Form 990 Pf Due Date

Form 990 Pf Due Date - Web add foundation’s details by searching for your ein, you can import your foundation’s details from the irs directly. To use the table, you must know when your organization’s tax year ends. Web annual exempt organization return: Web form 990 due date finder. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. The due date will vary for each organization depending on the accounting period they follow. You can also choose to enter your foundation’s details manually. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. Web may 17, 2021, due date. At the top of this short period return, write “change of accounting period.”

Web annual exempt organization return: To use the table, you must know when your organization’s tax year ends. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. Web may 17, 2021, due date. Web form 990 due date finder. Ending date of tax year. You can also choose to enter your foundation’s details manually. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. Web add foundation’s details by searching for your ein, you can import your foundation’s details from the irs directly. The due date will vary for each organization depending on the accounting period they follow.

Web form 990 due date finder. At the top of this short period return, write “change of accounting period.” Web may 17, 2021, due date. Ending date of tax year. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. Web add foundation’s details by searching for your ein, you can import your foundation’s details from the irs directly. You can also choose to enter your foundation’s details manually. The due date will vary for each organization depending on the accounting period they follow. To use the table, you must know when your organization’s tax year ends.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal) If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month.

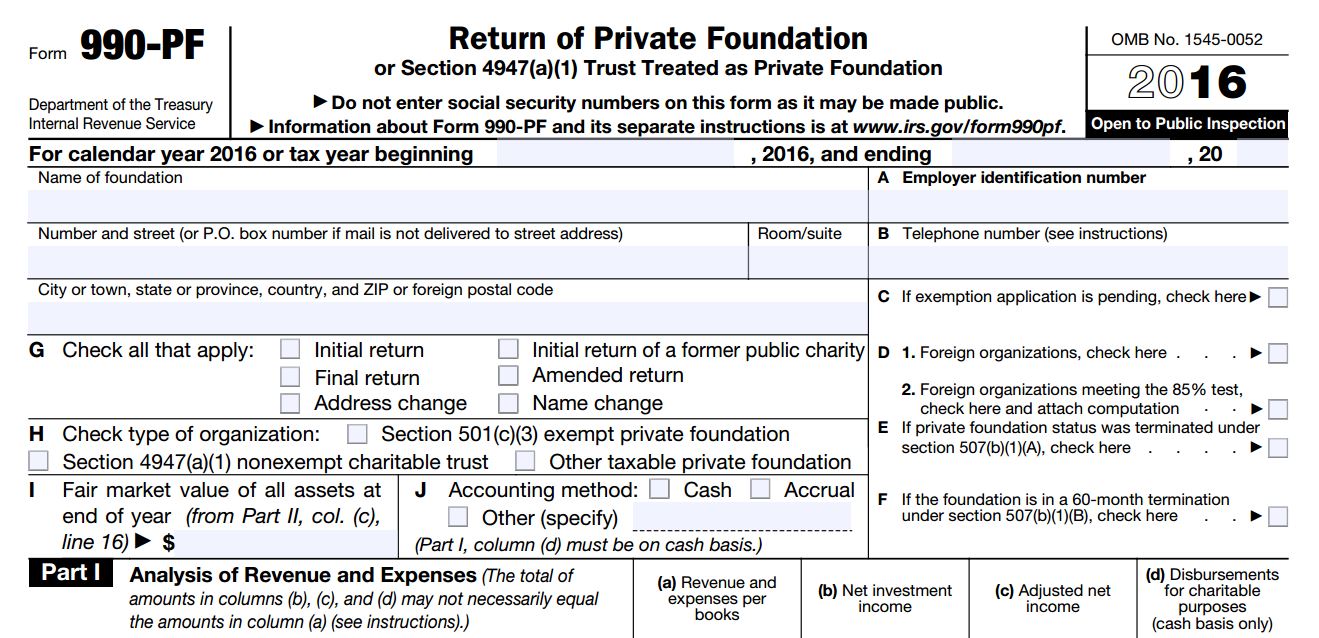

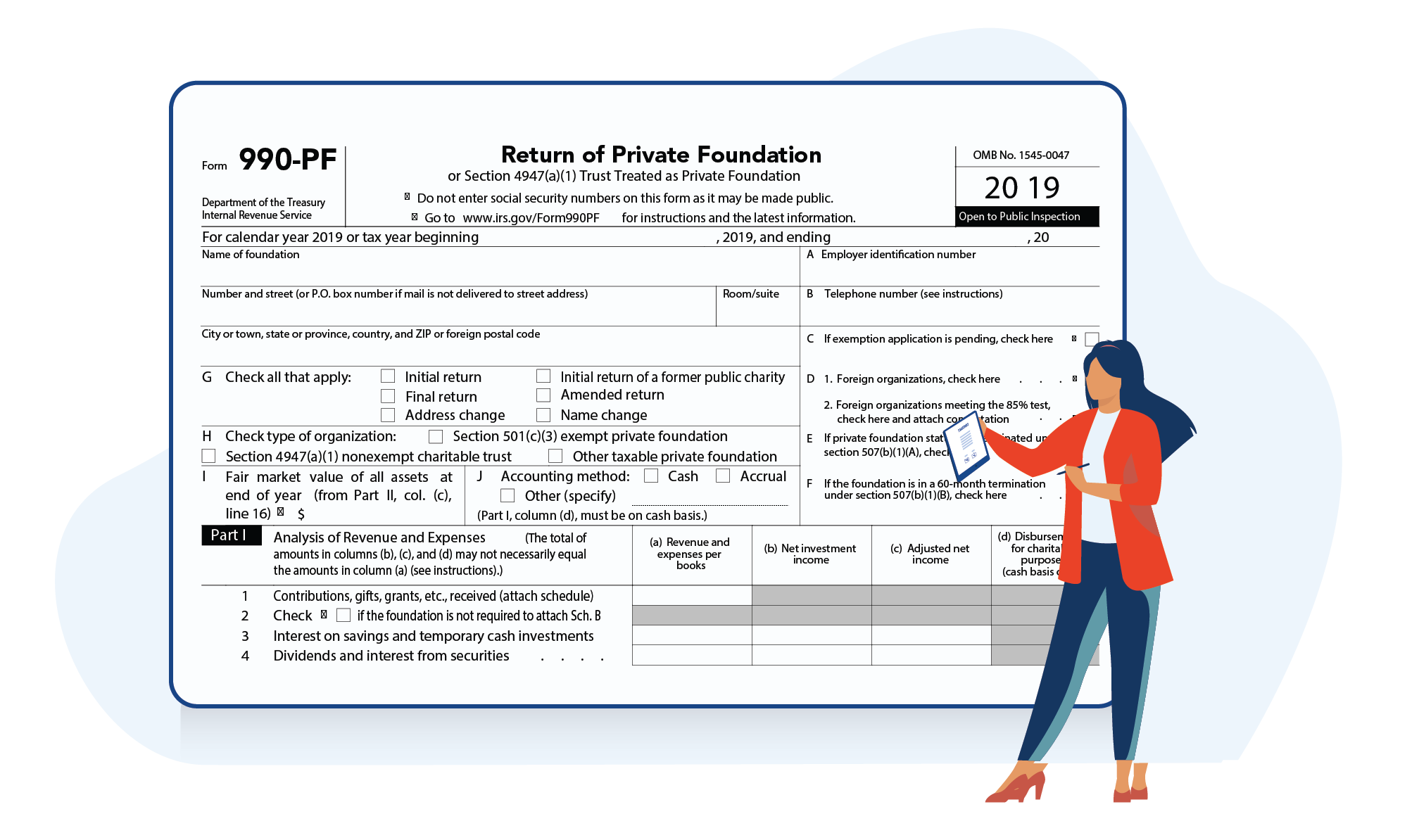

Form 990PF Edit, Fill, Sign Online Handypdf

Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Web annual exempt organization return: If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. The due date.

Form 990PF Return of Private Foundation (2014) Free Download

2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal) Web form 990 due date finder. At the top of this short period return, write “change of accounting period.” If your organization follows a calendar tax period, form 990 is due by may 15, 2023. The due date will vary for each organization depending on.

what is the extended due date for form 990 Fill Online, Printable

If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. You can also choose to enter your foundation’s details manually. Web form 990 due date finder. If your organization follows a calendar tax period, form 990 is.

File 990PF online Form 990PF efiling Software

To use the table, you must know when your organization’s tax year ends. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal) If your organization follows a calendar tax period, form 990 is due by may 15, 2023. You can also choose to enter your foundation’s details manually. Web form 990 due date finder.

File 990PF online Form 990PF efiling Software

Web add foundation’s details by searching for your ein, you can import your foundation’s details from the irs directly. Web may 17, 2021, due date. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. Ending date of tax year. Web annual exempt organization return:

What is IRS Form 990PF? Foundation Group®

The due date will vary for each organization depending on the accounting period they follow. Web form 990 due date finder. Web may 17, 2021, due date. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal)

What is Form 990PF?

To use the table, you must know when your organization’s tax year ends. You can also choose to enter your foundation’s details manually. At the top of this short period return, write “change of accounting period.” Web annual exempt organization return: The due date will vary for each organization depending on the accounting period they follow.

File 990PF online Form 990PF efiling Software

The due date will vary for each organization depending on the accounting period they follow. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Ending date of tax year. Web form 990 due date finder. If your organization follows a calendar tax period, form 990 is due by may 15,.

Web May 17, 2021, Due Date.

Web add foundation’s details by searching for your ein, you can import your foundation’s details from the irs directly. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. Web form 990 due date finder. To use the table, you must know when your organization’s tax year ends.

Web Annual Exempt Organization Return:

At the top of this short period return, write “change of accounting period.” The due date will vary for each organization depending on the accounting period they follow. You can also choose to enter your foundation’s details manually. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal)

If Your Organization Follows A Calendar Tax Period, Form 990 Is Due By May 15, 2023.

Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Ending date of tax year.