Irs Form 2624

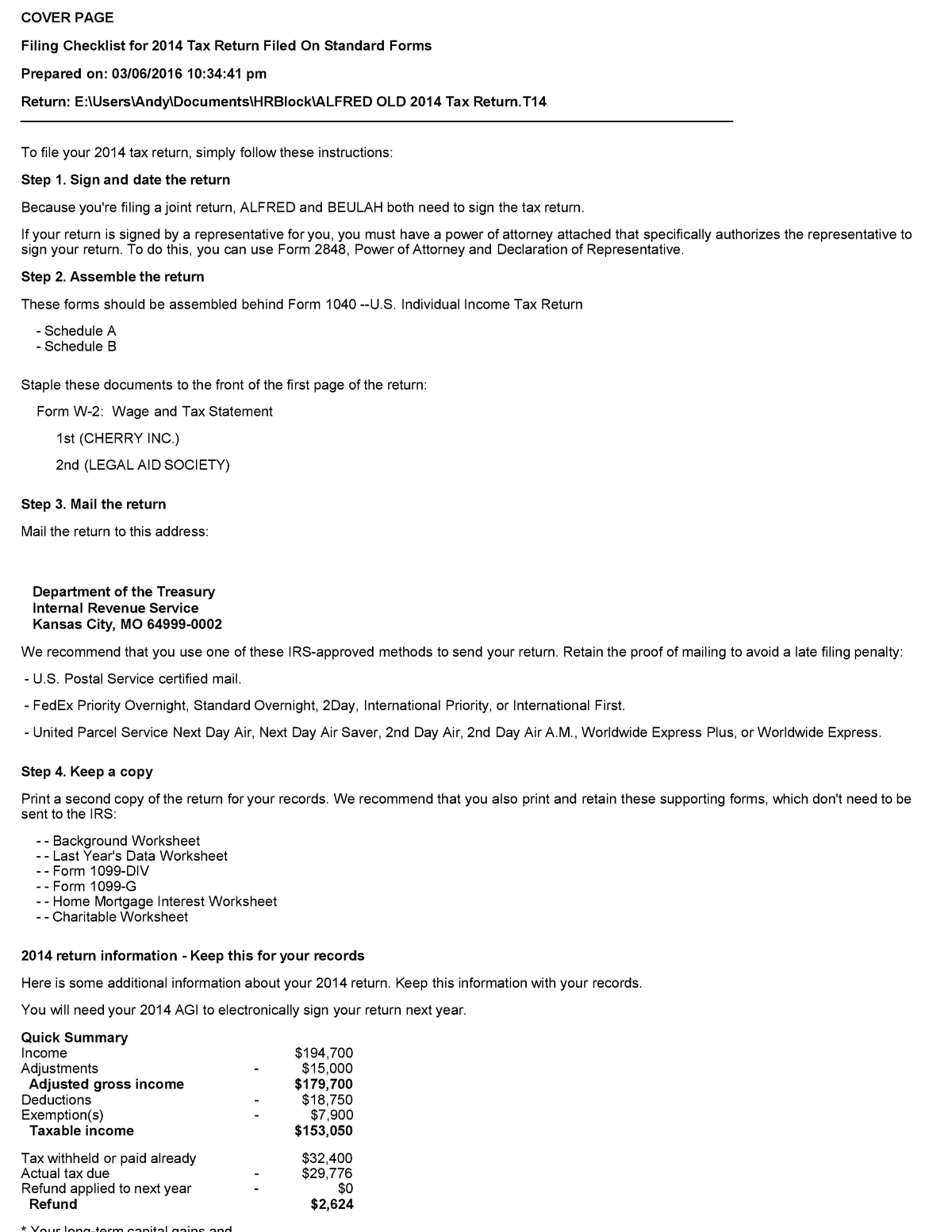

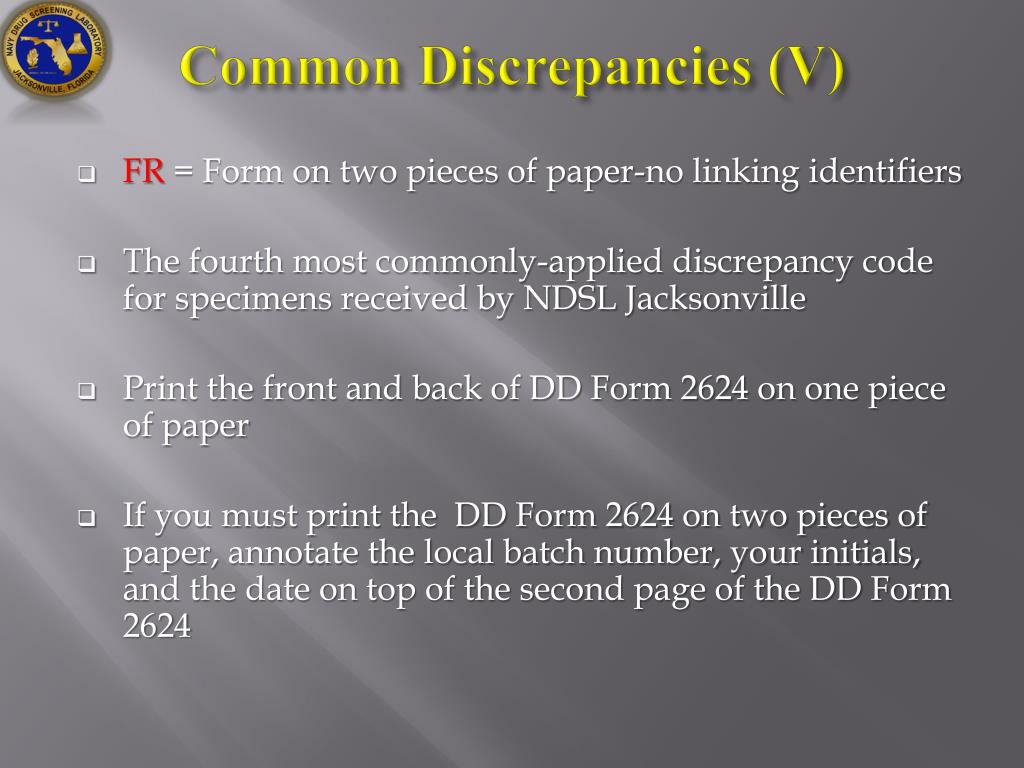

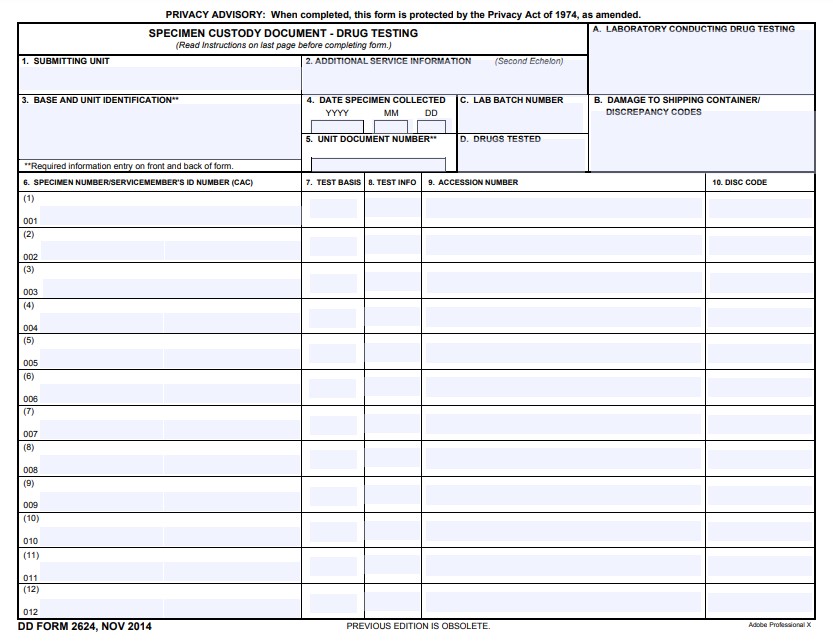

Irs Form 2624 - Enter the irs fax number in the to field and attach the irs form you would like to submit. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Web dd form 2624, nov 2014. The changes come in response to amendments to sec. Web where to send certain payments and applications other than tax returns. Use fill to complete blank online irs pdf forms for free. Web the irs is changing its procedures for contacting third parties and notifying taxpayers, starting aug. Tax season has arrived along with scams aiming to steal your identity. Web catalog number 2624 (rev. Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more.

Supporting documents to prove filing status. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Web on the app, go to the send fax section. This government document is issued by internal revenue service (irs) for use in u.s. Sign it in a few clicks draw your signature, type it,. Web by brooke crothers foxbusiness. Web prepare and file your federal income taxes online for free. Ad download or email form 2624 & more fillable forms, register and subscribe now!

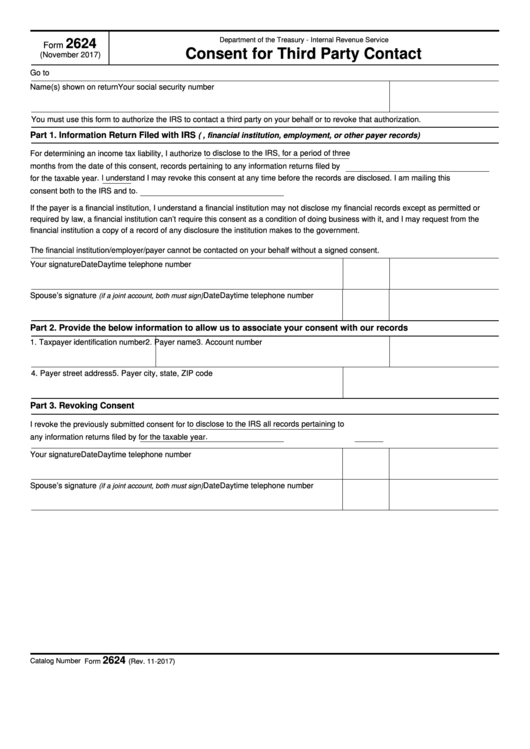

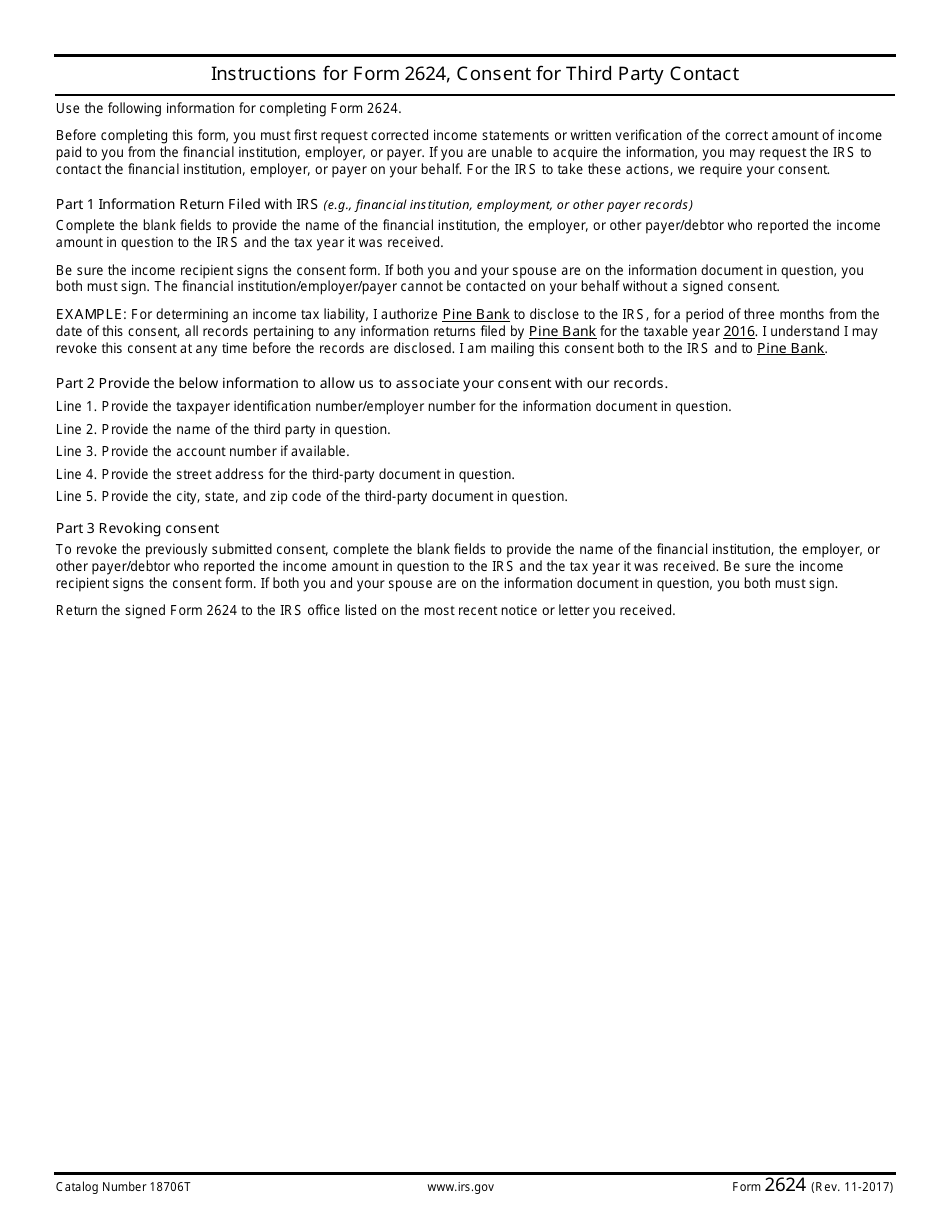

Consent for third party contact (irs) form. Web scammers are sending out fake irs letters to taxpayers demanding money — here's how to spot a fraud. Use part iii to figure the amount of gain required to be reported on the tax return in the current. The irs has highlighted numerous payment plan options for taxpayers who cannot pay taxes. Use fill to complete blank online irs pdf forms for free. Click on the send button and wait for the. Web the irs is changing its procedures for contacting third parties and notifying taxpayers, starting aug. Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more. Supporting documents to prove filing status. This government document is issued by internal revenue service (irs) for use in u.s.

Breanna Form 2624 Irs

Web the irs is changing its procedures for contacting third parties and notifying taxpayers, starting aug. Consent for third party contact (irs) form. Enter the irs fax number in the to field and attach the irs form you would like to submit. Web scammers are sending out fake irs letters to taxpayers demanding money — here's how to spot a.

Fillable Form 2624 Consent For Third Party Contact printable pdf download

Web catalog number 2624 (rev. Web consent for third party. Enter the irs fax number in the to field and attach the irs form you would like to submit. Web where to send certain payments and applications other than tax returns. Use fill to complete blank online irs pdf forms for free.

Stud dog contract Fill out & sign online DocHub

Web www.irs.gov form 14824 (rev. This government document is issued by internal revenue service (irs) for use in u.s. Web fill online, printable, fillable, blank form 2624: Enter the irs fax number in the to field and attach the irs form you would like to submit. The irs has highlighted numerous payment plan options for taxpayers who cannot pay taxes.

Fill Free fillable IRS PDF forms

Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more. Web where to send certain payments and applications other than tax returns. This government document is issued by internal revenue service (irs) for use in u.s. Web consent for third party. Web fill online, printable, fillable, blank form 2624:

자금운용표 자동계산

The days of distressing complex tax and legal forms are over. Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more. Web scammers are sending out fake irs letters to taxpayers demanding money — here's how to spot a fraud. Web where to send certain payments and applications other than tax returns..

Breanna Dd Form 2624 Back Side

Consent for third party contact (irs) form. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Click on the send button and wait for the. Web fill online, printable, fillable, blank form 2624: Sign it in a few clicks draw your signature, type it,.

Download dd 2624 Fillable Form

Sign it in a few clicks draw your signature, type it,. Ad download or email form 2624 & more fillable forms, register and subscribe now! Use fill to complete blank online irs pdf forms for free. Supporting documents to prove filing status. This government document is issued by internal revenue service (irs) for use in u.s.

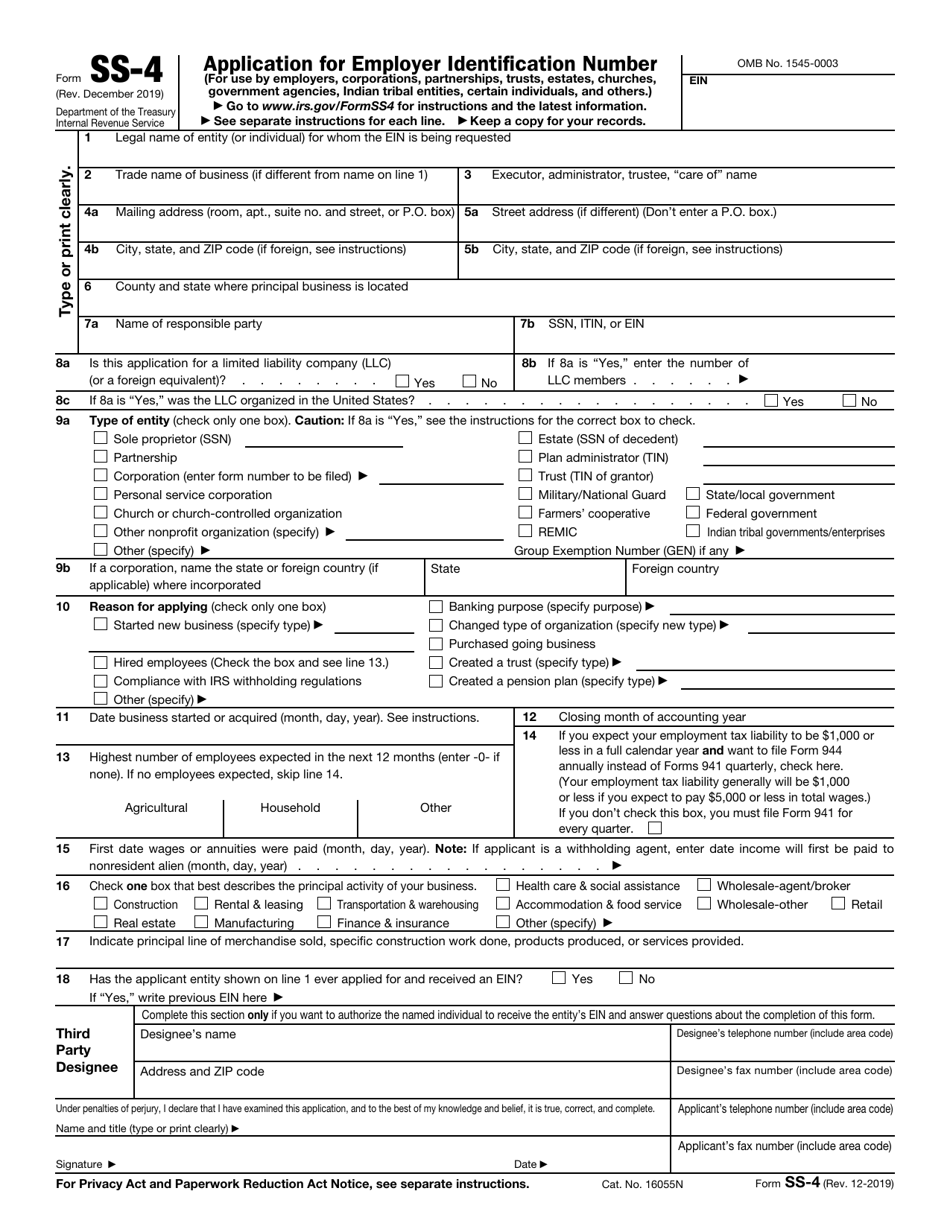

IRS Form SS4 Download Fillable PDF or Fill Online Application for

Web follow the simple instructions below: This government document is issued by internal revenue service (irs) for use in u.s. The irs has highlighted numerous payment plan options for taxpayers who cannot pay taxes. Web on the app, go to the send fax section. Click on the send button and wait for the.

IRS Form 2624 Download Fillable PDF or Fill Online Consent for Third

Web consent for third party. Web catalog number 2624 (rev. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Web the irs is changing its procedures for contacting third parties and notifying taxpayers, starting aug. Click on the send button and wait for the.

Breanna Form 2624 Example

Supporting documents to prove filing status. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. This government document is issued by internal revenue service (irs) for use in u.s. Tax season has arrived along with scams aiming to steal your identity. The latest scam targets electronic filing.

With Us Legal Forms The Whole Process Of Filling Out Legal Documents Is Anxiety.

Web prepare and file your federal income taxes online for free. Web www.irs.gov form 14824 (rev. Web where to send certain payments and applications other than tax returns. Edit your dd form 2624 online type text, add images, blackout confidential details, add comments, highlights and more.

Web By Brooke Crothers Foxbusiness.

Tax season has arrived along with scams aiming to steal your identity. Web scammers are sending out fake irs letters to taxpayers demanding money — here's how to spot a fraud. The irs has highlighted numerous payment plan options for taxpayers who cannot pay taxes. Web on the app, go to the send fax section.

Supporting Documents To Prove Filing Status.

This government document is issued by internal revenue service (irs) for use in u.s. Click on the send button and wait for the. Consent for third party contact (irs) form. Web consent for third party.

The Changes Come In Response To Amendments To Sec.

Enter the irs fax number in the to field and attach the irs form you would like to submit. Sign it in a few clicks draw your signature, type it,. When completed, this form is protected by the privacy act of 1974, as amended. Use part iii to figure the amount of gain required to be reported on the tax return in the current.