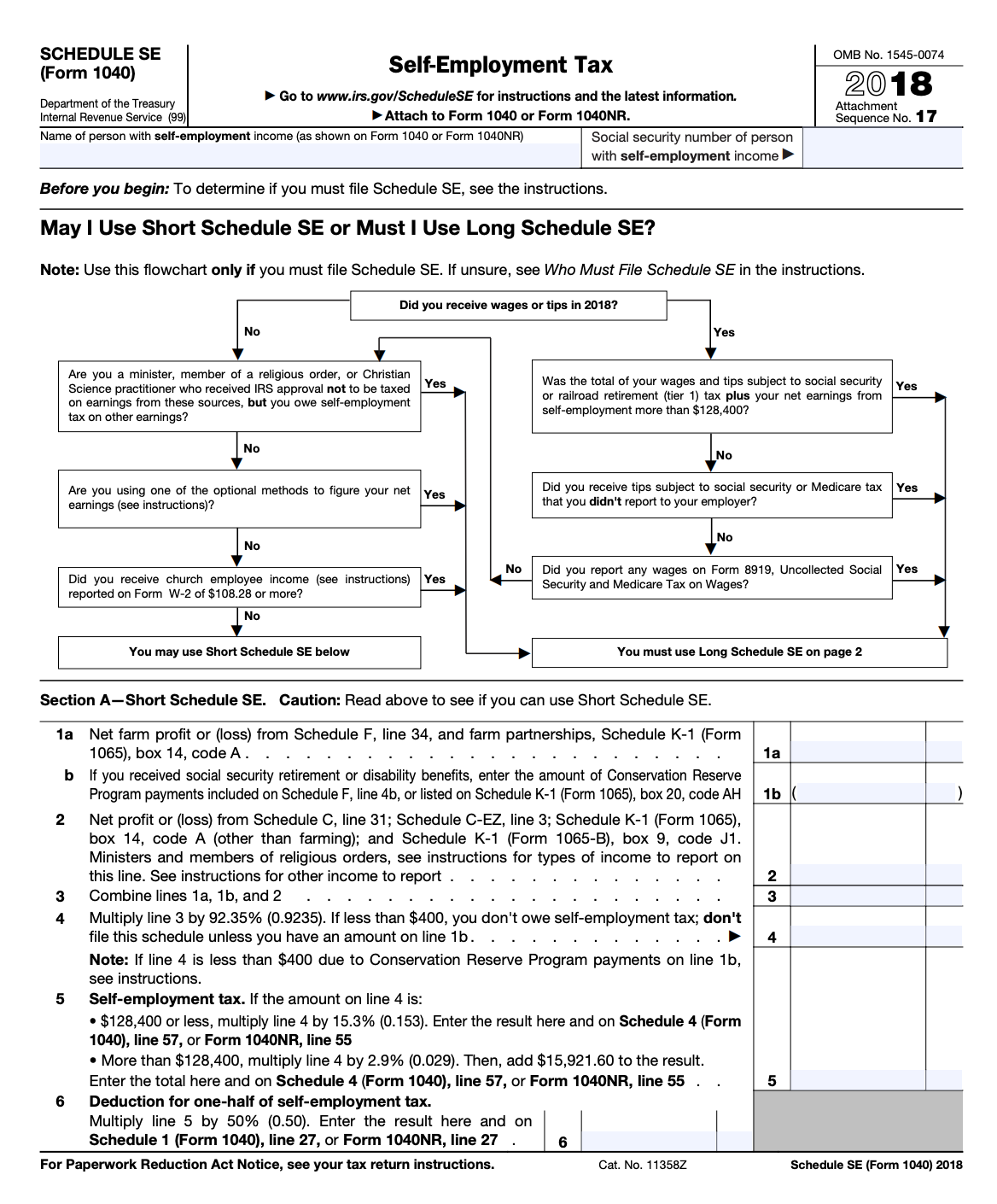

1040 Se Form

1040 Se Form - Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year. If you need to adjust schedule se, enter your income and expenses beforehand. Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If your only income subject to self. You had church employee income of $108.28 or more. The social security administration uses the information from schedule se to tax figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. The social security administration uses the information from schedule se to figure your benefits under the social security program.

The social security administration uses the information from schedule se to tax figure your benefits under the social security program. Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If your only income subject to self. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. You had church employee income of $108.28 or more. The social security administration uses the information from schedule se to figure your benefits under the social security program. Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year. If you need to adjust schedule se, enter your income and expenses beforehand.

If you need to adjust schedule se, enter your income and expenses beforehand. The social security administration uses the information from schedule se to tax figure your benefits under the social security program. The social security administration uses the information from schedule se to figure your benefits under the social security program. Web inside turbotax, search for sch se and then select the jump to link in the search results. If your only income subject to self. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year. You had church employee income of $108.28 or more. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

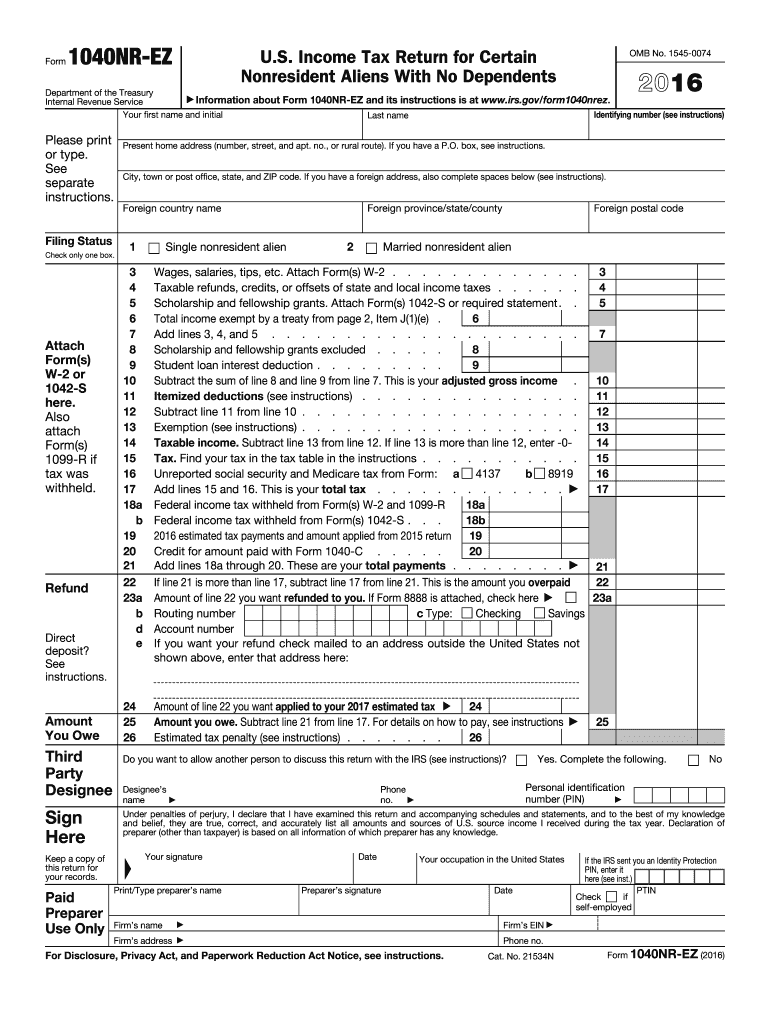

1040ez 2022 pdf Fill Online, Printable, Fillable Blank 2016form

The social security administration uses the information from schedule se to figure your benefits under the social security program. Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If your.

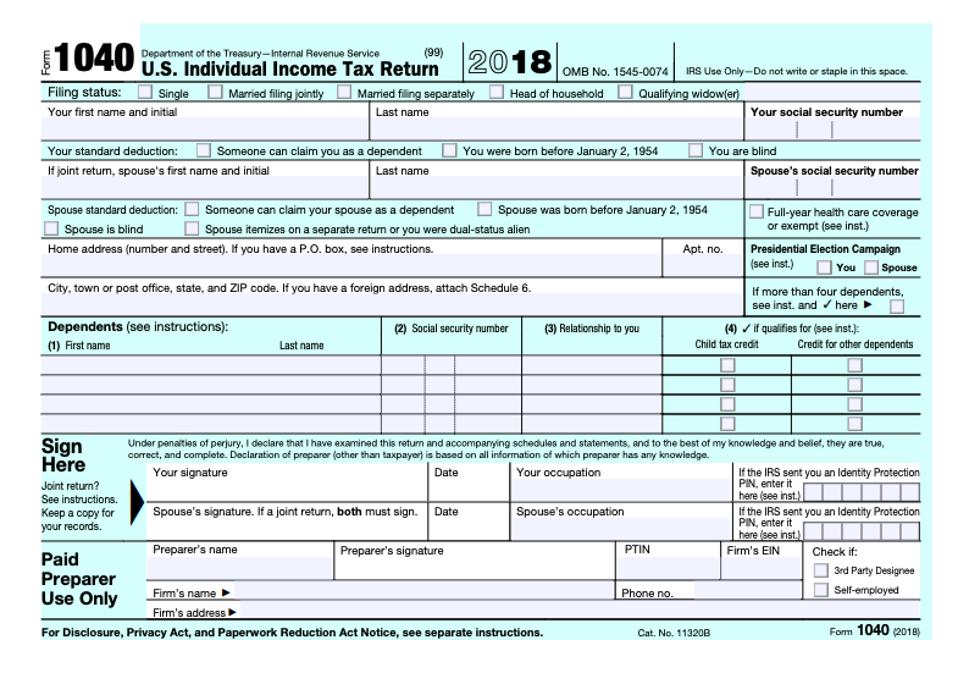

IRS Releases New NotQuitePostcardSized Form 1040 For 2018, Plus New

Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year. Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting.

1040Nr Ez Fill Out and Sign Printable PDF Template signNow

Web inside turbotax, search for sch se and then select the jump to link in the search results. You had church employee income of $108.28 or more. If your only income subject to self. Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year..

Form 1040 U.S. Individual Tax Return Definition

If your only income subject to self. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year. Web inside turbotax, search for sch.

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

The social security administration uses the information from schedule se to tax figure your benefits under the social security program. If you need to adjust schedule se, enter your income and expenses beforehand. The social security administration uses the information from schedule se to figure your benefits under the social security program. This tax applies no matter how old you.

2018 form 1040 schedule 2 Fill Online, Printable, Fillable Blank

If you need to adjust schedule se, enter your income and expenses beforehand. The social security administration uses the information from schedule se to figure your benefits under the social security program. The social security administration uses the information from schedule se to tax figure your benefits under the social security program. Web inside turbotax, search for sch se and.

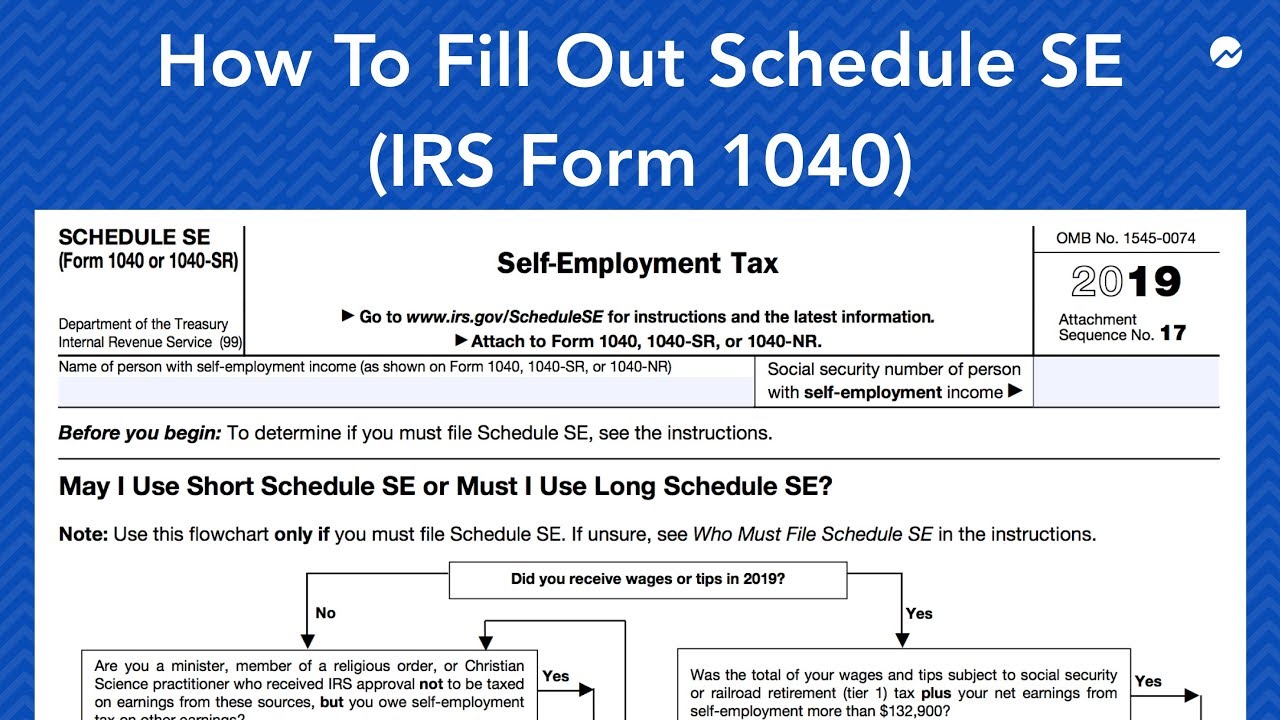

How to Fill out Schedule SE (IRS Form 1040) YouTube

This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Web inside turbotax, search for sch se and then select the jump to link in the search results. If your only income subject to self. The social security administration uses the information from schedule se to tax figure your.

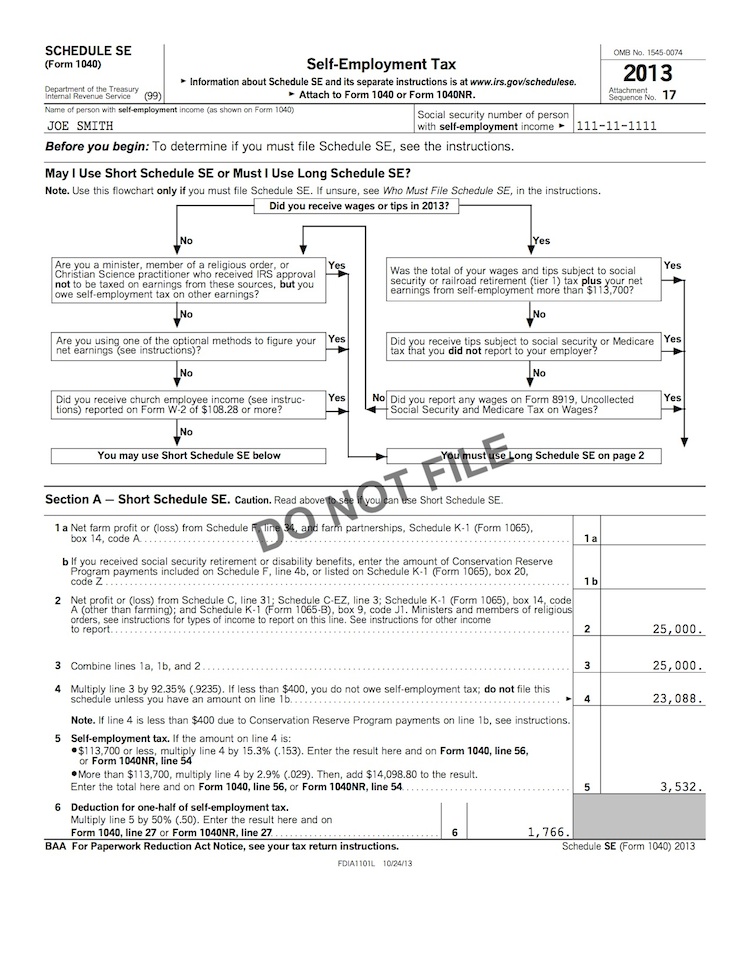

Form 1040 (Schedule SE) SelfEmployment Tax Form (2015) Free Download

If you need to adjust schedule se, enter your income and expenses beforehand. Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. Use the income or loss calculated on schedule.

Book Form 1040 Schedule SE Tax Goddess Publishing

This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. If your only income subject to self. You had church employee income of $108.28 or more. Use the.

Form 1040, Schedule SE SelfEmployment Tax

This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. You had church employee income of $108.28 or more. Web inside turbotax, search for sch se and then select the jump to link in the search results. Use the income or loss calculated on schedule c to calculate the.

The Social Security Administration Uses The Information From Schedule Se To Tax Figure Your Benefits Under The Social Security Program.

Web inside turbotax, search for sch se and then select the jump to link in the search results. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. The social security administration uses the information from schedule se to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

You Had Church Employee Income Of $108.28 Or More.

If you need to adjust schedule se, enter your income and expenses beforehand. If your only income subject to self. Use the income or loss calculated on schedule c to calculate the amount of social security and medicare taxes you should have paid during the year.

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)