Ihss Live In Provider Form

Ihss Live In Provider Form - To learn how to apply for services: Sign up with the public authority registry after you’ve become an ihss provider. Deducted are fica, medicare, sdi, and dues. Web level 1 i'm an ihss provider living with my recipient. I ask because state and federal taxes are not deducted from my paycheck. Attend a mandatory provider orientation. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the exemption (may be unknown or permanent). All of these requirements must be completed within 90 days from the date you begin the provider enrollment process. Sign up with the public authority just once for more than one ihss recipient. Web the ihss service desk is available to help those recipients and providers that need assistance with the electronic services portal website.

Attend a mandatory provider orientation. Complete a criminal background check via livescan fingerprinting. And be fingerprinted and complete a criminal background check. As of 1/03/2023, there have been a total of 1,785 exemption 1 requests approved, 1,213 denied, and 0 pending. State law requires that you pay the costs for fingerprinting and the criminal background check. Sign up with the public authority registry after you’ve become an ihss provider. The paper enrollment form is available on the cdss website for those who want to use it. Attend a mandatory new provider orientation; Over 550,000 ihss providers currently serve over 650,000 recipients. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the exemption (may be unknown or permanent).

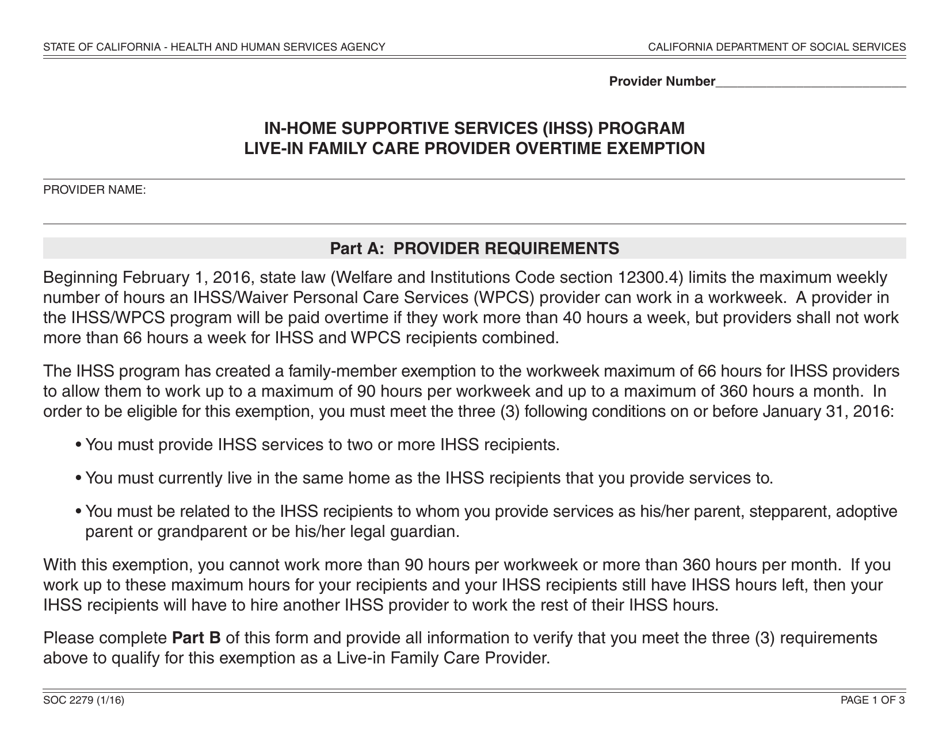

Web find caregiver work for free. Deducted are fica, medicare, sdi, and dues. Web a provider in the ihss/wpcs program will be paid overtime if they work more than 40 hours a week, but providers shall not work more than 66 hours a week for ihss and wpcs recipients combined. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the exemption (may be unknown or permanent). Web here are the steps you need to take to complete the enrollment process and be approved as an ihss provider. Complete a criminal background check via livescan fingerprinting. This may allow you to qualify for caleitc and other tax credits. Attend a mandatory new provider orientation; Sign up with the public authority just once for more than one ihss recipient. State law requires that you pay the costs for fingerprinting and the criminal background check.

Form SOC2274 Download Printable PDF or Fill Online Inhome Supportive

Deducted are fica, medicare, sdi, and dues. And be fingerprinted and complete a criminal background check. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the.

Form SOC2279 Download Fillable PDF or Fill Online Inhome Supportive

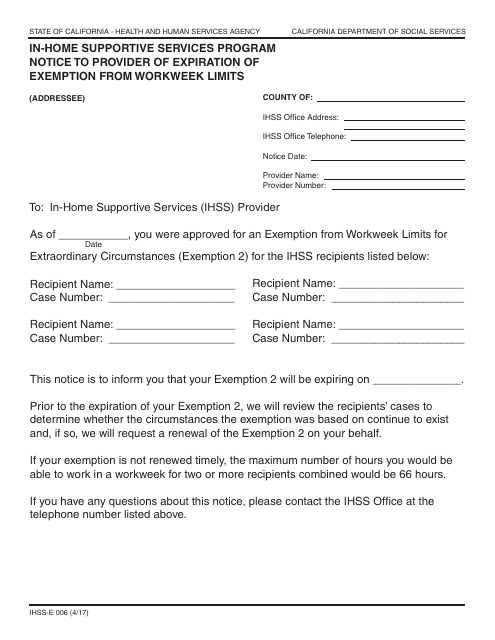

As of 1/03/2023, there have been a total of 1,785 exemption 1 requests approved, 1,213 denied, and 0 pending. I ask because state and federal taxes are not deducted from my paycheck. Web the ihss public authority will help match you with ihss recipients if you don't have one in mind: This may allow you to qualify for caleitc and.

Info & Resources > CDSS Programs > IHSS > Livein provider self

Overtime exemption and violation data: Complete a criminal background check via livescan fingerprinting. Web a provider in the ihss/wpcs program will be paid overtime if they work more than 40 hours a week, but providers shall not work more than 66 hours a week for ihss and wpcs recipients combined. Complete the ihss provider enrollment packet; Web here are the.

Ihss Provider Application Form Form Resume Examples gq9608lVOR

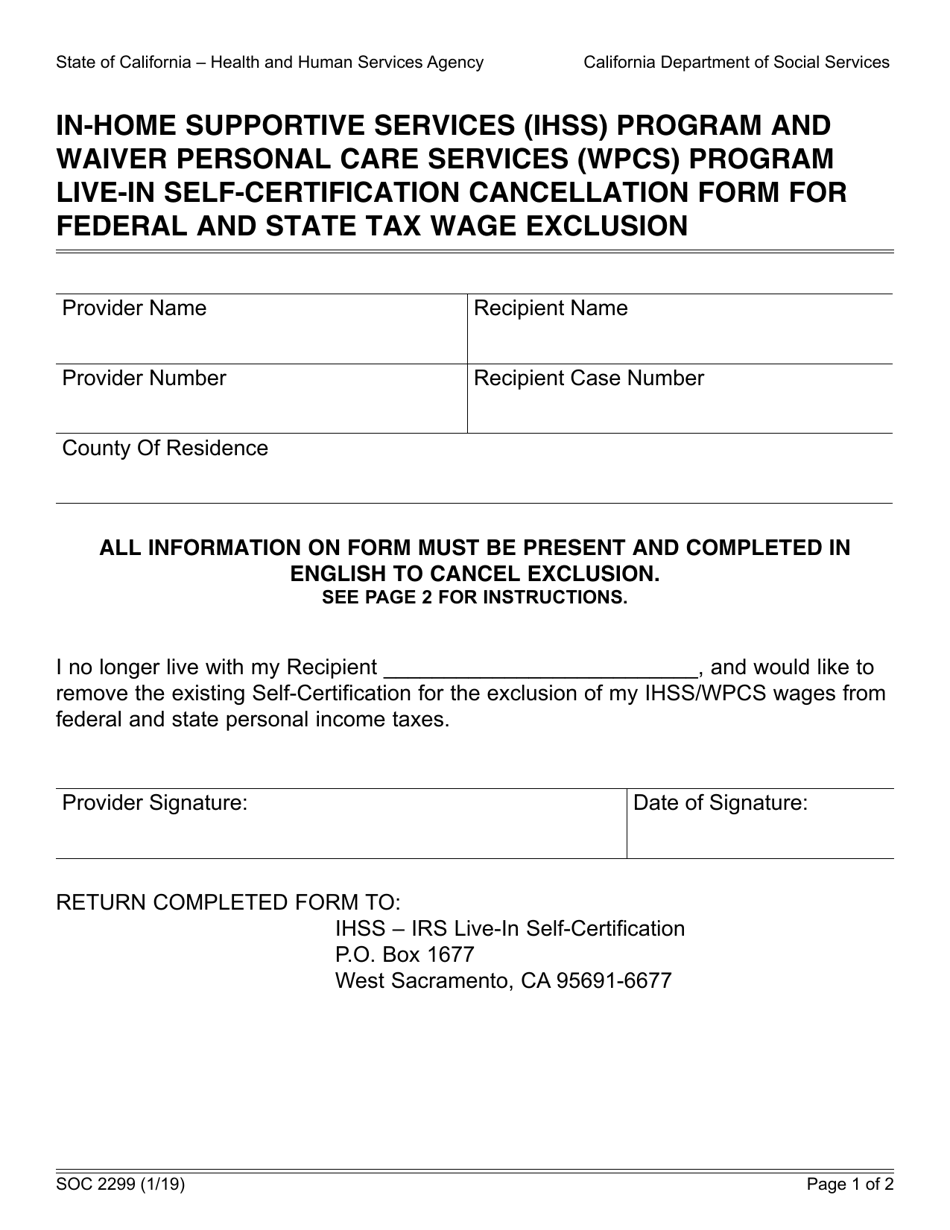

I received a letter from ihss saying that providers who live with the recipient of those services are not considered part of gross income for purpose of federal income tax. The first step in the process is to complete and sign the ihss program provider enrollment form (soc 426) and return it in person to the county ihss office. Web.

Form SOC2299 Download Fillable PDF or Fill Online Inhome Supportive

Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the exemption (may be unknown or permanent). Web level 1 i'm an ihss provider living with my.

Soc 2298 Fill Online, Printable, Fillable, Blank pdfFiller

Web the ihss service desk is available to help those recipients and providers that need assistance with the electronic services portal website. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption.

Ihss Doctor Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a provider in the ihss/wpcs program will be paid overtime if they work more than 40 hours a week, but providers shall not work more than 66 hours a week for ihss and wpcs recipients combined. Ihss provider violation statistics (excel) for provider violations, as of 6/30/2023 To learn how to apply for services: This may allow you to.

Form IHSSE006 Download Fillable PDF or Fill Online Inhome Supportive

Provide original id and ssn. All of these requirements must be completed within 90 days from the date you begin the provider enrollment process. Interested in additional ihss provider work? Complete the ihss provider enrollment packet; Over 550,000 ihss providers currently serve over 650,000 recipients.

Parent Provider Requirements Live Stream Event IHSS Advocates

Over 550,000 ihss providers currently serve over 650,000 recipients. Web ihss provider overtime exemption and violation statistics. I ask because state and federal taxes are not deducted from my paycheck. State law requires that you pay the costs for fingerprinting and the criminal background check. Web level 1 i'm an ihss provider living with my recipient.

IHSS Live Scan at Inglewood Live Scan NOW OPEN INGLEWOOD LIVE SCAN

When you go to the live scan location, you must pay a $32 criminal background investigation transaction fee plus another fee for the actual live scan, which may bring the total charges to as much as $70. The first step in the process is to complete and sign the ihss program provider enrollment form (soc 426) and return it in.

I Received A Letter From Ihss Saying That Providers Who Live With The Recipient Of Those Services Are Not Considered Part Of Gross Income For Purpose Of Federal Income Tax.

Over 550,000 ihss providers currently serve over 650,000 recipients. Web for the qualified medical reason exemption, providers must include a written statement signed by their doctor, nurse practitioner, or other licensed medical professional under the license of a physician, stating that the provider qualifies for the exemption and providing the length of the exemption (may be unknown or permanent). And be fingerprinted and complete a criminal background check. The first step in the process is to complete and sign the ihss program provider enrollment form (soc 426) and return it in person to the county ihss office.

Web State Law Requires That You, The Ihss Provider, Pay For The Fingerprinting And Cbi Process.

Attend a mandatory provider orientation. To learn how to apply for services: With private messaging, providers can keep track of all client interactions with ease. Web ihss provider overtime exemption and violation statistics.

Deducted Are Fica, Medicare, Sdi, And Dues.

Web here are the steps you need to take to complete the enrollment process and be approved as an ihss provider. Interested in additional ihss provider work? Overtime exemption and violation data: State law requires that you pay the costs for fingerprinting and the criminal background check.

I Ask Because State And Federal Taxes Are Not Deducted From My Paycheck.

Web a provider in the ihss/wpcs program will be paid overtime if they work more than 40 hours a week, but providers shall not work more than 66 hours a week for ihss and wpcs recipients combined. Ihss provider violation statistics (excel) for provider violations, as of 6/30/2023 As of 1/03/2023, there have been a total of 1,785 exemption 1 requests approved, 1,213 denied, and 0 pending. Complete the ihss provider enrollment forms.