Form 990 Late Filing Penalty

Form 990 Late Filing Penalty - “an organization that fails to file. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. What are the reasons for the penalty? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization. These penalty rates apply for the late filing of. Web a penalty of $110/day for each delayed day will be imposed. Criteria for penalty relief 1. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. The maximum penalty amount is $56,000 or 5% of gross reciept.

Web file for multiple business and employees by importing all their data in bulk. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. The maximum penalty amount is $56,000 or 5% of gross reciept. What are the reasons for the penalty? Web a penalty of $110/day for each delayed day will be imposed. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. Web can penalties for filing form 990 late be abated? Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day.

Web can penalties for filing form 990 late be abated? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization. The same penalty is also applicable for failing to furnish. Criteria for penalty relief 1. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. “an organization that fails to file. Web file for multiple business and employees by importing all their data in bulk. What are the reasons for the penalty? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990.

What You Need To Know About Form 990PF Penalties...

Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. The same penalty is also applicable for failing to furnish. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web a penalty of $110/day for each delayed day will.

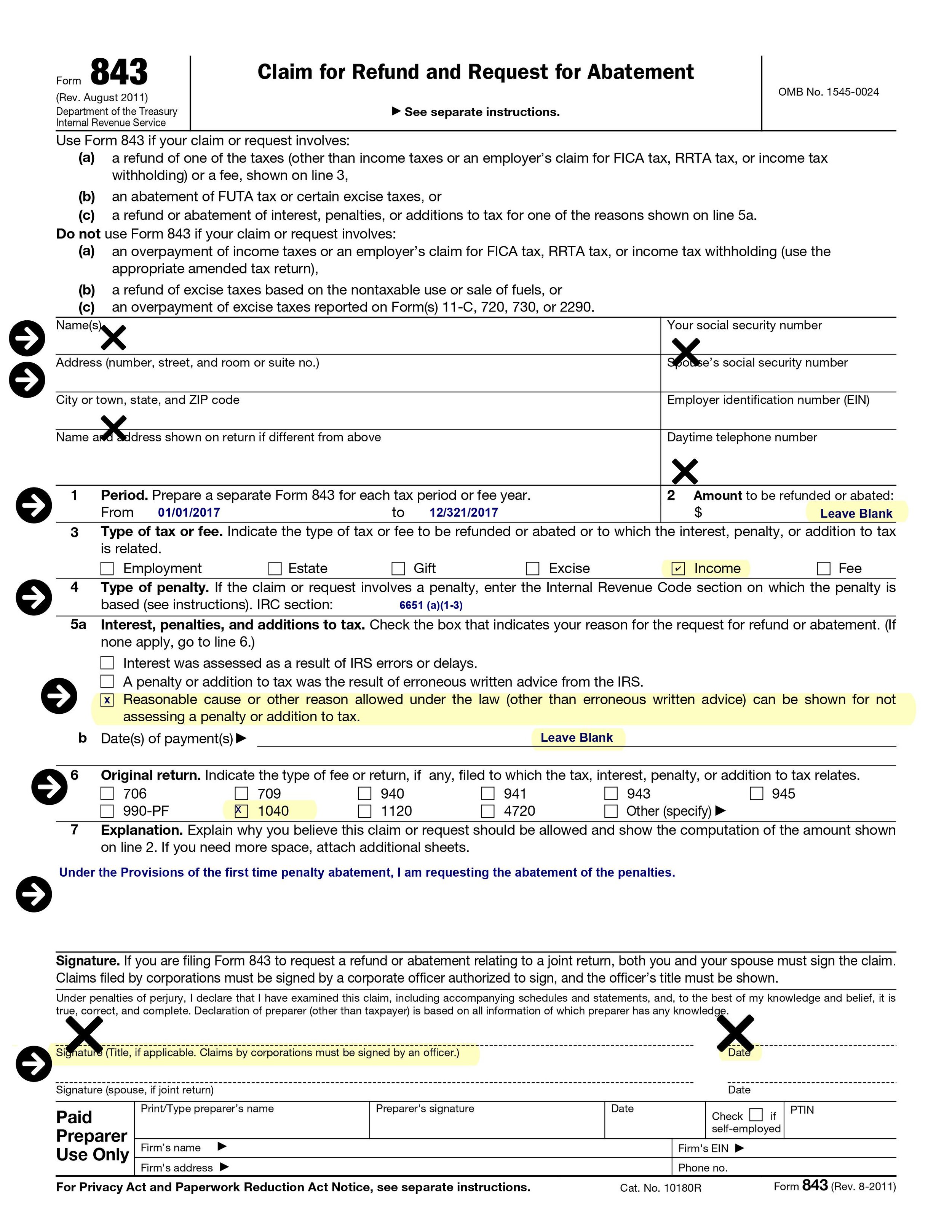

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

These penalty rates apply for the late filing of. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. “an organization that fails to file. Form 990 late filing penalties.

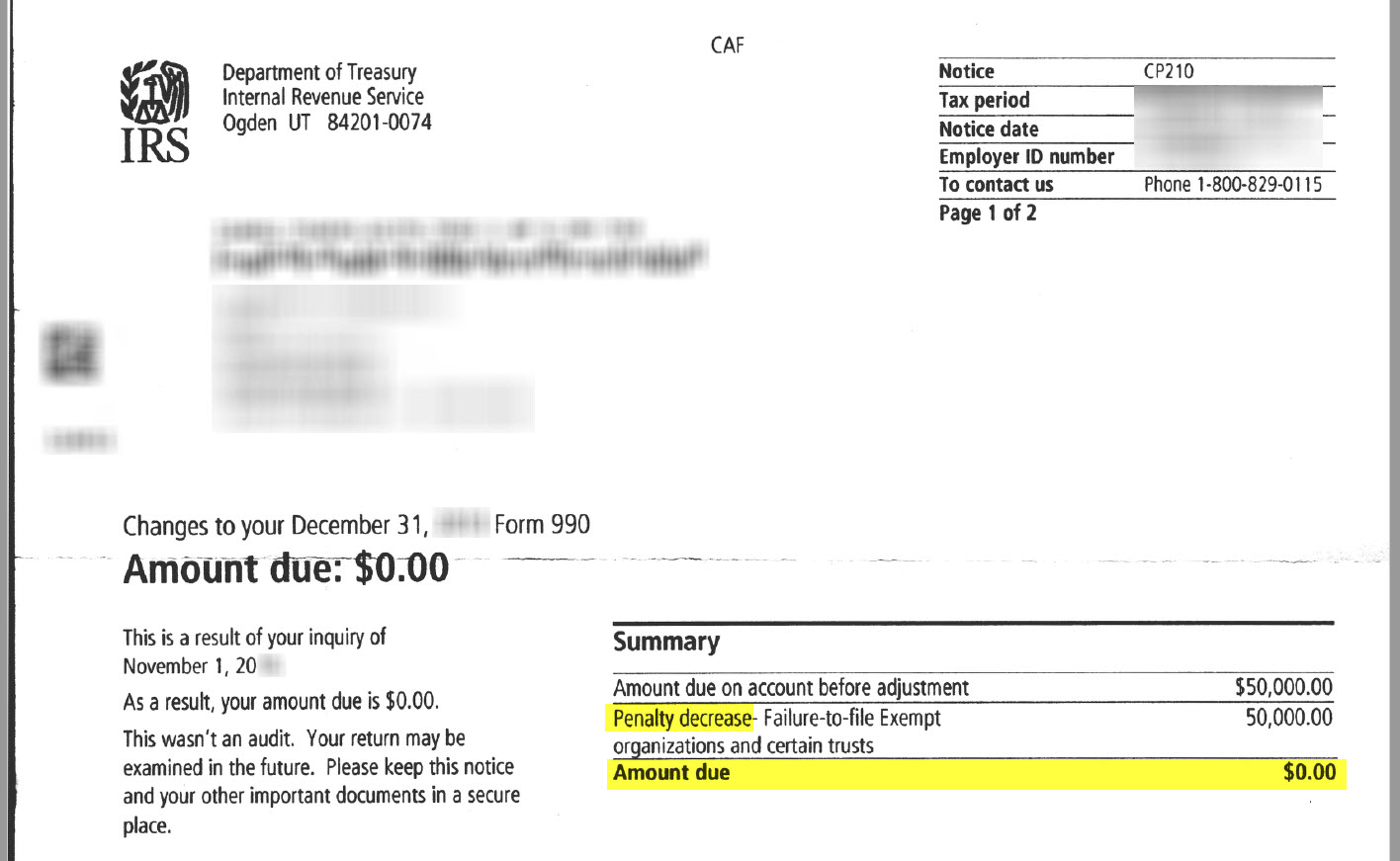

4,280 IRS Penalty Abated for LateFiled Form 990 David B. McRee, CPA

These penalty rates apply for the late filing of. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization.

Prepare Form 990EZ

Web a penalty of $110/day for each delayed day will be imposed. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. The same penalty is also applicable for failing to furnish. Web if an organization whose gross receipts are less than $1,000,000 for its tax.

How to Write a Form 990 Late Filing Penalty Abatement Letter

“an organization that fails to file. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. The maximum penalty amount is $56,000 or 5% of gross reciept. The same penalty is also applicable for failing to furnish. Second, file the returns as soon as.

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. What are the reasons for the penalty? These penalty.

How to Write a Form 990 Late Filing Penalty Abatement Letter Form 990

These penalty rates apply for the late filing of. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web a political organization that fails to file a required form 990 or fails to include required information on those returns.

Form 990 Electronic Filing Requirements Atlanta Audit Firm

Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. Web can penalties for filing form 990 late be abated? Criteria for penalty relief 1. “an organization that fails to file. Web file for multiple business and employees by importing all their data in bulk.

IRS Form 990 Penalty Abatement Manual for Nonprofits Published by CPA

The same penalty is also applicable for failing to furnish. What are the reasons for the penalty? Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the.

Form 990 LateFiling Penalty Abatement Manual, Example Letters and

Web a penalty of $110/day for each delayed day will be imposed. Web can penalties for filing form 990 late be abated? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. What are the reasons for the penalty? Web.

Web If An Organization Whose Gross Receipts Are Less Than $1,000,000 For Its Tax Year Files Its Form 990 After The Due Date (Including Any Extensions), And The Organization.

Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. Second, file the returns as soon as. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. These penalty rates apply for the late filing of.

“An Organization That Fails To File.

Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. What are the reasons for the penalty? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t.

Failure To Timely File The Information Return, Absent Reasonable Cause, Can Give Rise To A Penalty Under Section.

The maximum penalty amount is $56,000 or 5% of gross reciept. Web a penalty of $110/day for each delayed day will be imposed. The same penalty is also applicable for failing to furnish. Web can penalties for filing form 990 late be abated?

Criteria For Penalty Relief 1.

Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web file for multiple business and employees by importing all their data in bulk.