Form Ct 1040Nr Py

Form Ct 1040Nr Py - We last updated the nonresident/part. Use this calculator to determine your connecticut income tax. This form is most often used by individuals who have lived and/or worked in multiple. Select the filing status as. The connecticut department of revenue services (drs) urges you to. Web department of revenue services state of connecticut (rev. Federal adjusted gross income from. Web we last updated the tax instruction booklet: Our experts can get your taxes. Web department of revenue services.

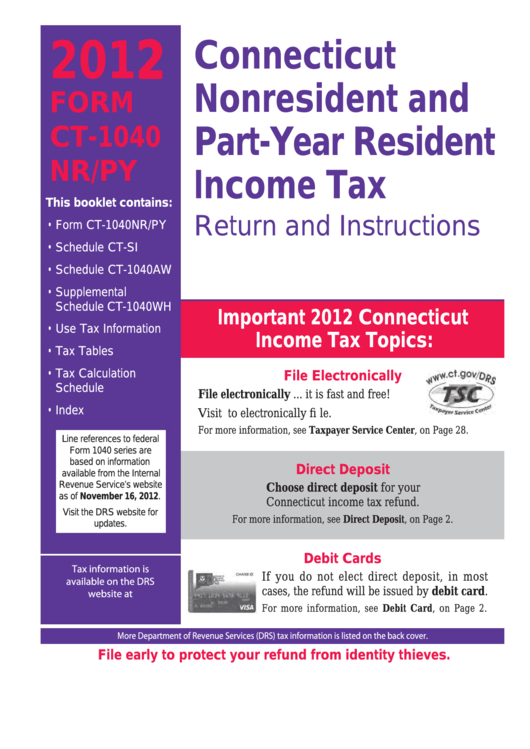

Our experts can get your taxes. Select the filing status as. Web department of revenue services state of connecticut (rev. Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. Web we last updated the tax instruction booklet: The connecticut department of revenue services (drs) urges you to. Federal adjusted gross income from. Web return and instructions this booklet contains: This form is most often used by individuals who have lived and/or worked in multiple. We last updated the nonresident/part.

Select the filing status as. Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. This form is most often used by individuals who have lived and/or worked in multiple. We last updated the nonresident/part. Web department of revenue services. Use this calculator to determine your connecticut income tax. The connecticut department of revenue services (drs) urges you to. Web return and instructions this booklet contains: Our experts can get your taxes. Federal adjusted gross income from.

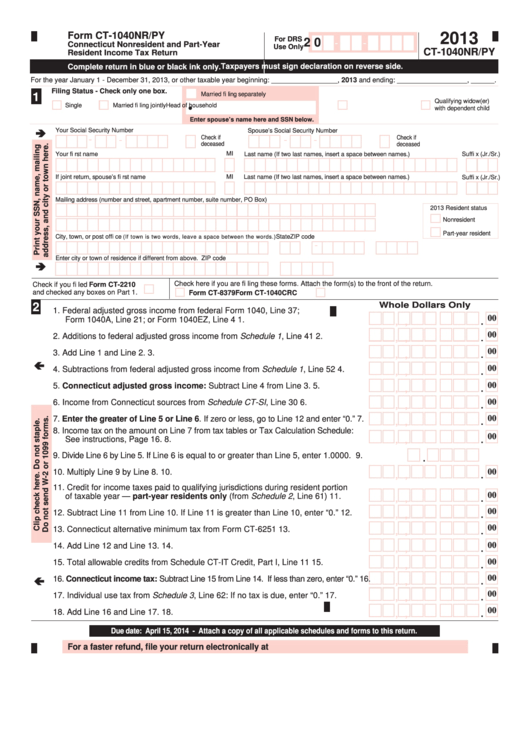

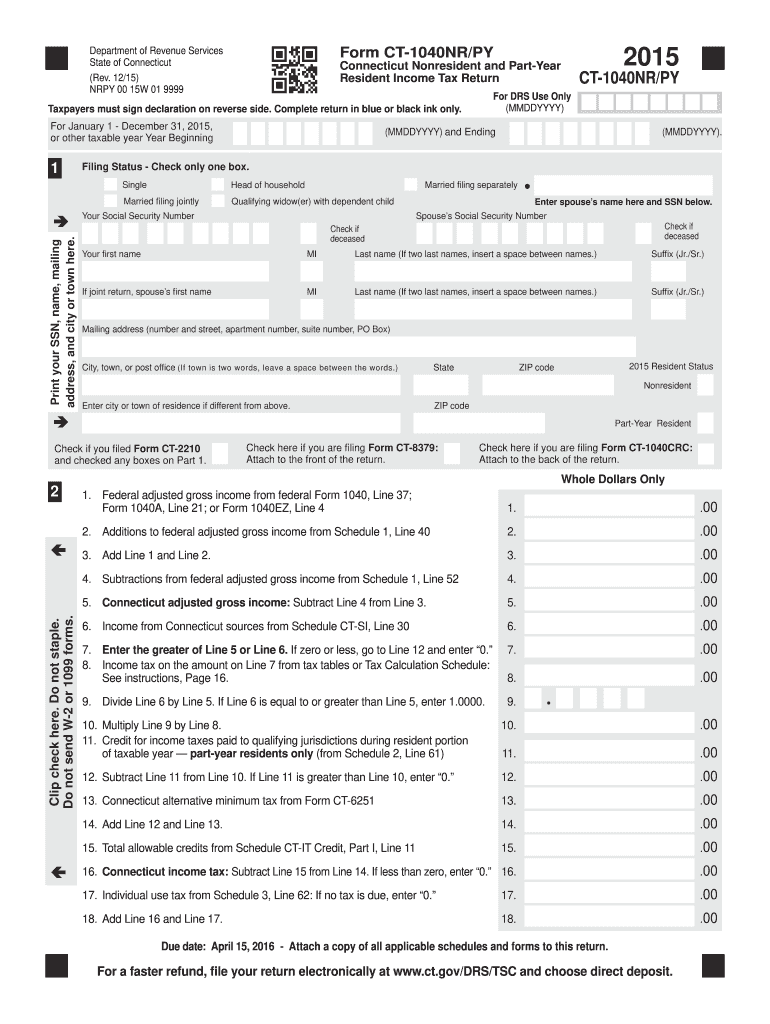

Fillable Form Ct1040nr/py Connecticut Nonresident And PartYear

Our experts can get your taxes. This form is most often used by individuals who have lived and/or worked in multiple. Web we last updated the tax instruction booklet: Web department of revenue services state of connecticut (rev. Federal adjusted gross income from.

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

Use this calculator to determine your connecticut income tax. Our experts can get your taxes. Web we last updated the tax instruction booklet: Web department of revenue services state of connecticut (rev. This form is most often used by individuals who have lived and/or worked in multiple.

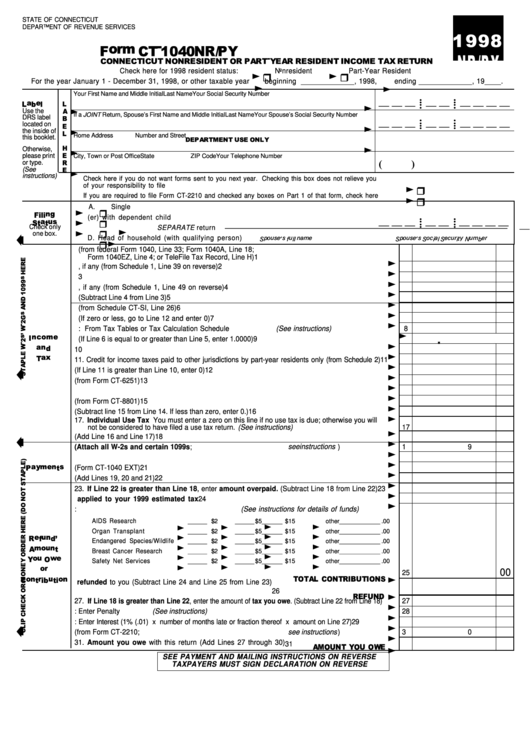

Fillable Form Ct1040nr/py Nonresident Or PartYear Resident

This form is most often used by individuals who have lived and/or worked in multiple. Use this calculator to determine your connecticut income tax. Web return and instructions this booklet contains: Federal adjusted gross income from. The connecticut department of revenue services (drs) urges you to.

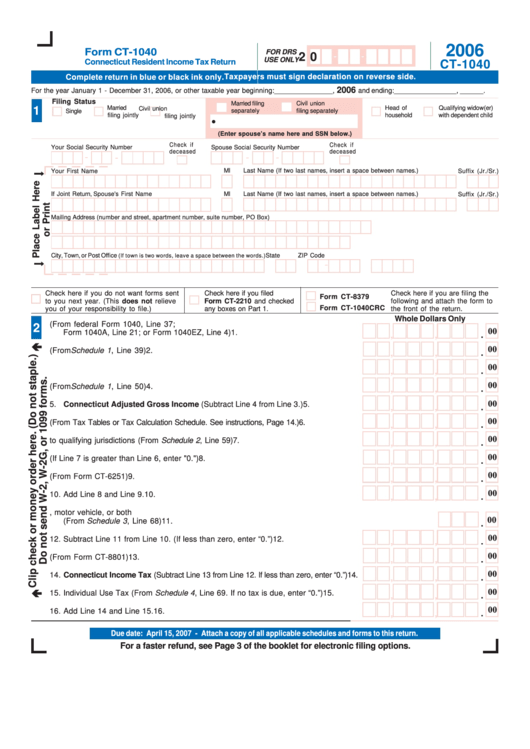

Form Ct1040 Connecticut Resident Tax Return 2006 printable

Web department of revenue services. Web department of revenue services state of connecticut (rev. We last updated the nonresident/part. This form is most often used by individuals who have lived and/or worked in multiple. Select the filing status as.

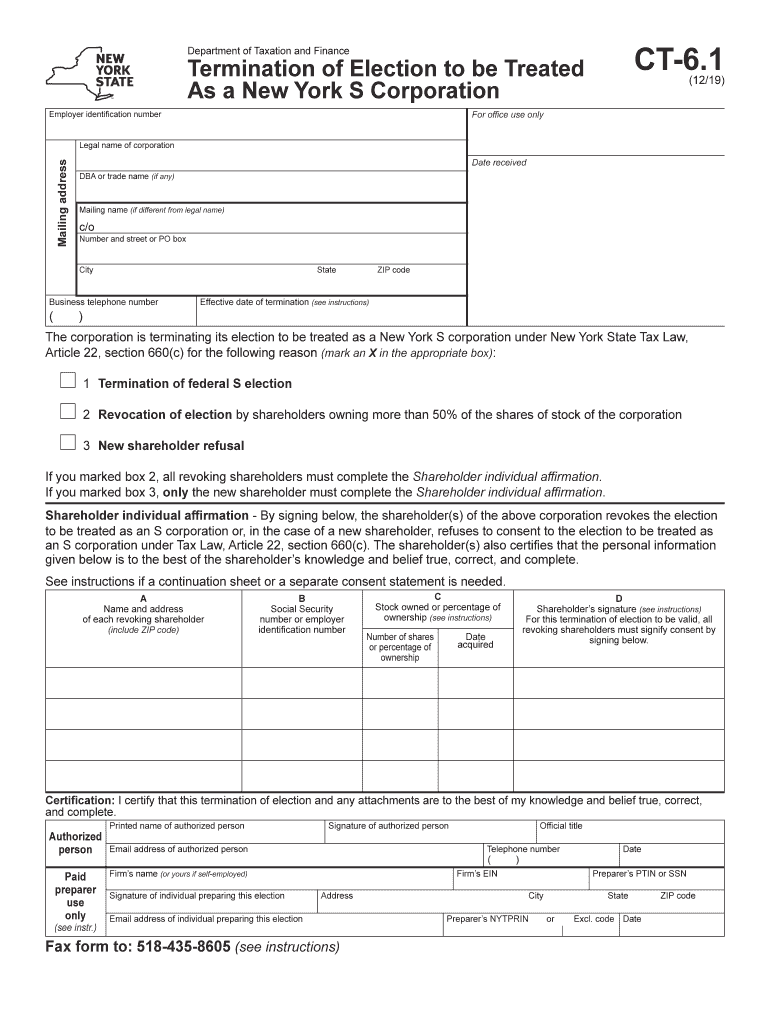

20192022 Form NY CT6.1 Fill Online, Printable, Fillable, Blank

Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. We last updated the nonresident/part. Web department of revenue services state of connecticut (rev. Federal adjusted gross income from. Select the filing status as.

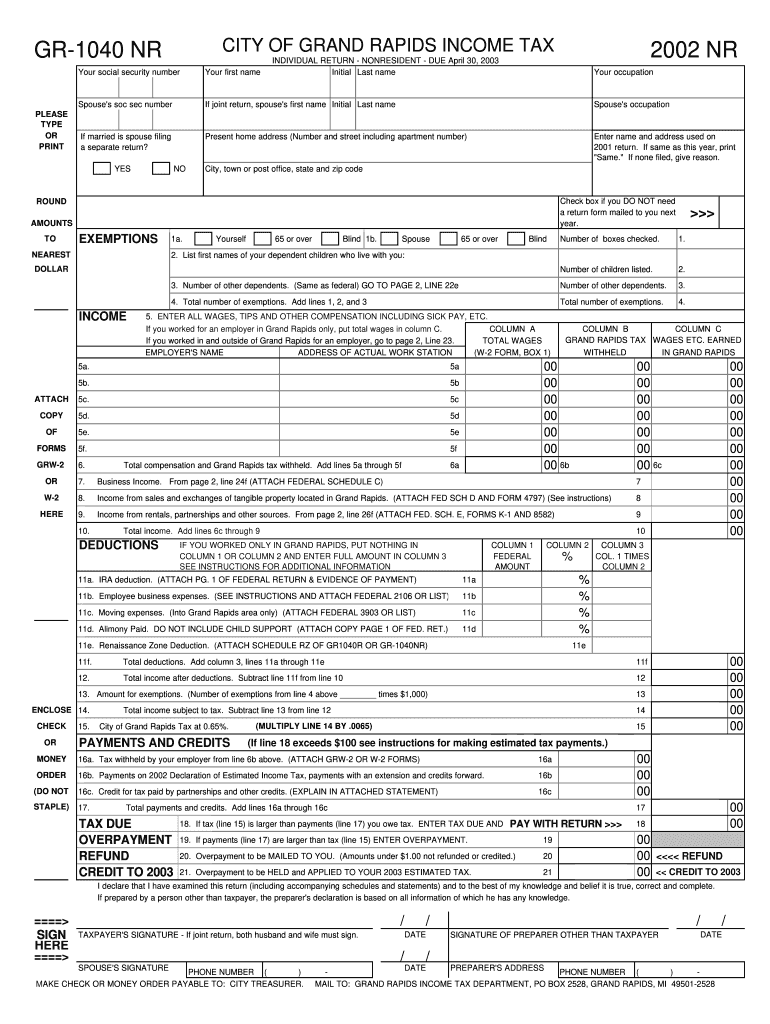

Gr 1040nr Fill Out and Sign Printable PDF Template signNow

Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. Web department of revenue services state of connecticut (rev. Use this calculator to determine your connecticut income tax. This form is most often used by individuals who have lived and/or.

2015 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Web return and instructions this booklet contains: Web department of revenue services. Use this calculator to determine your connecticut income tax. The connecticut department of revenue services (drs) urges you to. Web we last updated the tax instruction booklet:

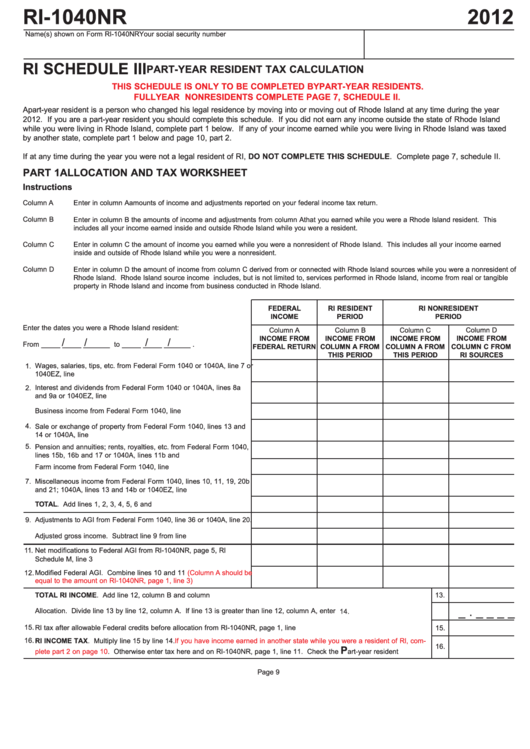

Form Ri1040nr Ri Schedule Iii PartYear Resident Tax Calculation

Web department of revenue services. Web return and instructions this booklet contains: Federal adjusted gross income from. This form is most often used by individuals who have lived and/or worked in multiple. Use this calculator to determine your connecticut income tax.

Form 1040NREZ

Web return and instructions this booklet contains: Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. Web department of revenue services state of connecticut (rev. This form is most often used by individuals who have lived and/or worked in.

CT R229 20132021 Fill and Sign Printable Template Online US Legal

Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming. Our experts can get your taxes. The connecticut department of revenue services (drs) urges you to. This form is most often used by individuals who have lived and/or worked in.

Our Experts Can Get Your Taxes.

Web return and instructions this booklet contains: Web department of revenue services state of connecticut (rev. Web department of revenue services. Select the filing status as.

Use This Calculator To Determine Your Connecticut Income Tax.

The connecticut department of revenue services (drs) urges you to. Federal adjusted gross income from. Web we last updated the tax instruction booklet: Web for the taxable year beginning on january 1, 2020, form ct‑1040nr/py has been updated to provide a check box for filers of federal form 1310, statement of person claiming.

This Form Is Most Often Used By Individuals Who Have Lived And/Or Worked In Multiple.

We last updated the nonresident/part.

:max_bytes(150000):strip_icc()/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)