Form 943-A

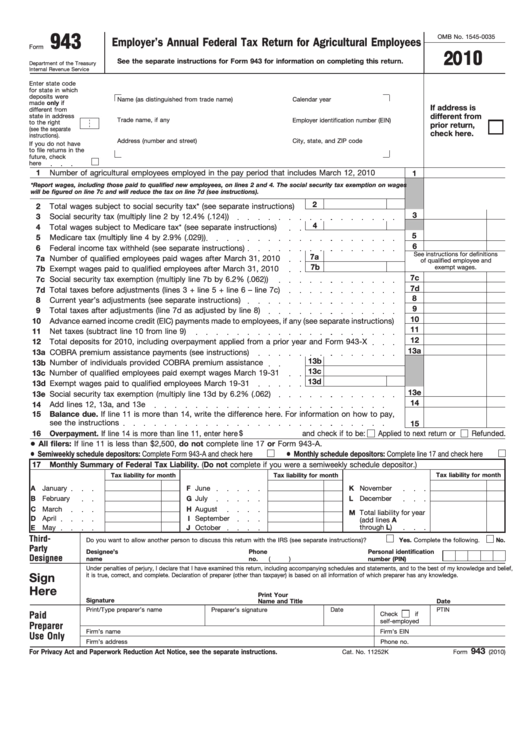

Form 943-A - Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under. To determine if you're a semiweekly schedule. Get a fillable 943 form 2022 template online. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. Also, you must enter the liabilities previously reported for the year that did not change. If you’re a monthly schedule depositor, complete section 17 and check the box. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly.

If you’re a monthly schedule depositor, complete section 17 and check the box. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Complete, edit or print tax forms instantly. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Write “amended” at the top of form. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Also, you must enter the liabilities previously reported for the year that did not change. In other words, it is a tax form used to report federal income tax, social. Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under.

Get ready for tax season deadlines by completing any required tax forms today. Web this change means that many agricultural producers may now qualify for the 2020 erc. Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under. Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. Write “amended” at the top of form. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Complete, edit or print tax forms instantly. Also, you must enter the liabilities previously reported for the year that did not change. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. If you’re a monthly schedule depositor, complete section 17 and check the box.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

Complete, edit or print tax forms instantly. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. To determine if you're a semiweekly schedule. Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. Web this change means that.

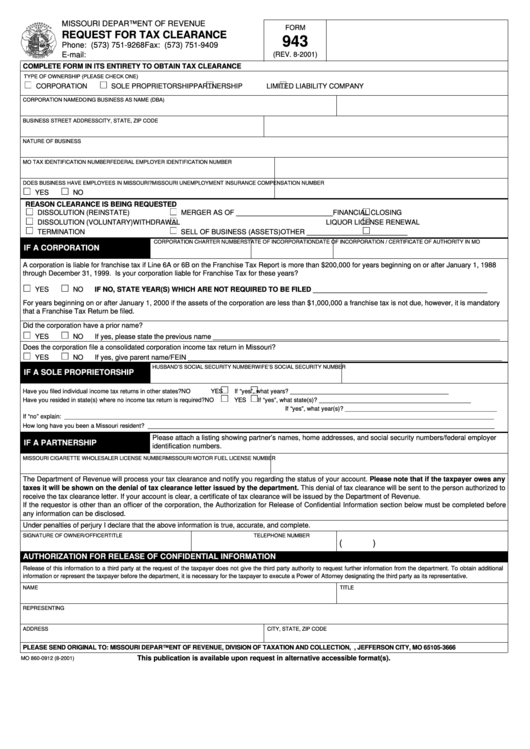

Form 943 Request For Tax Clearance printable pdf download

In other words, it is a tax form used to report federal income tax, social. Write “amended” at the top of form. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages for leave taken after march 31, 2021, and before october 1,. Web form 943, is the employer’s annual.

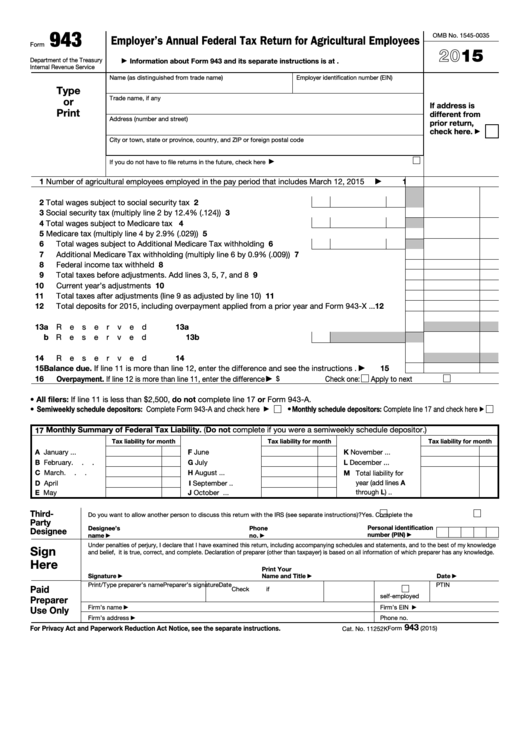

Fillable Form 943 Employer'S Annual Federal Tax Return For

Complete, edit or print tax forms instantly. Also, you must enter the liabilities previously reported for the year that did not change. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web we last updated the employer's annual federal tax return for agricultural employees.

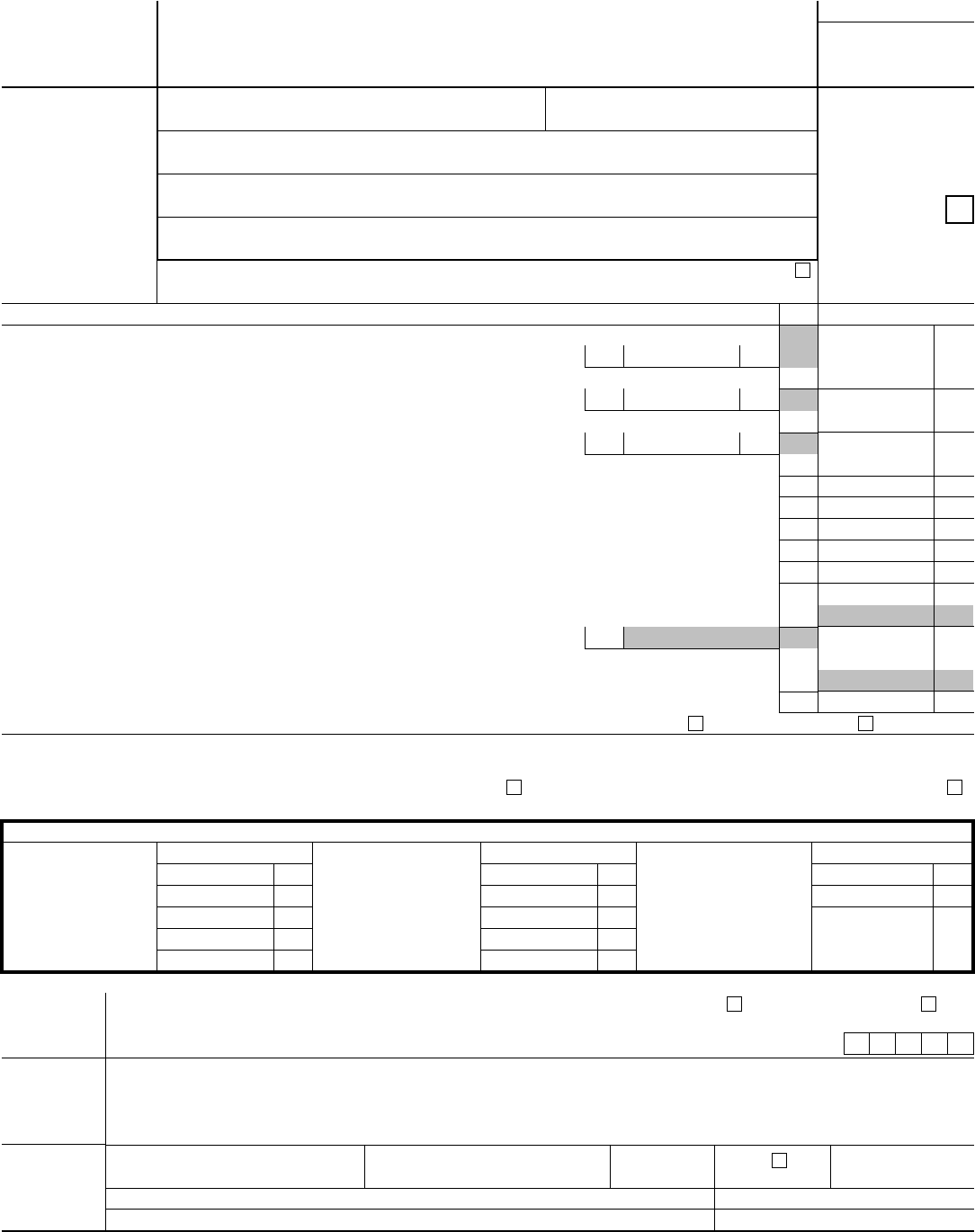

Editable IRS Form 943A 2017 2019 Create A Digital Sample in PDF

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who.

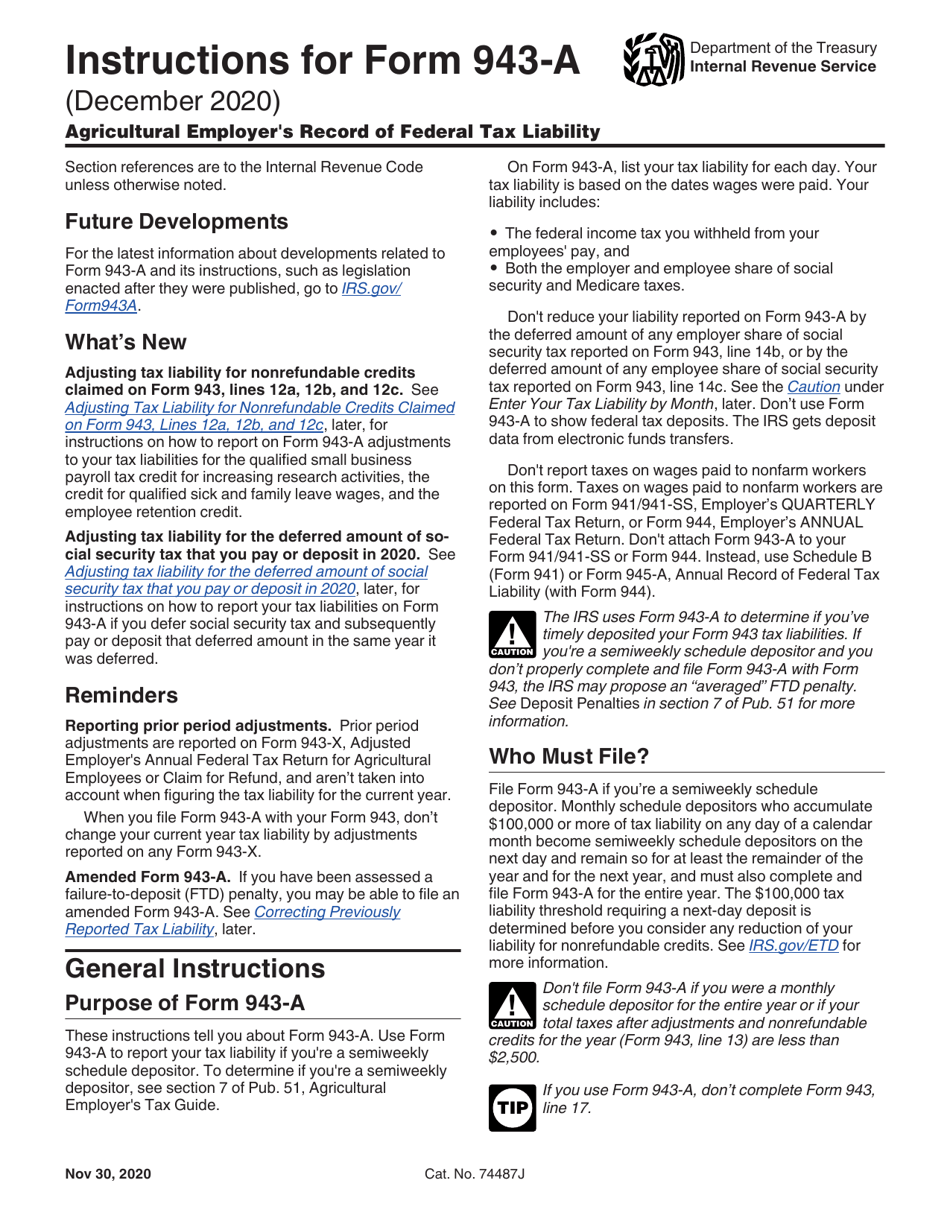

Download Instructions for IRS Form 943A Agricultural Employer's Record

Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web irs form 943, ( employer's annual federal tax.

943a Fill Online, Printable, Fillable, Blank pdfFiller

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages for leave taken after march 31, 2021, and before october 1,. Also, you must enter the.

Form 943 Edit, Fill, Sign Online Handypdf

In other words, it is a tax form used to report federal income tax, social. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 943, employer's annual federal tax return for agricultural.

Form 943 Employer'S Annual Federal Tax Return For Agricultural

Web this change means that many agricultural producers may now qualify for the 2020 erc. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Get a fillable 943 form 2022 template online. Web form 943, is the employer’s annual federal tax return for agricultural.

Agricultural Employer's Record of Federal Tax Liability Free Download

In other words, it is a tax form used to report federal income tax, social. Get ready for tax season deadlines by completing any required tax forms today. If you’re a monthly schedule depositor, complete section 17 and check the box. To determine if you're a semiweekly schedule. Web irs form 943, ( employer's annual federal tax return for agricultural.

Agricultural Employer's Record of Federal Tax Liability Free Download

Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Web form 943, is the employer’s annual federal tax return for agricultural employees. Ad access irs tax forms. If you’re a monthly schedule depositor, complete section 17 and check the box. Web up to $32 cash back form 943, employer’s annual federal tax return for.

Write “Amended” At The Top Of Form.

Web form 943 (schedule r) allows (1) an agent appointed by an employer or payer or (2) a customer who enters into a contract that meets the requirements under. Ad access irs tax forms. Web this change means that many agricultural producers may now qualify for the 2020 erc. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

Complete, Edit Or Print Tax Forms Instantly.

Also, you must enter the liabilities previously reported for the year that did not change. To determine if you're a semiweekly schedule. Web agricultural employers (who deposit income tax withheld and social security and medicare taxes on a semiweekly schedule) use this form to report their tax liability. In other words, it is a tax form used to report federal income tax, social.

Web The Rate Of Social Security Tax On Taxable Wages, Including Qualified Sick Leave Wages And Qualified Family Leave Wages For Leave Taken After March 31, 2021, And Before October 1,.

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. If you’re a monthly schedule depositor, complete section 17 and check the box. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Get a fillable 943 form 2022 template online.

Web Up To $32 Cash Back Form 943, Employer’s Annual Federal Tax Return For Agricultural Employees, Is Used To Report Federal Income Tax, Social Security And Medicare.

Web form 943, is the employer’s annual federal tax return for agricultural employees. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Get ready for tax season deadlines by completing any required tax forms today.