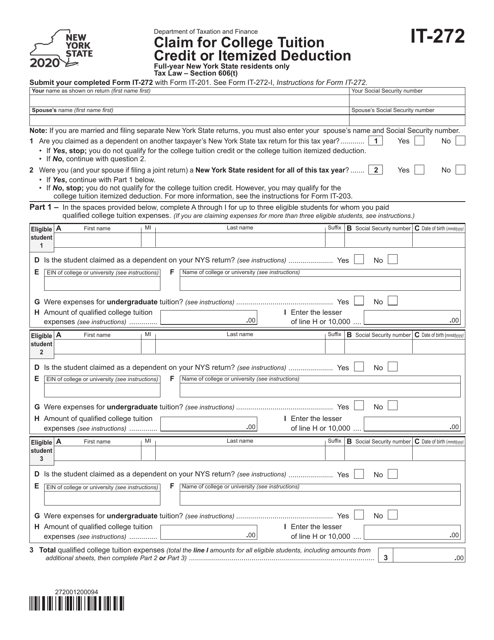

Form It 272

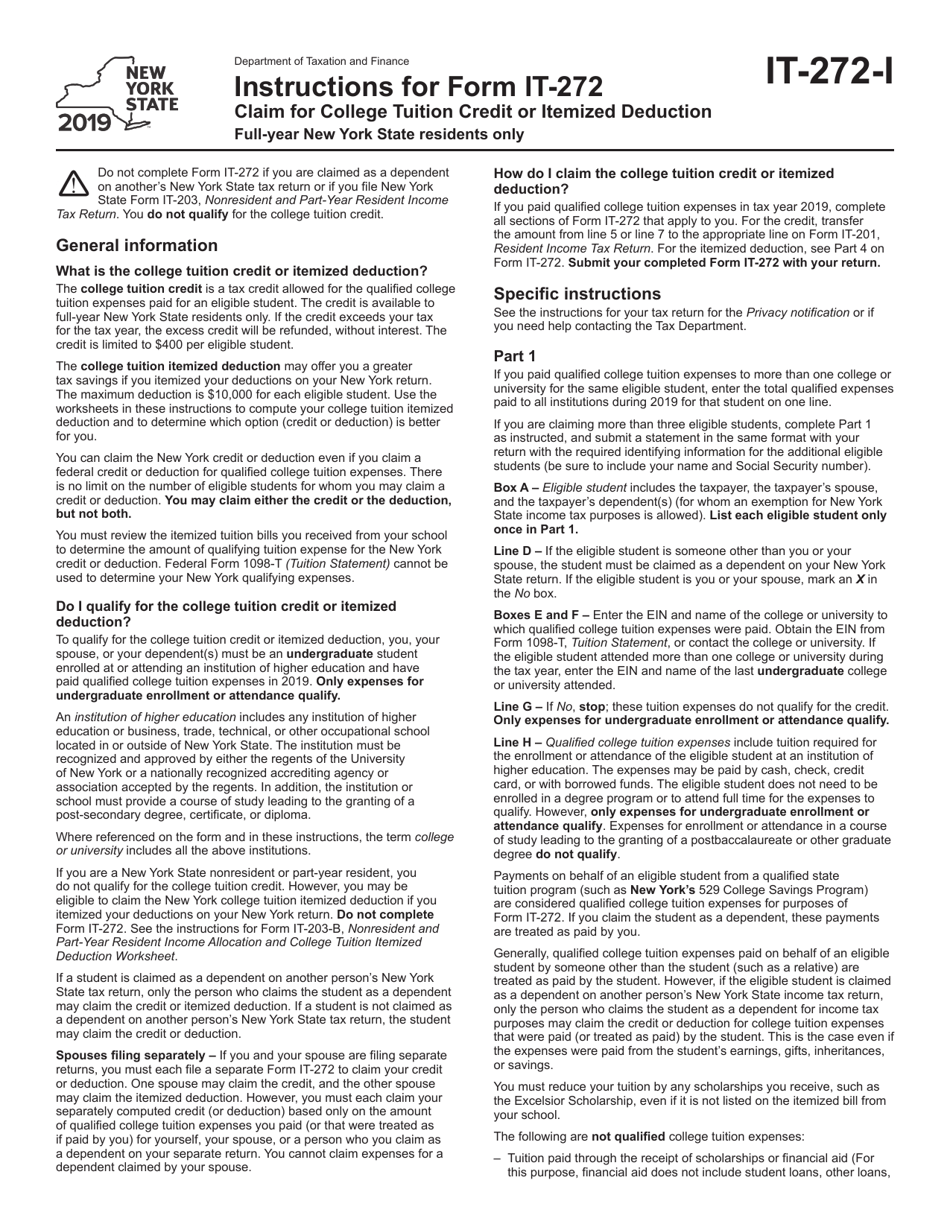

Form It 272 - Compute the amount by which your credit or deduction would have been reduced if the refund,. On page 2, 2nd column, the instruction as to how to claim the credit should read: The college's ein must follow one of the following formats: If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. Web current tax year net income (before distributions): Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. Part 3 is completed if line 3 is $5,0000 or more. The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. • attach this form to your. Calculated new york > credits:.

If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. The college's ein must follow one of the following formats: • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b Web current tax year net income (before distributions): Calculated new york > credits:. You can take either a tax credit or an itemized tax. • attach this form to your. Compute the amount by which your credit or deduction would have been reduced if the refund,. Who qualifies for ny tuition credit? On page 2, 2nd column, the instruction as to how to claim the credit should read:

On page 2, 2nd column, the instruction as to how to claim the credit should read: You can take either a tax credit or an itemized tax. Part 3 is completed if line 3 is $5,0000 or more. • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b The college's ein must follow one of the following formats: Who qualifies for ny tuition credit? If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. Web • complete this form to compute your college tuition credit. Compute the amount by which your credit or deduction would have been reduced if the refund,. Web current tax year net income (before distributions):

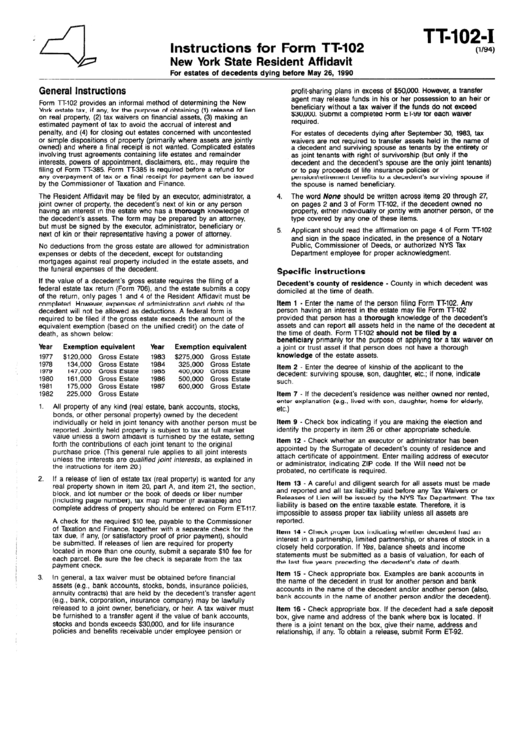

Form Tt102I Instructions New York State Resident Affidavit

Who qualifies for ny tuition credit? • attach this form to your. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Compute the amount by which your credit or deduction would have been.

Form IT 272 College Tuition Credit Miller Financial Services

Part 3 is completed if line 3 is $5,0000 or more. Compute the amount by which your credit or deduction would have been reduced if the refund,. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. Calculated new york > credits:. Web • complete this form to compute your college.

NY DTF IT2104 20212022 Fill out Tax Template Online US Legal Forms

Calculated new york > credits:. Web current tax year net income (before distributions): Compute the amount by which your credit or deduction would have been reduced if the refund,. Web • complete this form to compute your college tuition credit. Part 3 is completed if line 3 is $5,0000 or more.

The Eye Has It 272/365 Thanks for looking. Here's my album… Flickr

The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Web • complete this form to compute your college tuition credit. If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the.

It 203 b instructions

Who qualifies for ny tuition credit? You can take either a tax credit or an itemized tax. If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. The college's ein must follow one of the following.

USM Form 272 and 272A Service Of Process Pleading

Calculated new york > credits:. Part 3 is completed if line 3 is $5,0000 or more. The college's ein must follow one of the following formats: Who qualifies for ny tuition credit? Web • complete this form to compute your college tuition credit.

Download Instructions for Form IT272 Claim for College Tuition Credit

• in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. If you cannot claim all of your credit because it is more than your new york state tax less.

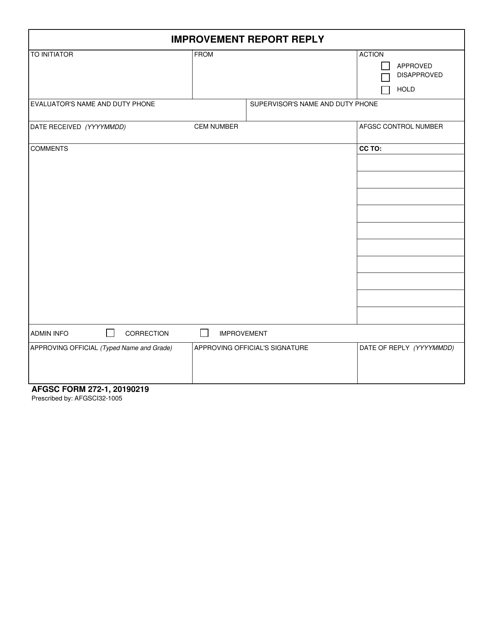

AFGSC Form 2721 Download Fillable PDF or Fill Online Improvement

Calculated new york > credits:. • attach this form to your. Who qualifies for ny tuition credit? The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Web current tax year net income (before distributions):

Form IT272 Download Fillable PDF or Fill Online Claim for College

On page 2, 2nd column, the instruction as to how to claim the credit should read: Web • complete this form to compute your college tuition credit. Compute the amount by which your credit or deduction would have been reduced if the refund,. If you cannot claim all of your credit because it is more than your new york state.

How Do I Reset Canon Printer? (18882729758) My Geeks Help

Web • complete this form to compute your college tuition credit. • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b Who qualifies for ny tuition credit? • attach this form to your. On page 2, 2nd column, the instruction as to how to claim the.

Compute The Amount By Which Your Credit Or Deduction Would Have Been Reduced If The Refund,.

On page 2, 2nd column, the instruction as to how to claim the credit should read: Part 3 is completed if line 3 is $5,0000 or more. Calculated new york > credits:. Who qualifies for ny tuition credit?

• In Column (A), Enter The Amount From Part I, Line 24B • In Column (B), Enter The Amount From Part I, Line 25B

The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. You can take either a tax credit or an itemized tax. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. • attach this form to your.

The College's Ein Must Follow One Of The Following Formats:

Web • complete this form to compute your college tuition credit. Web current tax year net income (before distributions): If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10.