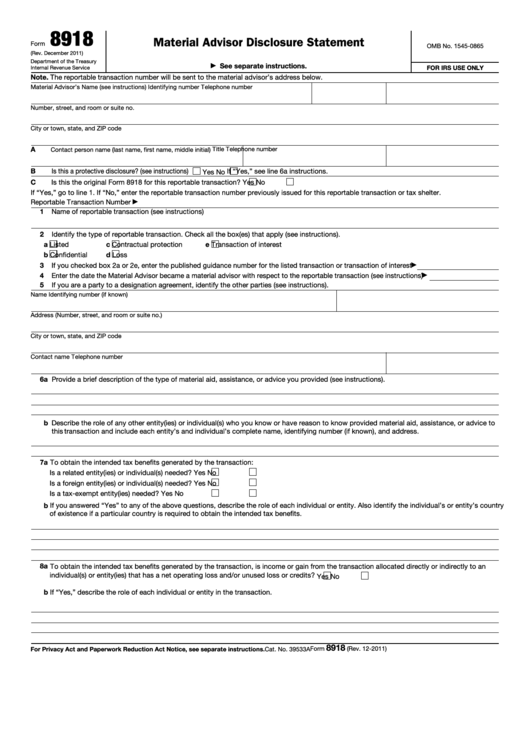

Irs Form 8918

Irs Form 8918 - After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. The irs will accept prior versions of. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. Web this form is for reporting to the irs something called a reportable or listed transaction. Web form 8918 available on irs.gov. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Web catalog number 39533a form. Material advisors who file a form 8918 will. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs.

Web form 8918 replaces form 8264, application for registration of a tax shelter. The reportable transaction number will be sent to the material advisor’s address below. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. Material advisors who file a form 8918 will. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs. Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Material advisor disclosure statement 1121 06/19/2022 Form 8918 replaces form 8264, application for registration of a tax shelter. The irs will accept prior versions of. Web form 8918 available on irs.gov.

Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. Material advisors who file a form 8918 will receive a reportable transaction number from the irs. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material advisor. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. November 2021) department of the treasury internal revenue service. Web form 8918 is used by materials advisors, with respect to any reportable transaction, to disclose certain information about the reportable transaction with the irs. General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Material advisors who file a form 8918 will. Web form 8918 replaces form 8264, application for registration of a tax shelter. Web form 8918 available on irs.gov.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

The reportable transaction number will be sent to the material advisor’s address below. Material advisors to any reportable transaction file form 8918 to disclose certain information about the reportable transaction. These are transactions that the irs has specifically identified as possible tax abuse areas. Web this form is for reporting to the irs something called a reportable or listed transaction..

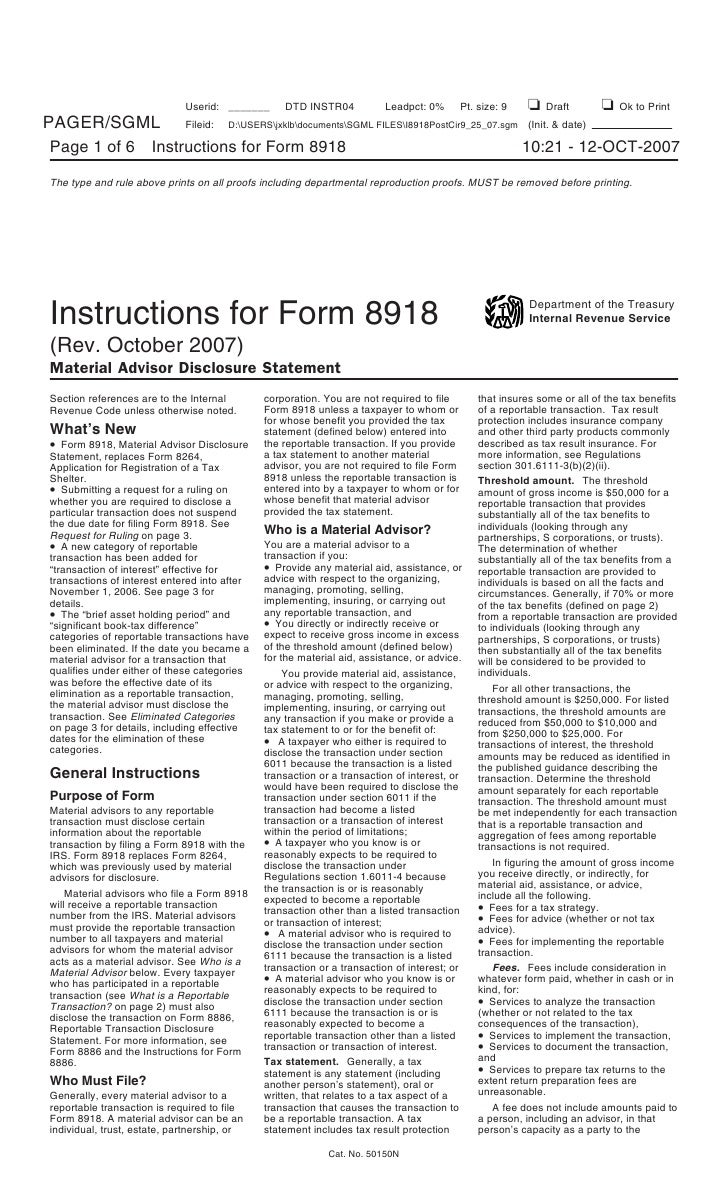

Inst 8918Instructions for Form 8918, Material Advisor Disclosure Sta…

Material advisors who file a form 8918 will. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. The material advisor is someone that helps create and. Web irs lets tax pros.

Inst 8918Instructions for Form 8918, Material Advisor Disclosure Sta…

Material advisors who file a form 8918 will receive a reportable transaction number from the irs. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: November 2021) department of the treasury internal revenue service. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom the material advisor acts as a material.

Fill Free fillable Form 8918 2011 Material Advisor Disclosure

Web form 8918 replaces form 8264, application for registration of a tax shelter. Web this form is for reporting to the irs something called a reportable or listed transaction. Web form 8918 available on irs.gov. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement. Web catalog.

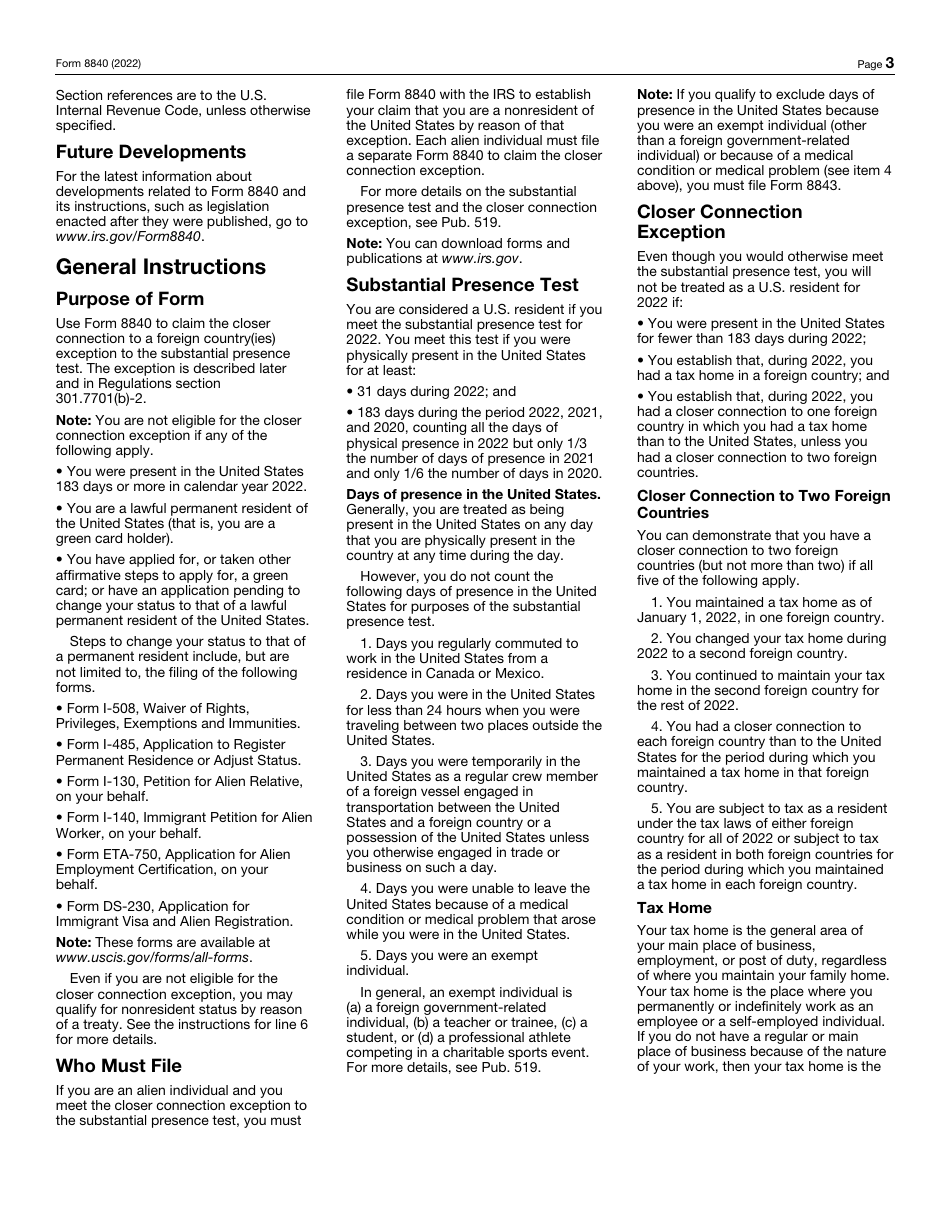

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

November 2021) department of the treasury internal revenue service. General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. Web this form is for reporting to the irs something called a reportable or listed transaction. Web catalog number 39533a form. Material advisors who.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to.

IRS Fax Numbers Where You Can Send Your Tax Forms iFax

Material advisors who file a form 8918 will receive a reportable transaction number from the irs. November 2021) department of the treasury internal revenue service. Web form 8918 replaces form 8264, application for registration of a tax shelter. Material advisor disclosure statement 1121 06/19/2022 Form 8918 replaces form 8264, application for registration of a tax shelter.

Fill Free fillable IRS PDF forms

Form 8918 replaces form 8264, application for registration of a tax shelter. The material advisor is someone that helps create and. Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs..

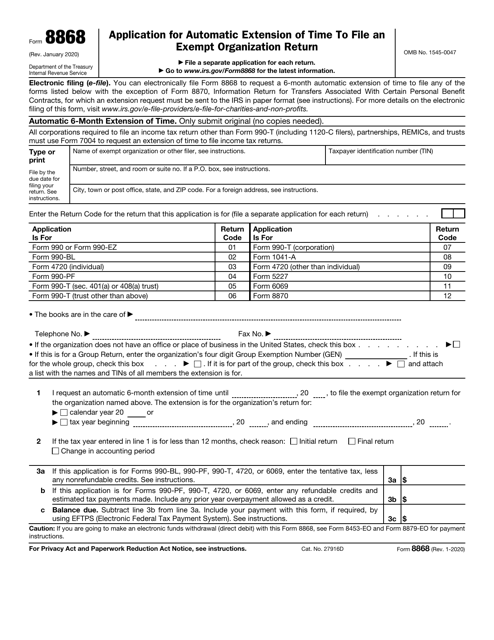

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Web form 8918 replaces form 8264, application for registration of a tax shelter. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. Material advisors who file a form 8918 will receive.

Fillable Form 8918 Material Advisor Disclosure Statement printable

Material advisors who file a form 8918 will receive a reportable transaction number from the irs. Web form 8918 replaces form 8264, application for registration of a tax shelter. The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. The irs will accept prior versions of..

Instructions For Form 8918, Material Advisor Disclosure Statement 1121 12/09/2021 Form 8918:

Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Web form 8918 available on irs.gov. Web a material advisor required to file a disclosure statement under this section must file a completed form 8918, “material advisor disclosure statement” (or successor form) in accordance with this paragraph (d) and the instructions to the form. Web until further notice, the irs is implementing the temporary procedure described below for fax transmission of form 8918, material advisor disclosure statement.

Material Advisors Must Provide The Reportable Transaction Number To All Taxpayers And Material Advisors For Whom The Material Advisor Acts As A Material Advisor.

General instructions purpose of form material advisors to any reportable transaction must disclose certain information about the reportable transaction by filing a form 8918 with the irs. November 2021) department of the treasury internal revenue service. The internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its. Web catalog number 39533a form.

Material Advisors To Any Reportable Transaction File Form 8918 To Disclose Certain Information About The Reportable Transaction.

The reportable transaction number will be sent to the material advisor’s address below. The irs will accept prior versions of. Form 8918 replaces form 8264, application for registration of a tax shelter. Web form 8918 replaces form 8264, application for registration of a tax shelter.

Web Irs Lets Tax Pros Fax Form 8918 For Material Advisor Disclosures.

These are transactions that the irs has specifically identified as possible tax abuse areas. After june 1, 2022, the irs will accept only the latest version of form 8918 (rev. Web this form is for reporting to the irs something called a reportable or listed transaction. Material advisors who file a form 8918 will receive a reportable transaction number from the irs.