3804 Cr Form

3804 Cr Form - Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Please provide your email address and it will be emailed to you. Web information, get form ftb 3804. This is a nonrefundable credit. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web we would like to show you a description here but the site won’t allow us. Web 1 enter the federal adjusted gross income from federal form 1040, line 37, or from federal form 1040a, line 21. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. 2 enter the federal tax from federal form 1040, line 46, or from. Web almost every form and publication has a page on irs.gov with a friendly shortcut.

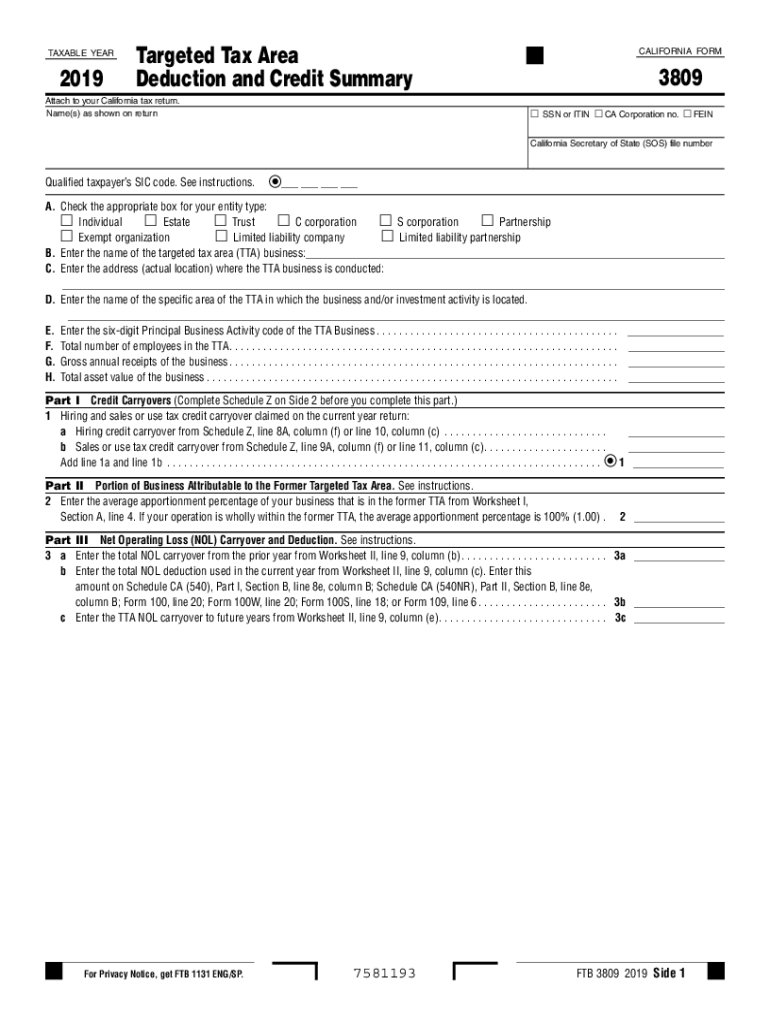

Attach the completed form ftb 3804. Ssn or itin fein part i elective tax credit amount. Form 3885a, depreciation and amortization adjustments. 2 enter the federal tax from federal form 1040, line 46, or from. Web information, get form ftb 3804. Name(s) as shown on your california tax return. Web california individual form availability. It depends on whether you are using turbo tax online, or the purchased product. Web 1 enter the federal adjusted gross income from federal form 1040, line 37, or from federal form 1040a, line 21. Web we would like to show you a description here but the site won’t allow us.

If you are using the purchased product, you can. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. When will the elective tax expire? Form 3885a, depreciation and amortization adjustments. Attach to your california tax return. Please provide your email address and it will be emailed to you. This is a nonrefundable credit. 2 enter the federal tax from federal form 1040, line 46, or from. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Attach the completed form ftb 3804.

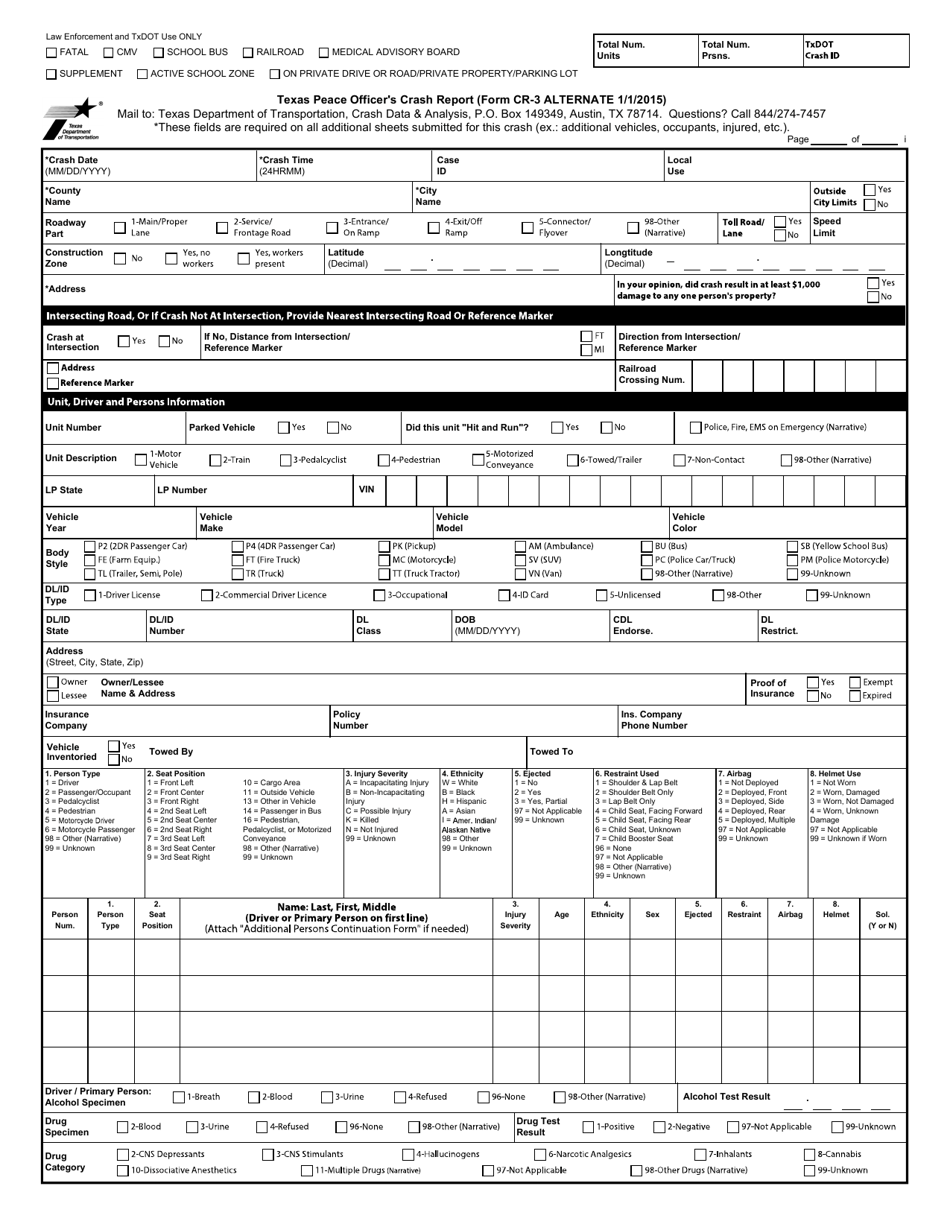

Form CR3A Download Fillable PDF or Fill Online Texas Peace Officer's

When will the elective tax expire? Web california individual form availability. Attach the completed form ftb 3804. Please provide your email address and it will be emailed to you. 2 enter the federal tax from federal form 1040, line 46, or from.

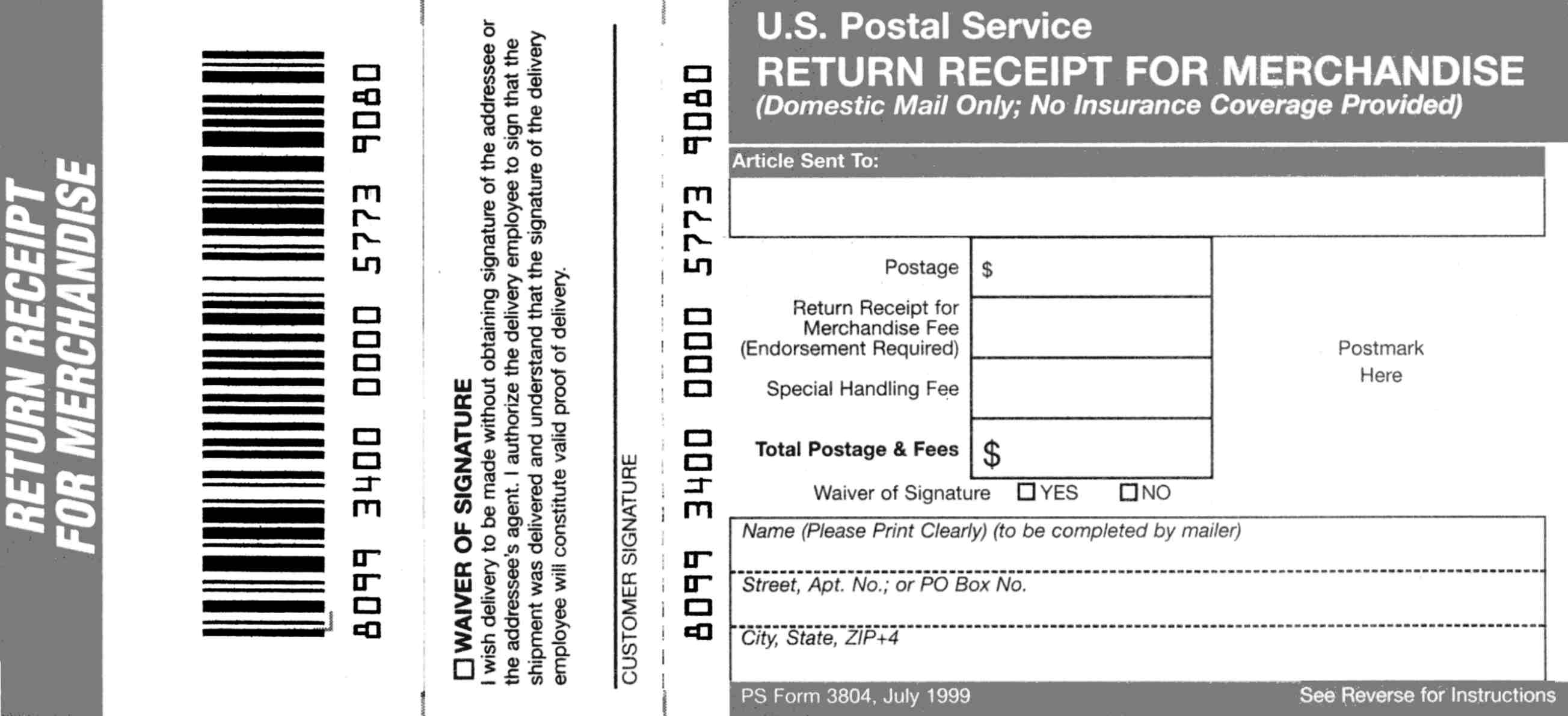

Domestic Mail Manual S917 Return Receipt for Merchandise

Name(s) as shown on your california tax return. Please provide your email address and it will be emailed to you. Web 1 enter the federal adjusted gross income from federal form 1040, line 37, or from federal form 1040a, line 21. It depends on whether you are using turbo tax online, or the purchased product. The credit is nonrefundable, and.

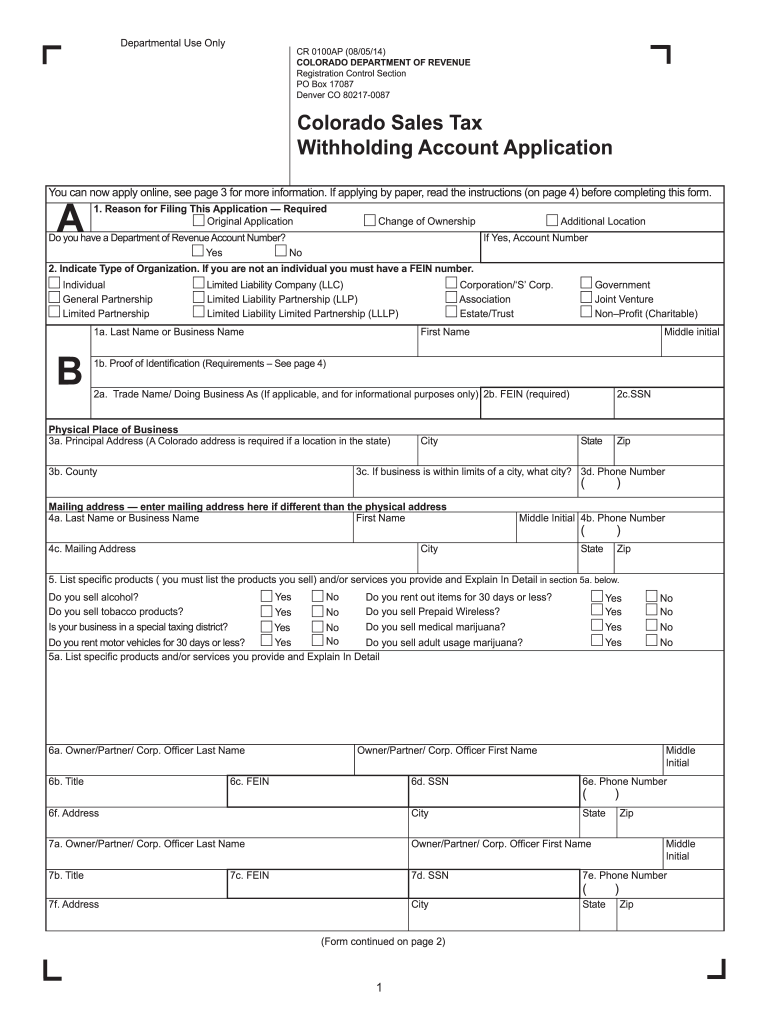

Cr Form Fill Out and Sign Printable PDF Template signNow

Web california individual form availability. For example, the form 1040 page is at irs.gov/form1040; Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web 1 enter the federal adjusted gross income from federal form 1040, line 37, or from.

Brautkleid

Web almost every form and publication has a page on irs.gov with a friendly shortcut. This is a nonrefundable credit. Web we would like to show you a description here but the site won’t allow us. Web information, get form ftb 3804. Web california individual form availability.

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. If you are using the purchased product, you can. Attach the completed form ftb 3804. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Name(s) as shown on your california tax return.

Seksowny kostium uczennicy Chiliroser CR3804 sklep Dlazmyslow.pl

Web information, get form ftb 3804. When will the elective tax expire? The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. This is only available by request. Attach to your california tax return.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

It depends on whether you are using turbo tax online, or the purchased product. Please provide your email address and it will be emailed to you. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Ssn or itin fein part i elective tax credit amount. Web we would like to show you a description here but the.

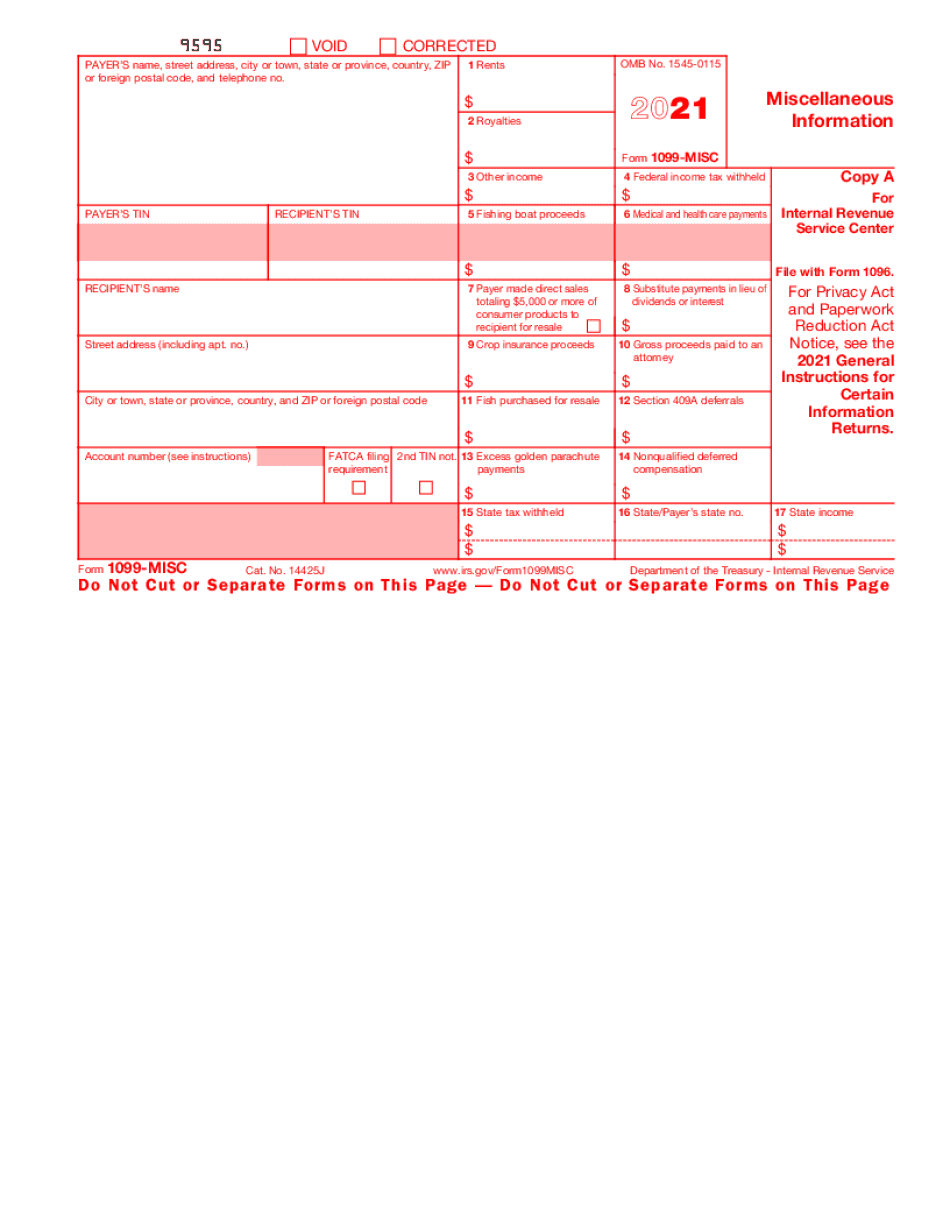

1099MISC Form 2022 Fillable Template

It depends on whether you are using turbo tax online, or the purchased product. This is only available by request. Web form 3804 form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web use form ftb 3804 to report the.

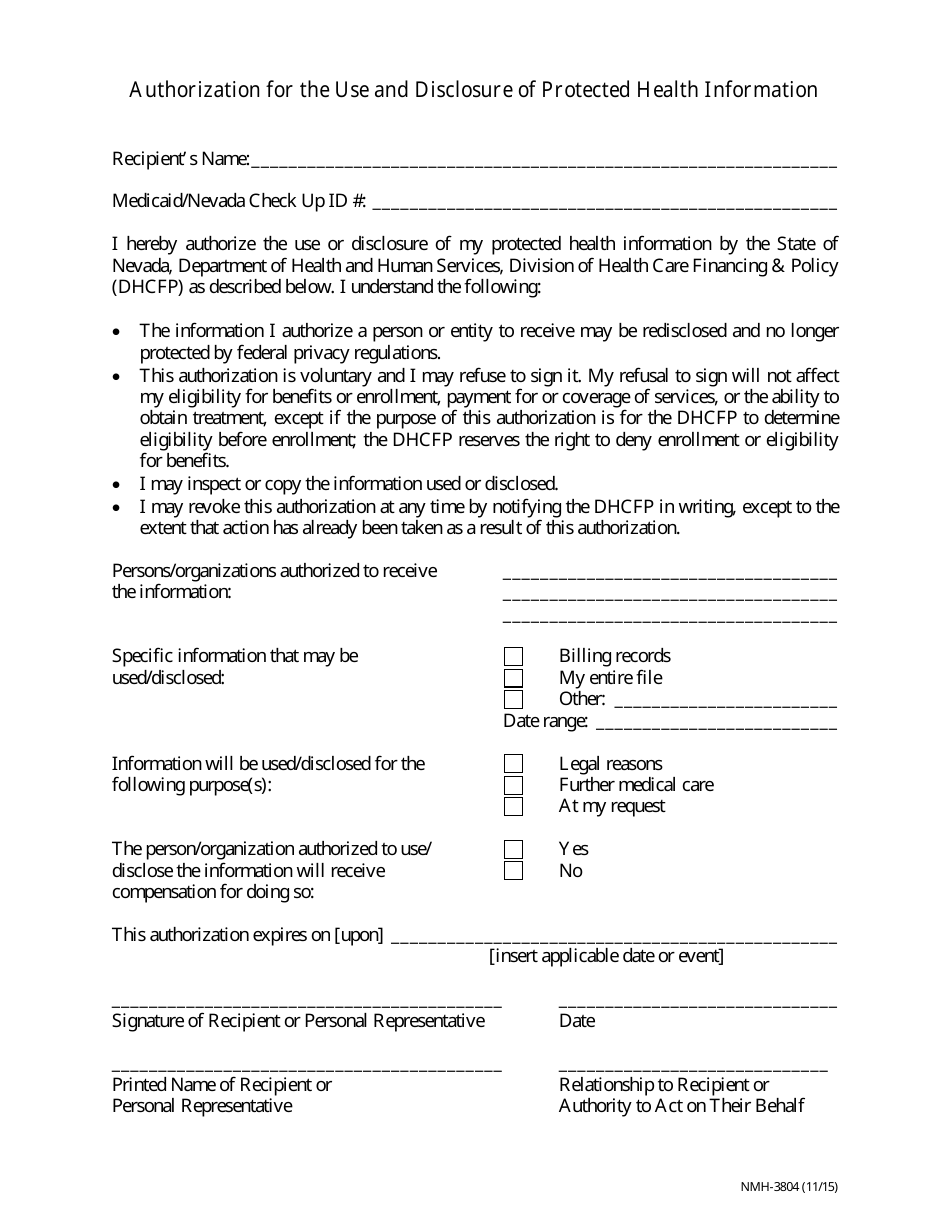

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

If you are using the purchased product, you can. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web california individual form availability. Web 1 enter the federal adjusted gross income from federal form 1040, line 37, or from.

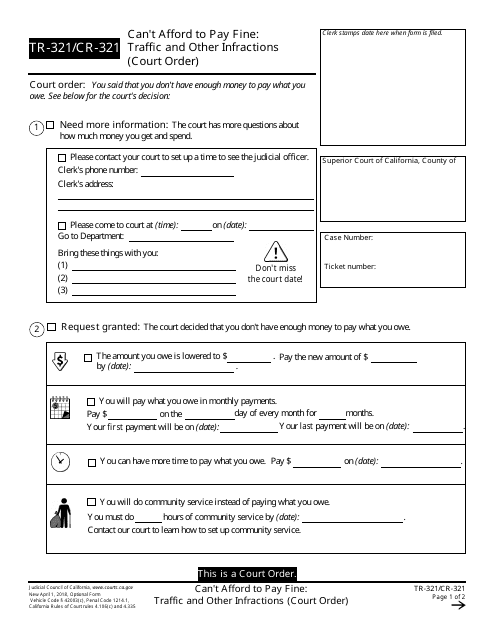

Form TR321 (CR321) Download Fillable PDF or Fill Online Can't Afford

Form 3885a, depreciation and amortization adjustments. Web almost every form and publication has a page on irs.gov with a friendly shortcut. It depends on whether you are using turbo tax online, or the purchased product. Name(s) as shown on your california tax return. This is a nonrefundable credit.

Attach To Your California Tax Return.

It depends on whether you are using turbo tax online, or the purchased product. 2 enter the federal tax from federal form 1040, line 46, or from. For example, the form 1040 page is at irs.gov/form1040; Form 3885a, depreciation and amortization adjustments.

This Is A Nonrefundable Credit.

Web almost every form and publication has a page on irs.gov with a friendly shortcut. If you are using the purchased product, you can. Name(s) as shown on your california tax return. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income.

Web 1 Enter The Federal Adjusted Gross Income From Federal Form 1040, Line 37, Or From Federal Form 1040A, Line 21.

When will the elective tax expire? Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Ssn or itin fein part i elective tax credit amount. Web california individual form availability.

Attach The Completed Form Ftb 3804.

Web we would like to show you a description here but the site won’t allow us. This is only available by request. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Please provide your email address and it will be emailed to you.