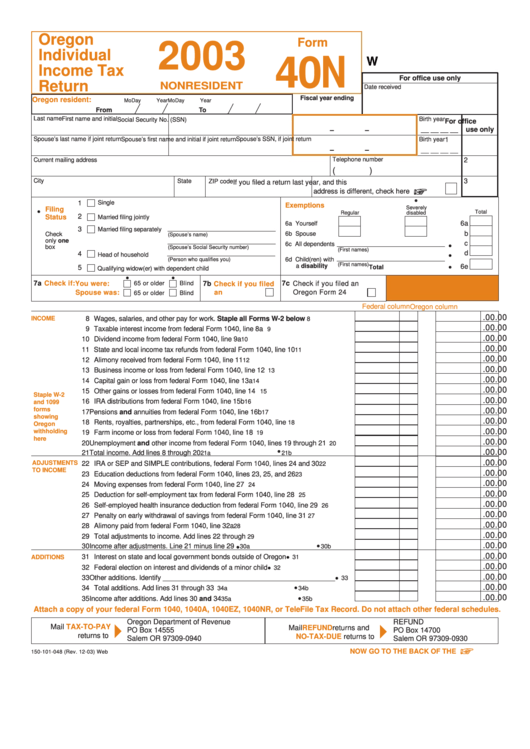

Form Or-40N

Form Or-40N - Web form 40 is the general income tax return for oregon residents. This will help ensure the proper calculation. Oregon.gov/dor • april 18, 2023 is the due date for filing your return and paying your tax due. Web form 40n oregon — nonresident individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Submit original form—do not submit photocopy fiscal year ending: Save or instantly send your ready documents. Form 40 can be efiled, or a paper copy can be filed via mail. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due. *dependent relationship code (see instructions). Web we last updated oregon form 40 in january 2023 from the oregon department of revenue.

Web form 40n oregon — nonresident individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Form 40 can be efiled, or a paper copy can be filed via mail. Line 1 of form 3800 is for the return for the year in which you. 01) name ssn 00541901050000 amended statement. We last updated the resident individual income tax. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. And form 6041, line 1. *dependent relationship code (see instructions). Easily fill out pdf blank, edit, and sign them. Form 40 can be efiled, or a paper copy can be filed via mail.

Easily fill out pdf blank, edit, and sign them. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due. Web instructions for forms 40n and 40p step 1: *dependent relationship code (see instructions). This form is for income earned in tax year 2022, with tax returns due in april 2023. Submit original form—do not submit photocopy fiscal year ending: Save or instantly send your ready documents. Oregon.gov/dor • april 18, 2023 is the due date for filing your return and paying your tax due. Web up to $40 cash back if you filed an earlier return, include your earlier return on form 3800, line 1; Show details we are not affiliated with.

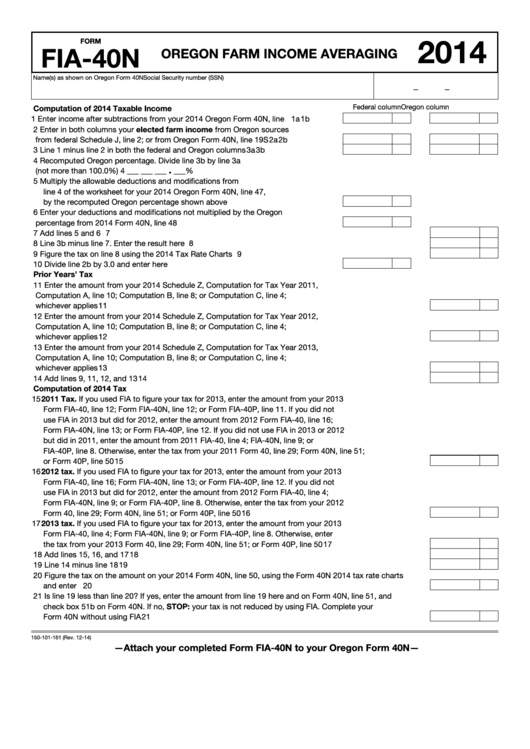

Fillable Form Fia40n And Form Fia40p Oregon Farm Averaging

And form 6041, line 1. Web form 40n oregon — nonresident individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Form 40 can be efiled, or a paper copy can be filed via mail. This form is for income earned in tax year 2022, with tax returns due.

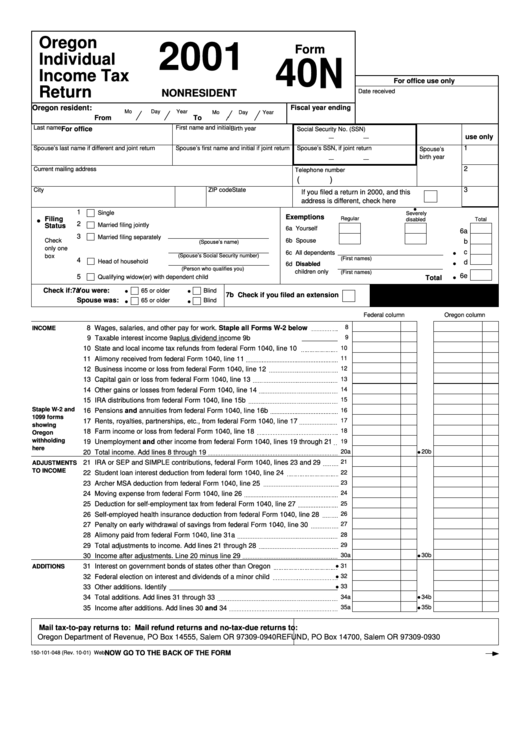

Fillable Form 40n Individual Tax Return October 2001

01) name ssn 00541901050000 amended statement. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Oregon.gov/dor • april 18, 2023 is the due date for filing your return and paying your tax due. This form is for income earned in tax year 2022, with tax returns due in april 2023.

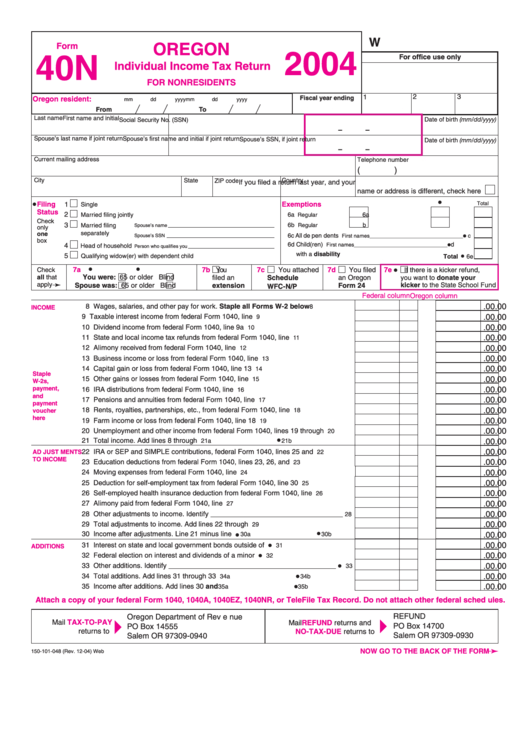

Fillable Form 40n Web Individual Tax Return For Nonresidents

Line 1 of form 3800 is for the return for the year in which you. Web a tropical wave located just less than 1,000 miles west of the far eastern caribbean is expected to become a tropical depression late monday or tuesday, the. Form 40 can be efiled, or a paper copy can be filed via mail. Web we last.

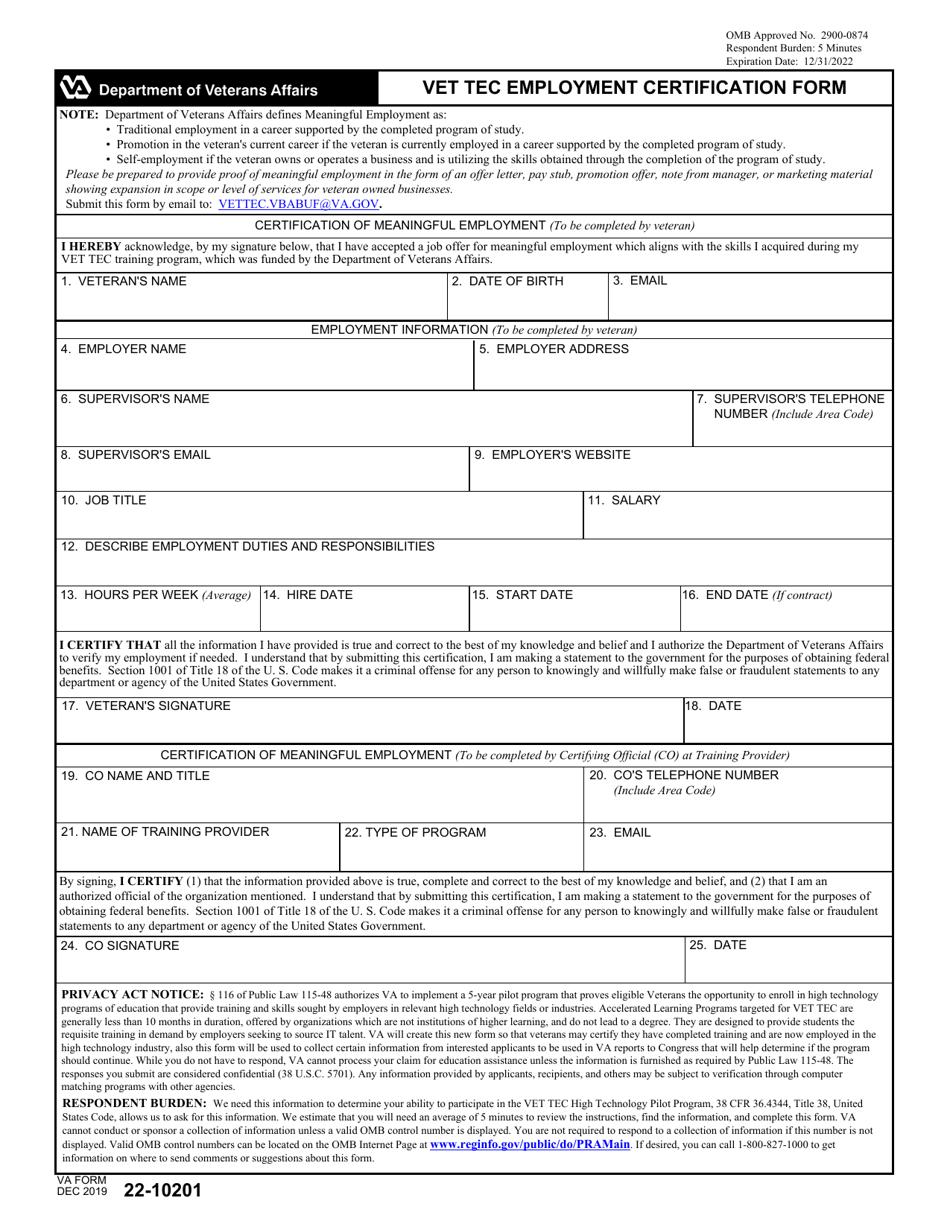

VA Form 2210201 Download Fillable PDF or Fill Online Vet Tec

Line 1 of form 3800 is for the return for the year in which you. Web instructions for forms 40n and 40p step 1: Web form 40 is the general income tax return for oregon residents. And form 6041, line 1. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due.

2020 Form OR DoR 40N Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Show details we are not affiliated with. Form 40 can be efiled, or a paper copy can be filed via mail. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Fillable Form 40n Oregon Individual Tax Return Nonresident

And form 6041, line 1. Web instructions for forms 40n and 40p step 1: Submit original form—do not submit photocopy fiscal year ending: Oregon.gov/dor • april 18, 2023 is the due date for filing your return and paying your tax due. 01) name ssn 00541901050000 amended statement.

Form 40N, Nonresident Individual Tax Return Edit, Fill, Sign

Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due. This will help ensure the proper calculation. Save or instantly send your ready documents. *dependent relationship code (see instructions). Web instructions for forms 40n and 40p step 1:

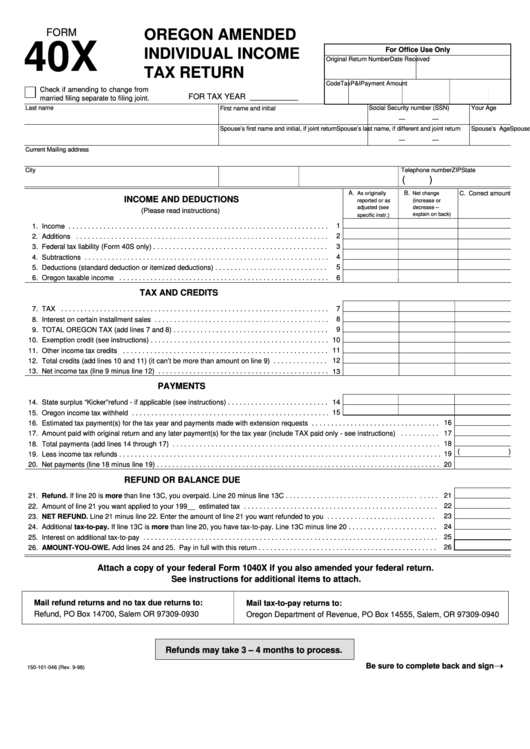

Fillable Form 40x Oregon Amended Individual Tax Return

Easily fill out pdf blank, edit, and sign them. Web form or 40 n, oregon individual income tax return for 2020 use a or 40n 2020 template to make your document workflow more streamlined. Web a tropical wave located just less than 1,000 miles west of the far eastern caribbean is expected to become a tropical depression late monday or.

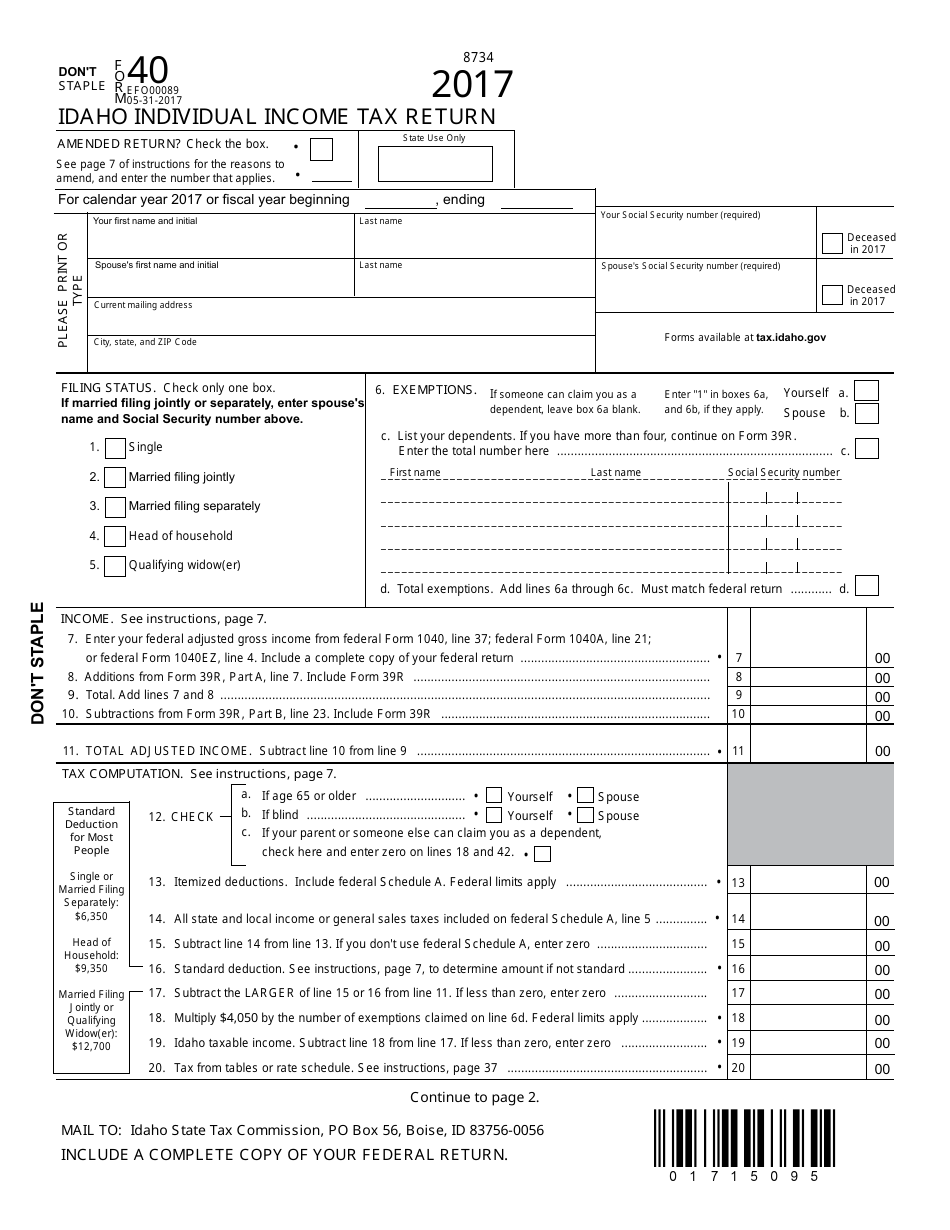

Form 40 Download Fillable PDF or Fill Online Idaho Individual

This form is for income earned in tax year 2022, with tax returns due in april 2023. And form 6041, line 1. Web instructions for forms 40n and 40p step 1: Form 40 can be efiled, or a paper copy can be filed via mail. *dependent relationship code (see instructions).

Web A Tropical Wave Located Just Less Than 1,000 Miles West Of The Far Eastern Caribbean Is Expected To Become A Tropical Depression Late Monday Or Tuesday, The.

Oregon.gov/dor • april 18, 2023 is the due date for filing your return and paying your tax due. Form 40 can be efiled, or a paper copy can be filed via mail. Line 1 of form 3800 is for the return for the year in which you. *dependent relationship code (see instructions).

Web Form 40N Oregon — Nonresident Individual Income Tax Return Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

Show details we are not affiliated with. Form 40 can be efiled, or a paper copy can be filed via mail. Web we last updated oregon form 40 in january 2023 from the oregon department of revenue. Web form 40 is the general income tax return for oregon residents.

And Form 6041, Line 1.

This will help ensure the proper calculation. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due. Save or instantly send your ready documents. Submit original form—do not submit photocopy fiscal year ending:

01) Name Ssn 00541901050000 Amended Statement.

We last updated the resident individual income tax. Web up to $40 cash back if you filed an earlier return, include your earlier return on form 3800, line 1; Web form or 40 n, oregon individual income tax return for 2020 use a or 40n 2020 template to make your document workflow more streamlined. This form is for income earned in tax year 2022, with tax returns due in april 2023.