How Long Does It Take To Process Form 4549

How Long Does It Take To Process Form 4549 - Web so, if we completed 1,000 form n‑400 applications in the previous six months, and 80% (or 800) of them were completed within 60 days (or two months), then the processing times webpage will display two months as the processing time for form n‑400 in may 2022. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. The notice of deficiency will provide you 90 days (150 days if you are outside the u.s.) to respond by petitioning the tax court. Web you could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. 6532 (a) provides that no suit may begin after the expiration of 2 years from the date of mailing by certified mail or registered mail to the taxpayer of a notice of the disallowance of the part of the claim to which the suit or proceeding relates. This letter is also used as an initial reporting tool. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Web the irs uses form 4549 when the audit is complete. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Taxhelp believes the tax court is more fair to taxpayers than the other forums.

Taxhelp believes the tax court is more fair to taxpayers than the other forums. At this point, you have the options of: If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Web so, if we completed 1,000 form n‑400 applications in the previous six months, and 80% (or 800) of them were completed within 60 days (or two months), then the processing times webpage will display two months as the processing time for form n‑400 in may 2022. But there are certain times when they are more likely to use this letter. The notice of deficiency will provide you 90 days (150 days if you are outside the u.s.) to respond by petitioning the tax court. Web irs definition form 4549, income tax examination changes, is used for cases that result in: Web you could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person.

Web you could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. This letter is also used as an initial reporting tool. At this point, you have the options of: Web irs definition form 4549, income tax examination changes, is used for cases that result in: You will have 90 days to petition the tax court. But there are certain times when they are more likely to use this letter. Web if you do not respond to form 4549, the irs will send you a notice of deficiency. Taxhelp believes the tax court is more fair to taxpayers than the other forums. If the time to petition tax court expires, the irs will begin collection and enforcement. If you do not file a petition, the irs will bill you for the taxes.

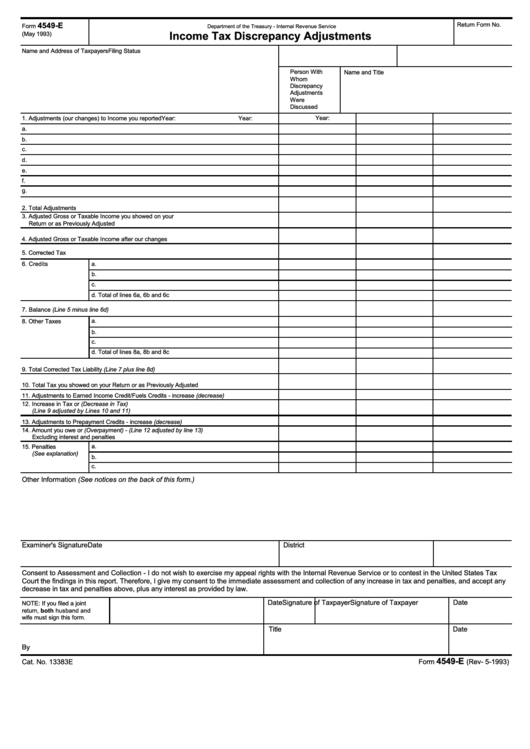

Fillable Form 4549E Tax Discrepancy Adjustments Form

Web if you do not respond to form 4549, the irs will send you a notice of deficiency. In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this.

How Long Does it Take for YouTube to Process a Video?

If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Web the irs uses form 4549 when the audit is.

Form 4549 YouTube

In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be.

Form 4549e Tax Dicrepancy Adjustments printable pdf download

Web irs definition form 4549, income tax examination changes, is used for cases that result in: If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

Web if you do not sign the form 4549, the irs will send you a notice of deficiency. If you do not file a petition, the irs will bill you for the taxes. But there are certain times when they are more likely to use this letter. This letter is also used as an initial reporting tool. Web the irs.

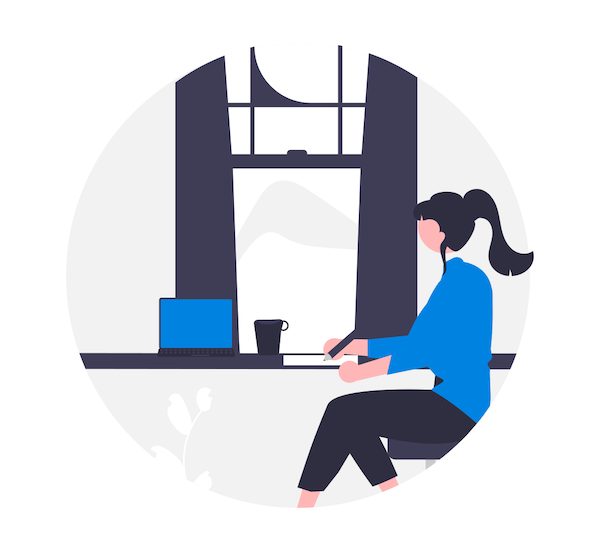

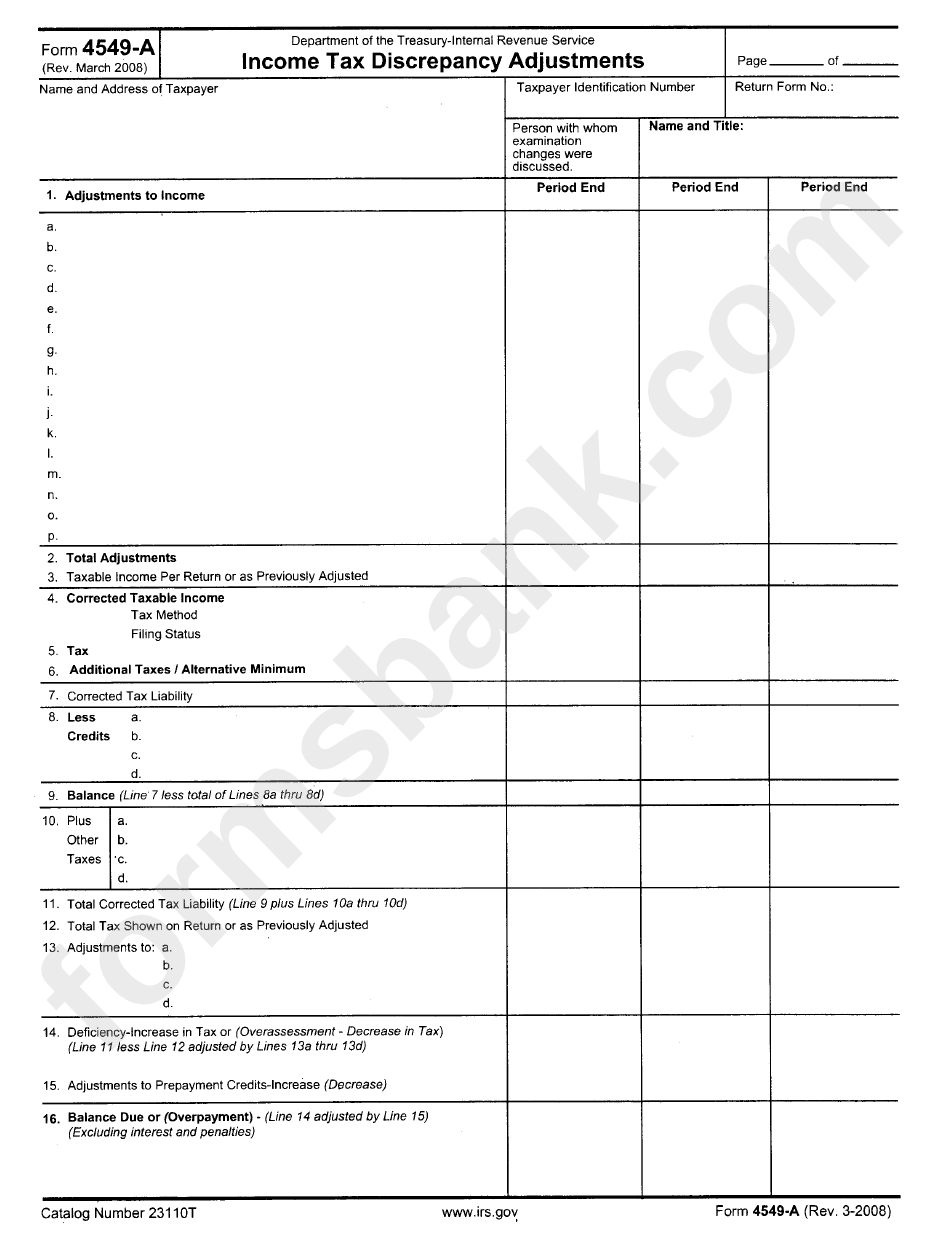

Form 4549A Tax Examination Changes printable pdf download

If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. But there are certain times when they are more likely to use this letter. Web irs definition form 4549, income tax examination changes, is used for cases that result in: Web the irs uses form 4549 when the.

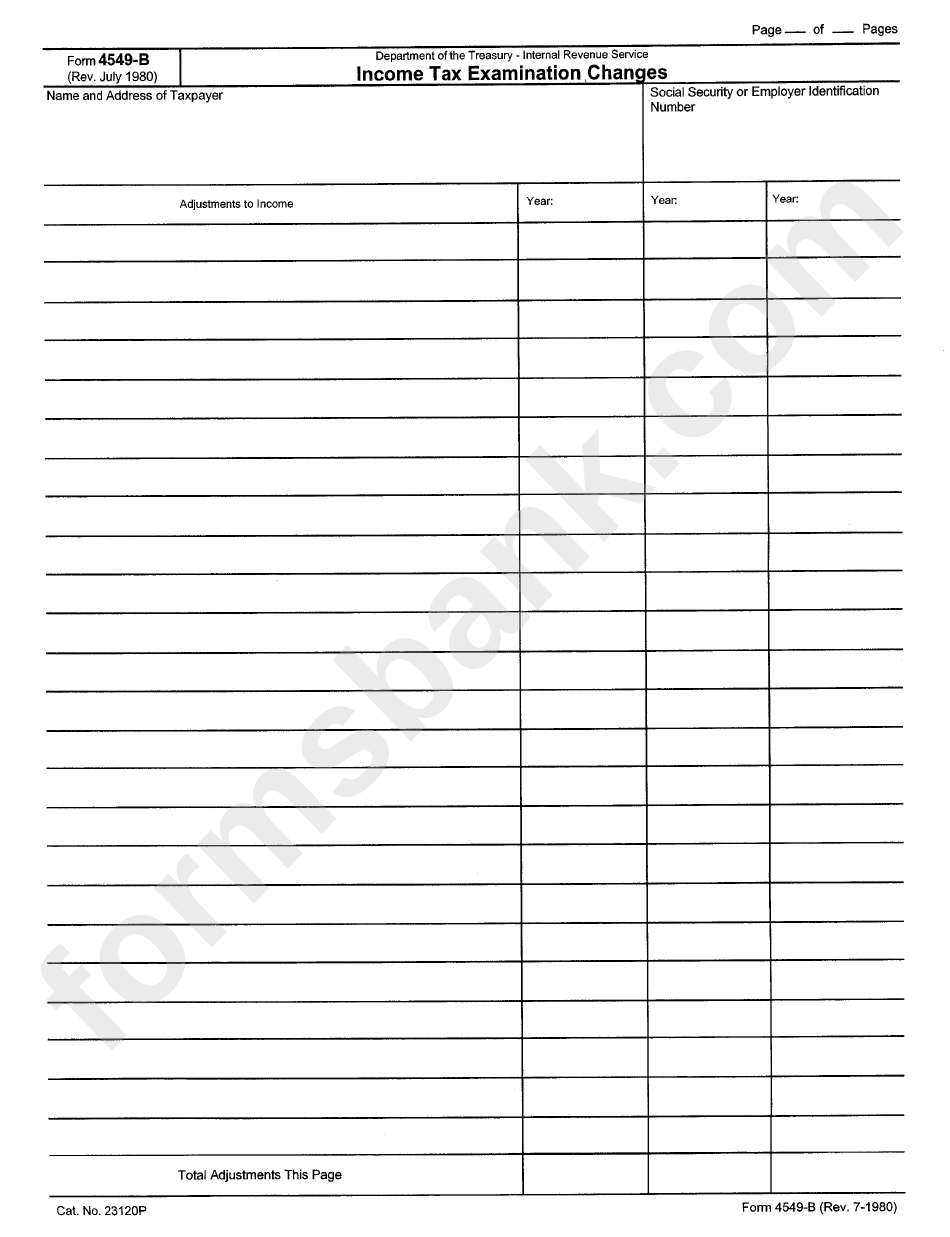

Form 4549B Tax Examitation Changes printable pdf download

In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. 6532 (a) provides that no suit may begin after the expiration of 2 years from the date of mailing by certified mail or registered mail to the taxpayer of a notice of the disallowance of the part of the.

The Tax Times RA's Report Was Initial Determination For Penalty

1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Web tax audit guide to irs form 4549 irs form 4549 (income tax examination changes) form 4549 explanation and how to respond form 4549 is an irs form that is sent to.

Form 4549A Tax Discrepancy Adjustments printable pdf download

Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax.

Irs form 4549 Sample Glendale Community

Web so, if we completed 1,000 form n‑400 applications in the previous six months, and 80% (or 800) of them were completed within 60 days (or two months), then the processing times webpage will display two months as the processing time for form n‑400 in may 2022. But there are certain times when they are more likely to use this.

The Notice Of Deficiency Will Provide You 90 Days (150 Days If You Are Outside The U.s.) To Respond By Petitioning The Tax Court.

Web tax audit guide to irs form 4549 irs form 4549 (income tax examination changes) form 4549 explanation and how to respond form 4549 is an irs form that is sent to taxpayers whose returns have been audited. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Web steps in response to form 4549: Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement.

Web If You Do Not Sign The Form 4549, The Irs Will Send You A Notice Of Deficiency.

At this point, you have the options of: But there are certain times when they are more likely to use this letter. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. You will have 90 days to petition the tax court.

If You Do Not File A Petition, The Irs Will Bill You For The Taxes.

This letter is also used as an initial reporting tool. 6532 (a) provides that no suit may begin after the expiration of 2 years from the date of mailing by certified mail or registered mail to the taxpayer of a notice of the disallowance of the part of the claim to which the suit or proceeding relates. Web you could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days.

Web If You Do Not Respond To Form 4549, The Irs Will Send You A Notice Of Deficiency.

Taxhelp believes the tax court is more fair to taxpayers than the other forums. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. If the time to petition tax court expires, the irs will begin collection and enforcement. Web irs definition form 4549, income tax examination changes, is used for cases that result in: