Irs Form 2290 Phone Number

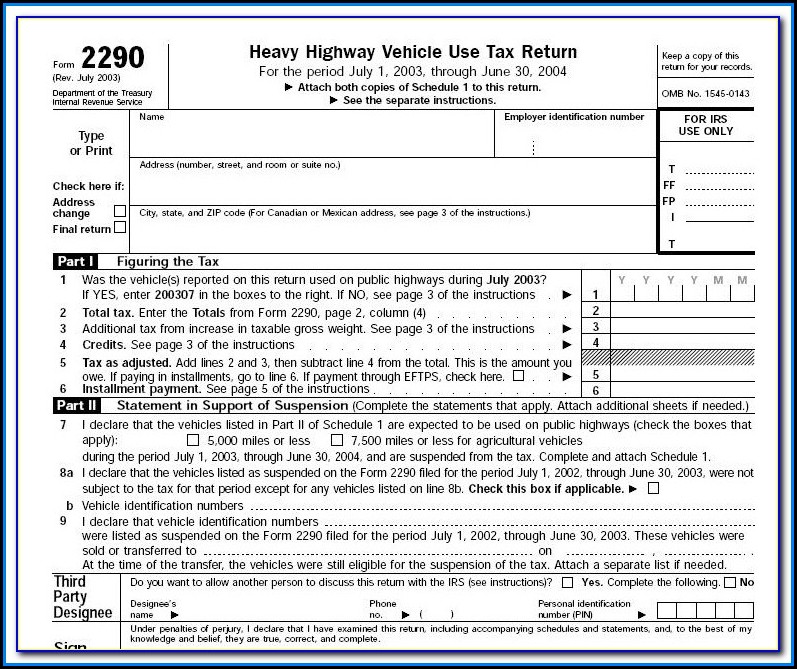

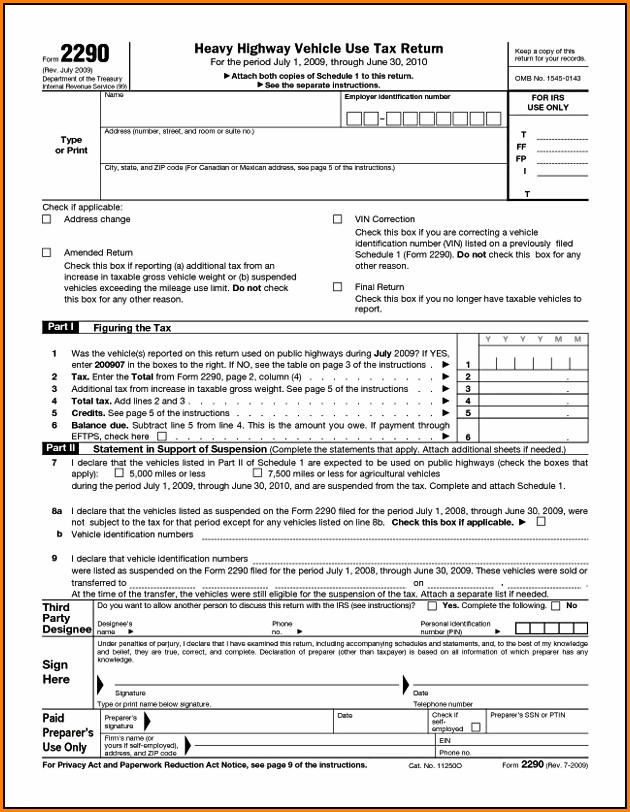

Irs Form 2290 Phone Number - It appears that the irs has mistakenly sent out some of these letters. Without payment due or if payment is made through eftps or by credit/debit card. Web 7525 tree ln, madison, wi 53717. Maximum 512 characters are allowed. Web regardless of how you file your form 2290, the irs requires a business tax id called an employer identification number (ein). Web e file heavy vehicle use tax form 2290 with irs authorized e file provider greentax2290.com. Web if you are filing a form 2290 paper return: Web only 3 simple steps to get schedule 1 filing your irs hvut 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution. Web irs form 2290 help address: If you received a letter from the irs concerning payment if you received a letter from the irs stating that your 2290 payment was not received, do not be alarmed.

Web if you are filing a form 2290 paper return: Filing can be completed in minutes, and you can have your schedule 1, with electronic stamp, in as little as 24 hours. Web internal revenue service p.o. Web if you can't find the answers to your tax questions on irs.gov, we can offer you help in more than 350 languages with the support of professional interpreters. Alaska & hawaii follow pacific time services: You’re registering a vehicle in your name; To 6:00 p.m., eastern time. Form 2290 without payment due or if payment is made through eftps or by credit/debit card: Web regardless of how you file your form 2290, the irs requires a business tax id called an employer identification number (ein). Our hours of operation are 5:00 am to 5:00 pm pacific time.

Please attach a signed cover sheet and indicate “expedite schedule 1 request.” include your name, phone number, fax number, the date the form 2290 was filed and the number of pages being faxed. For businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf). Filing can be completed in minutes, and you can have your schedule 1, with electronic stamp, in as little as 24 hours. Web if you’re unsure whether you need to file a form 2290, you can use the irs’ interactive tax assistant (ita). If you are calling from the united states, then use this number: Gather your information employer identification number. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. If you received a letter from the irs concerning payment if you received a letter from the irs stating that your 2290 payment was not received, do not be alarmed. Get started with a fast and secure hvut 2290 form online filing solution starting at $14.90. Form 2290 without payment due or if payment is made through eftps or by credit/debit card:

Irs Form 2290 Contact Number Universal Network

You’re registering a vehicle in your name; Web irs form 2290 help address: Web internal revenue service call site you can get immediate help with your form 2290 questions by calling the form 2290 call site. Web if you’re unsure whether you need to file a form 2290, you can use the irs’ interactive tax assistant (ita). Our hours of.

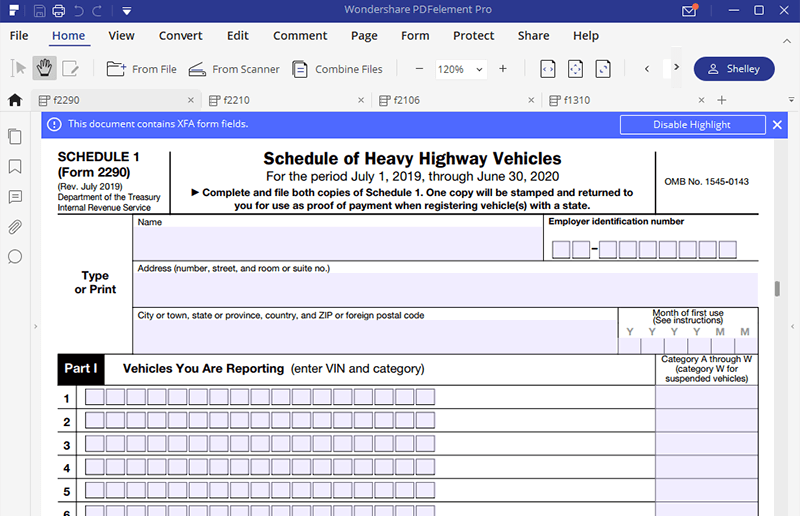

File IRS 2290 Form Online for 20222023 Tax Period

You must include a copy of the form 2290 and schedule 1 previously filed. Web regardless of how you file your form 2290, the irs requires a business tax id called an employer identification number (ein). Get started with a fast and secure hvut 2290 form online filing solution starting at $14.90. It appears that the irs has mistakenly sent.

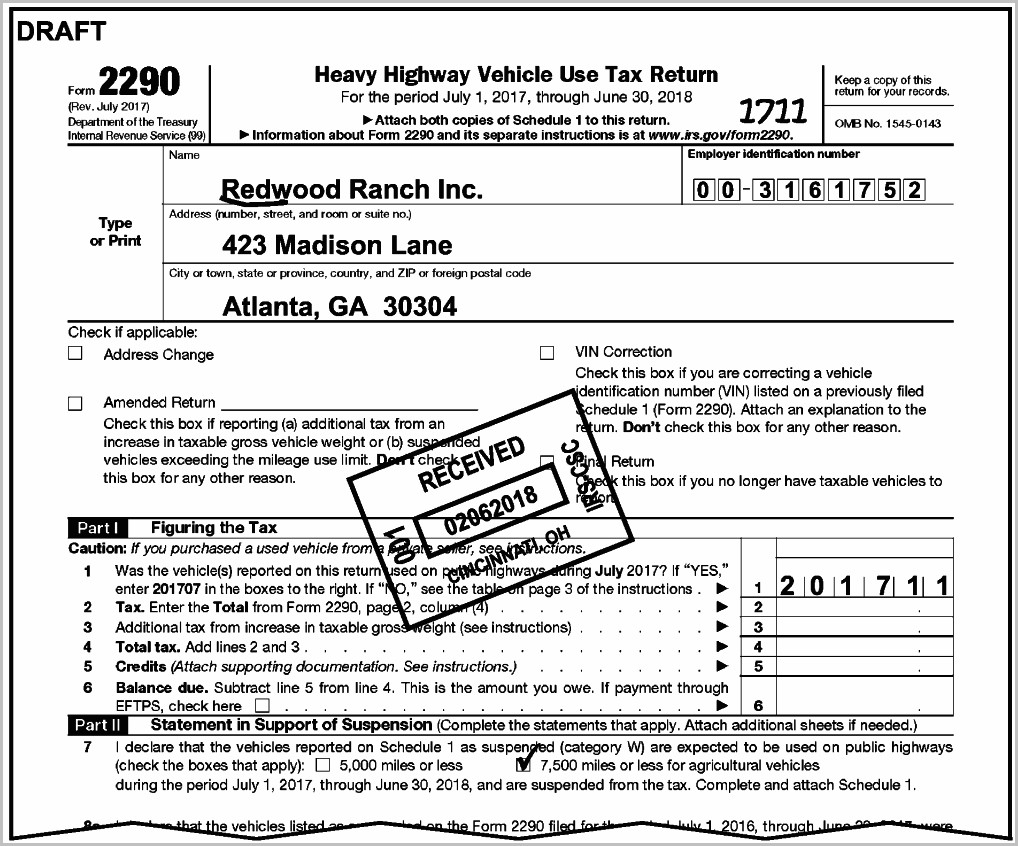

Form 2290 Irs Phone Number Form Resume Examples v19x1DoY7E

Spanish speaking assistors are available. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web if you can't find the answers to your tax questions on irs.gov, we can offer you help in more than 350 languages with the support of professional interpreters. You’re registering a vehicle in your name; Form 2290.

Ssurvivor Form 2290 Irs Phone Number

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web regardless of how you file your form 2290, the irs requires a business tax id called an employer identification number (ein). Web internal revenue service p.o. Without payment due or if payment is made through eftps or.

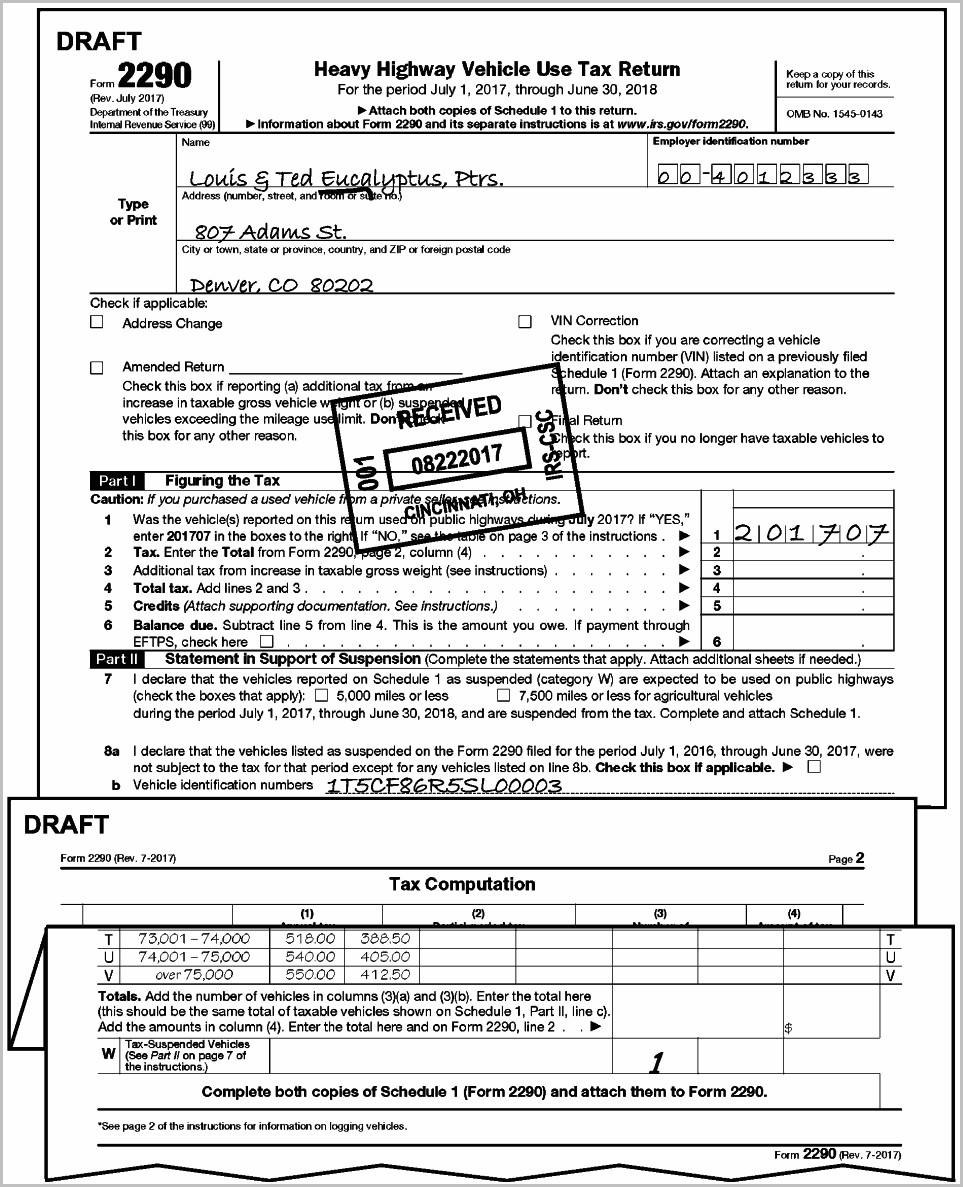

Irs Form 2290 July 2017 Universal Network

You cannot use your social security number don't have an ein? Allow four weeks for your new ein to be established in our systems before filing your form 2290. Without payment due or if payment is made through eftps or by credit/debit card. Our hours of operation are 5:00 am to 5:00 pm pacific time. If you received a letter.

Irs.gov Form 2290 Form Resume Examples

Web save 15% with code save15jjk. If you are calling from the united states, then use this number: Have your form 2290 and information about your filing available when you call. Web internal revenue service p.o. Web 7525 tree ln, madison, wi 53717.

Irs Form 2290 Instructions Form Resume Examples

The assistor from the irs will have your form 2290, heavy vehicle use tax return information. You must include a copy of the form 2290 and schedule 1 previously filed. You cannot use your social security number don't have an ein? For businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf). Please.

Understanding Form 2290 StepbyStep Instructions for 20222023

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web internal revenue service p.o. Spanish speaking assistors are available. Filing can be completed in minutes, and you can have your schedule 1, with electronic stamp, in as little as 24 hours. You’re registering a vehicle in your.

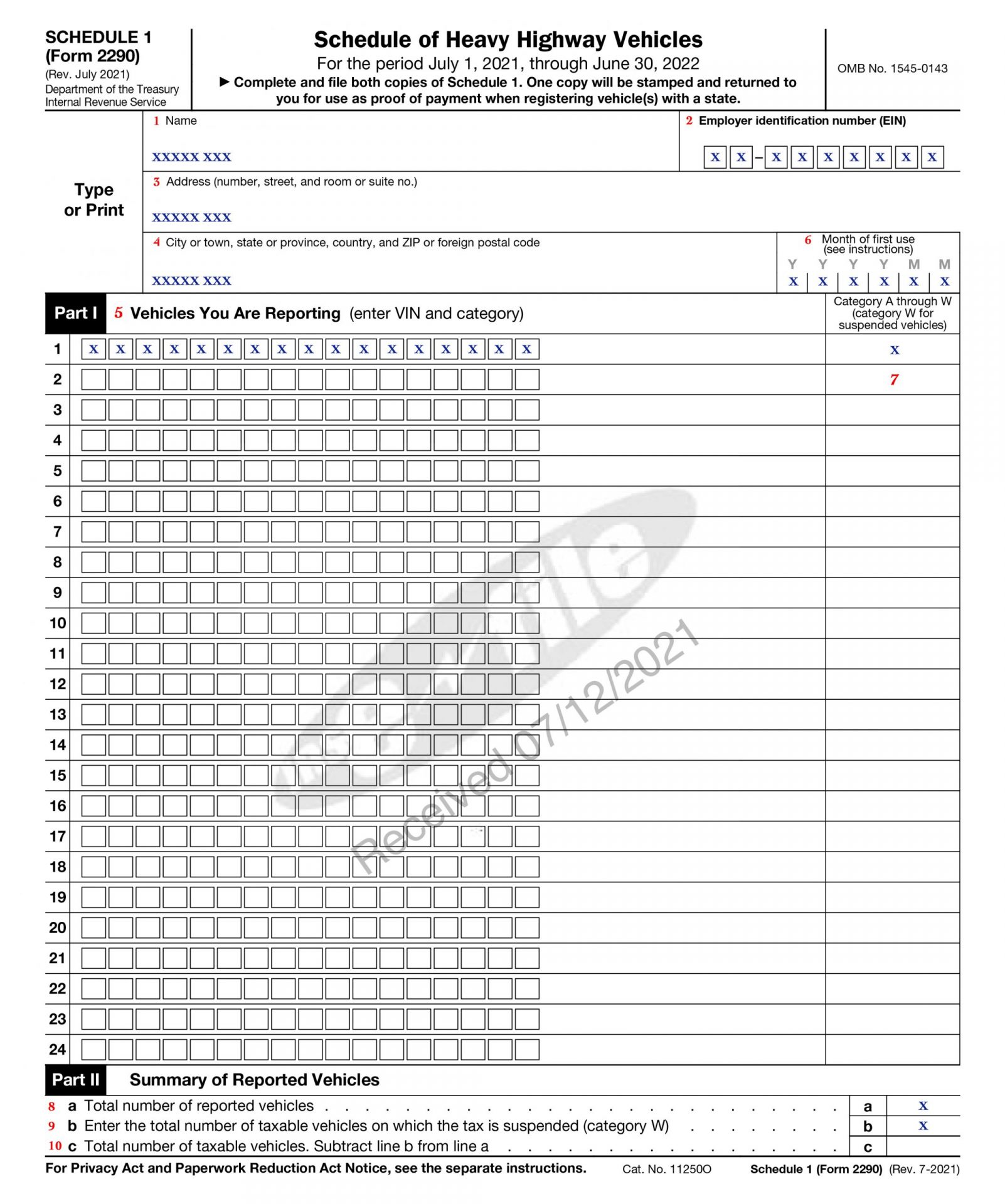

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

540 e foothill blvd #100g san dimas, ca 91773 email address: Spanish speaking assistors are available. Web if you can't find the answers to your tax questions on irs.gov, we can offer you help in more than 350 languages with the support of professional interpreters. You cannot use your social security number don't have an ein? Web regardless of how.

Form 2290 Irs Phone Number Form Resume Examples v19x1DoY7E

Web irs form 2290 help address: Keep your form 22990 details and filing information ready before you make a call. If for any reason you aren’t 100% satisfied with our service, we’ll give you a full refund, no questions asked. If you received a letter from the irs concerning payment if you received a letter from the irs stating that.

Keep Your Form 22990 Details And Filing Information Ready Before You Make A Call.

Allow four weeks for your new ein to be established in our systems before filing your form 2290. Web internal revenue service p.o. You cannot use your social security number don't have an ein? Web if you’re unsure whether you need to file a form 2290, you can use the irs’ interactive tax assistant (ita).

The Assistor From The Irs Will Have Your Form 2290, Heavy Vehicle Use Tax Return Information.

If for any reason you aren’t 100% satisfied with our service, we’ll give you a full refund, no questions asked. To 6:00 p.m., eastern time. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. 540 e foothill blvd #100g san dimas, ca 91773 email address:

Alaska & Hawaii Follow Pacific Time Services:

Gather your information employer identification number. Web save 15% with code save15jjk. If you received a letter from the irs concerning payment if you received a letter from the irs stating that your 2290 payment was not received, do not be alarmed. Web only 3 simple steps to get schedule 1 filing your irs hvut 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution.

Web If You Can't Find The Answers To Your Tax Questions On Irs.gov, We Can Offer You Help In More Than 350 Languages With The Support Of Professional Interpreters.

For businesses, corporations, partnerships and trusts who need information and/or help regarding their business returns or business (bmf). You must include a copy of the form 2290 and schedule 1 previously filed. Our hours of operation are 5:00 am to 5:00 pm pacific time. If you are calling from the united states, then use this number: