Mo Form 53-1

Mo Form 53-1 - Annual 10% eedp reconciliation return 10 percent electrical energy: Sales tax return and instructions: Use fill to complete blank online missouri pdf forms for free. If this is your final return, enter the close date below and check the reason for closing your account. Form 2039 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Open up the pdf template in the editor. This is where to put in your data. All forms are printable and downloadable. Missouri law requires any person selling Click on the variant to select if you see the checkboxes.

Web filing your missouri sales tax returns offline. All forms are printable and downloadable. Click on the variant to select if you see the checkboxes. As an alternative, the department will accept an excel file formatted with the business’ same location and rate data as the department’s. Annual 10% eedp reconciliation return 10 percent electrical energy: Web nonprotested sales tax payment report (note: 2% timely payment allowance (if applicable). See the outlined fillable lines. Use fill to complete blank online missouri pdf forms for free. Once you have completed your required.

Web filing your missouri sales tax returns offline. Sales tax return and instructions: 2% timely payment allowance (if applicable). Once you have completed your required. If this is your final return, enter the close date below and check the reason for closing your account. As an alternative, the department will accept an excel file formatted with the business’ same location and rate data as the department’s. Open up the pdf template in the editor. This is where to put in your data. Web select this option to pay the balance due from a monthly, quarterly, or annual sales, consumer’s use or vendor’s use tax return. Web bulk and customized record request form:

Fill Free fillable forms for the state of Missouri

See the outlined fillable lines. Web sales and use tax returns are available for downloading from our website at dor.mo.gov/forms/. If this is your final return, enter the close date below and check the reason for closing your account. Open up the pdf template in the editor. Once you have completed your required.

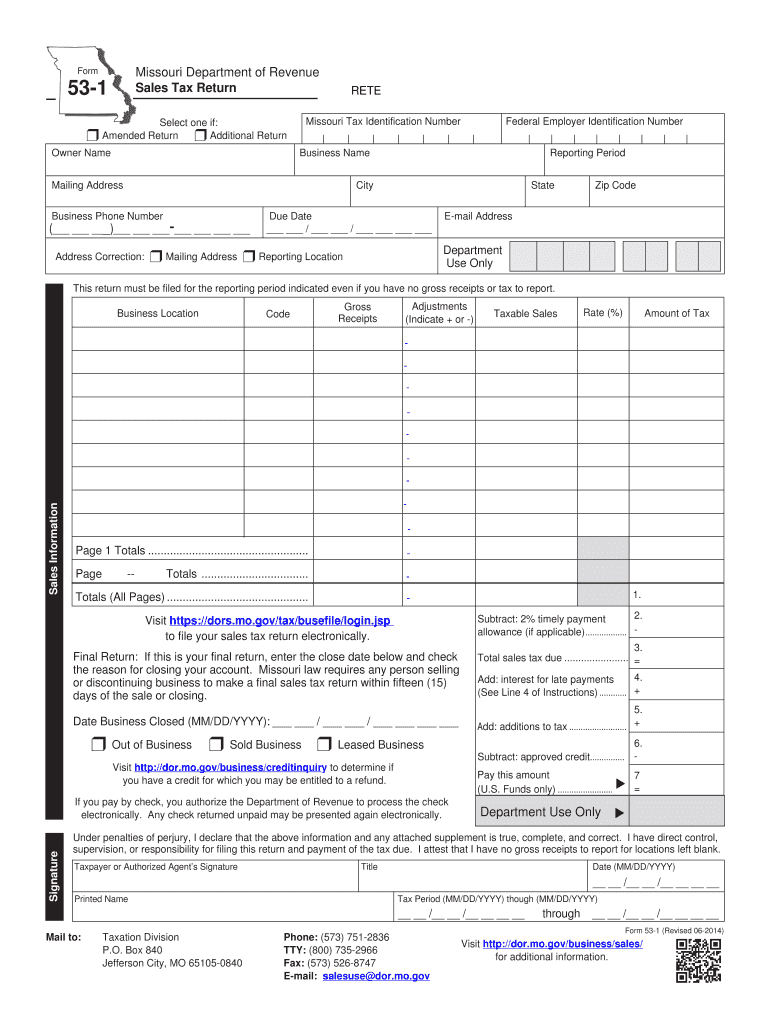

Fill Free fillable Form 531 Sales Tax Return PDF form

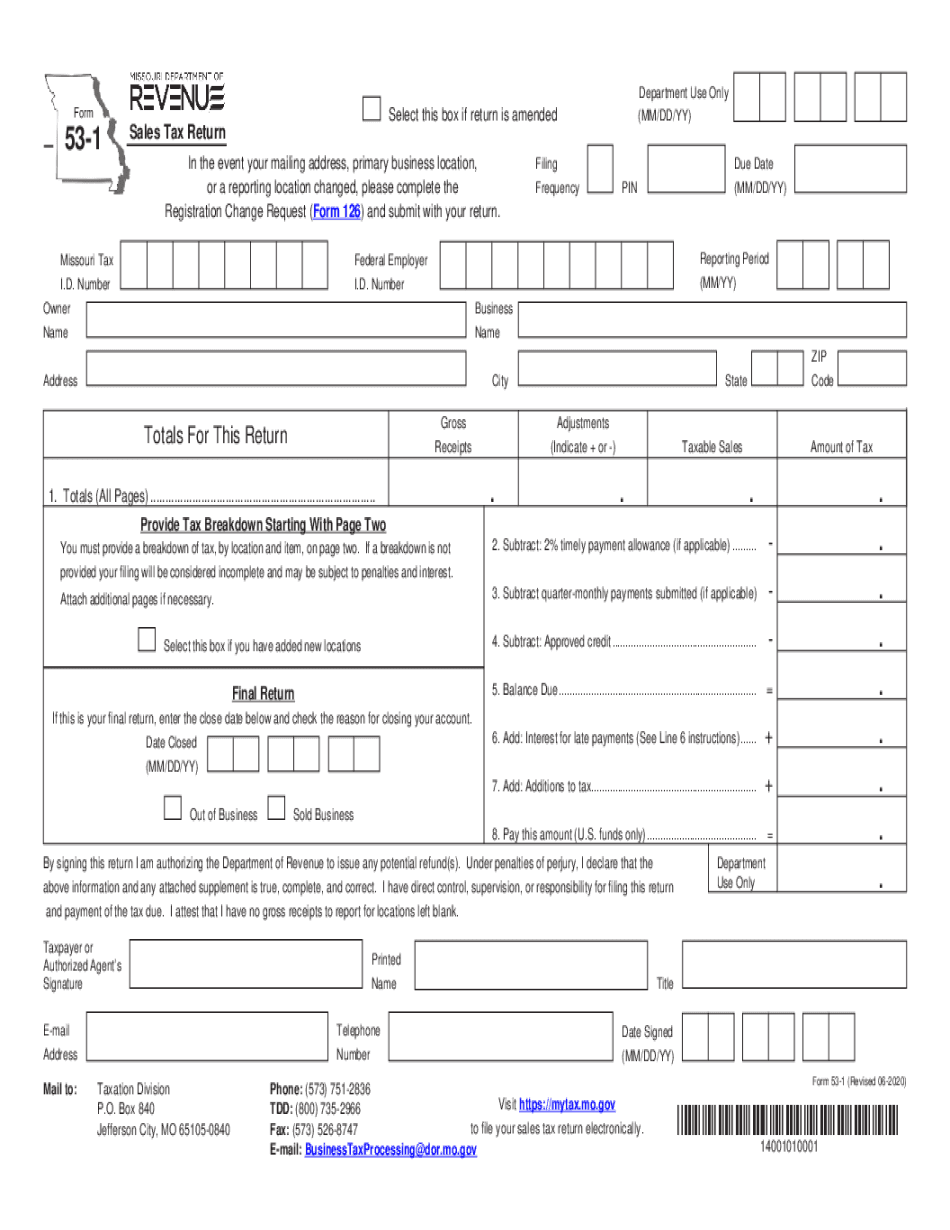

Annual 10% eedp reconciliation return 10 percent electrical energy: Sales tax return and instructions: If this is your final return, enter the close date below and check the reason for closing your account. Department use only (mm/dd/yy) reporting period (mm/yy) missouri tax. Once you have completed your required.

2014 MO DoR Form 531 Fill Online, Printable, Fillable, Blank pdfFiller

Web select this option to pay the balance due from a monthly, quarterly, or annual sales, consumer’s use or vendor’s use tax return. See the outlined fillable lines. Form 2039 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. If this is your final return, enter the close date below and check the reason for.

MO Form 14 Complete Legal Document Online US Legal Forms

All forms are printable and downloadable. This is where to put in your data. Web filing your missouri sales tax returns offline. Sales tax return and instructions: Missouri law requires any person selling

MO Form MO1040A 20202022 Fill out Tax Template Online US Legal Forms

Web filing your missouri sales tax returns offline. As an alternative, the department will accept an excel file formatted with the business’ same location and rate data as the department’s. Click on the variant to select if you see the checkboxes. Once you have completed your required. 2% timely payment allowance (if applicable).

Fill Free fillable Form 531 Sales Tax Return PDF form

Web select this option to pay the balance due from a monthly, quarterly, or annual sales, consumer’s use or vendor’s use tax return. Web filing your missouri sales tax returns offline. Form 2039 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Once you have completed your required. Department use only (mm/dd/yy) reporting period (mm/yy).

MO DoR Form 531 2020 Printable Blank PDF Online

Use fill to complete blank online missouri pdf forms for free. If this is your final return, enter the close date below and check the reason for closing your account. Click on the variant to select if you see the checkboxes. Missouri law requires any person selling Open up the pdf template in the editor.

2014 Form MO 2643A Fill Online, Printable, Fillable, Blank pdfFiller

Web bulk and customized record request form: Missouri law requires any person selling See the outlined fillable lines. This is where to put in your data. Web nonprotested sales tax payment report (note:

20182022 MO Form 8210353 Fill Online, Printable, Fillable, Blank

As an alternative, the department will accept an excel file formatted with the business’ same location and rate data as the department’s. This is where to put in your data. Web sales and use tax returns are available for downloading from our website at dor.mo.gov/forms/. Department use only (mm/dd/yy) reporting period (mm/yy) missouri tax. Annual 10% eedp reconciliation return 10.

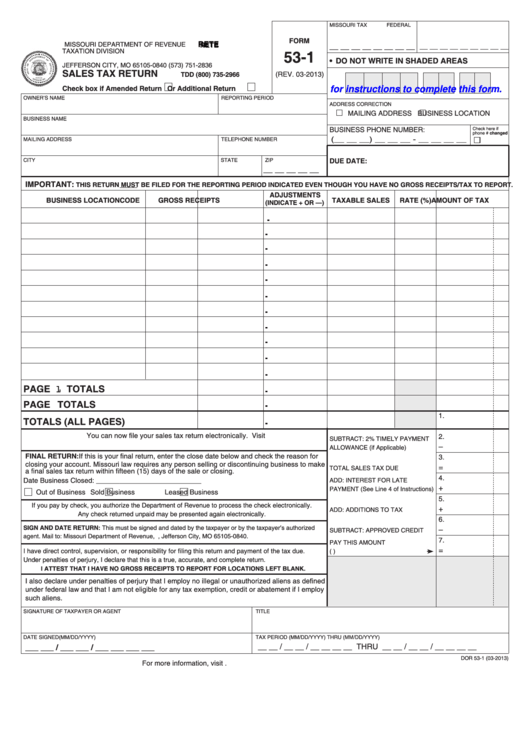

Fillable Form 531 Sales Tax Return 2013 printable pdf download

Once you have completed your required. Once completed you can sign your fillable form or send for signing. See the outlined fillable lines. Sales tax return and instructions: Web select this option to pay the balance due from a monthly, quarterly, or annual sales, consumer’s use or vendor’s use tax return.

Use Fill To Complete Blank Online Missouri Pdf Forms For Free.

2% timely payment allowance (if applicable). Once completed you can sign your fillable form or send for signing. Click on the variant to select if you see the checkboxes. Web filing your missouri sales tax returns offline.

Once You Have Completed Your Required.

This is where to put in your data. Annual 10% eedp reconciliation return 10 percent electrical energy: Sales tax return and instructions: If this is your final return, enter the close date below and check the reason for closing your account.

Department Use Only (Mm/Dd/Yy) Reporting Period (Mm/Yy) Missouri Tax.

Open up the pdf template in the editor. Form 2039 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Web bulk and customized record request form: Missouri law requires any person selling

See The Outlined Fillable Lines.

As an alternative, the department will accept an excel file formatted with the business’ same location and rate data as the department’s. Sales tax return and instructions: Web select this option to pay the balance due from a monthly, quarterly, or annual sales, consumer’s use or vendor’s use tax return. Web sales and use tax returns are available for downloading from our website at dor.mo.gov/forms/.