941 Form 2020 3Rd Quarter

941 Form 2020 3Rd Quarter - Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Complete, edit or print tax forms instantly. Web this august, the irs released the draft of form 941 with the expected changes. Let's make sure we updated quickbooks to. Try it for free now! See the instructions for line 36. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Under these facts, you would qualify for the second and third.

Form 941 is used by employers. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. October, november, december go to www.irs.gov/form941ss for instructions and the latest. Under these facts, you would qualify for the second and third. Web i've checked here on our end and there's no reported case where can't access the 941 forms for the third quarter. Ad upload, modify or create forms. See the instructions for line 36. The lines 13b, 24, and 25 are not. Web payroll tax returns. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021.

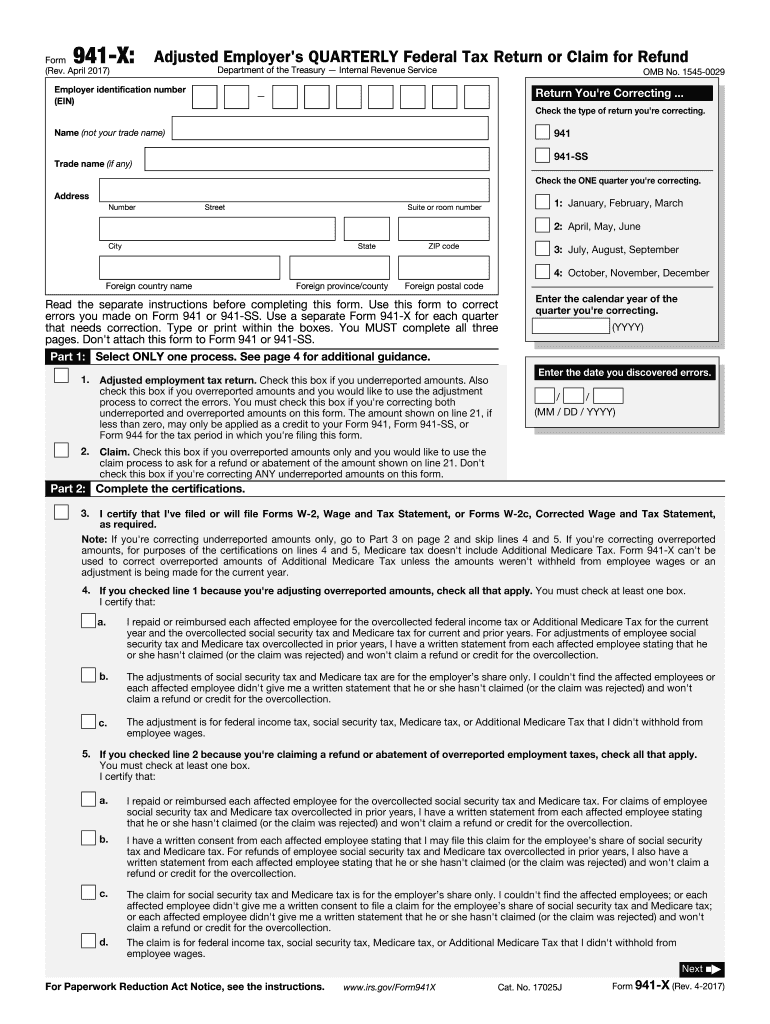

October, november, december go to www.irs.gov/form941ss for instructions and the latest. Check the type of return you’re correcting. Web payroll tax returns. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Ad upload, modify or create forms. See the instructions for line 36. Web 941 only to report taxes for the quarter ending march 31, 2021. The lines 13b, 24, and 25 are not. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Complete, edit or print tax forms instantly.

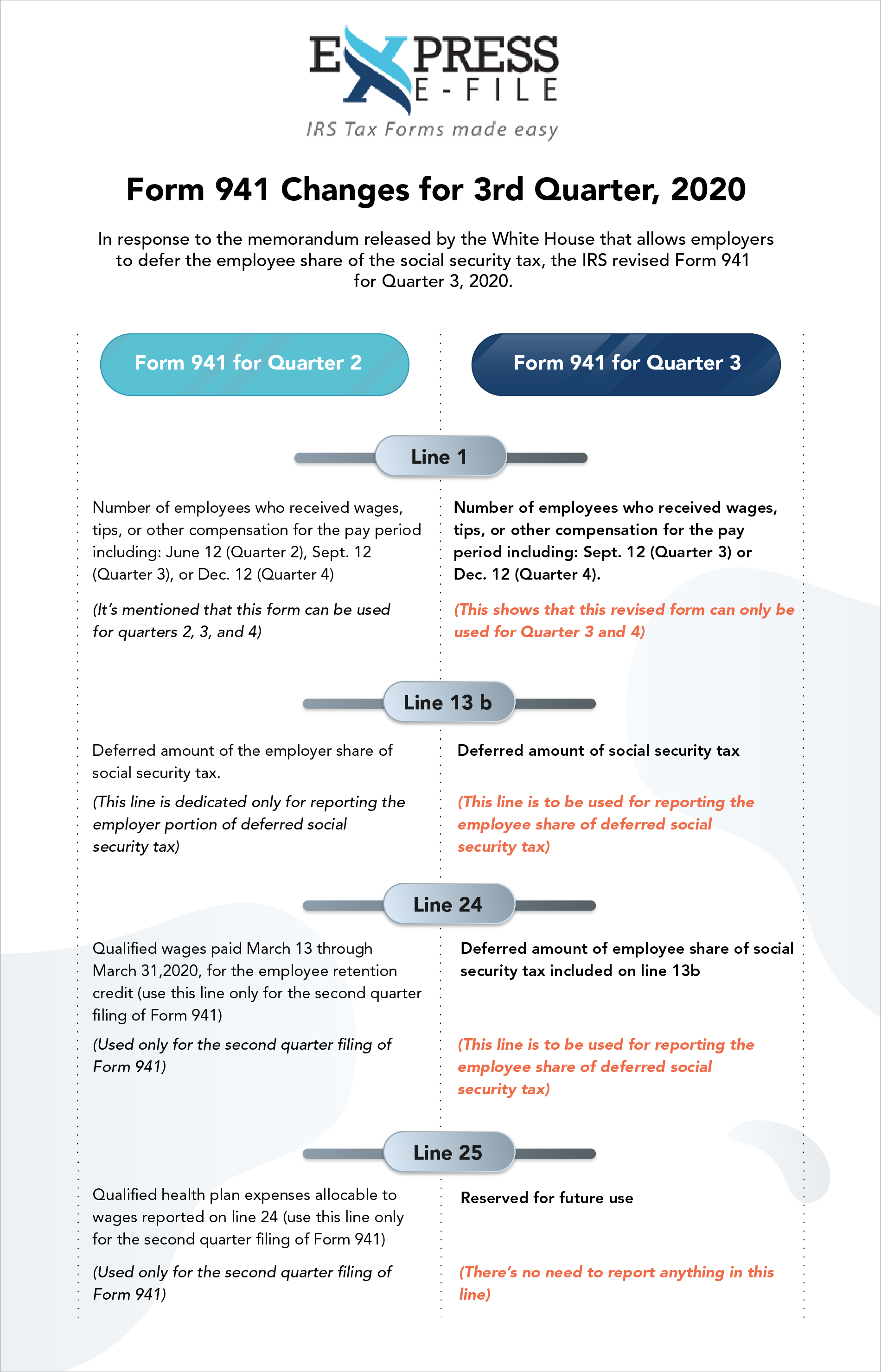

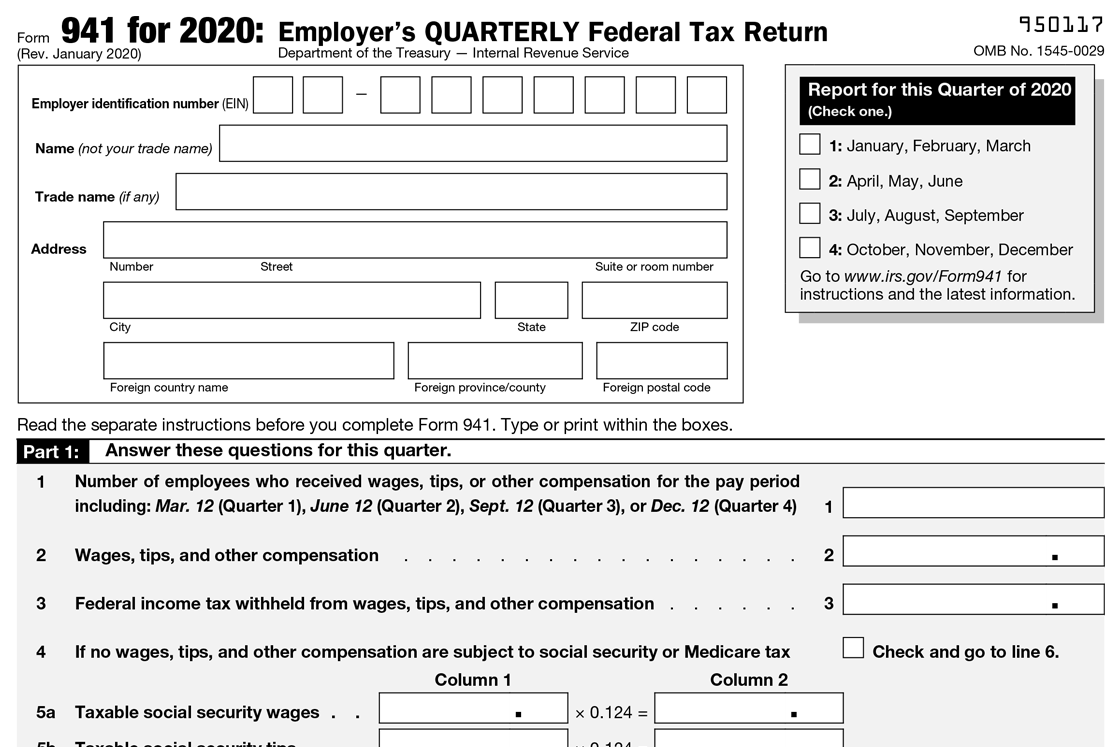

Form 941 Changes for 3rd Quarter 2020

Web payroll tax returns. Under these facts, you would qualify for the second and third. Complete, edit or print tax forms instantly. The lines 13b, 24, and 25 are not. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

What You Need to Know About 3rd Quarter IRS Form 941 Changes 2020

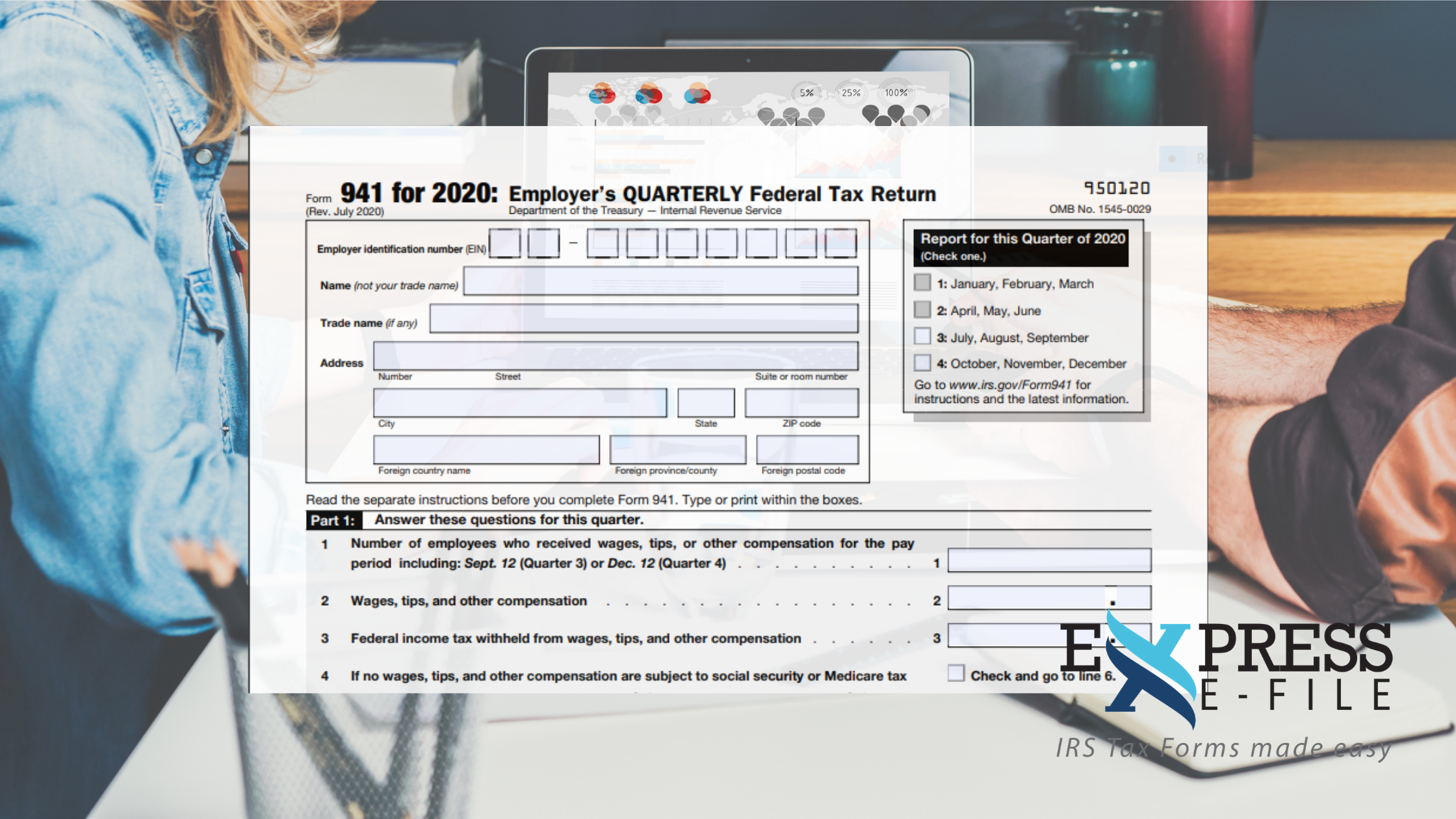

The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. July 2020) employer’s quarterly federal tax return 950120 omb no. Try it for free now! Complete, edit or print tax forms instantly. Ad upload, modify or create forms.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

The lines 13b, 24, and 25 are not. July 2020) employer’s quarterly federal tax return 950120 omb no. Under these facts, you would qualify for the second and third. Web 941 only to report taxes for the quarter ending march 31, 2021. Ad upload, modify or create forms.

941 Form Fill Out and Sign Printable PDF Template signNow

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. See the instructions for line 36. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter. Under these facts, you would qualify for the second and third. Complete,.

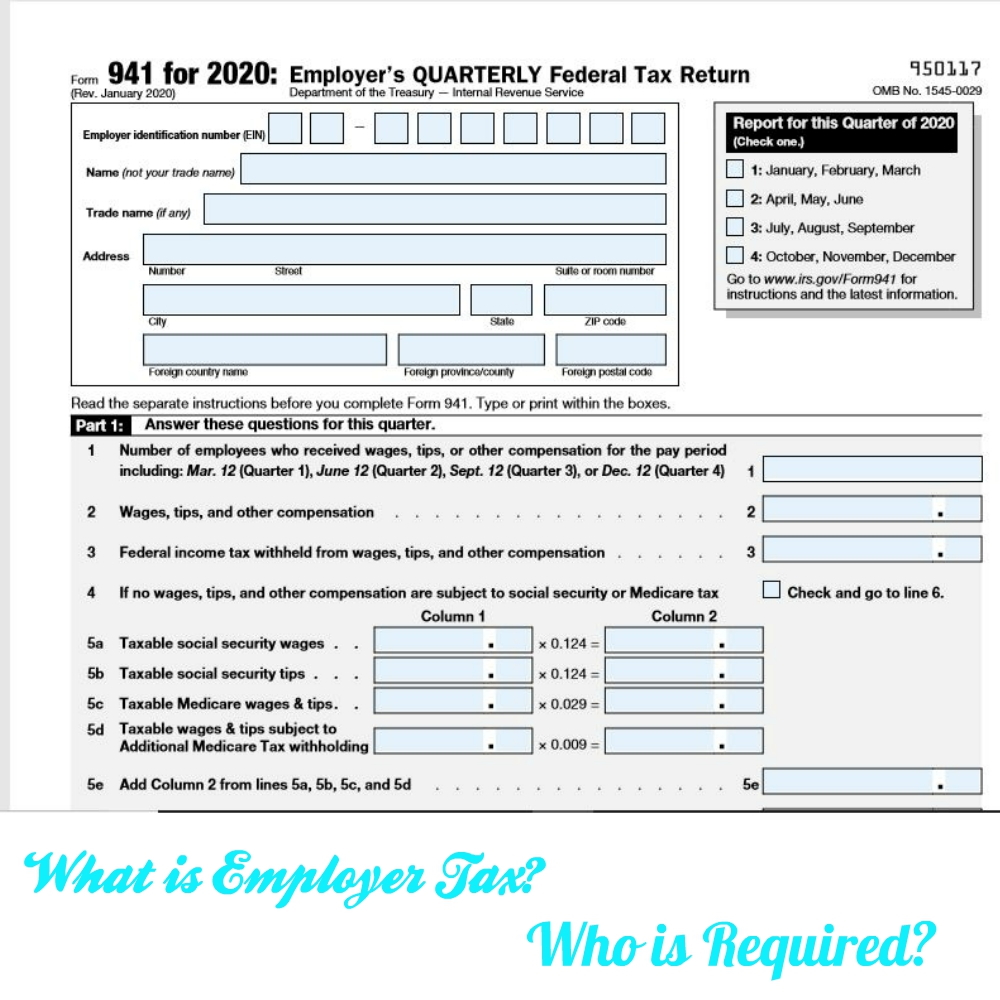

2020 Form 941 Employer’s Quarterly Federal Tax Return What is

The lines 13b, 24, and 25 are not. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web this august, the irs released the draft of form 941 with the expected changes. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to.

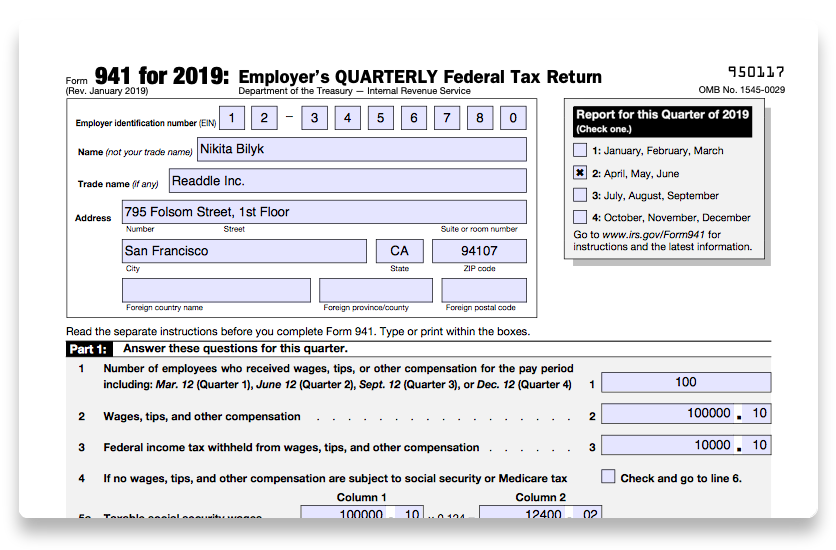

How to fill out IRS Form 941 2019 PDF Expert

See the instructions for line 36. Under these facts, you would qualify for the second and third. Let's make sure we updated quickbooks to. July 2020) employer’s quarterly federal tax return 950120 omb no. Web they were $45 in the second quarter of 2020, $85 in the third quarter and $75 in the fourth quarter.

What is the IRS Form 941? Form 941 Instructions and Information

See the instructions for line 36. Web in the 3rd quarter: Form 941 is used by employers. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

See the instructions for line 36. Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Those returns are processed in. Web i've checked here on our end and there's no reported case where can't access the 941 forms for the.

Update Form 941 Changes Regulatory Compliance

Let's make sure we updated quickbooks to. October, november, december name (not your trade name) calendar year (also check quarter). See the instructions for line 36. Try it for free now! Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order.

Update on IRS Form 941 Changes Effective Immediately

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Ad upload, modify or create forms. July 2020) employer’s quarterly federal tax return 950120 omb no. See the instructions for line 36. October, november, december name (not your trade name) calendar year (also check quarter).

Web 941 Only To Report Taxes For The Quarter Ending March 31, 2021.

Complete, edit or print tax forms instantly. Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Web don’t miss your 2020 form 941 third quarter deadline here’s everything you need to know to file form 941 from start to finish with taxbandits today! Check the type of return you’re correcting.

Ad Upload, Modify Or Create Forms.

Web enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web payroll tax returns. Ad upload, modify or create forms. Web i've checked here on our end and there's no reported case where can't access the 941 forms for the third quarter.

July 2020) Employer’s Quarterly Federal Tax Return 950120 Omb No.

October, november, december name (not your trade name) calendar year (also check quarter). The lines 13b, 24, and 25 are not. Complete, edit or print tax forms instantly. October, november, december go to www.irs.gov/form941ss for instructions and the latest.

Try It For Free Now!

The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Form 941 is used by employers. Under these facts, you would qualify for the second and third. Web in the 3rd quarter: