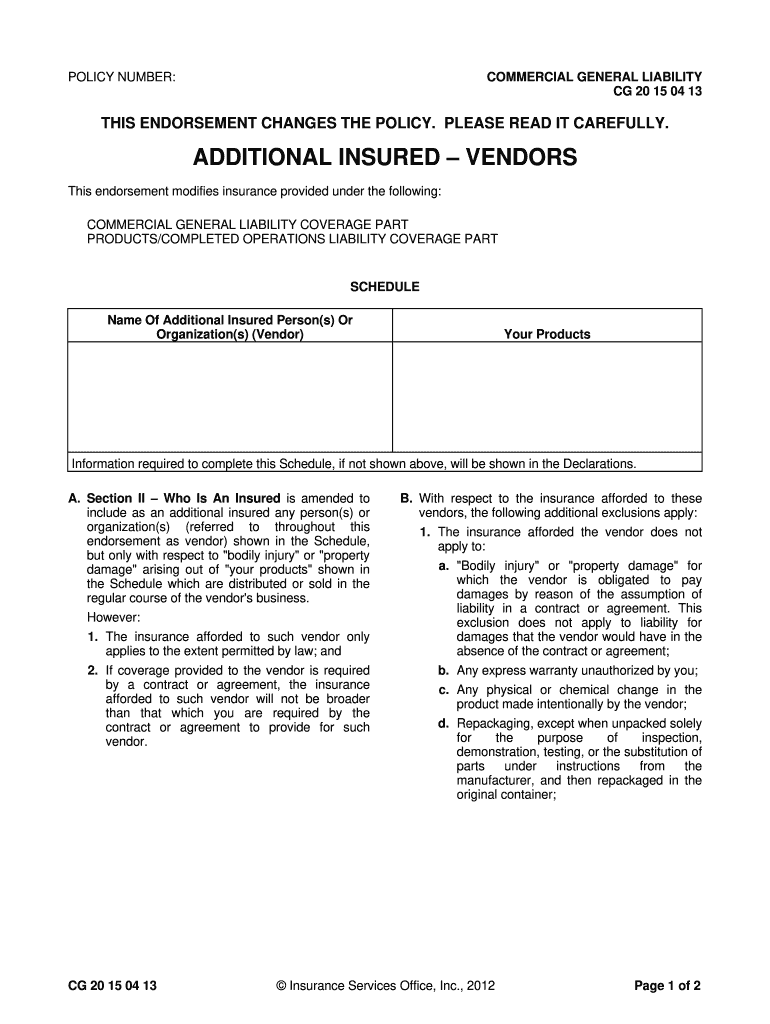

Additional Insured Form

Additional Insured Form - Commercial general liability coverage part products/completed operations liability coverage part schedule name of additional insured. Intended to extend insurance coverage to a party not typically covered by a policy, there are a number of benefits and stipulations to adding an additional insured. Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. You’ll typically need to fill out an additional insured endorsement form. Provides additional insured status to a designated person or organization that has granted the named insured a license. This endorsement modifies insurance provided under the following: Web if additional insured status is required by contract or agreement, coverage and limits of liability apply only to the extent required in the contract or agreement. If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance: (if no entry appears above, information required to complete this endorsement will be shown in the. Web to add an additional insured to an insurance policy, consult an insureon insurance agent and review the policy, identify whether an additional insured can be added, and assess the level of coverage the additional insured is requesting.

Commercial general liability coverage part products/completed operations liability coverage part schedule name of additional insured. Commercial general liability coverage part. Information required to complete this schedule, if not shown above, will. This endorsement modifies insurance provided under the following: Schedule name of person or organization: Provides additional insured status to a designated person or organization that has granted the named insured a license. If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance: Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. Available under the applicable limits of Web additional insured is a type of status associated with general liability insurance policies that provides coverage to other individuals or groups that were not initially named in the policy.

Web if additional insured status is required by contract or agreement, coverage and limits of liability apply only to the extent required in the contract or agreement. This endorsement modifies insurance provided under the following: Information required to complete this schedule, if not shown above, will. Commercial general liability coverage part products/completed operations liability coverage part schedule name of additional insured. Basically, as the policyholder (named insured) , an additional insured endorsement extends your liability coverage to a third party to address an additional liability exposure you potentially create for him. Required by the contract or agreement; Provides additional insured status to a designated person or organization that has granted the named insured a license. (if no entry appears above, information required to complete this endorsement will be shown in the. Intended to extend insurance coverage to a party not typically covered by a policy, there are a number of benefits and stipulations to adding an additional insured. Schedule name of person or organization:

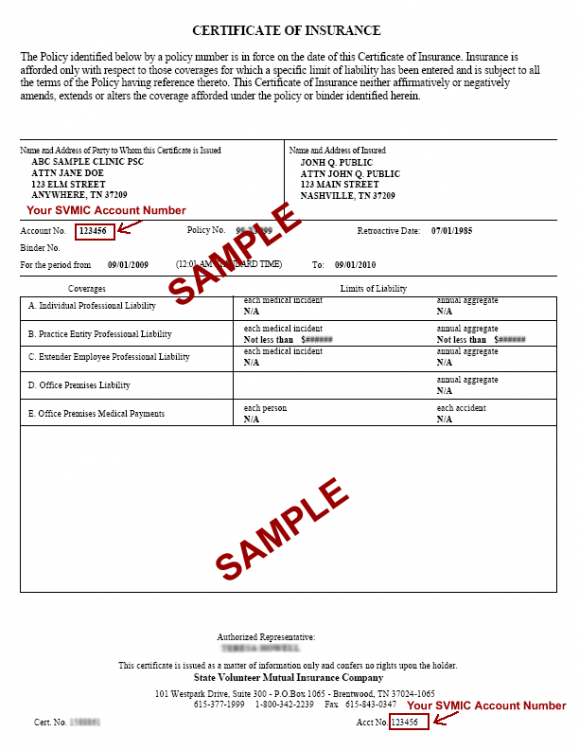

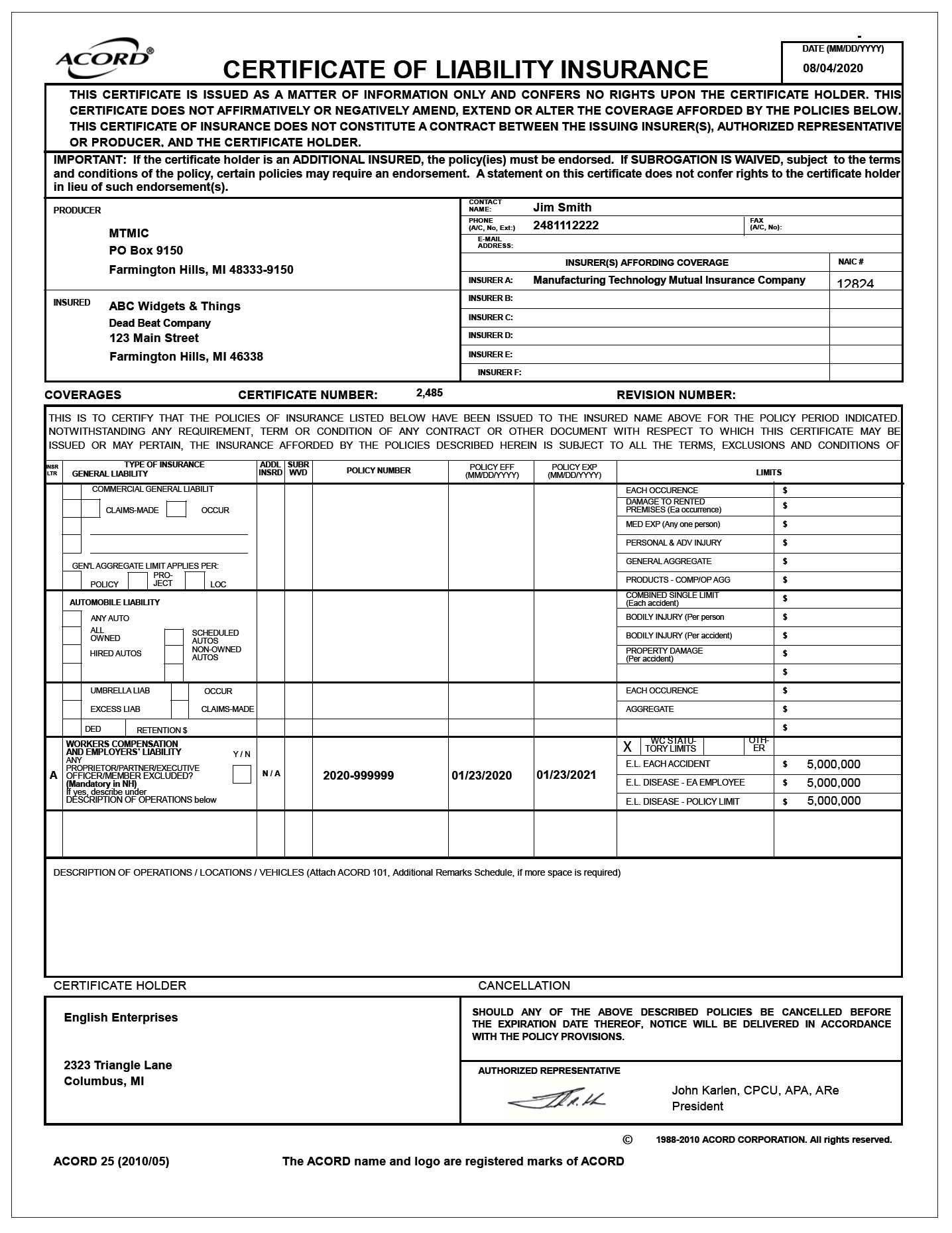

Insurance Certificate By / Certificate of Liability Insurance

Required by the contract or agreement; Provides additional insured status to a designated person or organization that has granted the named insured a license. (if no entry appears above, information required to complete this endorsement will be shown in the. You’ll typically need to fill out an additional insured endorsement form. Web additional insured is a type of status associated.

Form CG20 26 11 85 Download Printable PDF or Fill Online Additional

Intended to extend insurance coverage to a party not typically covered by a policy, there are a number of benefits and stipulations to adding an additional insured. Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. (if no entry appears above, information required to complete this endorsement will be shown.

Contracts And Additional Insured Status [Understand Your Risk]

You’ll typically need to fill out an additional insured endorsement form. Commercial general liability coverage part. Commercial general liability coverage part schedule name of additional insured person(s) or organization(s): Web to add an additional insured to an insurance policy, consult an insureon insurance agent and review the policy, identify whether an additional insured can be added, and assess the level.

Cg2015 Fill Out and Sign Printable PDF Template signNow

Commercial general liability coverage part. Intended to extend insurance coverage to a party not typically covered by a policy, there are a number of benefits and stipulations to adding an additional insured. Schedule name of person or organization: Basically, as the policyholder (named insured) , an additional insured endorsement extends your liability coverage to a third party to address an.

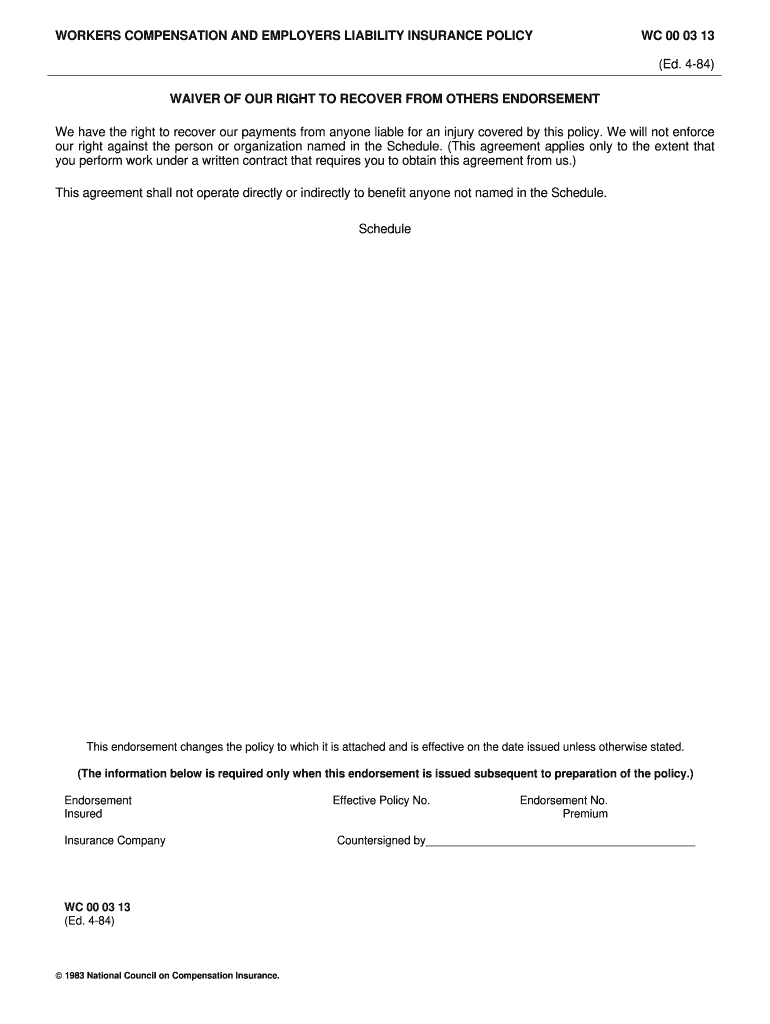

Iso Blanket Waiver Of Subrogation Kitchens Design, Ideas And Renovation

Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. Information required to complete this schedule, if not shown above, will. Basically, as the policyholder (named insured) , an additional insured endorsement extends your liability coverage to a third party to address an additional liability exposure you potentially create for him..

Additional Insured Endorsement Form Fillable Fill Online, Printable

Available under the applicable limits of Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. Web if additional insured status is required by contract or agreement, coverage and limits of liability apply only to the extent required in the contract or agreement. Basically, as the policyholder (named insured) , an.

Certificate Of Liability Insurance Form Additional Insured Lost Payee

Basically, as the policyholder (named insured) , an additional insured endorsement extends your liability coverage to a third party to address an additional liability exposure you potentially create for him. If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:.

Additional Insured Form Cg 20 26 Aulaiestpdm Blog

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance: Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy. You’ll typically need to fill out an additional insured endorsement form..

ads/responsive.txt Acord Additional Insured Endorsement form

Web additional insured is a type of status associated with general liability insurance policies that provides coverage to other individuals or groups that were not initially named in the policy. Commercial general liability coverage part. Available under the applicable limits of This endorsement modifies insurance provided under the following: Required by the contract or agreement;

Acord Additional Insured Endorsement form Beautiful 20 Elegant Stock

You’ll typically need to fill out an additional insured endorsement form. Basically, as the policyholder (named insured) , an additional insured endorsement extends your liability coverage to a third party to address an additional liability exposure you potentially create for him. Schedule name of person or organization: This endorsement modifies insurance provided under the following: Web additional insured endorsements are.

You’ll Typically Need To Fill Out An Additional Insured Endorsement Form.

(if no entry appears above, information required to complete this endorsement will be shown in the. Web additional insured is a type of status associated with general liability insurance policies that provides coverage to other individuals or groups that were not initially named in the policy. Information required to complete this schedule, if not shown above, will. Web additional insured endorsements are one of the most commonly requested and often misunderstood forms in an insurance policy.

Web If Additional Insured Status Is Required By Contract Or Agreement, Coverage And Limits Of Liability Apply Only To The Extent Required In The Contract Or Agreement.

This endorsement modifies insurance provided under the following: Commercial general liability coverage part products/completed operations liability coverage part schedule name of additional insured. Intended to extend insurance coverage to a party not typically covered by a policy, there are a number of benefits and stipulations to adding an additional insured. Commercial general liability coverage part schedule name of additional insured person(s) or organization(s):

Basically, As The Policyholder (Named Insured) , An Additional Insured Endorsement Extends Your Liability Coverage To A Third Party To Address An Additional Liability Exposure You Potentially Create For Him.

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance: Required by the contract or agreement; Schedule name of person or organization: Commercial general liability coverage part.

Provides Additional Insured Status To A Designated Person Or Organization That Has Granted The Named Insured A License.

Available under the applicable limits of Web to add an additional insured to an insurance policy, consult an insureon insurance agent and review the policy, identify whether an additional insured can be added, and assess the level of coverage the additional insured is requesting.

![Contracts And Additional Insured Status [Understand Your Risk]](https://blog.ecbm.com/hs-fs/hubfs/Understand Risk Additional Insured.png?width=800&height=400&name=Understand Risk Additional Insured.png)