Maine Individual Income Tax Form 1040Me 2021

Maine Individual Income Tax Form 1040Me 2021 - Web 2020 individual income tax form changes. Edit, sign and print tax forms on any device with signnow. This booklet includes instructions as well as the form itself. Web calculate the maine income for each partner/shareholder. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web this booklet contains all the information you need to fill out and file [ [form 1040me]] for your individual income taxes. • the maine standard deduction is equal to. We last updated the 1040me. We last updated the form 1040me instructions in january 2023,. Register and subscribe now to work on your me form 1040me & more fillable forms.

This booklet includes instructions as well as the form itself. Web texas is one of nine states that doesn’t have an individual income tax. Web federal income tax information and forms: Web worksheet for other tax credits (pdf) other tax credits worksheet. Ad download or email 1040me long & more fillable forms, register and subscribe now! This booklet includes instructions as well as the form itself. File your form 1040me electronically using maine fastfile. We last updated the form 1040me instructions in january 2023,. Web for tax years beginning on or after january 1, 2021, maine taxable income must be increased by the amount of any increase in the business meals deduction allowed for. We last updated the 1040me.

Web [ [form 1040me]] is one of the general individual income tax returns for residents of maine. How do i file a maine income tax return? File your form 1040me electronically using maine fastfile. Web beginning with tax forms required to be filed with mrs in 2024, employers and payers that are. Web maine individual income tax form 1040me for tax period 1/1/2020 to 12/31/2020 or 2 0 2 0to check here if this is an amendedreturn. This booklet includes instructions as well as the form itself. We last updated the 1040me. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web worksheet for other tax credits (pdf) other tax credits worksheet. We last updated the form 1040me instructions in january 2023,.

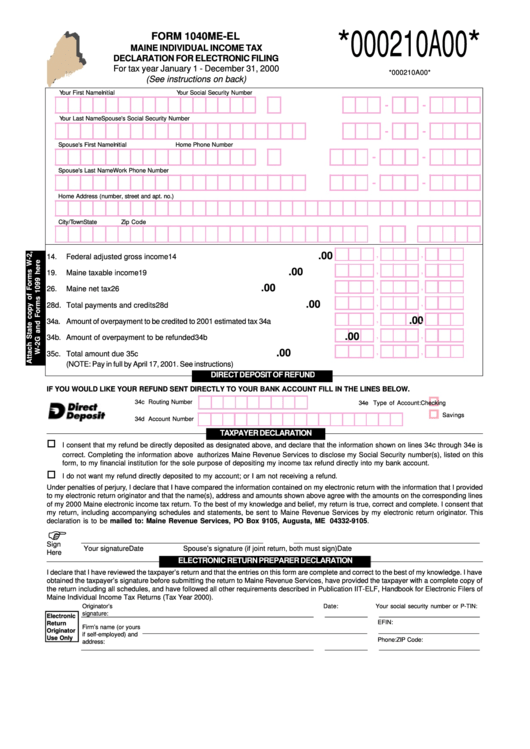

Form 1040meEl Maine Individual Tax Declaration For Electronic

Web calculate the maine income for each partner/shareholder. Web beginning with tax forms required to be filed with mrs in 2024, employers and payers that are. We last updated the form 1040me instructions in january 2023,. • the maine standard deduction is equal to. Complete, edit or print tax forms instantly.

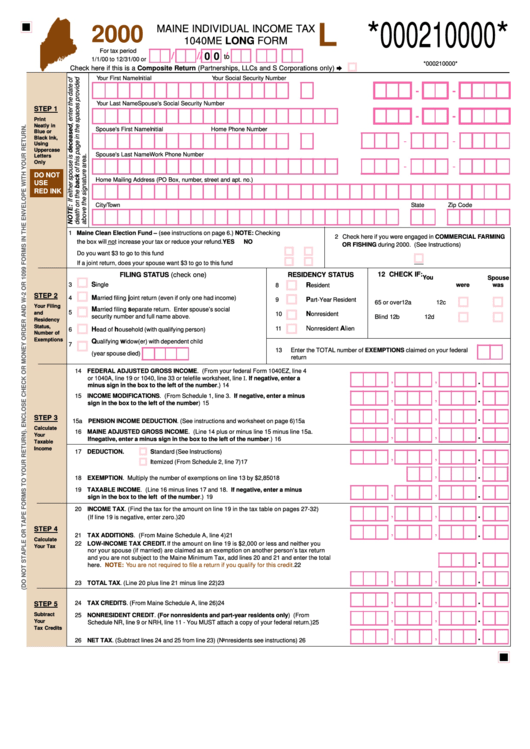

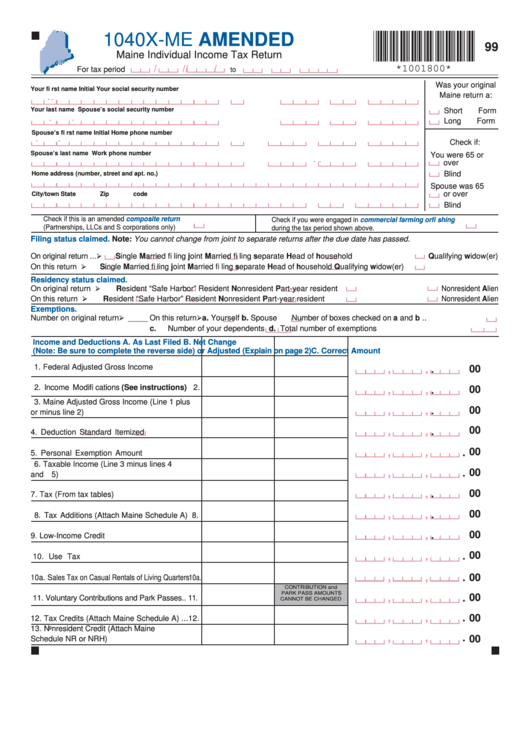

Form 1040me Maine Individual Tax Long Form 2000 printable

Web form 1040me due date: Worksheet for form 1040me, schedule a, line 20. Complete, edit or print tax forms instantly. Web if the taxable income is: Web this booklet contains all the information you need to fill out and file [ [form 1040me]] for your individual income taxes.

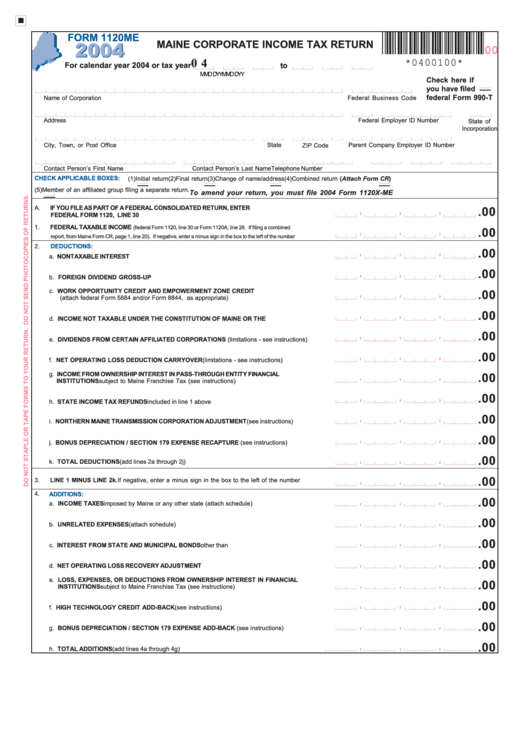

990 Maine Tax Forms And Templates free to download in PDF

Edit, sign and print tax forms on any device with signnow. Web texas is one of nine states that doesn’t have an individual income tax. File your form 1040me electronically using maine fastfile. Web 2020 individual income tax form changes. Ad download or email 1040me long & more fillable forms, register and subscribe now!

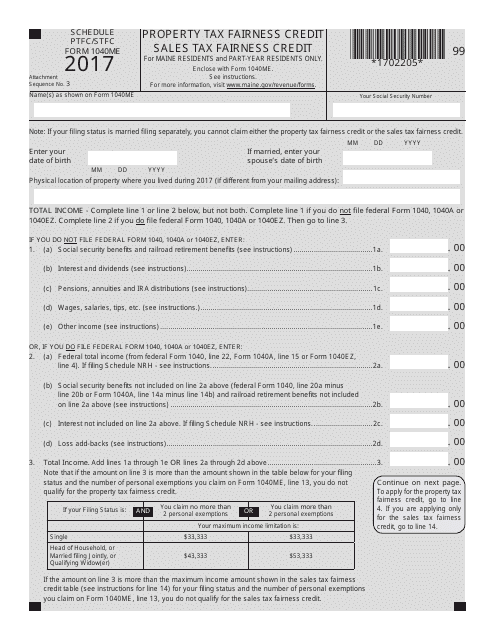

Form 1040ME Schedule PTFC/STFC Download Printable PDF or Fill Online

We last updated the 1040me. Web we last updated maine form 1040me in january 2023 from the maine revenue services. Web form 1040me due date: We last updated the form 1040me instructions in january 2023,. Complete, edit or print tax forms instantly.

Form 1040Me Maine Individual Tax Return Form printable pdf

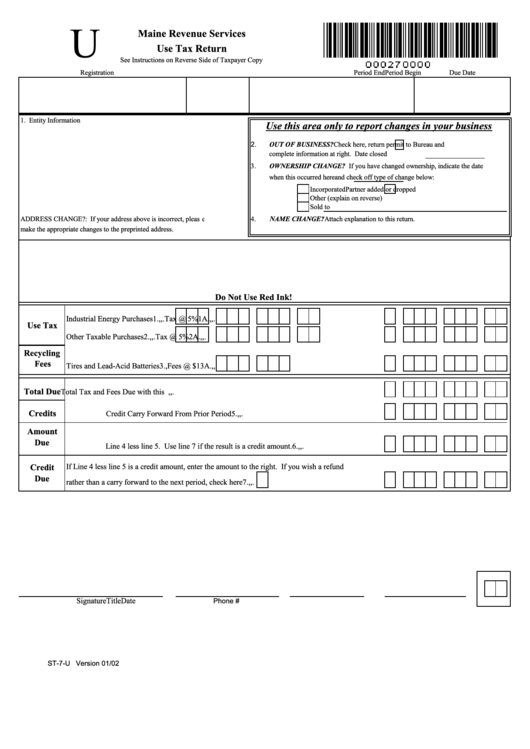

Important changes for 2020 reporting use tax on income tax return. Ad download or email 1040me long & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. This booklet includes instructions as well as the form itself. Web form 1040me due date:

Top 151 Maine Tax Forms And Templates free to download in PDF format

• the maine standard deduction is equal to. Web if the taxable income is: Web we last updated maine form 1040me in january 2023 from the maine revenue services. Important changes for 2020 reporting use tax on income tax return. Enter this amount on line 2 and on the composite.

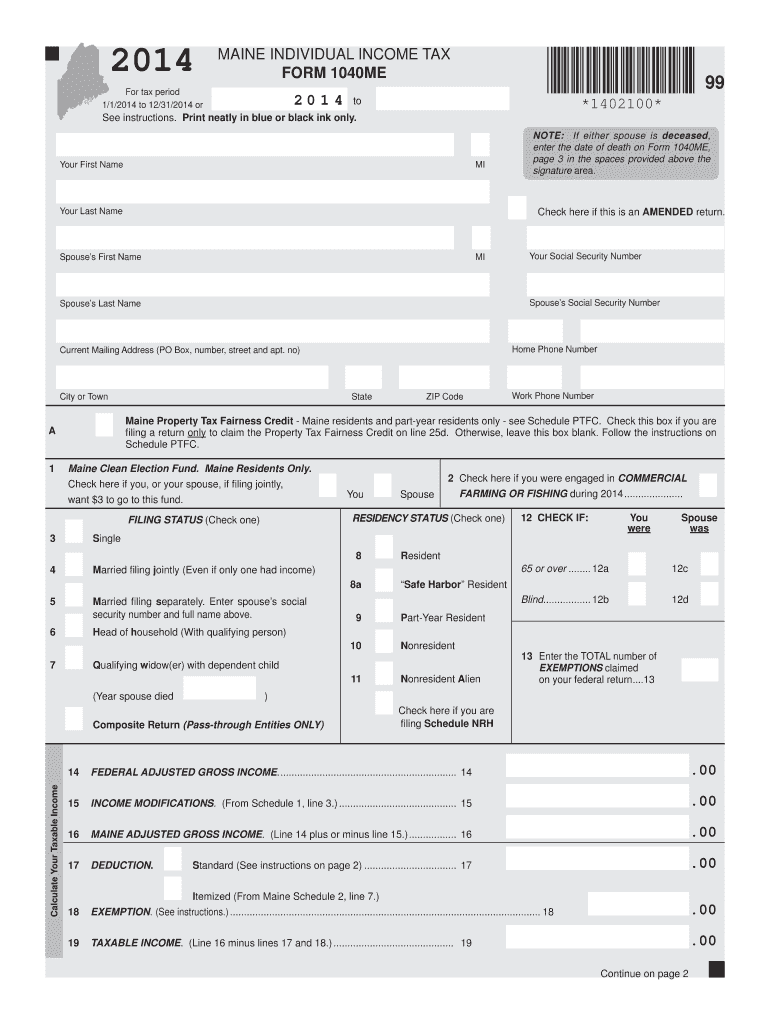

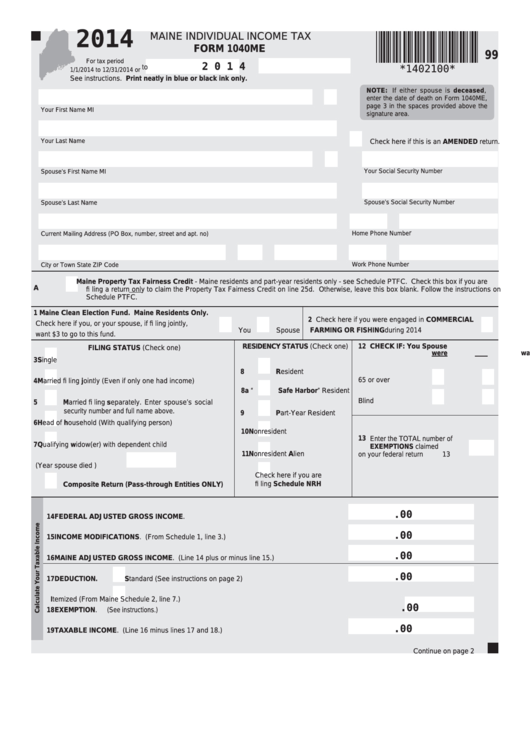

2014 Form ME 1040ME Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Multiply the income reported on line 1 by 7.15% (0.0715). Web this booklet contains all the information you need to fill out and file [ [form 1040me]] for your individual income taxes. Web worksheet for other tax credits (pdf) other tax credits worksheet. File your form 1040me electronically using maine fastfile.

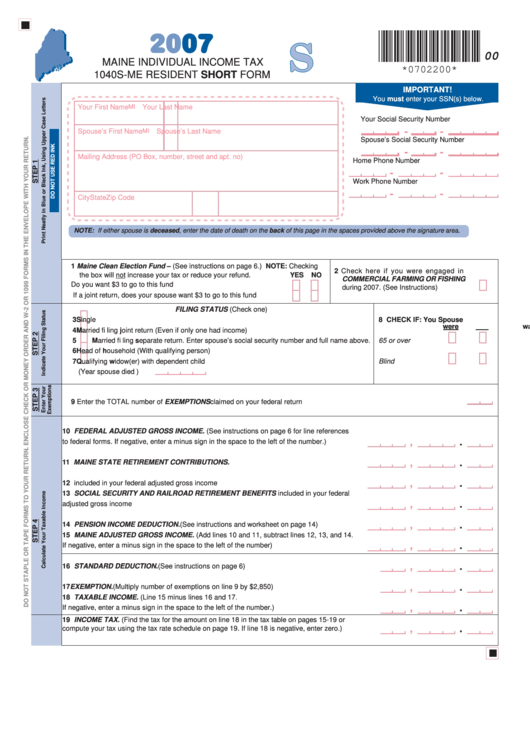

Form 1040sMe Maine Individual Tax 2007 printable pdf download

Web for tax years beginning on or after january 1, 2021, maine taxable income must be increased by the amount of any increase in the business meals deduction allowed for. • the maine standard deduction is equal to. The other states without an individual income tax are: Enter this amount on line 2 and on the composite. Web if the.

Irs 1040 Form Line 14 FAFSA Tutorial

Web we last updated maine form 1040me in january 2023 from the maine revenue services. How do i file a maine income tax return? Web federal income tax information and forms: Web worksheet for other tax credits (pdf) other tax credits worksheet. Web [ [form 1040me]] is one of the general individual income tax returns for residents of maine.

Fillable Form 1040me Maine Individual Tax 2014 printable pdf

Web for tax years beginning on or after january 1, 2021, maine taxable income must be increased by the amount of any increase in the business meals deduction allowed for. Complete, edit or print tax forms instantly. Web [ [form 1040me]] is one of the general individual income tax returns for residents of maine. Web texas is one of nine.

The Other States Without An Individual Income Tax Are:

This booklet includes instructions as well as the form itself. Worksheet for form 1040me, schedule a, line 20. Complete, edit or print tax forms instantly. Web 2020 individual income tax form changes.

For Tax Years Beginning On.

We last updated the 1040me. File your form 1040me electronically using maine fastfile. Register and subscribe now to work on your me form 1040me & more fillable forms. Web this booklet contains all the information you need to fill out and file [ [form 1040me]] for your individual income taxes.

Web Maine Individual Income Tax Form 1040Me For Tax Period 1/1/2020 To 12/31/2020 Or 2 0 2 0To Check Here If This Is An Amendedreturn.

Important changes for 2020 reporting use tax on income tax return. • the maine standard deduction is equal to. Web calculate the maine income for each partner/shareholder. Multiply the income reported on line 1 by 7.15% (0.0715).

Ad Download Or Email 1040Me Long & More Fillable Forms, Register And Subscribe Now!

This booklet includes instructions as well as the form itself. We last updated the form 1040me instructions in january 2023,. How do i file a maine income tax return? Web for tax years beginning on or after january 1, 2021, maine taxable income must be increased by the amount of any increase in the business meals deduction allowed for.