Arkansas Tax Exempt Form

Arkansas Tax Exempt Form - Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. We have one or no dependent, and [ Ar4ecsp employee's special withholding exemption certificate: Ar4ext application for automatic extension of time: Ar4p employee's withholding certificate for pensions and. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. Am married filing jointly with my spouse.

Contractor tax rate change rebate supplemental form: Grain drying and storage exemption | et1401: Ar4p employee's withholding certificate for pensions and. Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. Ar4mec military employee’s withholding exemption certificate: [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Military spouses residency relief act information. To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Web file this form with your employer to exempt your earnings from state income tax withholding. You can find resale certificates for other states here.

File this form with your employer. Military spouses residency relief act information. Keep this certificate with your records. You can find resale certificates for other states here. Am married filing jointly with my spouse. Web file this form with your employer to exempt your earnings from state income tax withholding. Contractor tax rate change rebate supplemental form: Web ar4ec employee's withholding exemption certificate: Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: Ar4ecsp employee's special withholding exemption certificate:

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

You can find resale certificates for other states here. File this form with your employer. Other decreases in exemptions or dependents, such as the death Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. Ar4p employee's withholding certificate for pensions and.

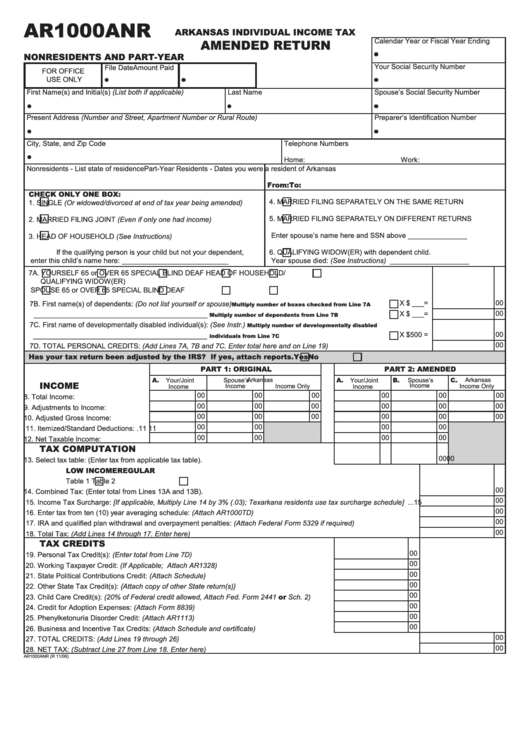

Form Ar1000anr Arkansas Individual Tax Amended Return

Web ar4ec employee's withholding exemption certificate: Web state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip employee: File this form with your employer. Grain drying and storage exemption | et1401: You can find resale certificates for other states here.

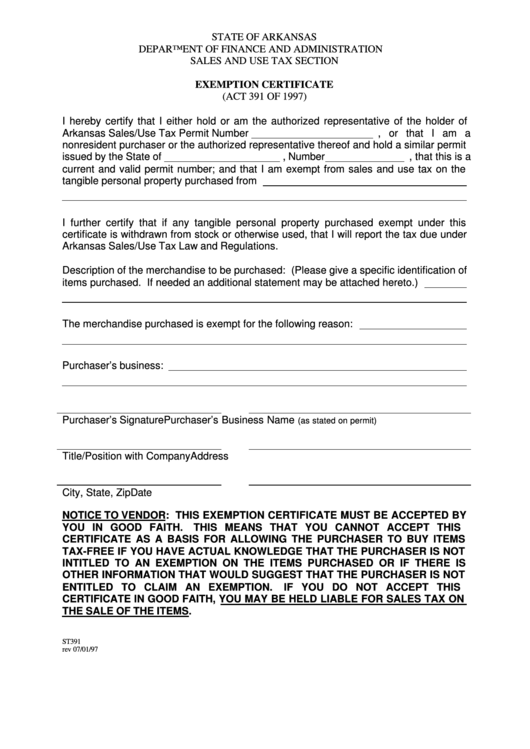

Exemption Crtificate Form State Of Arkansas Department Of Finance

To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Ar4ext application for automatic extension of time: Military spouses residency relief act information. Ar4mec military employee’s withholding exemption certificate: Otherwise, your employer must withhold state income tax from your wages.

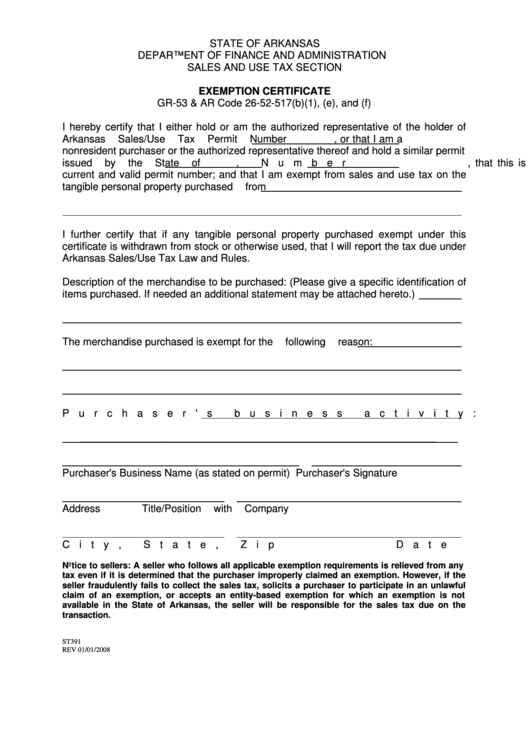

Fillable Form Gr53 & Ar Exemption Certificate Form State Of

If any of these links are broken, or you can't find the form you need, please let us know. Web file this form with your employer to exempt your earnings from state income tax withholding. Other decreases in exemptions or dependents, such as the death To accommodate the vast number of entities choosing to file for 501 (c) (3) status.

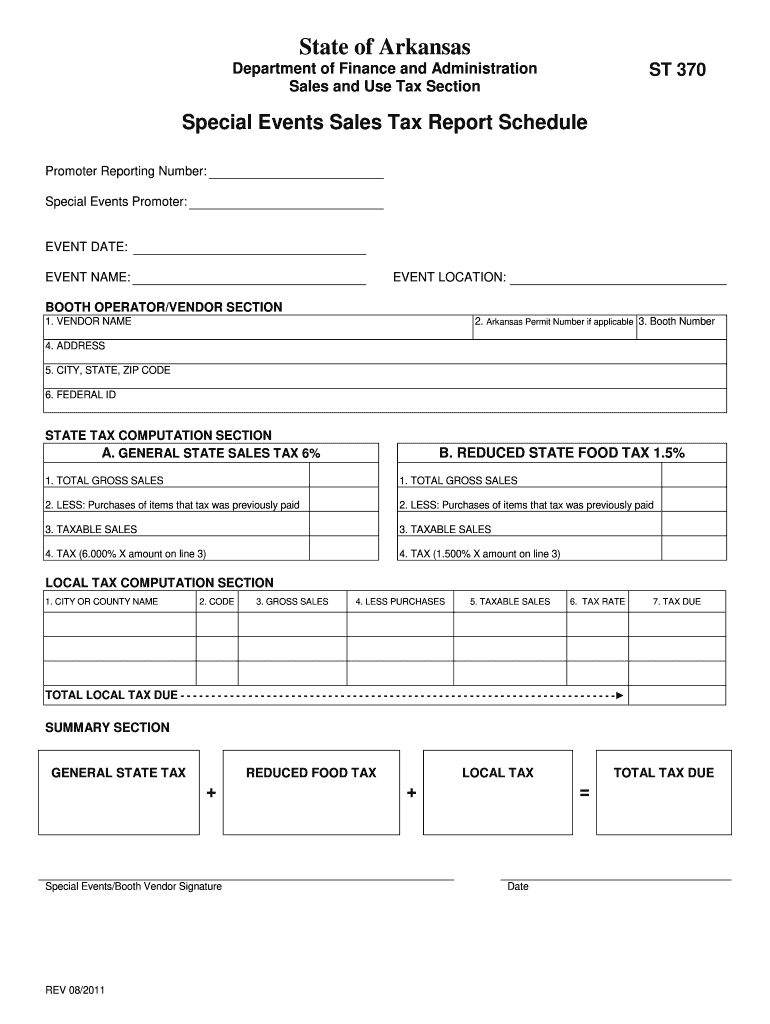

Arkansas Resale Certificate PDF Form Fill Out and Sign Printable PDF

File this form with your employer. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. You can find resale certificates for other states here. Military spouses residency relief act information. Ar4p employee's withholding certificate for pensions and.

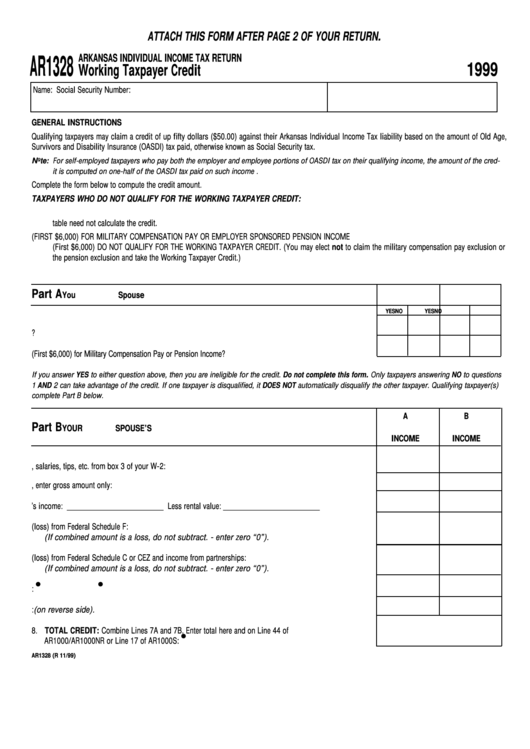

Form Ar1328 Arkansas Individual Tax Return printable pdf download

Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year. Keep this certificate with your records. Web state of arkansas employee’s withholding exemption certificate print.

logodesignlabor Arkansas Tax Exempt Form

Ar4p employee's withholding certificate for pensions and. Ar4mec military employee’s withholding exemption certificate: File this form with your employer. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. We have one or no dependent, and [

logodesignlabor Arkansas Tax Exempt Form

Am married filing jointly with my spouse. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less.

logodesignlabor Arkansas Tax Exempt Form

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Am married filing jointly with my spouse. Military spouses residency relief act information. To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Web exemption.

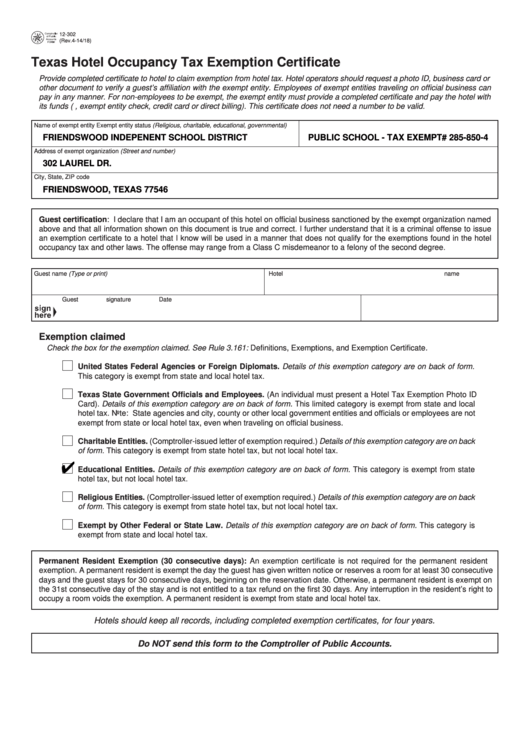

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Ar4ecsp employee's special withholding exemption certificate: Web file this form with your employer to exempt your earnings from state income tax withholding. Web exemption is divorced or legally separated, or.

If Any Of These Links Are Broken, Or You Can't Find The Form You Need, Please Let Us Know.

File this form with your employer. Web file this form with your employer to exempt your earnings from state income tax withholding. Ar4ext application for automatic extension of time: Contractor tax rate change rebate supplemental form:

Ar4Ecsp Employee's Special Withholding Exemption Certificate:

Web we have three arkansas sales tax exemption forms available for you to print or save as a pdf file. Ar4p employee's withholding certificate for pensions and. You can find resale certificates for other states here. Web ar4ec employee's withholding exemption certificate:

Web State Of Arkansas Employee’s Withholding Exemption Certificate Print Full Name Social Security Number Print Home Address City State Zip Employee:

Keep this certificate with your records. Other decreases in exemptions or dependents, such as the death Ar4mec military employee’s withholding exemption certificate: We have one or no dependent, and [

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without Exemptions Or Dependents.

Military spouses residency relief act information. [ ] [ ] am single and my gross income from all sources will not exceed $10,200. To accommodate the vast number of entities choosing to file for 501 (c) (3) status with the irs, the arkansas secretary of state provides a blank template with suggested irs. Web exemption is divorced or legally separated, or claims his or her own exemption on a separate certificate, or (b) the support of a dependent for whom you claimed an exemption is expected to be less than half of the total support for the year.