Irs Form 8233

Irs Form 8233 - Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual, annually and give it to their employer. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. This irm is intended for customer accounts services issues involving form 8233, exemption from withholding on compensation for independent (& certain dependent) personal service of a nonresident alien individual. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february 2023, so this is the latest version of form 8233, fully updated for tax year 2022. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent. For instructions and the latest information. Web provide the payor with a properly completed form 8233 for the tax year. The primary users of this irm are wage and investment employees. This allows employers to avoid withholding federal income tax on the students' and scholars. Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual.

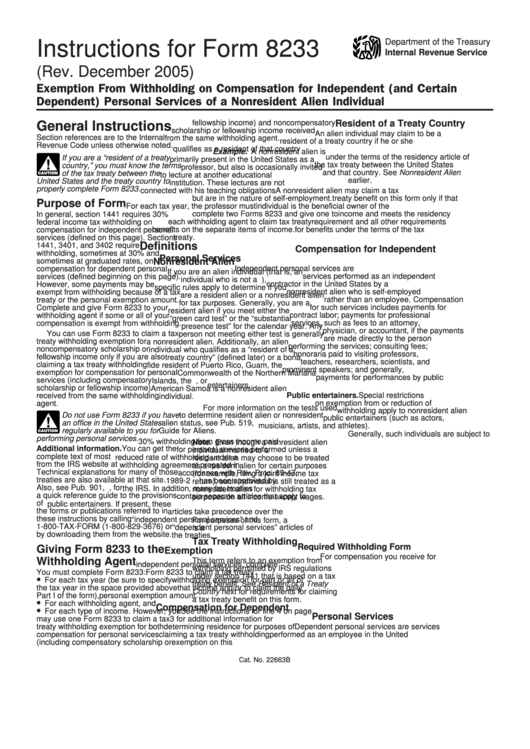

This allows employers to avoid withholding federal income tax on the students' and scholars. For instructions and the latest information. Exemption on the payee’s tax return September 2018) department of the treasury internal revenue service. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february 2023, so this is the latest version of form 8233, fully updated for tax year 2022. Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual, annually and give it to their employer. This irm is intended for customer accounts services issues involving form 8233, exemption from withholding on compensation for independent (& certain dependent) personal service of a nonresident alien individual. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent.

Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. The primary users of this irm are wage and investment employees. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent. Social security number or individual taxpayer identification number (itin). This allows employers to avoid withholding federal income tax on the students' and scholars. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february 2023, so this is the latest version of form 8233, fully updated for tax year 2022. Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual, annually and give it to their employer. This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the. The form 8233 must report the payee’s taxpayer identification number (tin), generally the payee’s u.s. For instructions and the latest information.

Twitch Affiliate Tax Form Overview StreamerSquare

By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. The.

Form 8233 Exemption from Withholding on Compensation for Independent

This irm is intended for customer accounts services issues involving form 8233, exemption from withholding on compensation for independent (& certain dependent) personal service of a nonresident alien individual. This allows employers to avoid withholding federal income tax on the students' and scholars. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw).

PPT PowerPoint Presentation, free download ID519123

Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. For instructions and the latest information. This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the. Exemption on the payee’s tax return The form 8233 must report the payee’s.

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. Web provide the payor with a properly completed form 8233 for the tax year. Social security number or individual taxpayer identification number (itin). Web international students and scholars who qualify should complete form 8233, exemption from withholding on.

8233 Printable PDF Sample

Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent. By filing form 8233, they are looking to claim an exemption from federal.

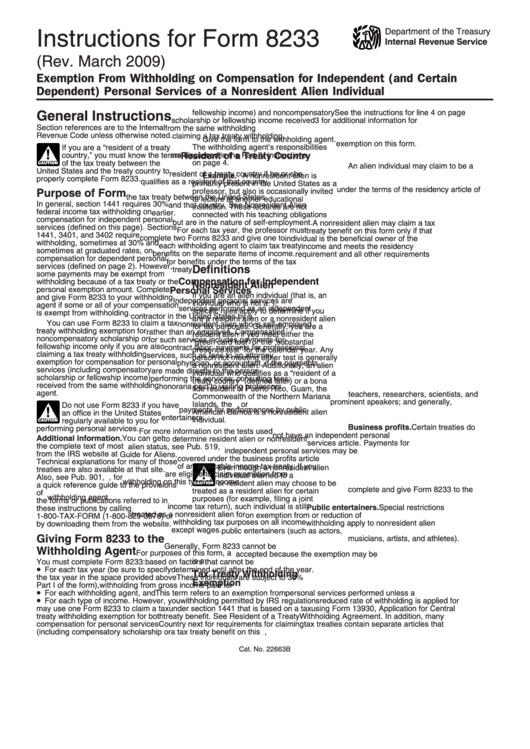

Instructions For Form 8233 printable pdf download

This allows employers to avoid withholding federal income tax on the students' and scholars. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. Social security number or individual taxpayer identification number (itin)..

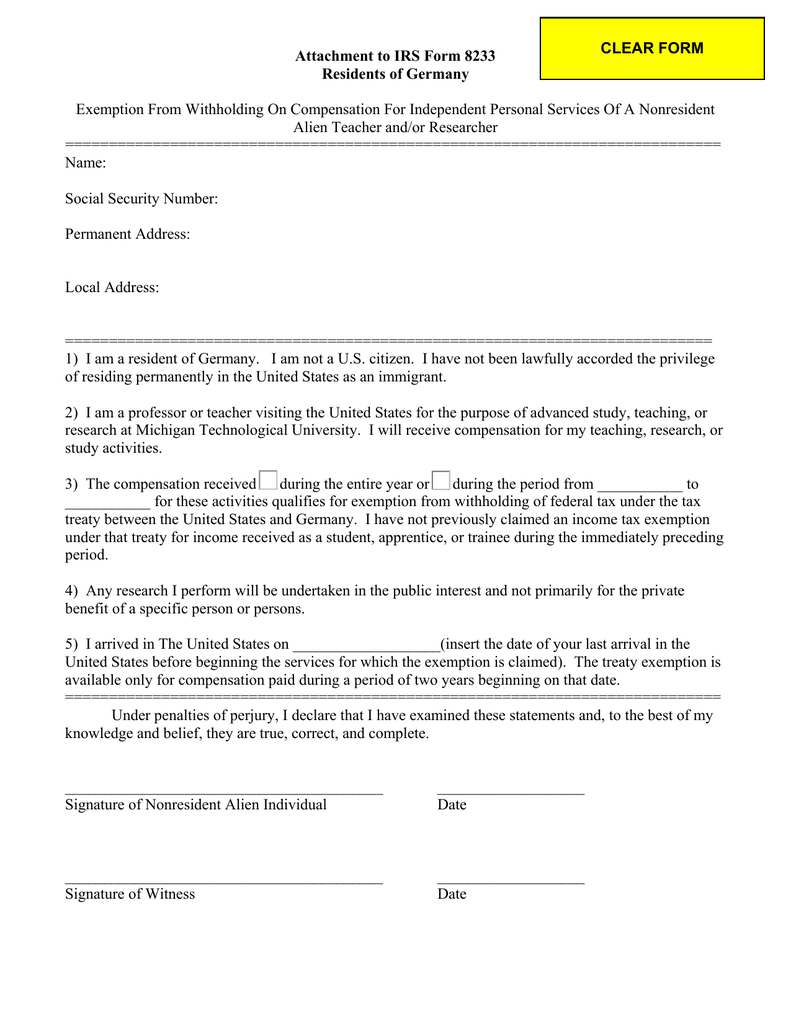

Attachment to IRS Form 8233 Residents of Germany

Social security number or individual taxpayer identification number (itin). By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february 2023, so this is the.

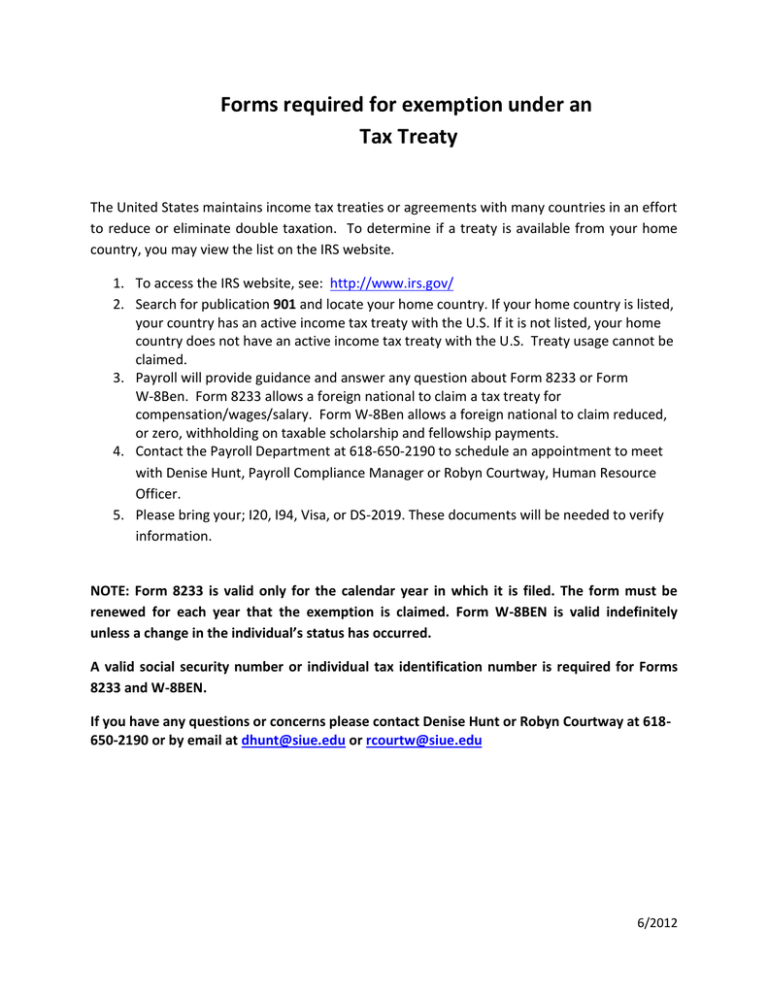

Forms Required Under A Tax Treaty

Exemption on the payee’s tax return Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states. For instructions and the latest information. Exemption from withholding on compensation for independent (and certain dependent) personal.

Top 17 Form 8233 Templates free to download in PDF format

This allows employers to avoid withholding federal income tax on the students' and scholars. Exemption on the payee’s tax return Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. For instructions and the latest information. Web provide the payor with a properly completed form 8233 for the tax year.

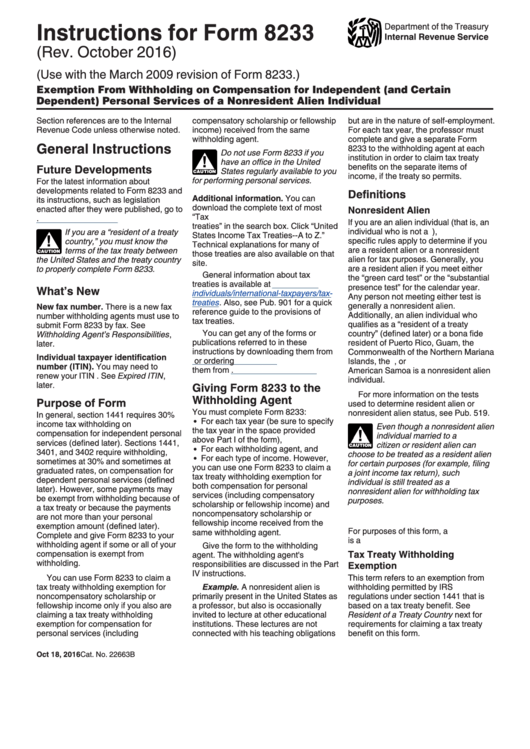

Instructions For Form 8233 2016 printable pdf download

Exemption on the payee’s tax return The form 8233 must report the payee’s taxpayer identification number (tin), generally the payee’s u.s. Social security number or individual taxpayer identification number (itin). This irm is intended for customer accounts services issues involving form 8233, exemption from withholding on compensation for independent (& certain dependent) personal service of a nonresident alien individual. Web.

September 2018) Department Of The Treasury Internal Revenue Service.

This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the. For instructions and the latest information. Exemption on the payee’s tax return This allows employers to avoid withholding federal income tax on the students' and scholars.

The Primary Users Of This Irm Are Wage And Investment Employees.

Exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual. Social security number or individual taxpayer identification number (itin). Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february 2023, so this is the latest version of form 8233, fully updated for tax year 2022. Web form 8233 (exemption from withholding on compensation for independent and certain dependent personal services of a nonresident alien individual) is one of many tax forms used by nonresident aliens who are working in the united states.

This Irm Is Intended For Customer Accounts Services Issues Involving Form 8233, Exemption From Withholding On Compensation For Independent (& Certain Dependent) Personal Service Of A Nonresident Alien Individual.

Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual, annually and give it to their employer. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty. Web provide the payor with a properly completed form 8233 for the tax year. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship or fellowship income) received from the same withholding agent.