8233 Form Irs

8233 Form Irs - Web tax refunds are included on the next regular paycheck. By filing form 8233, they are looking to claim an exemption from federal income tax. Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. Complete, edit or print tax forms instantly. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. Form 8233 ( exemption from. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web sections 1441, 3401, and 3402 require withholding, sometimes at 30% and sometimes at graduated rates, on compensation for dependent personal services (defined later). Tax refunds for previous tax years must be claimed with the irs on your tax return. Every year, countless nonresidents ask us what form 8233 is used for.

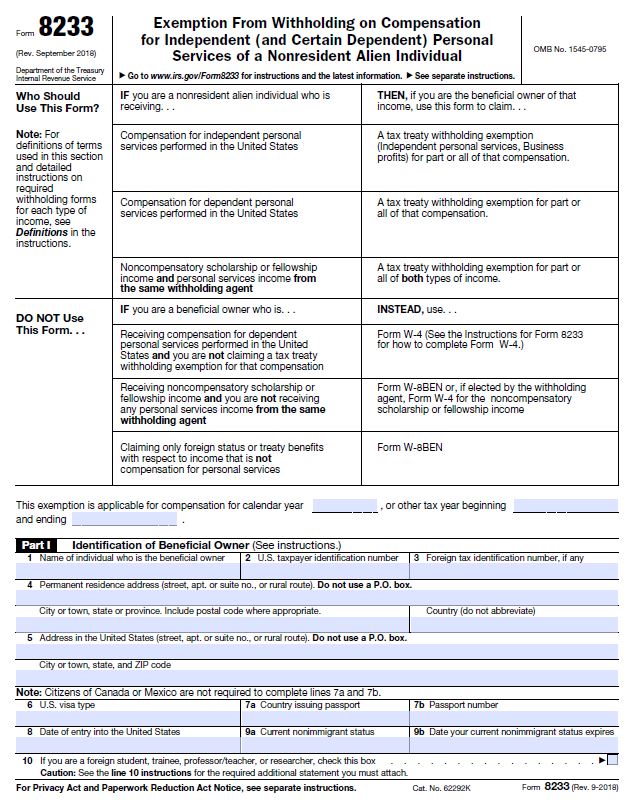

Every year, countless nonresidents ask us what form 8233 is used for. By filing form 8233, they are looking to claim an exemption from federal income tax. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Ad access irs tax forms. Form 8233 ( exemption from. Tax refunds for previous tax years must be claimed with the irs on your tax return. Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Web tax refunds are included on the next regular paycheck. Web employer's quarterly federal tax return. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february.

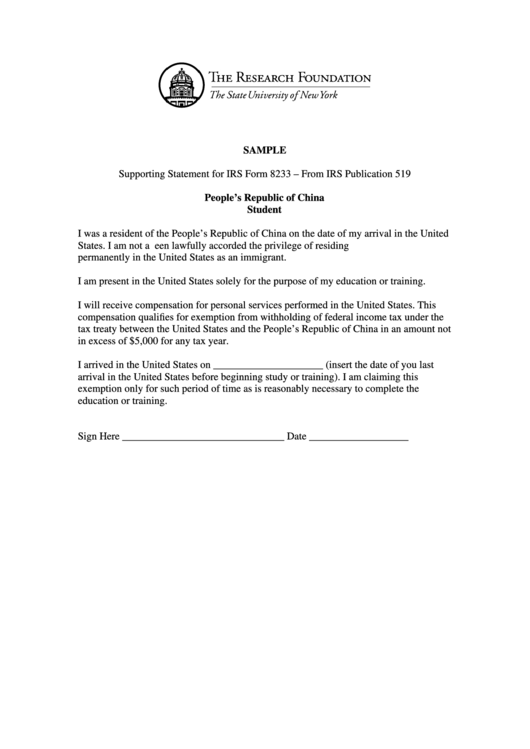

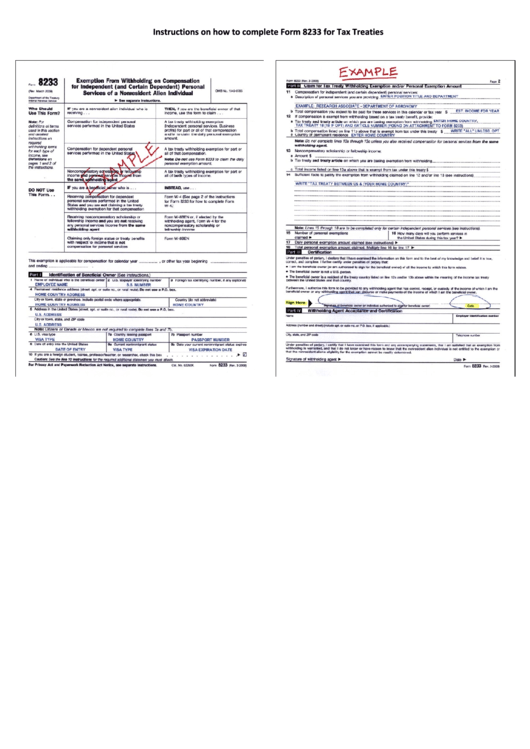

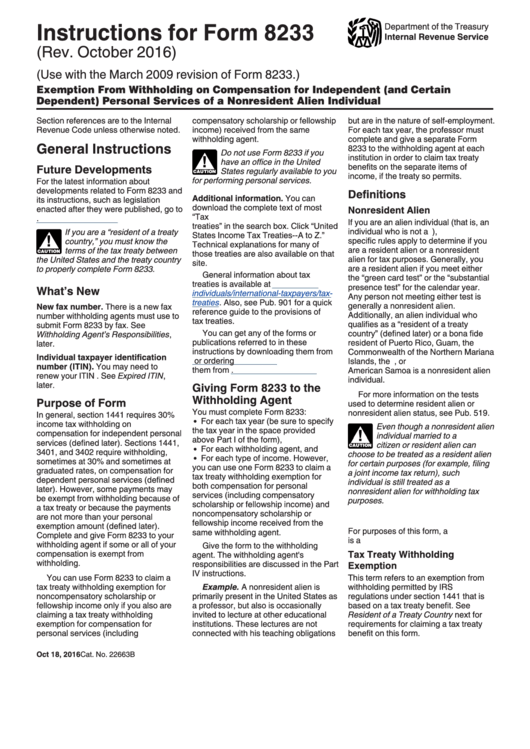

Instructions for form 8233, exemption from withholding on compensation for independent (and certain dependent) personal service of a nonresident alien. Complete, edit or print tax forms instantly. Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Form 8233 ( exemption from. Giving form 8233 to the withholding agent you must complete a separate form 8233: Tax refunds for previous tax years must be claimed with the irs on your tax return. Web 314 rows form 8233 is valid for only one (1) year. December 2001) department of the treasury internal revenue service exemption from withholding on compensation for independent (and certain. Web tax refunds are included on the next regular paycheck. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for.

irs form 8233 printable pdf file enter the appropriate calendar year

Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. Ad access irs tax forms. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. December 2001) department of the treasury internal revenue.

fw8ben Withholding Tax Irs Tax Forms

Form 8233 ( exemption from. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. By filing form 8233, they are looking to claim an exemption from federal income tax. Web what is form 8233 and what is its purpose? Tax refunds for previous tax years must be claimed with the irs.

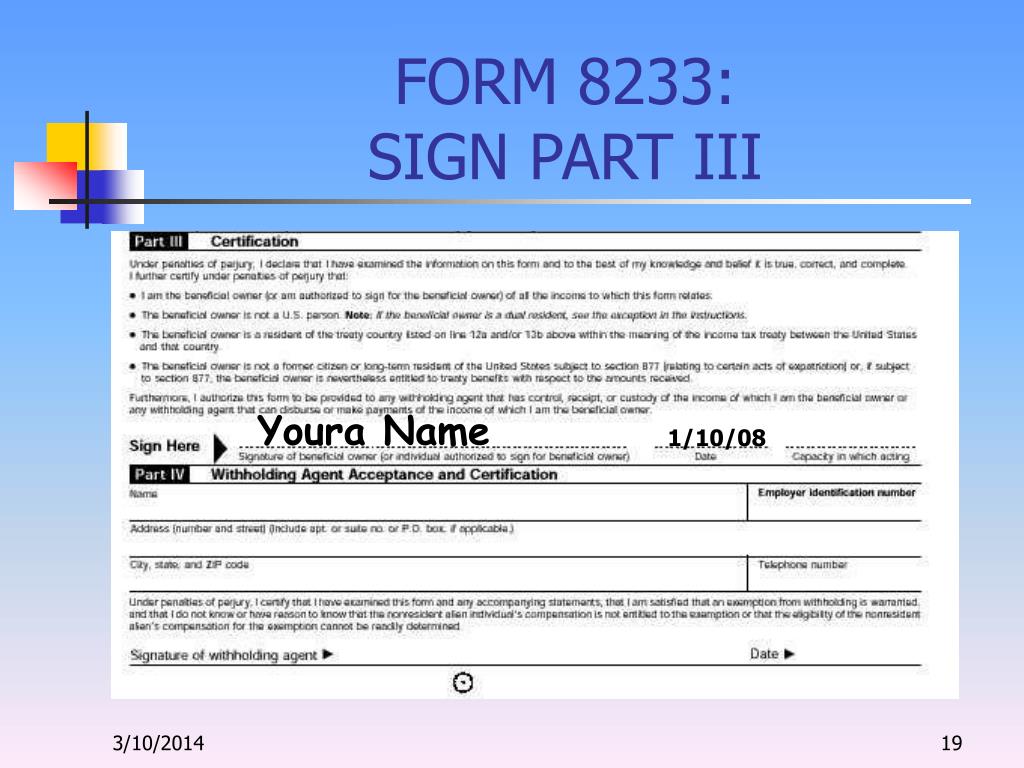

PPT Taxes & Treaties for International Student Employees PowerPoint

December 2001) department of the treasury internal revenue service exemption from withholding on compensation for independent (and certain. Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Ad access irs tax forms. Identification of beneficial owner line 1. Complete, edit or print tax forms instantly.

16 Form 8233 Templates free to download in PDF

Web tax refunds are included on the next regular paycheck. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Web what is form 8233 and what is its purpose? Web employer's quarterly federal tax return. Instructions for form 8233, exemption from withholding on compensation.

Instructions On How To Complete Form 8233 For Tax Treaties printable

The payee has a u.s. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. By filing form 8233, they are looking to claim an exemption from federal income tax. This form is used if an employee is a resident of another. Web the 8233 is an internal revenue service (irs) mandated.

Instructions For Form 8233 2016 printable pdf download

Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Every year, countless nonresidents ask us what form 8233 is used.

Tax Return Uk International Student QATAX

Web complete and give form 8233 to your withholding agent if some or all of your compensation is exempt from withholding. This form is used if an employee is a resident of another. Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. • for each tax year.

IRS FORM 8233 Non Resident Alien EXEMPTIONS YouTube

Web sections 1441, 3401, and 3402 require withholding, sometimes at 30% and sometimes at graduated rates, on compensation for dependent personal services (defined later). Web complete and give form 8233 to your withholding agent if some or all of your compensation is exempt from withholding. December 2001) department of the treasury internal revenue service exemption from withholding on compensation for.

Form 8233 Exemption from Withholding on Compensation for Independent

Web we last updated the exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien individual in february. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Tax refunds for previous tax years must be claimed with the.

irs 8233 form Fill out & sign online DocHub

Web what is form 8233 and what is its purpose? Identification of beneficial owner line 1. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. This form is used if an employee is a resident of another. Web complete and give form 8233 to.

Web The 8233 Is An Internal Revenue Service (Irs) Mandated Form To Collect Correct Nonresident Alien (Nra) Taxpayer Information For Both Individuals And Entities For.

Get ready for tax season deadlines by completing any required tax forms today. Form 8233 ( exemption from. Identification of beneficial owner line 1. Ad access irs tax forms.

Web Complete And Give Form 8233 To Your Withholding Agent If Some Or All Of Your Compensation Is Exempt From Withholding.

This form is used if an employee is a resident of another. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. December 2001) department of the treasury internal revenue service exemption from withholding on compensation for independent (and certain. Every year, countless nonresidents ask us what form 8233 is used for.

Web We Last Updated The Exemption From Withholding On Compensation For Independent (And Certain Dependent) Personal Services Of A Nonresident Alien Individual In February.

Web what is form 8233 and what is its purpose? Web sections 1441, 3401, and 3402 require withholding, sometimes at 30% and sometimes at graduated rates, on compensation for dependent personal services (defined later). Web 314 rows form 8233 is valid for only one (1) year. Giving form 8233 to the withholding agent you must complete a separate form 8233:

By Filing Form 8233, They Are Looking To Claim An Exemption From Federal Income Tax.

Web the corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service each year for all foreign nationals. Web international students and scholars who qualify should complete form 8233, exemption from withholding on compensation for independent (and certain dependent) personal. Web employer's quarterly federal tax return. Complete, edit or print tax forms instantly.