Mi Form 4

Mi Form 4 - 12/22 mcl 700.1309, mcl 700.3301, mcl 700.3311, mcl 700.3614, mcr 5.302, mcr 5.309 page 1 of 3 1. Local government forms and instructions. Employee's michigan withholding exemption certificate and instructions: Web state of michigan probate court county application for informal probate and/or appointment of personal representative (testate/intestate) case no. Web get your online template and fill it in using progressive features. Web voluntary contributions from form 4642, line 6. Type or print in blue or black ink. Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms looking for forms from 2015 and earlier? Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax liability in full by the due date to avoid penalty & interest. Web disclosure forms and information.

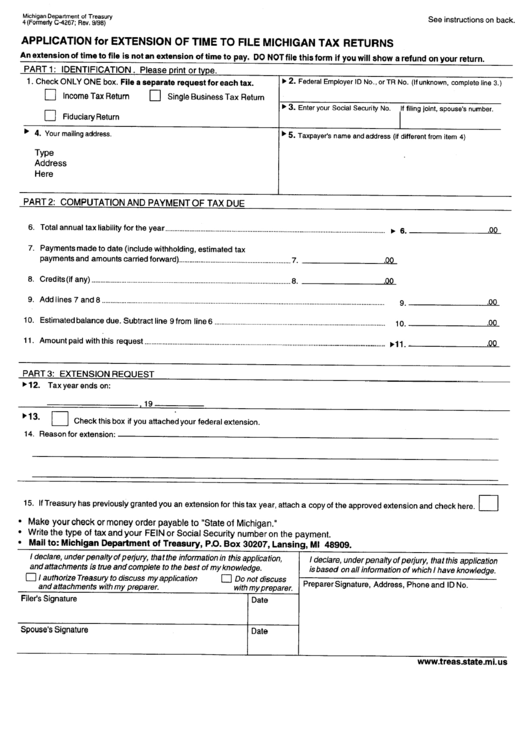

The form and payment must be postmarked on or before the original due date of the return. Web voluntary contributions from form 4642, line 6. Employee's michigan withholding exemption certificate and instructions: An extension of time to file is not an extension of time to pay. Kris jenkins, mason graham, jaylen harrell. Adjustments of gains and losses from sales of business property: Computation of tax for first taxable year less than 12 months may elect one of the following: Michigan personal tax return due date is extended to may 17. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. 00 00 00 00 00.

Web get your online template and fill it in using progressive features. Michigan department of treasury subject: Sales and other dispositions of capital assets: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Read instructions on page 2 before completing this form. Web disclosure forms and information. Web form 4 is a michigan individual income tax form. Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms looking for forms from 2015 and earlier? Make check payable to “state of michigan.” An extension of time to file is not an extension of time to pay.

Fillable Form 4 Application For Extension Of Time To File Michigan

Web when is the deadline to file form 4 with the state of michigan? An extension of time to file the federal return automatically extends the time to file the michigan return to the new federal due date. Web instructions included on form: The form and payment must be postmarked on or before the original due date of the return..

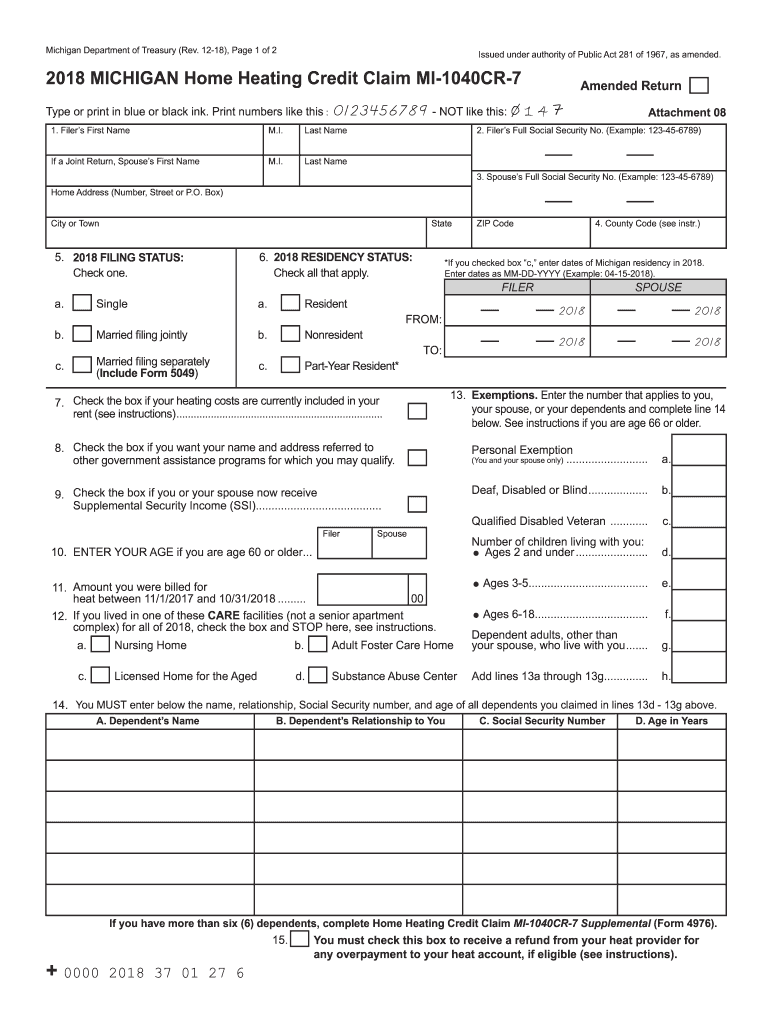

MI MI1040CR7 2018 Fill and Sign Printable Template Online US

The form and payment must be postmarked on or before the original due date of the return. The actual due date to file michigan state individual tax extension form is april 15 for calendar year filers (15th. 12/22 mcl 700.1309, mcl 700.3301, mcl 700.3311, mcl 700.3614, mcr 5.302, mcr 5.309 page 1 of 3 1. Web file form 4 or.

Michigan Form Uia 1733 Fill Online, Printable, Fillable, Blank

We will update this page with a new version of the form for 2024 as soon as it is made available by the michigan government. An extension of time to file is not an extension of time to pay. Sources told 247sports this summer that harrell could be this unit's. Mi 48929 + 0000 2021 05 02 27 4. Dozier,.

Áo sơ mi form rộng Những lưu ý và cách phối đồ Thời trang Dịu Hiền

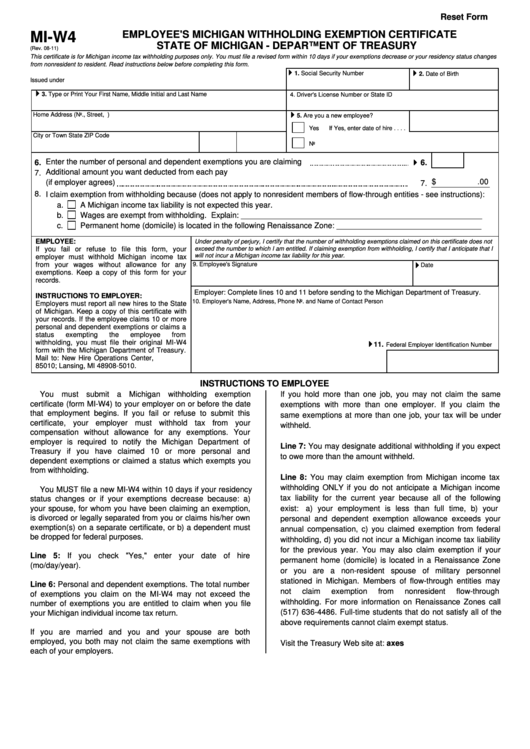

The actual due date to file michigan state individual tax extension form is april 15 for calendar year filers (15th. Web up to $40 cash back reset form michigan department of treasury (rev. Adjustments of gains and losses from sales of business property: The way you fill out this form determines how much tax your employer will withhold from your.

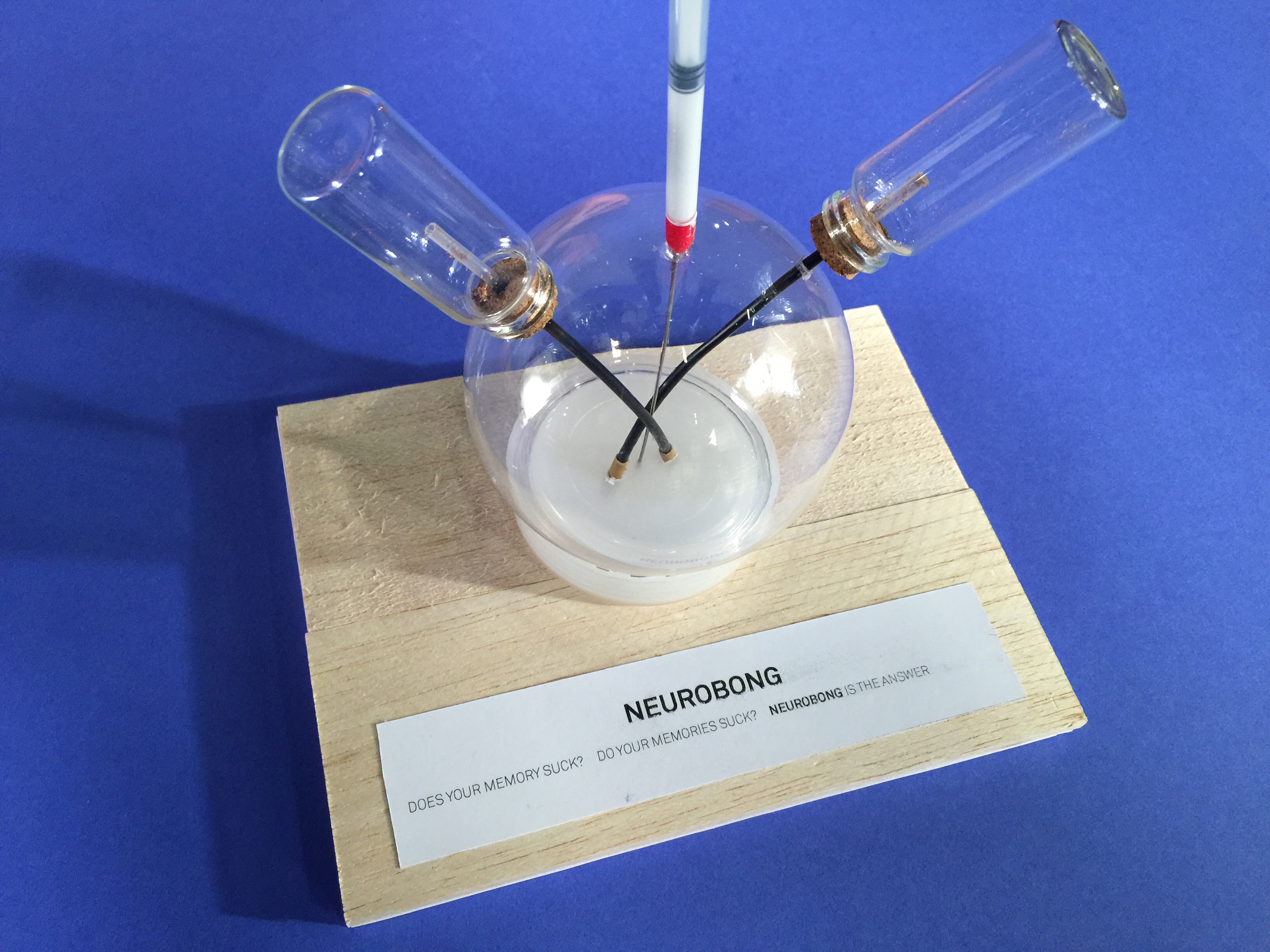

Form 4 Entry 40 Fileupload 1 1888FUTURES

Get everything done in minutes. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. 00 00 00 00 00. Dozier, usa today sports) who to watch: Kris jenkins, mason graham, jaylen harrell.

MI Form 1019 20202021 Fill out Tax Template Online US Legal Forms

If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions. Web file form 4 or a copy of your federal extension. Read instructions on page 2 before completing this form. Computation of tax for first taxable year less than 12 months may elect one of the following: Mi.

Fillable MiW4, Employee'S Michigan Withholding Exemption Certificate

Type or print in blue or black ink. Make check payable to “state of michigan.” 0717), page 1 of 2issued under authority of public act 281 of 1967, as amended.2017 michigan individual income tax return mi1040 return is due april 17, 2018. Local government forms and instructions. The form and payment must be postmarked on or before the original due.

Áo sơ mi form rộng Những lưu ý và cách phối đồ Thời trang Dịu Hiền

An extension of time to file the federal return automatically extends the time to file the michigan return to the new federal due date. We will update this page with a new version of the form for 2024 as soon as it is made available by the michigan government. 12/22 mcl 700.1309, mcl 700.3301, mcl 700.3311, mcl 700.3614, mcr 5.302,.

10 cách phối đồ với áo sơ mi form rộng và form dài đẹp và sang

Follow the simple instructions below: Web up to $40 cash back reset form michigan department of treasury (rev. Adjustments of gains and losses from sales of business property: This form is for income earned in tax year 2022, with tax returns due in april 2023. Type or print in blue or black ink.

Biến hoá thời trang cùng áo sơ mi form rộng để tươi trẻ mỗi ngày

Get everything done in minutes. Web when is the deadline to file form 4 with the state of michigan? Web if you received a letter of inquiry regarding annual return for the return period of 2022, visit michigan treasury online (mto) to file or access the 2022 sales, use and withholding taxes annual return fillable form. Health insurance claims assessment.

Dozier, Usa Today Sports) Who To Watch:

This form is for income earned in tax year 2022, with tax returns due in april 2023. Type or print in blue or black ink. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Enjoy smart fillable fields and interactivity.

Web Michigan Department Of Treasury, Form 4 (Rev.

Web voluntary contributions from form 4642, line 6. Computation of tax for first taxable year less than 12 months may elect one of the following: Web 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms looking for forms from 2015 and earlier? Web state of michigan probate court county application for informal probate and/or appointment of personal representative (testate/intestate) case no.

Web Form 4 Is A Michigan Individual Income Tax Form.

Health insurance claims assessment (hica) ifta / motor carrier. Web instructions included on form: Web up to $40 cash back reset form michigan department of treasury (rev. Employee's michigan withholding exemption certificate and instructions:

Make Check Payable To “State Of Michigan.”

Web if you received a letter of inquiry regarding annual return for the return period of 2022, visit michigan treasury online (mto) to file or access the 2022 sales, use and withholding taxes annual return fillable form. The actual due date to file michigan state individual tax extension form is april 15 for calendar year filers (15th. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. An extension of time to file is not an extension of time to pay.