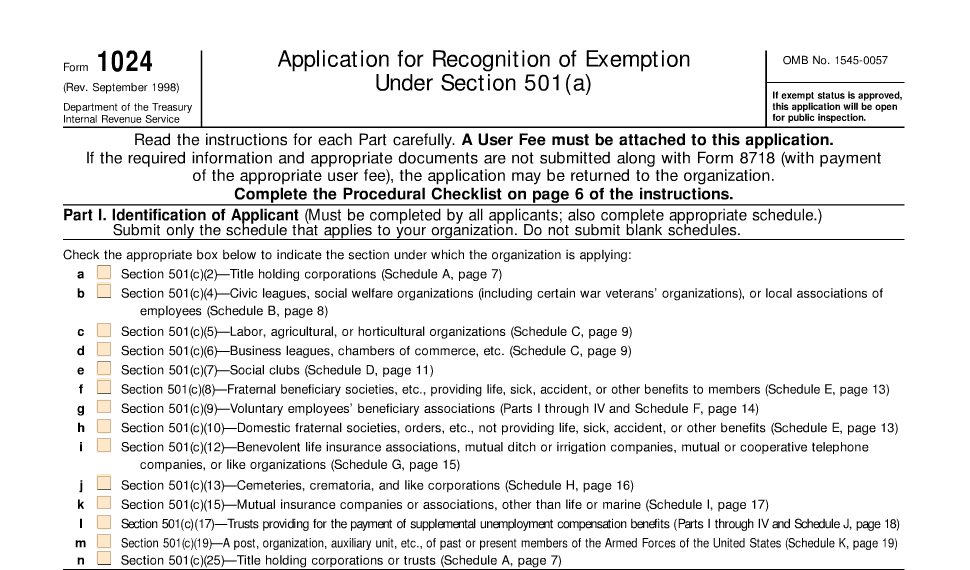

Form 1024 Pdf

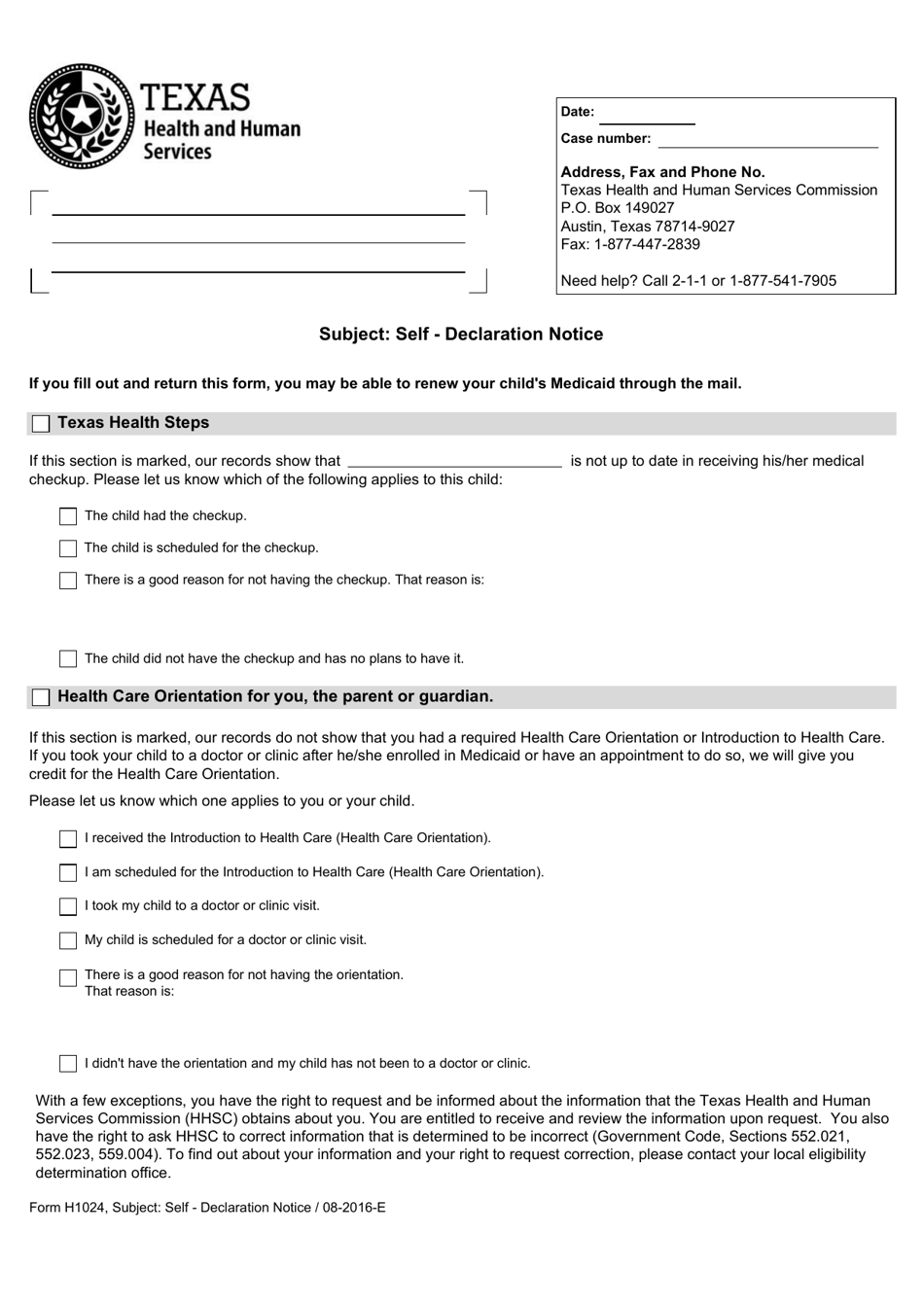

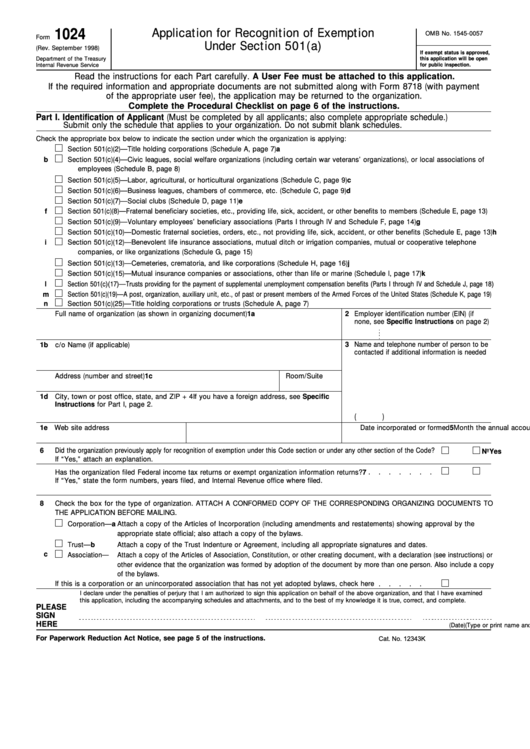

Form 1024 Pdf - Under section 501(c)(4) of the internal revenue code. September 1998) department of the treasury internal revenue service read the instructions for each part carefully. 0 8/2021) omb control no. Complete, edit or print tax forms instantly. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end. For instructions and the latest information. You can access the most recent version of the form at pay.gov. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)) or section 521. A user fee must be attached to. Combine amounts from within and outside the united states and report the totals on the financial statements.

A user fee must be attached to. Web form 1024 if exempt status is approved, this application will be open for public inspection. Under section 501(c)(4) of the internal revenue code. Read the instructions for each part carefully. If exempt status is approved, this application will be open 0 8/2021) omb control no. Combine amounts from within and outside the united states and report the totals on the financial statements. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)) or section 521. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. Ad download or email irs 1024 & more fillable forms, register and subscribe now!

Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)) or section 521. See the instructions for form 1024 for help in completing this application. September 1998) department of the treasury internal revenue service read the instructions for each part carefully. Under section 501(c)(4) of the internal revenue code. Web form 1024 if exempt status is approved, this application will be open for public inspection. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Combine amounts from within and outside the united states and report the totals on the financial statements. Ad download or email irs 1024 & more fillable forms, register and subscribe now! If exempt status is approved, this application will be open

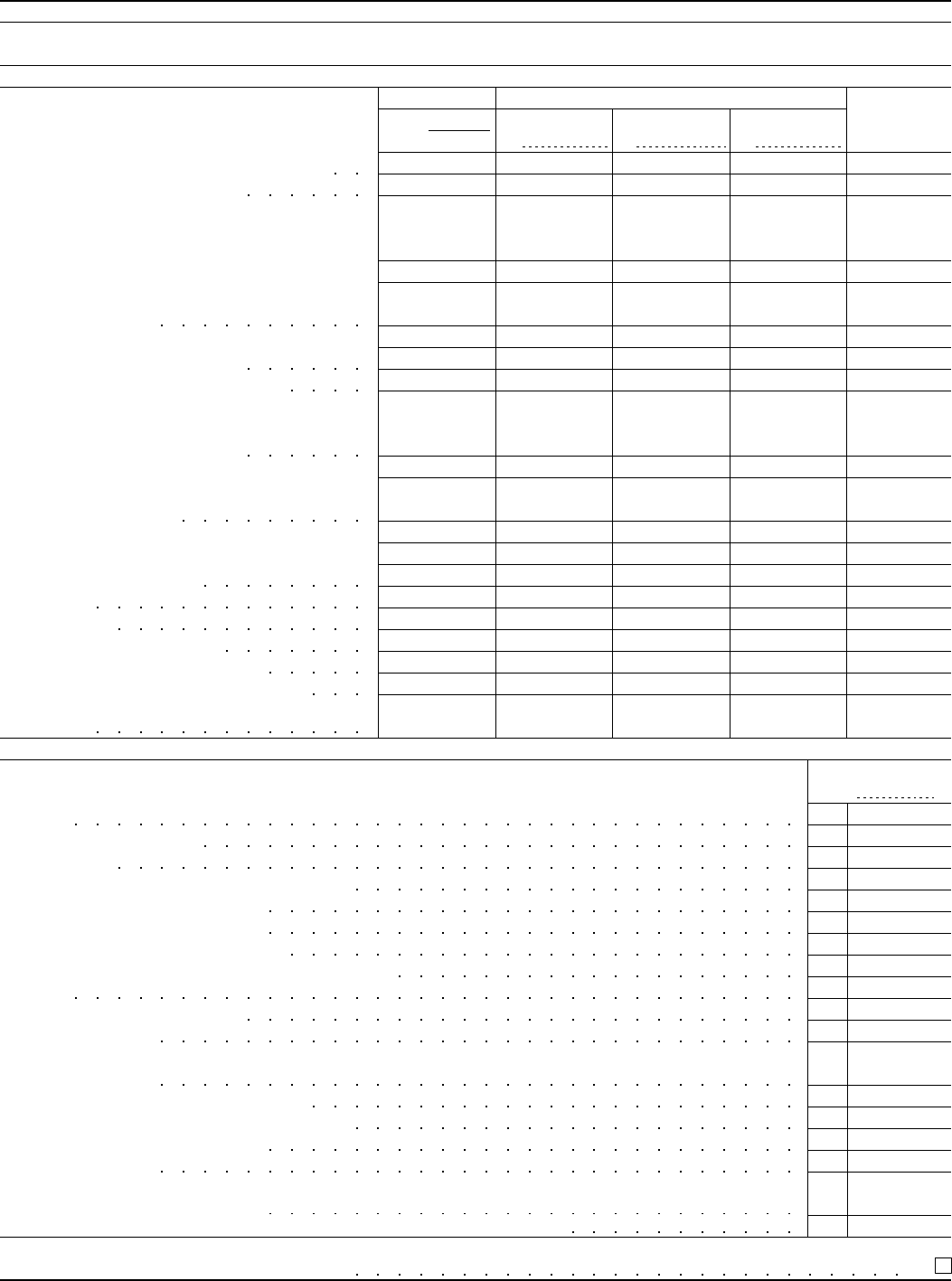

Form 1024 Edit, Fill, Sign Online Handypdf

See the instructions for form 1024 for help in completing this application. Complete, edit or print tax forms instantly. September 1998) department of the treasury internal revenue service read the instructions for each part carefully. For instructions and the latest information. Maintain approved applications with related permit and associated records based on appropriate item(s) in nps records schedule 1, resources.

Pdf form

See the instructions for form 1024 for help in completing this application. Combine amounts from within and outside the united states and report the totals on the financial statements. Web form 1024 must be submitted electronically through pay.gov. If exempt status is approved, this application will be open Ad download or email irs 1024 & more fillable forms, register and.

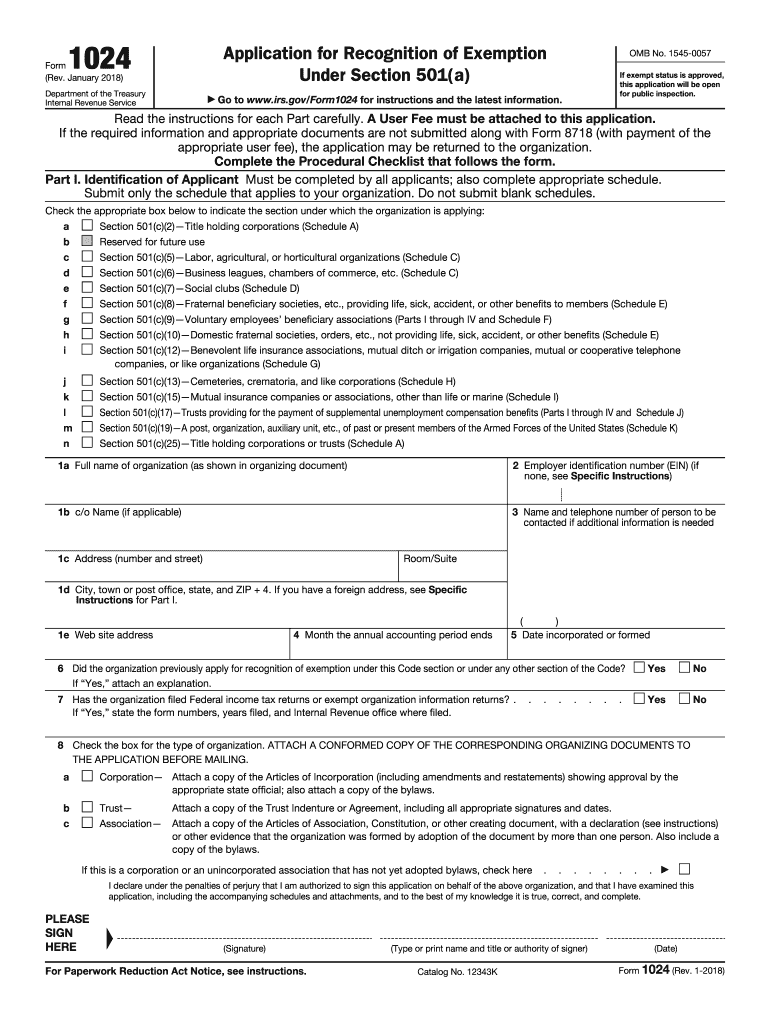

Form 1024 Application for Recognition of Exemption under Section 501

Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Maintain approved applications with related permit and associated records based on appropriate item(s) in nps records schedule 1, resources management and lands,. For instructions and the latest information. See the instructions for form 1024 for help.

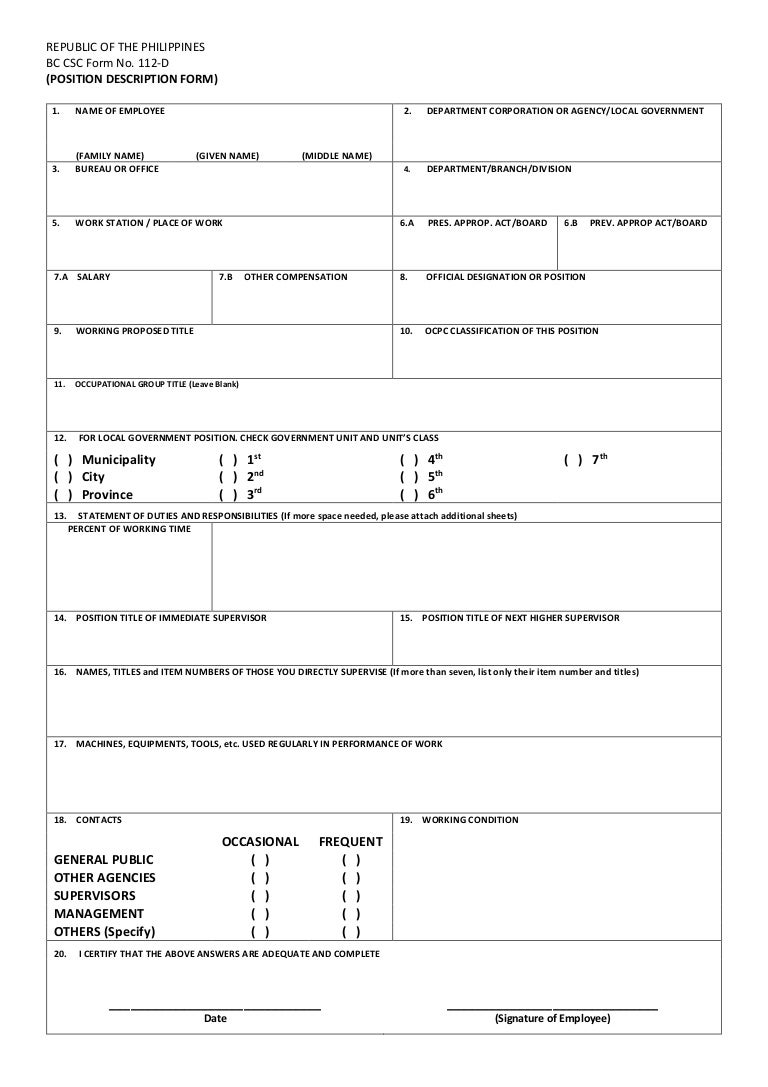

Form H1024 Download Fillable PDF or Fill Online Subject Self

You can access the most recent version of the form at pay.gov. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. 0 8/2021) omb control no. A user fee must be attached to. Application for recognition of exemption.

1024 Fill Out and Sign Printable PDF Template signNow

Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). You can access the most recent version of the form at pay.gov. Complete, edit or print tax forms instantly. Web form 1024 must be submitted electronically through pay.gov. Page 2 of 5 records retention:

Form 1024 Application for Recognition of Exemption under Section 501

Web report financial information in united states dollars (specify the conversion rate used). Maintain approved applications with related permit and associated records based on appropriate item(s) in nps records schedule 1, resources management and lands,. Complete, edit or print tax forms instantly. Web form 1024 must be submitted electronically through pay.gov. Under section 501(c)(4) of the internal revenue code.

IRS Form 1024 Tax Exemption for Other Organizations PDFfiller

You can access the most recent version of the form at pay.gov. Ad download or email irs 1024 & more fillable forms, register and subscribe now! Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)) or section 521. Ad download.

Fillable Form 1024 Application For Recognition Of Exemption Under

For instructions and the latest information. Ad download or email irs 1024 & more fillable forms, register and subscribe now! Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4). September 1998) department of the treasury internal revenue service read the instructions for each part carefully. Combine amounts from within and outside the united states and.

Form 1024 Edit, Fill, Sign Online Handypdf

Under section 501(c)(4) of the internal revenue code. Page 2 of 5 records retention: 0 8/2021) omb control no. Web form 1024 must be submitted electronically through pay.gov. You can access the most recent version of the form at pay.gov.

Form 1024 Application for Recognition of Exemption under Section 501

Combine amounts from within and outside the united states and report the totals on the financial statements. September 1998) department of the treasury internal revenue service read the instructions for each part carefully. Ad download or email irs 1024 & more fillable forms, register and subscribe now! You'll have to create a single pdf file (not exceeding 15mb) that you.

Web Department Of The Treasury Internal Revenue Service Application For Recognition Of Exemption Under Section 501(A) Go To Www.irs.gov/Form1024 For Instructions And The Latest Information.

0 8/2021) omb control no. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501 (a) (other than sections 501 (c) (3) or 501 (c) (4)) or section 521. Web report financial information in united states dollars (specify the conversion rate used). Ad download or email irs 1024 & more fillable forms, register and subscribe now!

Application For Recognition Of Exemption.

If exempt status is approved, this application will be open Under section 501(c)(4) of the internal revenue code. Combine amounts from within and outside the united states and report the totals on the financial statements. September 1998) department of the treasury internal revenue service read the instructions for each part carefully.

Read The Instructions For Each Part Carefully.

You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end. Complete, edit or print tax forms instantly. Maintain approved applications with related permit and associated records based on appropriate item(s) in nps records schedule 1, resources management and lands,. Don't use form 1024 if you are applying under section 501(c)(3) or section 501(c)(4).

Web Form 1024 Must Be Submitted Electronically Through Pay.gov.

You can access the most recent version of the form at pay.gov. For instructions and the latest information. Organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. See the instructions for form 1024 for help in completing this application.