Form 3115 Depreciation

Form 3115 Depreciation - Web have you ever had a client who was not depreciating their rental property? Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. The form is required for both changing. Or one who was depreciating the land as well as the building? In either case, the taxpayer may be required to. Applying a cost segregation study on a tax return 17 comments in this article we will discuss how to apply a cost segregation study on a tax. Web up to 10% cash back taking action: Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Form 3115 and amended return options.

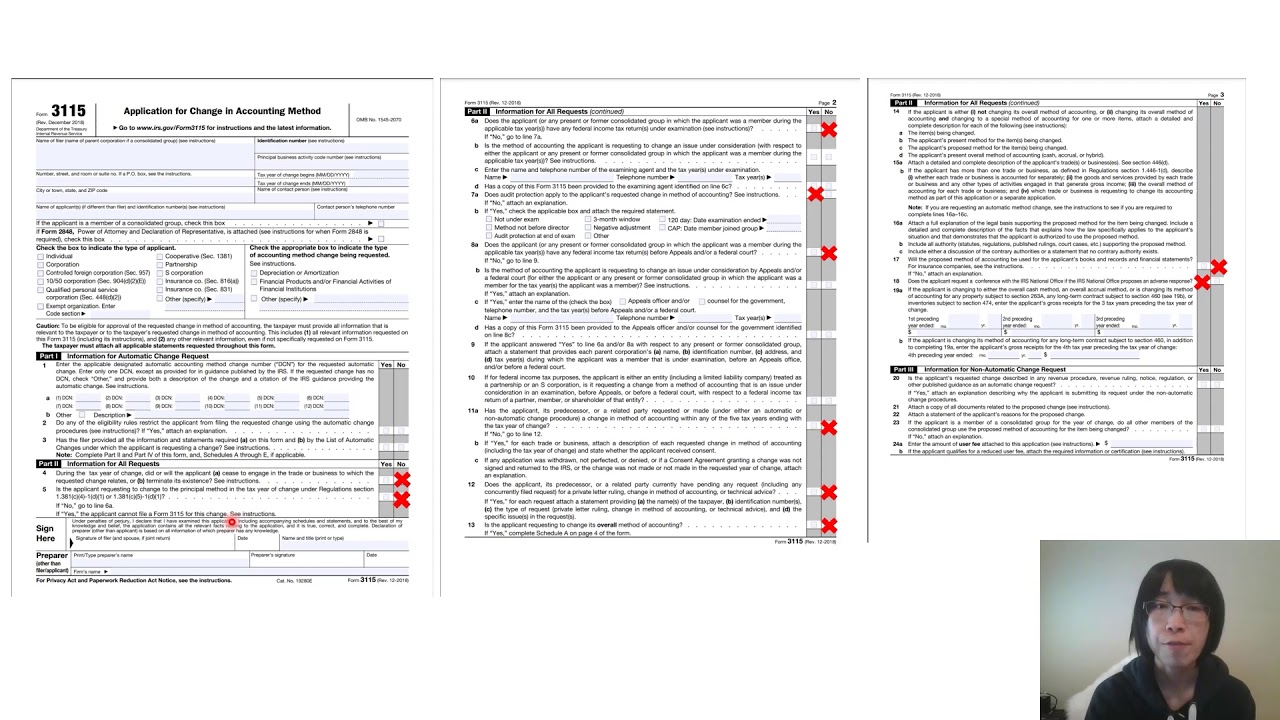

Web we would like to show you a description here but the site won’t allow us. Web part ii of form 3115. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. The form 3115 is the way you must make. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web change available for limited period: Form 3115 and amended return options. Form 3115 may be used for changing to ads depreciation for residential rental property. Web kbkg tax insight: Form 3115 for the new automatic change may only be filed on or after may 11, 2021, for a tax year of a cfc ending before jan.

The form is required for both changing. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web part ii of form 3115. Web have you ever had a client who was not depreciating their rental property? The irs on june 17, 2021. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Web change available for limited period: Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods.

Form 3115 Edit, Fill, Sign Online Handypdf

Form 3115 and amended return options. Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate copy was filed. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web a form 3115 is filed to change either an entity’s overall.

Correcting Depreciation Form 3115 LinebyLine

Residential rental property purchased in 2010. Web part ii of form 3115. In either case, the taxpayer may be required to. The form is required for both changing. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph.

Tax Accounting Methods

Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Form 3115 and amended return options. Web with respect to qip placed in service by the taxpayer after december 31, 2017, the revenue procedure allows taxpayers to correct their depreciation expense by either amending. This guidance is welcome for taxpayers.

Form 3115 Application for Change in Accounting Method(2015) Free Download

This guidance is welcome for taxpayers that wish to. Residential rental property purchased in 2010. The irs on june 17, 2021. Form 3115 and amended return options. Web part ii of form 3115.

Form 3115 Missed Depreciation printable pdf download

The form 3115 is the way you must make. Web up to 10% cash back taking action: Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year.

Form 3115 App for change in acctg method Capstan Tax Strategies

Form 3115 and amended return options. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web we would like to show you a description here but the site won’t allow us. Unclaimed depreciation of $11,773 on. Web have you ever had a client who was not depreciating their rental.

Form 3115 Application for Change in Accounting Method(2015) Free Download

This guidance is welcome for taxpayers that wish to. Form 3115 for the new automatic change may only be filed on or after may 11, 2021, for a tax year of a cfc ending before jan. Form 3115 and amended return options. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment.

How to catch up missed depreciation on rental property (part I) filing

The irs on june 17, 2021. Unclaimed depreciation of $11,773 on. Form 3115 and amended return options. Web taxpayers are allowed a choice to either amend tax returns or file a form 3115 to make the changes. Line 12 (a) item being changed:

Form 3115 Depreciation Guru

Form 3115 and amended return options. In either case, the taxpayer may be required to. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web kbkg tax insight: Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full.

Form 3115 Definition, Who Must File, & More

The form is required for both changing. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. This guidance is welcome for taxpayers that wish to. The form 3115 is the way you must make. Unclaimed depreciation of $11,773 on.

Web Form 3115 Will Have To Be Filed, With The Entire Amount Of Incorrect Or Overlooked Depreciation Deducted In Full In The Year Of Correction Via This Form 3115.

Form 3115 and amended return options. The form 3115 is the way you must make. Web section 6.01, relating to impermissible to permissible depreciation method changes, is modified by removing language in paragraph (1)(c)(viii) and paragraph. Web the duplicate copy of the resubmitted form 3115 is considered filed as of the date the original duplicate copy was filed.

Web The Form 3115 Allows Building Owners To Implement Cost Segregation Studies Through An “Automatic Change” With No Additional Payment Due To The Irs.

Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual. Web we would like to show you a description here but the site won’t allow us. Form 3115 for the new automatic change may only be filed on or after may 11, 2021, for a tax year of a cfc ending before jan. Web part ii of form 3115.

Or One Who Was Depreciating The Land As Well As The Building?

Web with respect to qip placed in service by the taxpayer after december 31, 2017, the revenue procedure allows taxpayers to correct their depreciation expense by either amending. Unclaimed depreciation of $11,773 on. The form is required for both changing. Form 3115 may be used for changing to ads depreciation for residential rental property.

Web Information About Form 3115, Application For Change In Accounting Method, Including Recent Updates, Related Forms And Instructions On How To File.

Web up to 10% cash back taking action: Applying a cost segregation study on a tax return 17 comments in this article we will discuss how to apply a cost segregation study on a tax. Web kbkg tax insight: Web change available for limited period: