Tax Exempt Form Oklahoma

Tax Exempt Form Oklahoma - Web • you can claim an exemption for your dependent. Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. Web once you have that, you are eligible to issue a resale certificate. Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Royalty interest to nonresident interest owners. Therefore, you can complete the sales tax exemption / resale certificate form by providing your oklahoma. Ad get lease, contracts & tax forms now. Web we make completing any oklahoma tax exempt form pdf much easier. Who do i contact if i have questions? What do i need to apply?.

Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Who do i contact if i have questions? Web • you can claim an exemption for your dependent. Create, edit, and print your business and legal documents quickly and easily! Have you been certified as receiving 100% permanent disability benefits?. During the special holiday, people can buy any product in. Web chased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. • you and/or your spouse are 65 years of age or older by 12/31/2020. Web once you have that, you are eligible to issue a resale certificate. A variety of commercial forestry service equipment will be exempt from oklahoma sales and use tax starting.

Entities that qualify for oklahoma sales tax exemption are. Web you can download a pdf of the oklahoma streamlined sales tax certificate of exemption (form sst) on this page. Web this packet of information and application forms will guide you in applying for sales tax exemption in oklahoma. A variety of commercial forestry service equipment will be exempt from oklahoma sales and use tax starting. What do i need to apply?. For other oklahoma sales tax exemption certificates, go here. No do i need a form? • you and/or your spouse are 65 years of age or older by 12/31/2020. Have you been certified as receiving 100% permanent disability benefits?. Web we make completing any oklahoma tax exempt form pdf much easier.

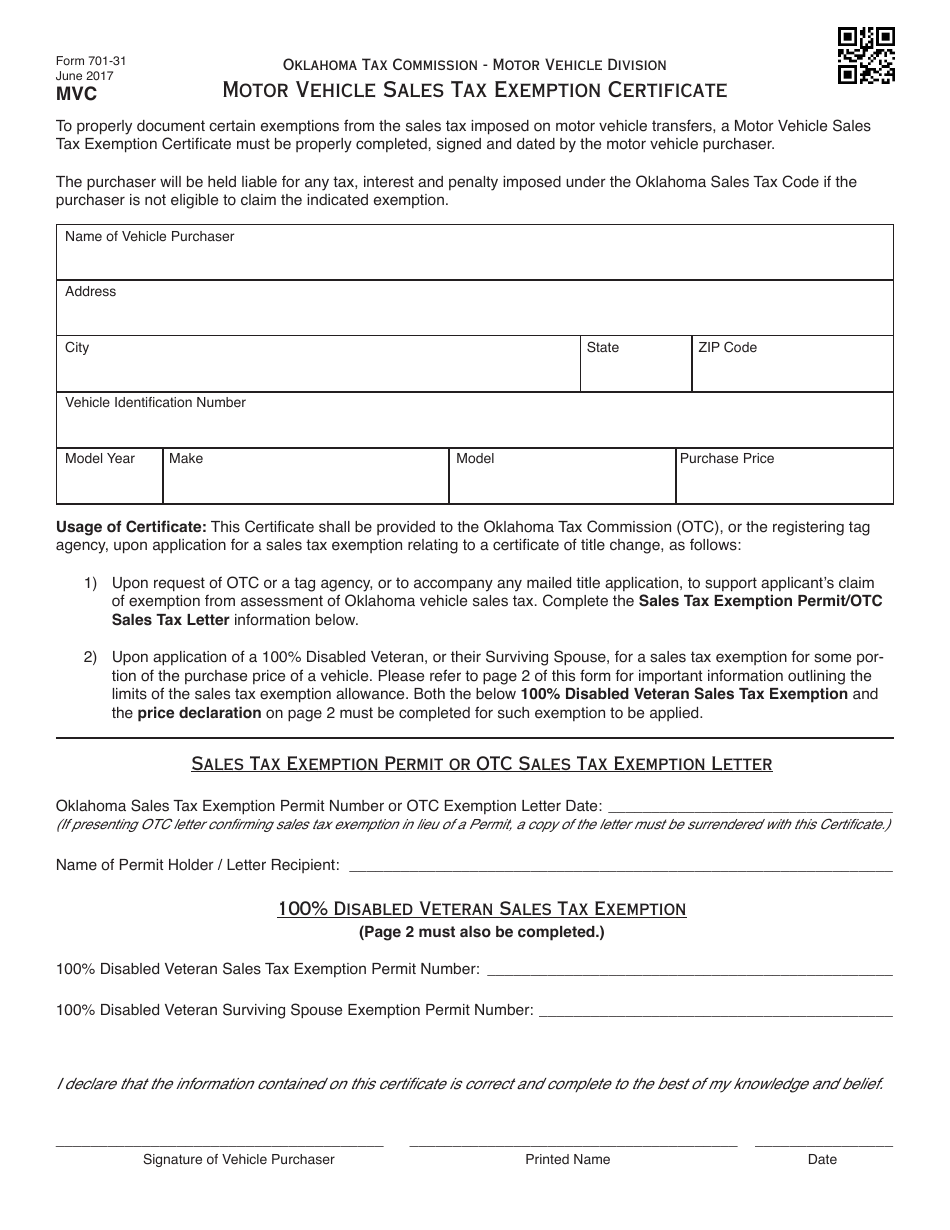

OTC Form 70131 Download Fillable PDF or Fill Online Motor Vehicle

This page discusses various sales tax exemptions in. Print & download start for free. Web this is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and. Web click on the state below where you will be traveling.

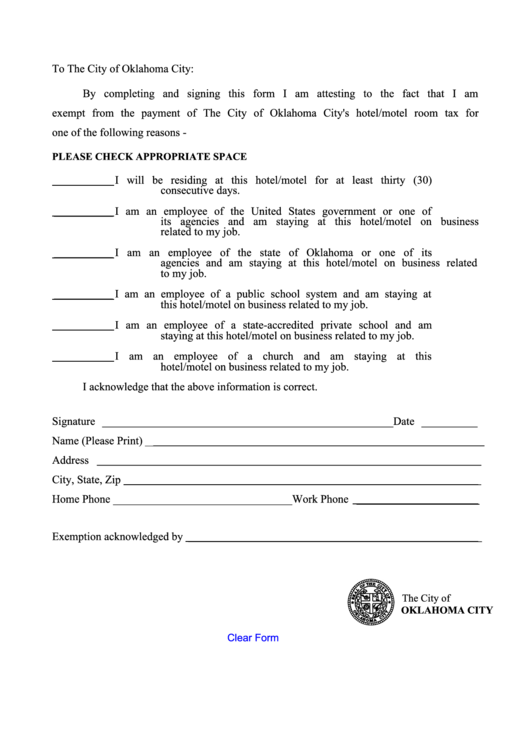

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

What do i need to apply?. Web january 17, 2023 re: Also include amounts for purchases for which you are paying. Web exemption for tree farming and logging businesses. For other oklahoma sales tax exemption certificates, go here.

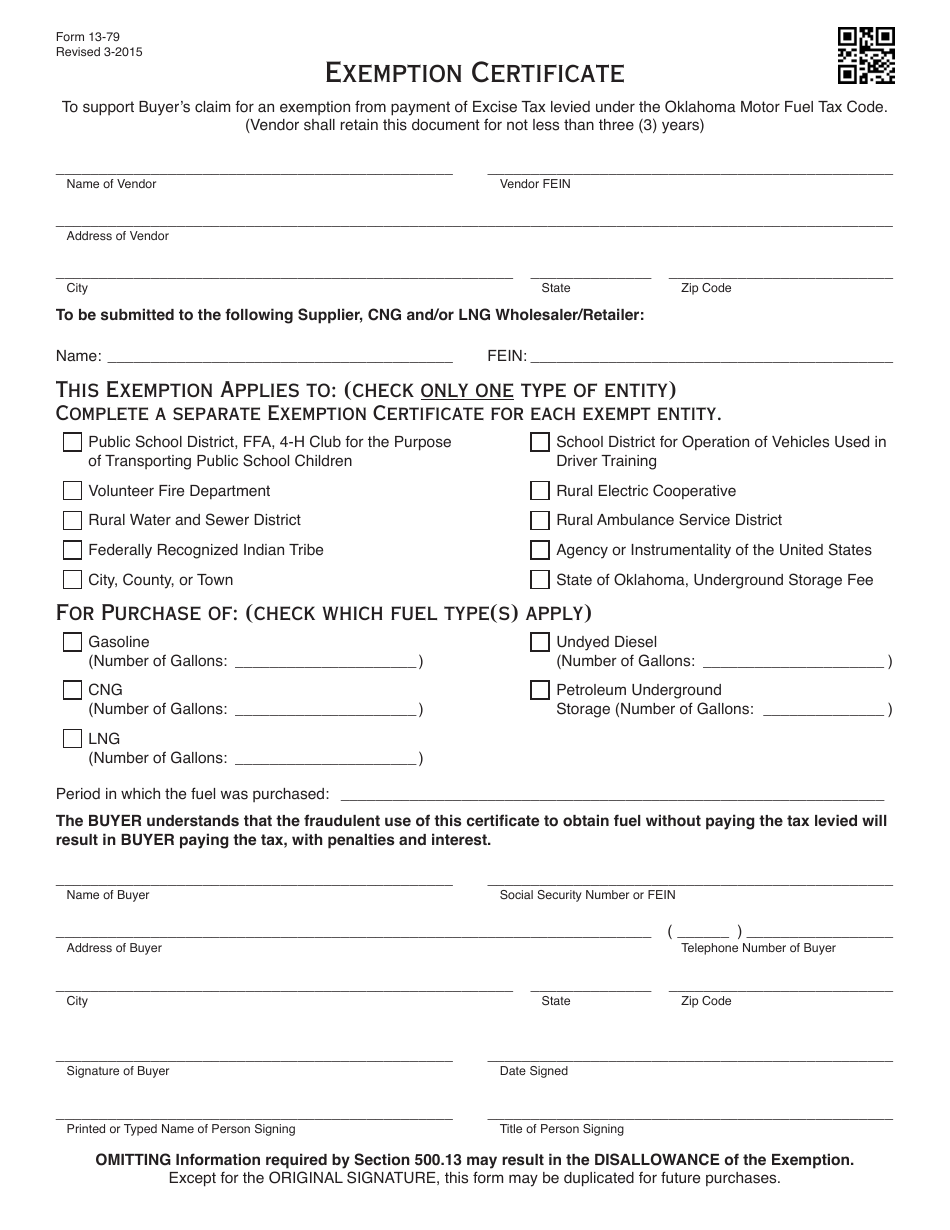

OTC Form 1379 Download Fillable PDF or Fill Online Exemption

Print & download start for free. Web • you can claim an exemption for your dependent. If you are not filing an income tax return, mail this. For other oklahoma sales tax exemption certificates, go here. Create, edit, and print your business and legal documents quickly and easily!

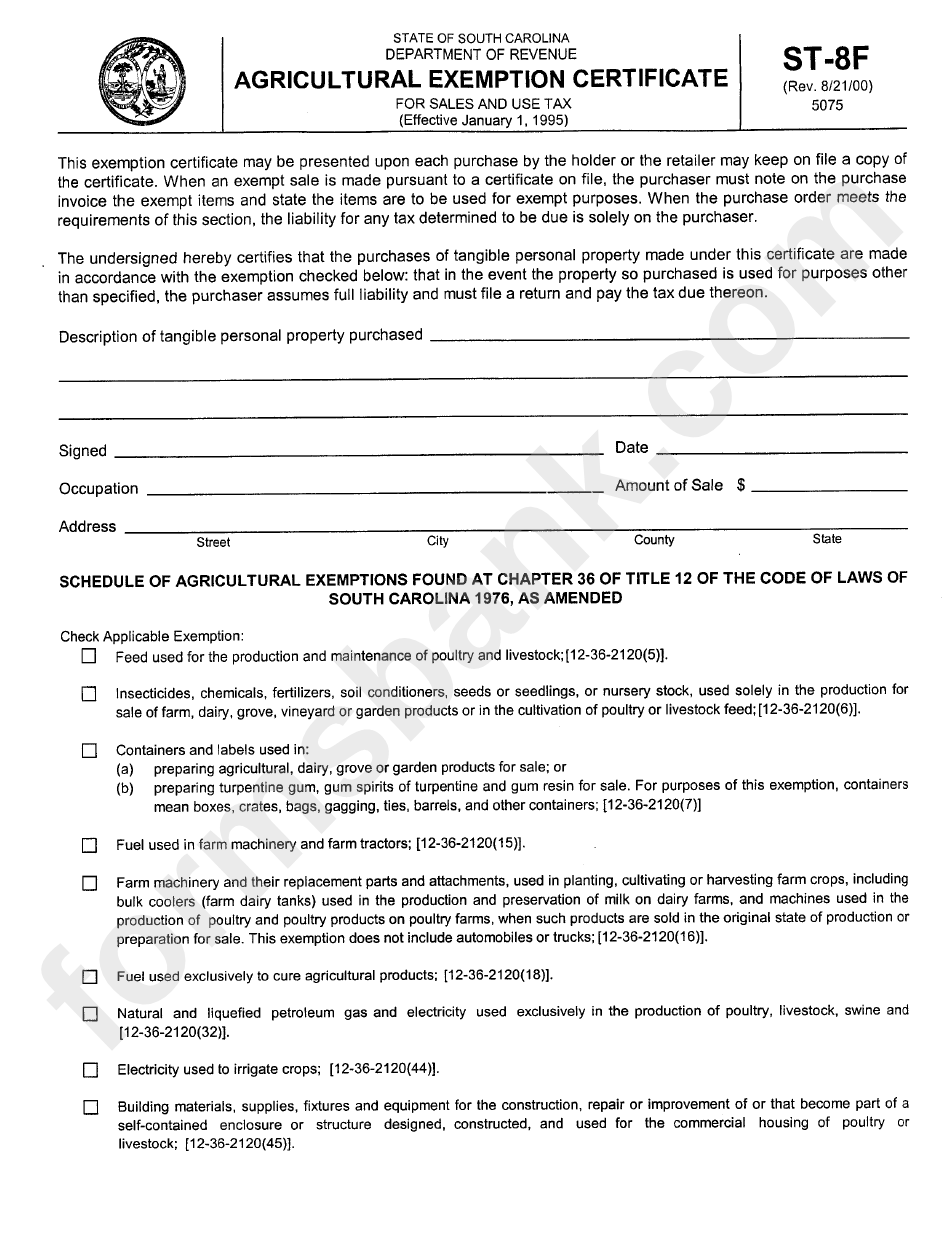

Form St8f Agricultural Exemption Certificate printable pdf download

Web information who is eligible for a 100% veteran disability exemption? Entities that qualify for oklahoma sales tax exemption are. Web chased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain.

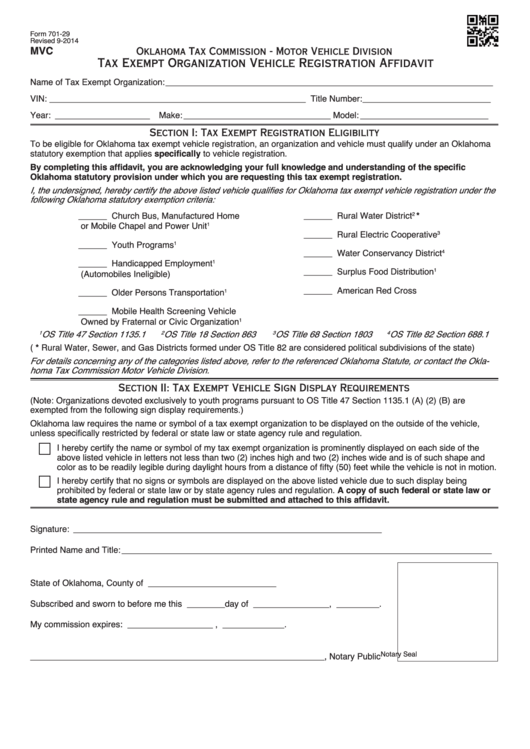

Top 20 Oklahoma Tax Exempt Form Templates free to download in PDF format

• you and/or your spouse are 65 years of age or older by 12/31/2020. Web exemption for tree farming and logging businesses. What do i need to apply?. If you are not filing an income tax return, mail this. Web • you can claim an exemption for your dependent.

Oklahoma tax exempt form Docs & forms

Web this is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and. Web we make completing any oklahoma tax exempt form pdf much easier. Web • you can claim an exemption for your dependent. Create, edit, and.

Oklahoma Tax Exempt Form printable pdf download

Web the agriculture exemption application on oktap allows you to apply for a new exemption permit, renew an expiring or already expired permit, update information for your already. This page discusses various sales tax exemptions in. A variety of commercial forestry service equipment will be exempt from oklahoma sales and use tax starting. Web the state's sales tax holiday is.

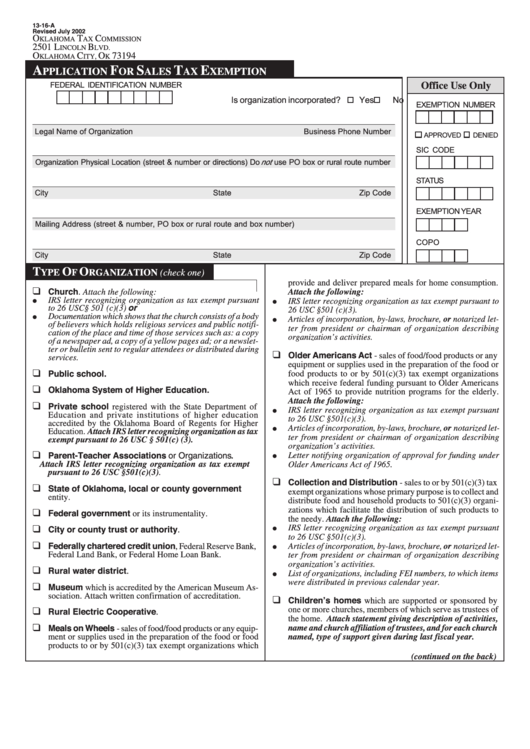

Form 1316A Application For Sales Tax Exemption Oklahoma Tax

Create, edit, and print your business and legal documents quickly and easily! Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. Who do i contact if i have questions? If you are not filing an income tax return, mail this. Web we make completing any oklahoma tax.

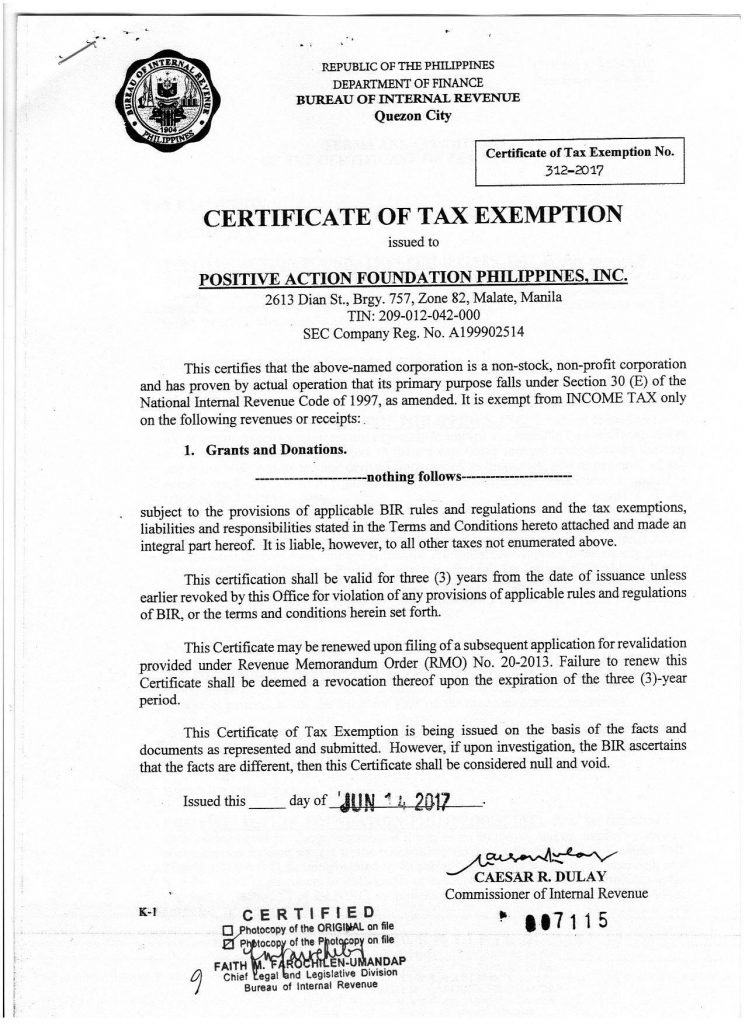

Certificate of TAX Exemption PAFPI

Web • you can claim an exemption for your dependent. Who do i contact if i have questions? What do i need to apply?. Web this is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and. Have.

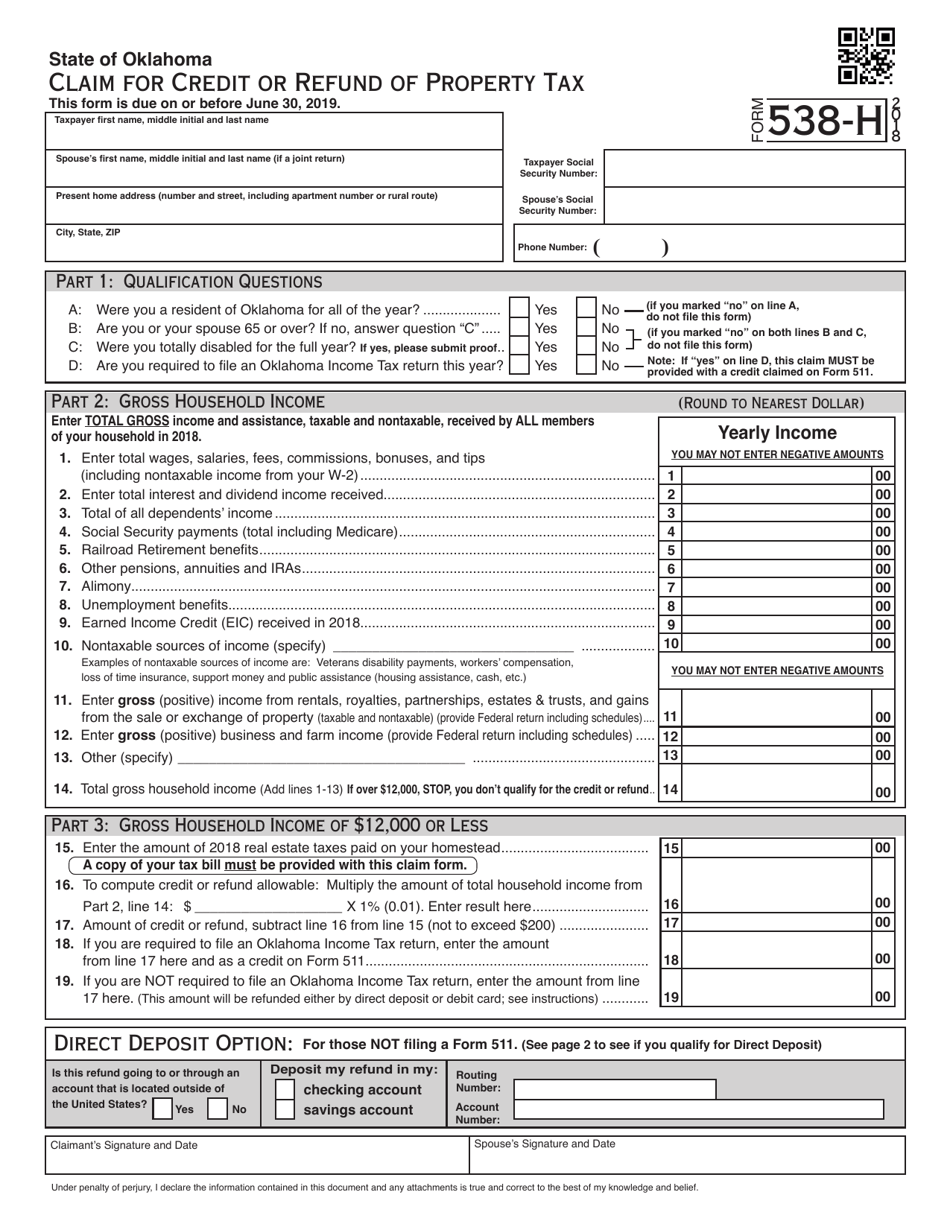

OTC Form 538H Download Fillable PDF or Fill Online Claim for Credit or

If you are not filing an income tax return, mail this. Therefore, you can complete the sales tax exemption / resale certificate form by providing your oklahoma. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? For other oklahoma sales tax exemption certificates, go here. This page discusses various sales tax exemptions in.

Web January 17, 2023 Re:

Online registration & reporting systems. This page discusses various sales tax exemptions in. Web exemption for tree farming and logging businesses. Therefore, you can complete the sales tax exemption / resale certificate form by providing your oklahoma.

Have You Been Certified As Receiving 100% Permanent Disability Benefits?.

Print & download start for free. Web information who is eligible for a 100% veteran disability exemption? Web the state's sales tax holiday is always the first friday through sunday in august, which is aug. Web • you can claim an exemption for your dependent.

Web Once You Have That, You Are Eligible To Issue A Resale Certificate.

Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. During the special holiday, people can buy any product in. For other oklahoma sales tax exemption certificates, go here. What do i need to apply?.

Web Click On The State Below Where You Will Be Traveling To Or Purchasing From To Find Out If That State Exempts State Taxes And What The Requirements Are (For Example, Many States.

If you are not filing an income tax return, mail this. No do i need a form? Web chased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Who do i contact if i have questions?