147 C Form Irs

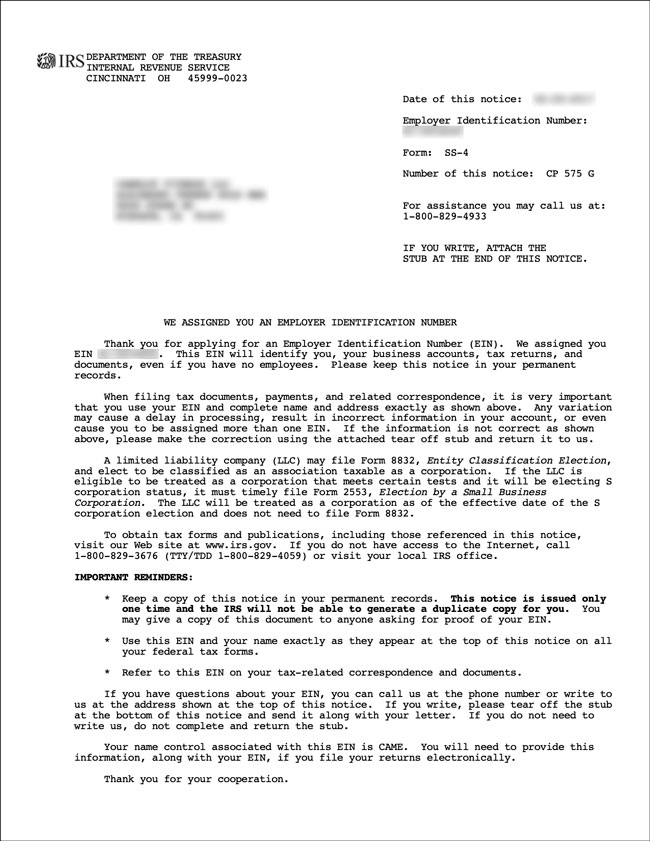

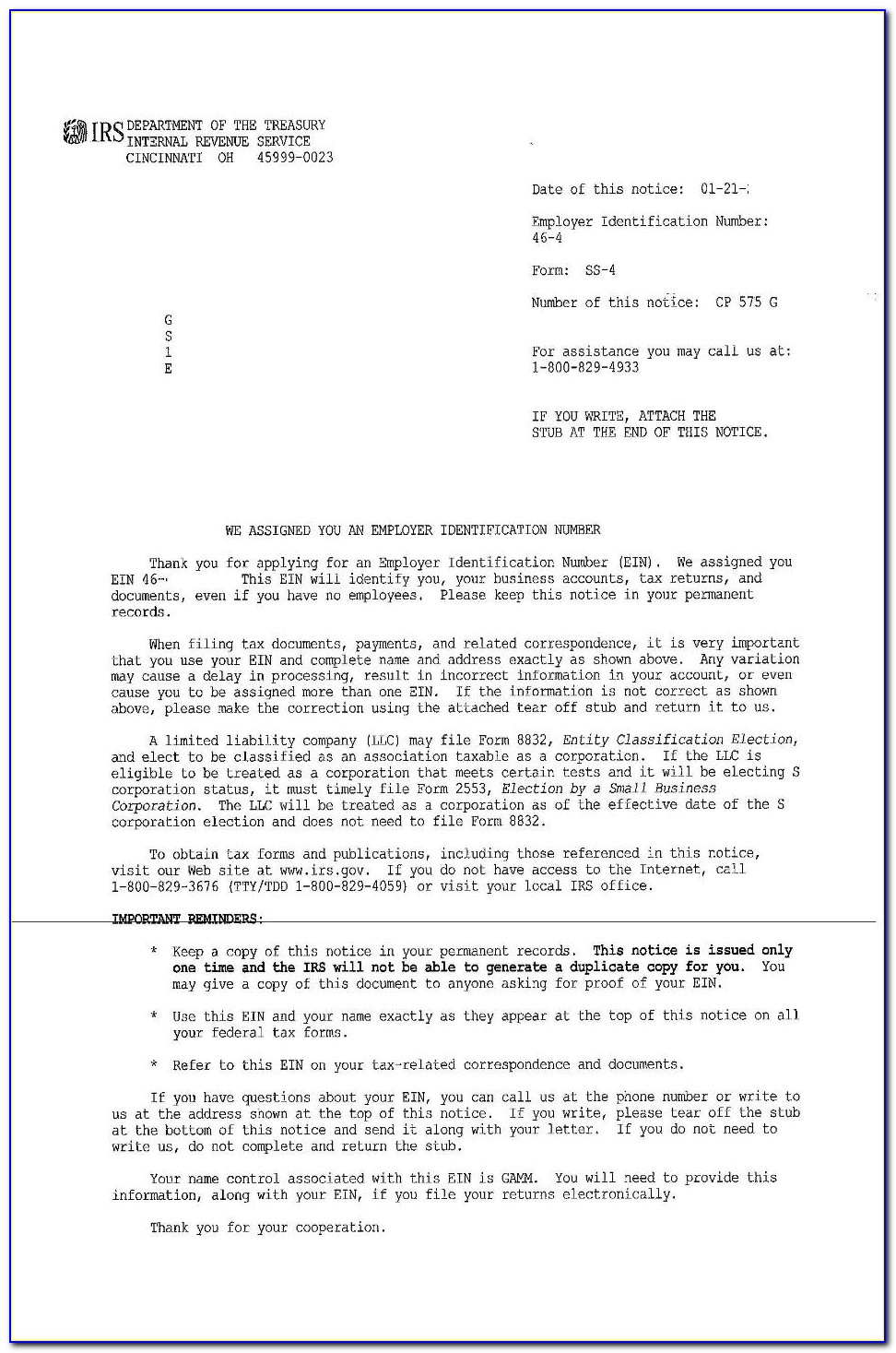

147 C Form Irs - The owner of a us llc sends this form to the irs in order to request. Web how to get a 147c ein verification letter from the irs. Web what is a 147c letter? Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web hence, the 147c letter, acquired from the internal revenue service (irs), is used to request a replacement for the company’s ein or allow a third party to verify the ein with their. Partnerships must generally file form 1065. It is common that most established businesses may not have their original ein confirmation letter available. The letter requests information about the business’s ein or employer identification number. Web 147c form from the irs is the employer identification number (ein) verification letter. Here’s how you request an ein verification letter (147c) the easiest way to get a copy.

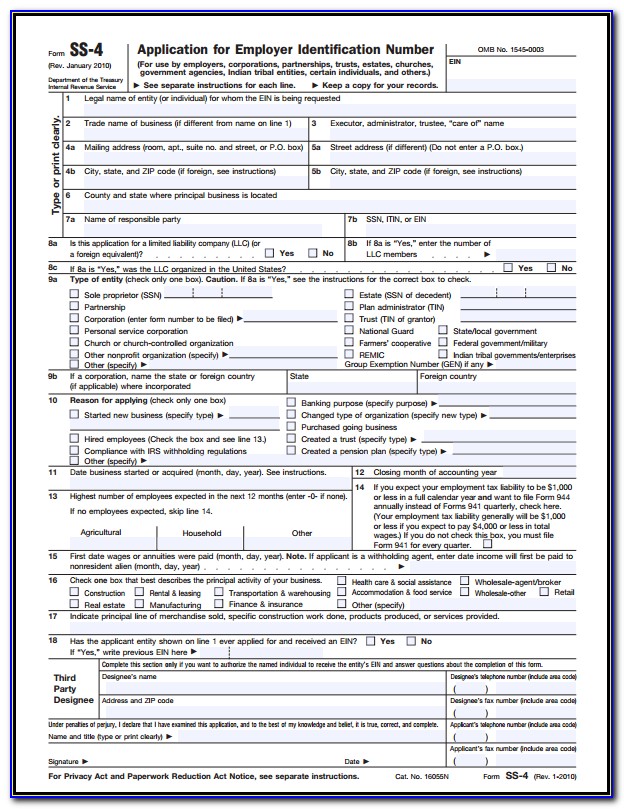

Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web this letter is in reply to a request for a ruling that the use of bond proceeds as described below will be an insubstantial deviation from the public notice and approval requirements. Partnerships must generally file form 1065. It is common that most established businesses may not have their original ein confirmation letter available. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web the only way to ask the irs for a 147c letter is to call them. Taxpayers may need to use. An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its. Web what is a 147c letter? Web 147c form from the irs is the employer identification number (ein) verification letter.

An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its. It is common that most established businesses may not have their original ein confirmation letter available. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. The owner of a us llc sends this form to the irs in order to request. The irs offers the following options: The letter requests information about the business’s ein or employer identification number. Web the only way to ask the irs for a 147c letter is to call them. Web how to get a 147c ein verification letter from the irs. Web hence, the 147c letter, acquired from the internal revenue service (irs), is used to request a replacement for the company’s ein or allow a third party to verify the ein with their. Web did the irs make a typo on your ein letter and you need a new form?

Irs Name Change Letter Sample Lovely Irs Ein Name Change Form Models

An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its. Web this letter is in reply to a request for a ruling that the use of bond proceeds as described below will be an insubstantial deviation from the public notice and.

Irs Letter 147c Sample Letter Resume Template Collections NLzn2jOz2Q

Use this option if you speak english or spanish and can call the. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Web hence, the 147c letter, acquired from the internal revenue service (irs), is used to request a replacement for the company’s.

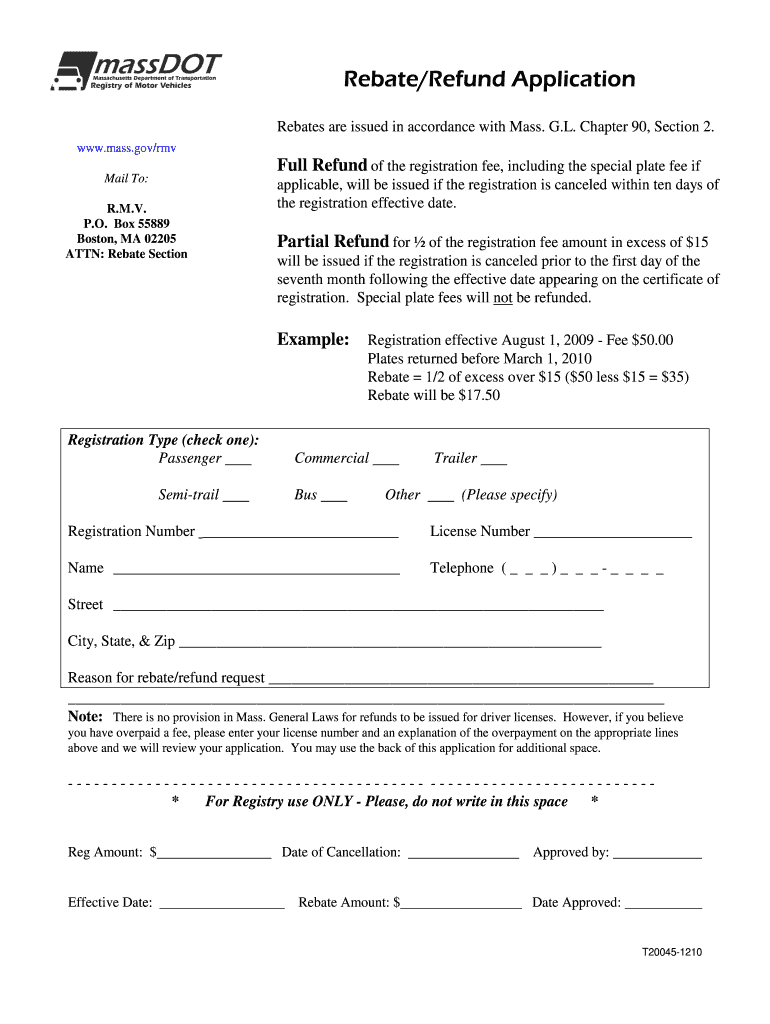

2010 Form MA T20045 Fill Online, Printable, Fillable, Blank pdfFiller

The 147c letter is a document that is sent to businesses by the irs. Web hence, the 147c letter, acquired from the internal revenue service (irs), is used to request a replacement for the company’s ein or allow a third party to verify the ein with their. Here’s how you request an ein verification letter (147c) the easiest way to.

PPACAHEALTH REFORM UPDATES PPACAW2 REPORTINGIRS GUIDANCE CHART

Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. The 147c letter is a document that is sent to businesses by the irs. An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs).

147c Letter Irs Sle Bangmuin Image Josh

The letter requests information about the business’s ein or employer identification number. Here’s how you request an ein verification letter (147c) the easiest way to get a copy. An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its. Partnerships must generally.

IRS FORM 147C PDF

The letter requests information about the business’s ein or employer identification number. The 147c letter is a document that is sent to businesses by the irs. Here’s how you request an ein verification letter (147c) the easiest way to get a copy. Use this option if you speak english or spanish and can call the. Your previously filed return should.

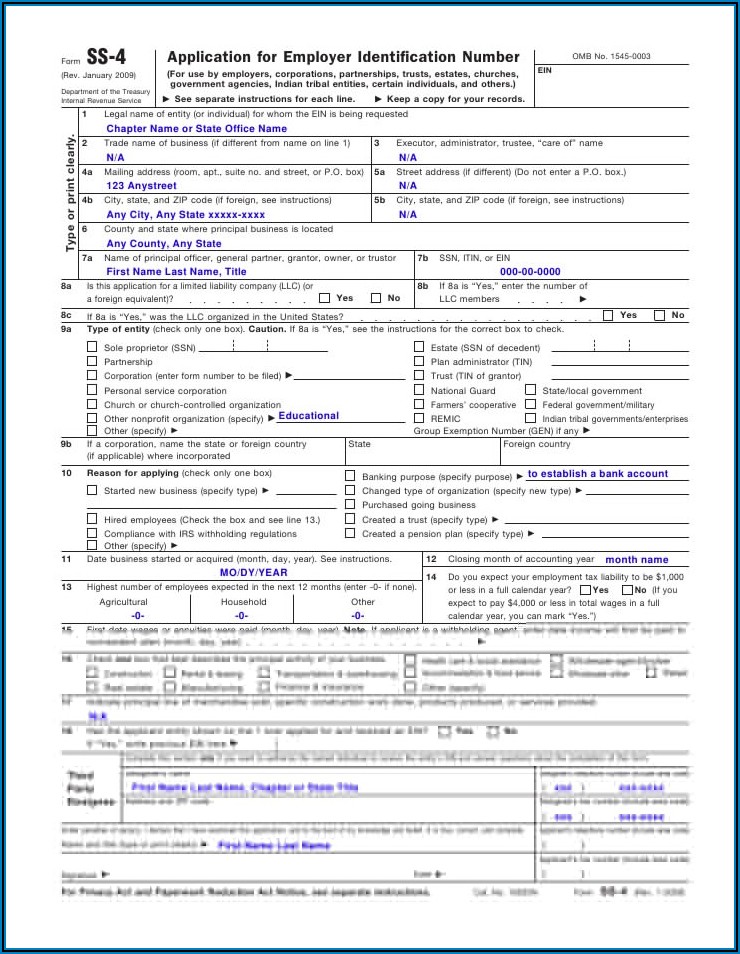

SS4 Letter

Web 147c form from the irs is the employer identification number (ein) verification letter. Use this option if you speak english or spanish and can call the. Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). Web the only way to ask the irs for a.

HOW TO GET IRS EIN CONFIRMATION LETTER THE EASY WAY

Your previously filed return should. Web how to get a 147c ein verification letter from the irs. Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). Web the only way to ask the irs for a 147c letter is to call them. Web follow the steps.

IRS W9 Form In Word Format Glendale Community

Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein. Taxpayers may need to use. This number reaches the irs business & specialty tax department,. Web did the irs make a typo on your ein letter and you need.

Irs Form 147c Letter Letter Resume Examples QBD3EAp2OX

Web did the irs make a typo on your ein letter and you need a new form? Web hence, the 147c letter, acquired from the internal revenue service (irs), is used to request a replacement for the company’s ein or allow a third party to verify the ein with their. Web irs letter 147c is an official form of verification.

Web Follow The Steps Below To Obtain A Faxed Irs Letter (147C) If You Are Unable To Locate The Ss‐4 Document Call The Irs At (800) 829‐4933 Press “1” For Service In.

Web what is a 147c letter? Here’s how you request an ein verification letter (147c) the easiest way to get a copy. The irs offers the following options: Web how to get a 147c ein verification letter from the irs.

The Owner Of A Us Llc Sends This Form To The Irs In Order To Request.

Use this option if you speak english or spanish and can call the. Web a 147c letter, ein verification letter, is a tax document used to request information about an already established employer identification number (ein). The letter requests information about the business’s ein or employer identification number. Web the irs uses this form to verify the accuracy of the information reported on an employer?s ein application.

Web Did The Irs Make A Typo On Your Ein Letter And You Need A New Form?

Web 147c form from the irs is the employer identification number (ein) verification letter. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Partnerships must generally file form 1065.

Web Hence, The 147C Letter, Acquired From The Internal Revenue Service (Irs), Is Used To Request A Replacement For The Company’s Ein Or Allow A Third Party To Verify The Ein With Their.

An irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its. Web this letter is in reply to a request for a ruling that the use of bond proceeds as described below will be an insubstantial deviation from the public notice and approval requirements. Taxpayers may need to use. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification.