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. For people with a modified adjusted. Web use form 8606 to report: Distributions from traditional, sep, or simple iras, if you have ever made. Web how can we help you?

Fixing Backdoor Roth IRAs The FI Tax Guy

Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. Use this address if you are not enclosing a payment use this. Web you can use a back door roth ira by completing these steps: Web form 8606 department of the treasury internal revenue service nondeductible iras go.

Fixing Backdoor Roth IRAs The FI Tax Guy

For people with a modified adjusted. Note that there's no tax benefit for the year you establish a. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web as you'll see on form 8606 itself (link opens a.

Backdoor IRA Gillingham CPA

Web reporting a backdoor roth ira on tax returns remains confusing for both taxpayers and tax return preparers. Web a backdoor roth ira permits account holders to work around income tax limits by converting what was originally a roth ira. Web how can we help you? Web for backdoor roths, the tax preparer will need irs tax form 8606 to.

Here’s The Recipe I Recommend Using To Report The Backdoor Roth Ira.

Note that there's no tax benefit for the year you establish a. Web form 8606 department of the treasury internal revenue service nondeductible iras go to www.irs.gov/form8606 for instructions and the latest information. Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax. Web for backdoor roths, the tax preparer will need irs tax form 8606 to properly manage the client's taxes.

Web Use Form 8606 To Report:

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Make a nondeductible contribution to a traditional ira. Web to check the results of your backdoor roth ira conversion, see your form 1040: Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs.

If Your Conversion Contains Contributions Made In 2022 For 2021 If Your Conversion.

Web you can use a back door roth ira by completing these steps: For people with a modified adjusted. Nondeductible contributions you made to traditional iras. This ira has no income limits preventing you from.

Use This Address If You Are Not Enclosing A Payment Use This.

Use this application to open an investor, a, c or advisor class traditional, roth or rollover ira using a financial professional. Web backdoor roth ira contribution limit. Web how can we help you? The ira contribution limit for 2022 is $6,000 per person, or $7,000 if the account owner is 50 or older.