Georgia Form 600 Instructions 2022

Georgia Form 600 Instructions 2022 - To successfully complete the form, you must download and use the current version of. Visit our website dor.georgia.gov for more information. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Download and save the form to your local computer. Kemp governor electronic filing the georgia department of revenue accepts visa, american

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web form 600 is a georgia corporate income tax form. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Corporation income tax general instructions booklet. Download and save the form to your local computer. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Visit our website dor.georgia.gov for more information. Credit card payments it 611 rev. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb)

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Download and save the form to your local computer. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. Corporation income tax general instructions booklet. Web form 600 is a georgia corporate income tax form. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) To successfully complete the form, you must download and use the current version of.

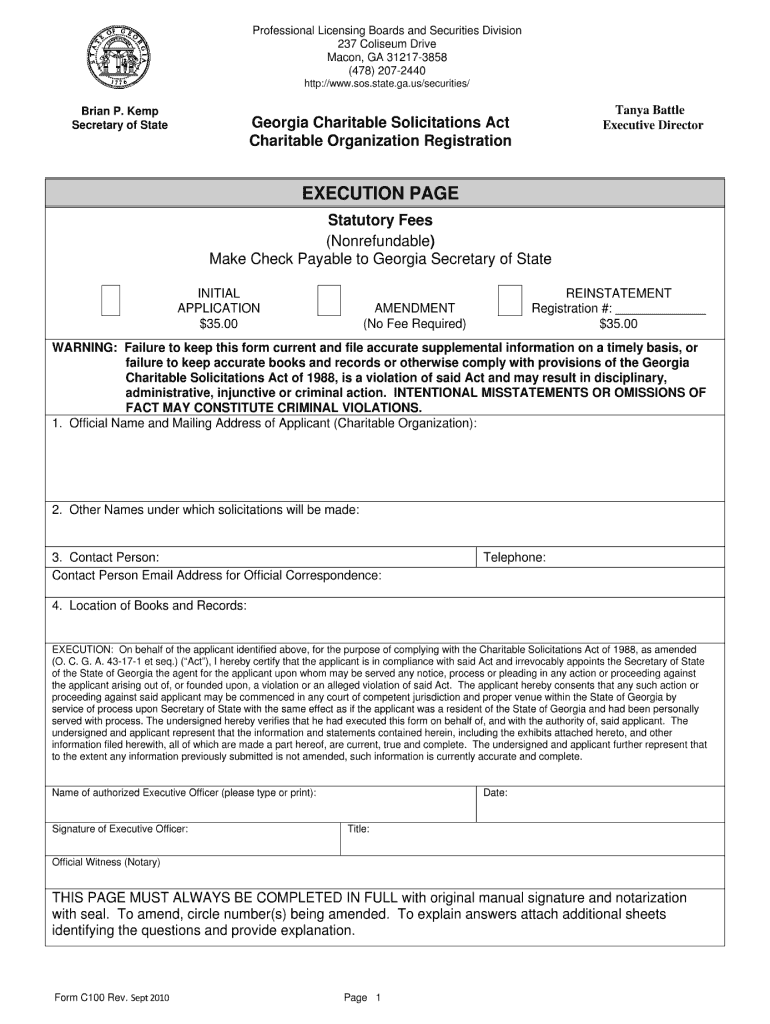

Form C100 Fill Out and Sign Printable PDF Template signNow

Kemp governor electronic filing the georgia department of revenue accepts visa, american Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. 07/20/22) corporation tax return page page 1 1 georgia department of revenue (approved web version) 2022 income tax return beginning ending 2023 net worth tax return amount of nonresident withholding.

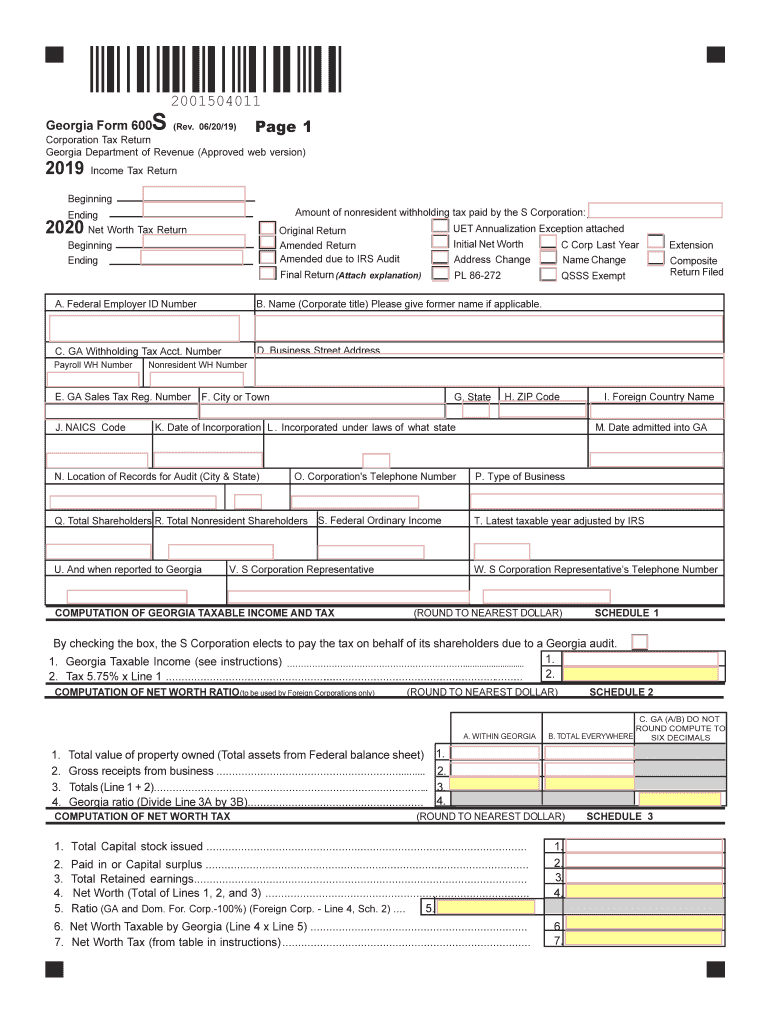

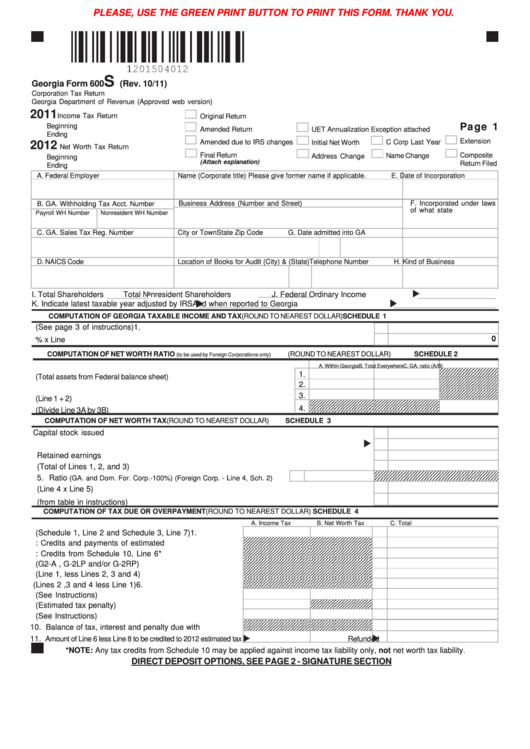

GA DoR 600S 20192022 Fill out Tax Template Online US Legal Forms

2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Visit our website dor.georgia.gov for more information. Kemp governor electronic filing the georgia department of.

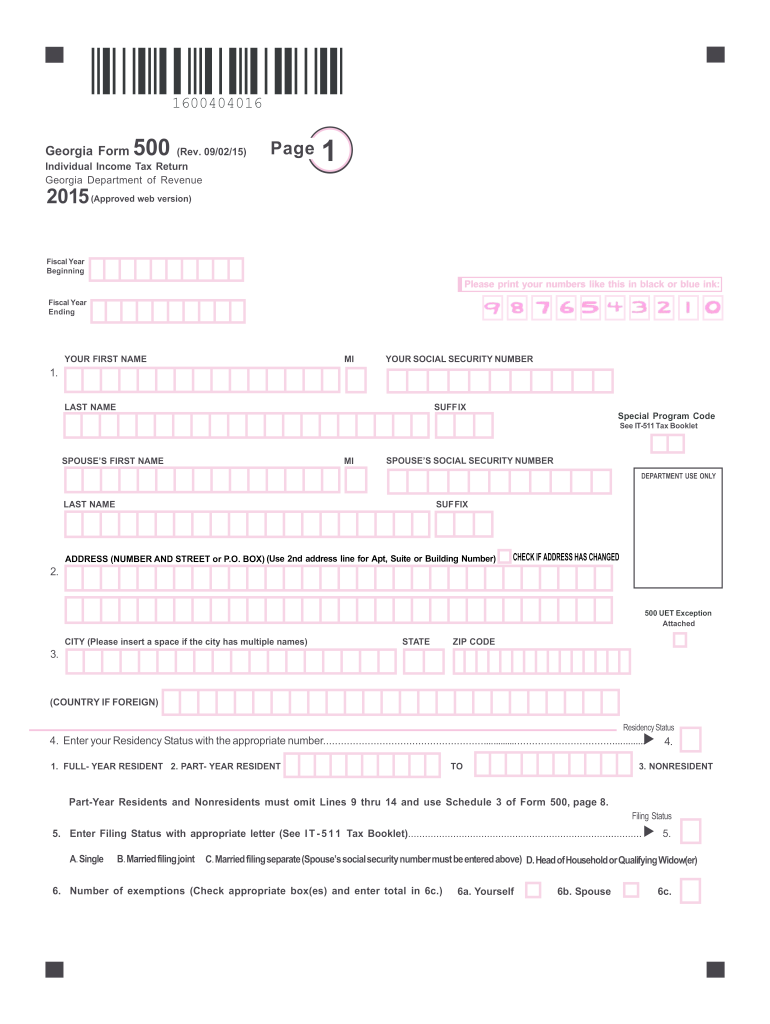

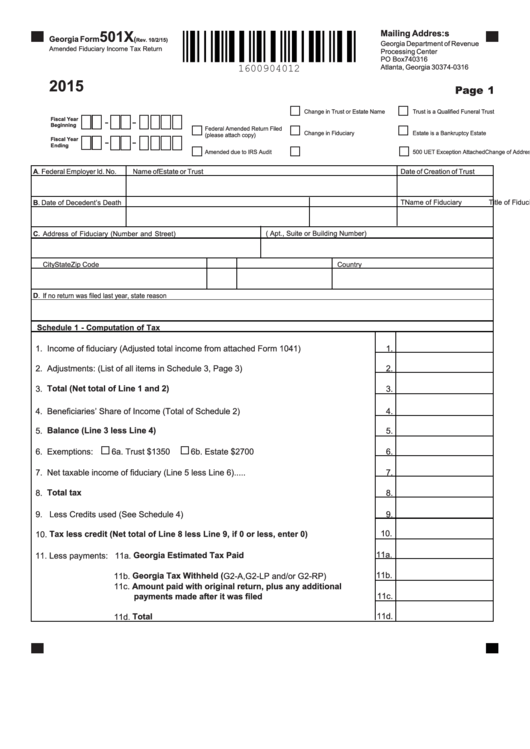

form 500 Fill out & sign online DocHub

While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th.

500 Tax Form Fill Out and Sign Printable PDF Template signNow

07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due.

Form Marriage Fill Online, Printable, Fillable, Blank pdfFiller

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. Web corporate income and net worth tax returns (form 600) must be filed on or before.

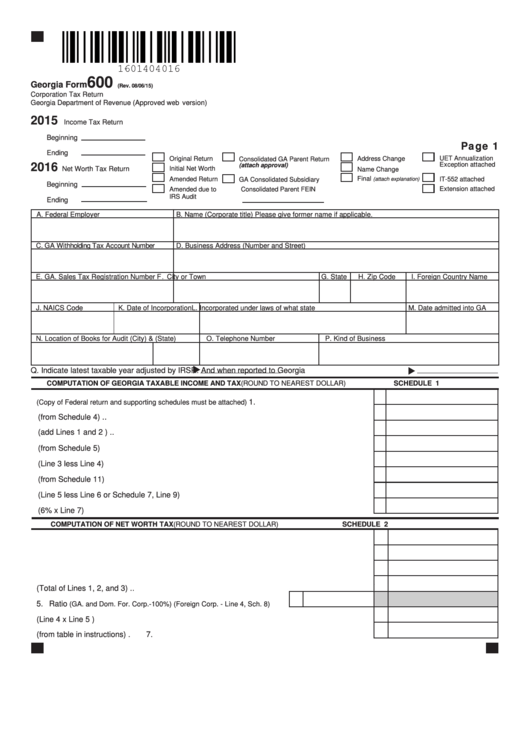

Fillable Form 600 Corporation Tax Return 2015 printable pdf

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) Corporation income tax general instructions booklet. Georgia.

2005 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. Visit our website dor.georgia.gov for more information. 07/20/22) page 1 corporation tax return 2022 georgia department of.

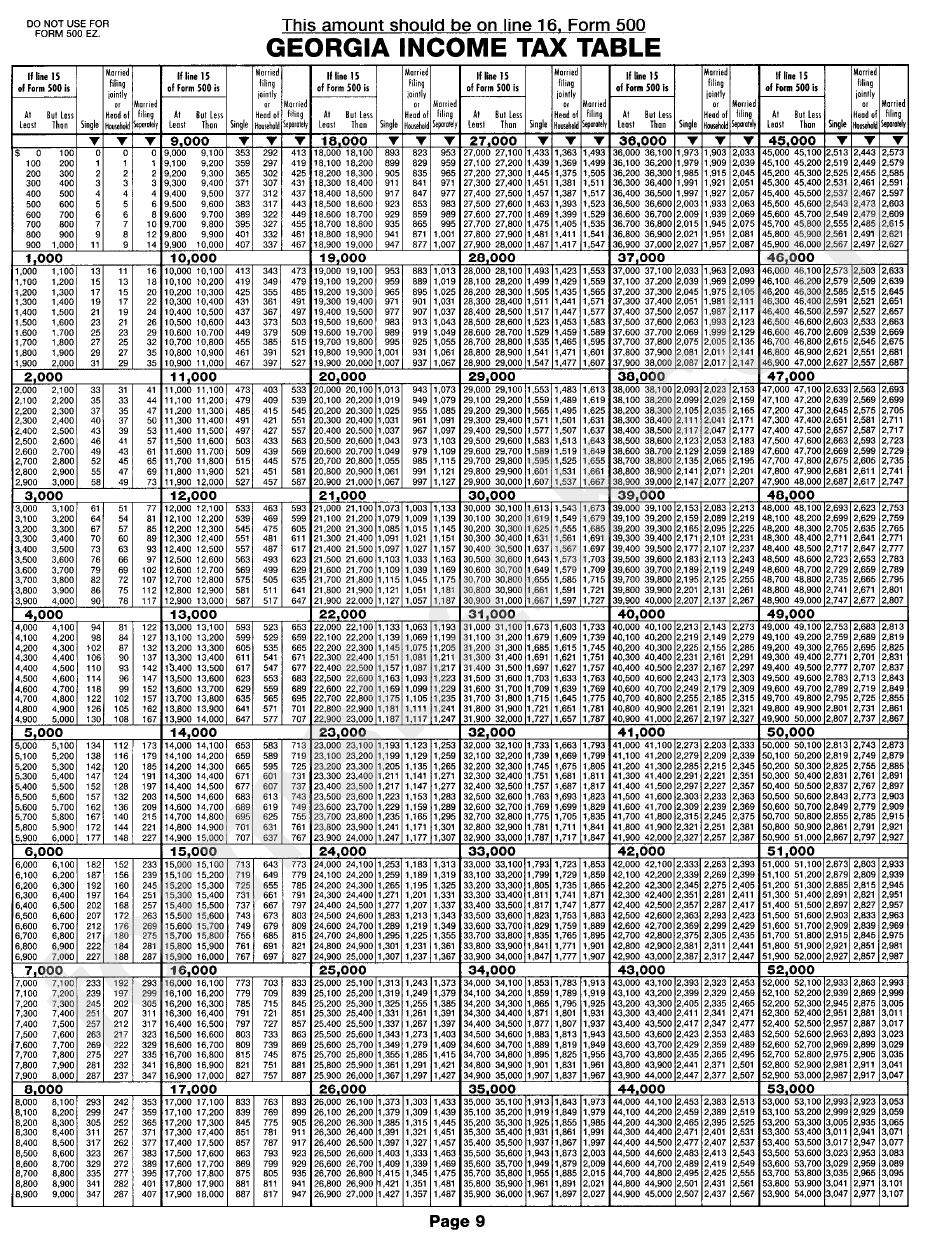

Form 500 Tax Table printable pdf download

07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Web form 600 is a georgia corporate income tax form. Corporation income tax general instructions booklet. Web.

Top 92 Tax Forms And Templates free to download in PDF

While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. Visit our website dor.georgia.gov for more information. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web georgia.

Fillable Form 600s Corporation Tax Return printable pdf download

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet.

Web Georgia Form 600S (Rev.

Corporation income tax general instructions booklet. Kemp governor electronic filing the georgia department of revenue accepts visa, american Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Visit our website dor.georgia.gov for more information.

Web Georgia Individual Income Tax Returns Must Be Received Or Postmarked By The April 18, 2023 Due Date.

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. To successfully complete the form, you must download and use the current version of. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Credit card payments it 611 rev.

Download And Save The Form To Your Local Computer.

Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms. 07/20/22) corporation tax return page page 1 1 georgia department of revenue (approved web version) 2022 income tax return beginning ending 2023 net worth tax return amount of nonresident withholding tax paid by. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb)

Web Form 600 Is A Georgia Corporate Income Tax Form.

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web department of revenue 2022 corporation income tax general instructions file form 600 and pay the tax electronically.