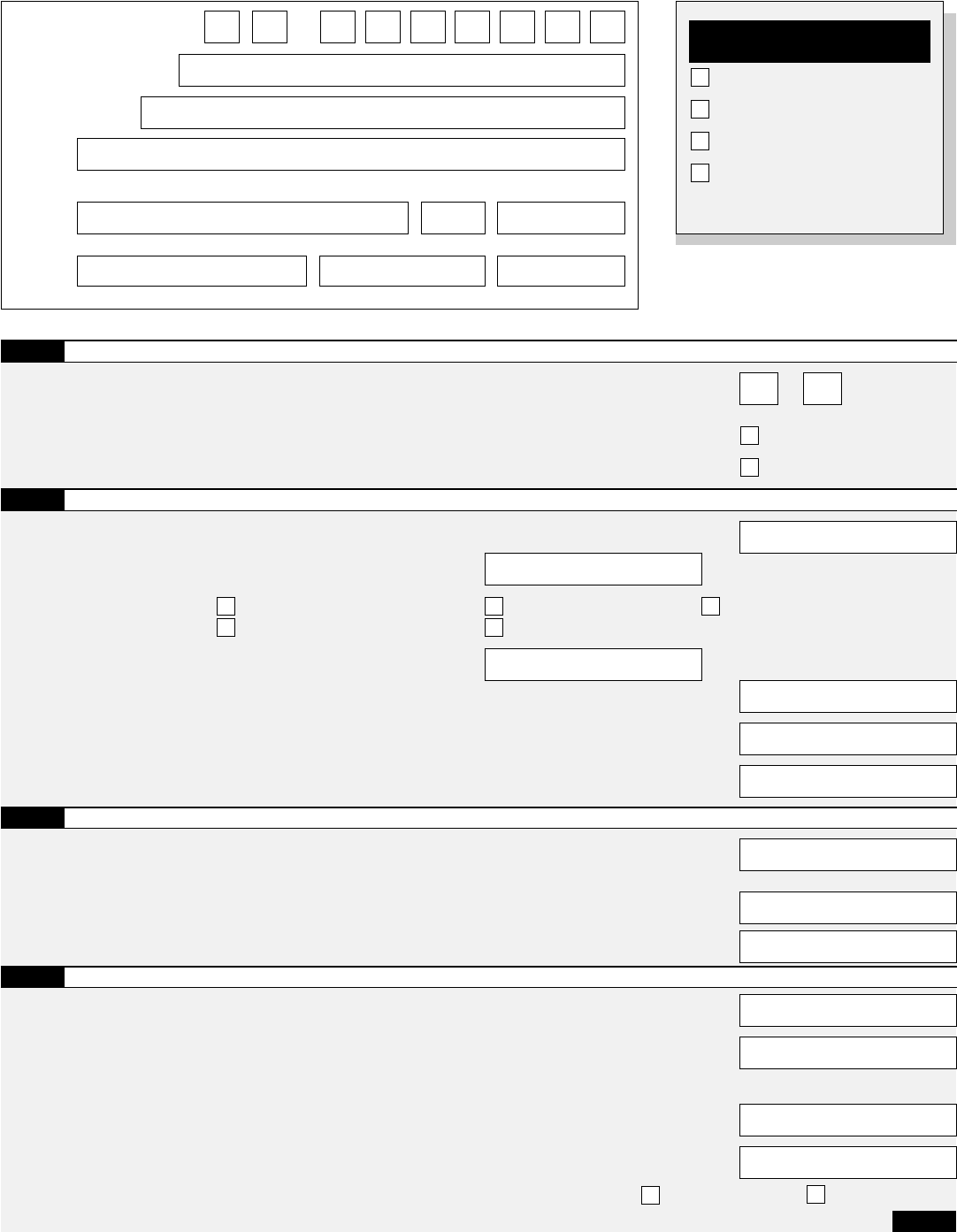

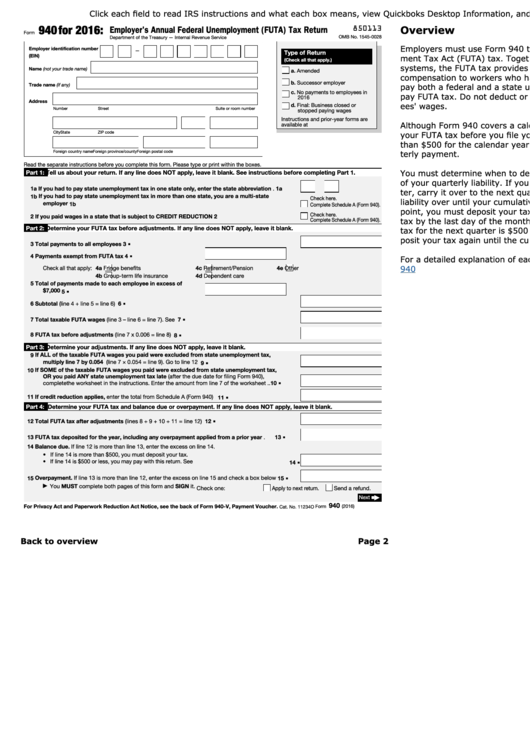

Form 940 For 2016

Form 940 For 2016 - Instructions for form 940 (2020) pdf. They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on form 940. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Web about form 940, employer's annual federal unemployment (futa) tax return. Web form 940 for 2016: Use form 940 to report your annual federal unemployment tax act (futa) tax. File this schedule with form 940. You must file your form 940 for 2022 by january 31, 2023. Web when filing its form 940. Web definition irs form 940 is the federal unemployment tax annual report.

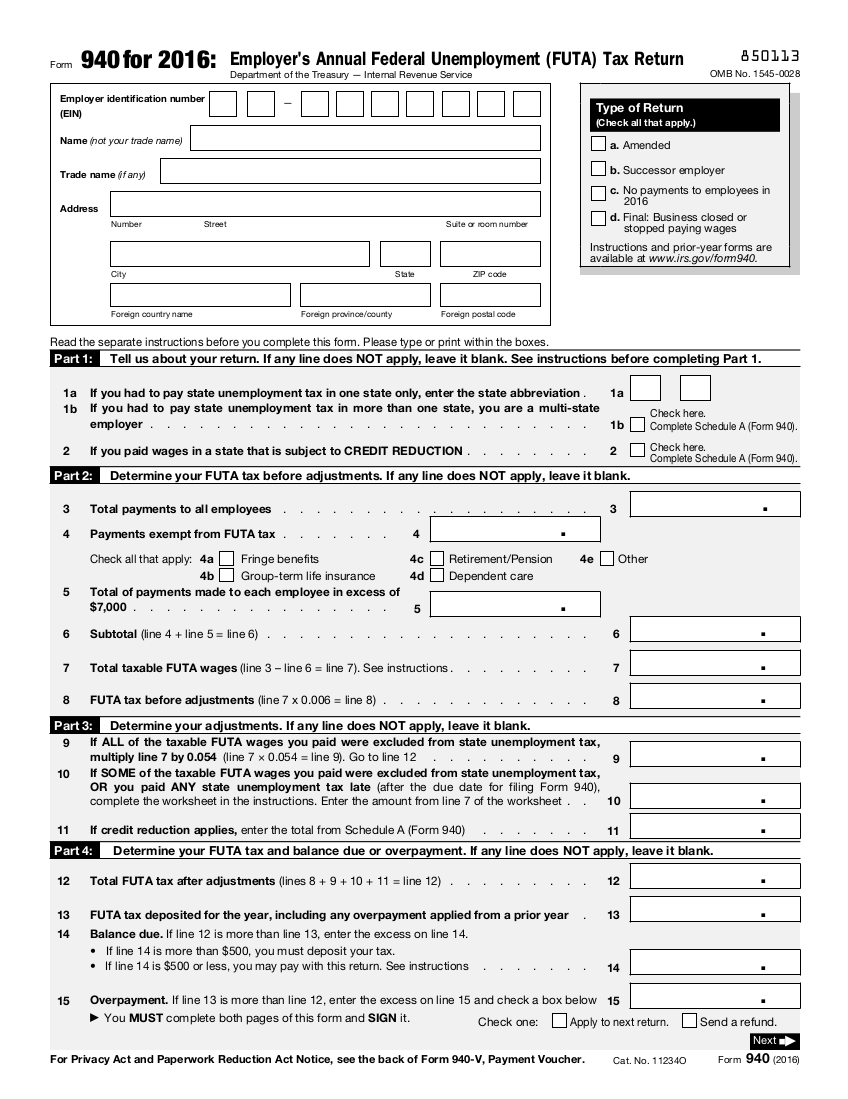

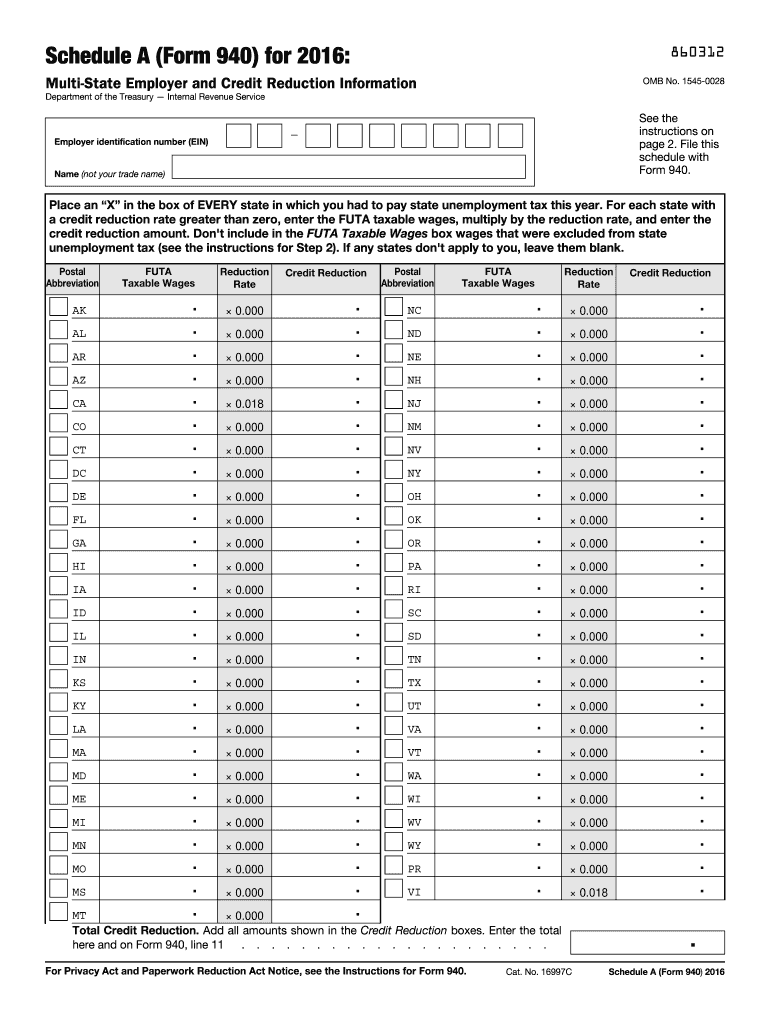

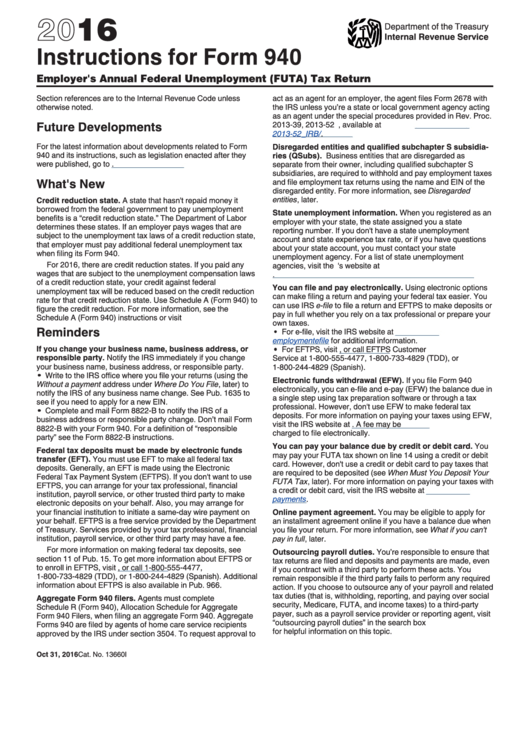

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. File this schedule with form 940. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on form 940. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web employer's annual federal unemployment (futa) tax return. Web 2016 california resident income tax return taxable year 2016 california resident income tax return fiscal year filers only: Web unlike futa tax deposits, you’ll only need to file form 940 once a year. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. Use schedule a (form 940) to

Web schedule a (form 940) for 2016: You must file your form 940 for 2022 by january 31, 2023. Instructions for form 940 (2020) pdf. They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on form 940. Web form 940 for 2016: Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web when filing its form 940. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Employer identification number (ein) — name (not.

Form 940 Edit, Fill, Sign Online Handypdf

However, you’ll receive an extension on this filing due date. Employer identification number (ein) — name (not your trade name) see the instructions on page 2. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. They don't deduct these employment taxes from employee pay, but they must set aside the appropriate.

ads/responsive.txt 2016 form 940 Schedule A Elegant form 941 Schedule B

Web definition irs form 940 is the federal unemployment tax annual report. Web employer's annual federal unemployment (futa) tax return. Employers must report and pay unemployment taxes to the irs for their employees. Web about form 940, employer's annual federal unemployment (futa) tax return. Web form 940 for 2016:

940 (2016) Edit Forms Online PDFFormPro

Instructions for form 940 (2020) pdf. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. File this schedule with form 940. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate.

940 Form 2016 Fill Out and Sign Printable PDF Template signNow

File this schedule with form 940. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Web employer's annual federal unemployment (futa) tax return. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit.

940 Pr Form Fill Out and Sign Printable PDF Template signNow

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. You must file your form 940 for 2022 by january 31, 2023. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion.

940 Form 2021 IRS Forms

Enter month of year end: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Employer identification number (ein) — name (not. File this schedule with form 940. Form 540 foreign country nameforeign province/state/countyforeign postal code your dob(mm/dd/yyyy)spouse's/rdp's dob (mm/dd/yyyy) irth

What is Form 940 and How is it Used by Small Businesses? Paychex

Use schedule a (form 940) to Web form 940 for 2016: Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Web when filing its form 940. Enter month of year end:

Form 940 Instructions How to Fill It Out and Who Needs to File It

Web instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless otherwise noted. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit.

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on form 940. Web definition irs form 940 is the federal unemployment tax annual report. Web about form 940, employer's annual federal unemployment (futa) tax return. Web employer's annual federal unemployment (futa) tax return. Employer identification number (ein) — name.

Instructions For Form 940 2016 printable pdf download

Enter month of year end: Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Employer identification number (ein) — name (not. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Employer identification number (ein) — name (not your trade name) see.

Employer Identification Number (Ein) — Name (Not Your Trade Name) See The Instructions On Page 2.

Employer identification number (ein) — name (not. You must file your form 940 for 2022 by january 31, 2023. For 2016, there are credit reduction states. However, you’ll receive an extension on this filing due date.

Employers Must Report And Pay Unemployment Taxes To The Irs For Their Employees.

Web employer's annual federal unemployment (futa) tax return. Web about form 940, employer's annual federal unemployment (futa) tax return. Use schedule a (form 940) to Form 540 foreign country nameforeign province/state/countyforeign postal code your dob(mm/dd/yyyy)spouse's/rdp's dob (mm/dd/yyyy) irth

Use Form 940 To Report Your Annual Federal Unemployment Tax Act (Futa) Tax.

Enter month of year end: Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web unlike futa tax deposits, you’ll only need to file form 940 once a year.

Employer's Annual Federal Unemployment (Futa) Tax Return Department Of The Treasury — Internal Revenue Service.

If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. They don't deduct these employment taxes from employee pay, but they must set aside the appropriate amount and report it on form 940. Instructions for form 940 (2020) pdf. Web schedule a (form 940) for 2016: