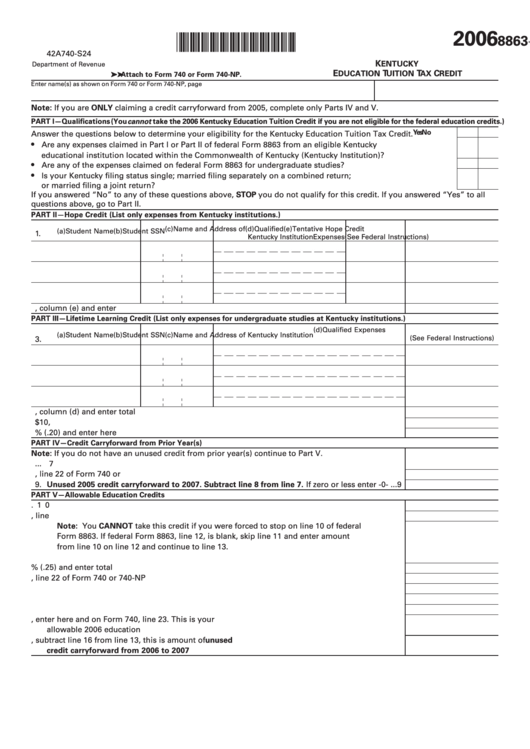

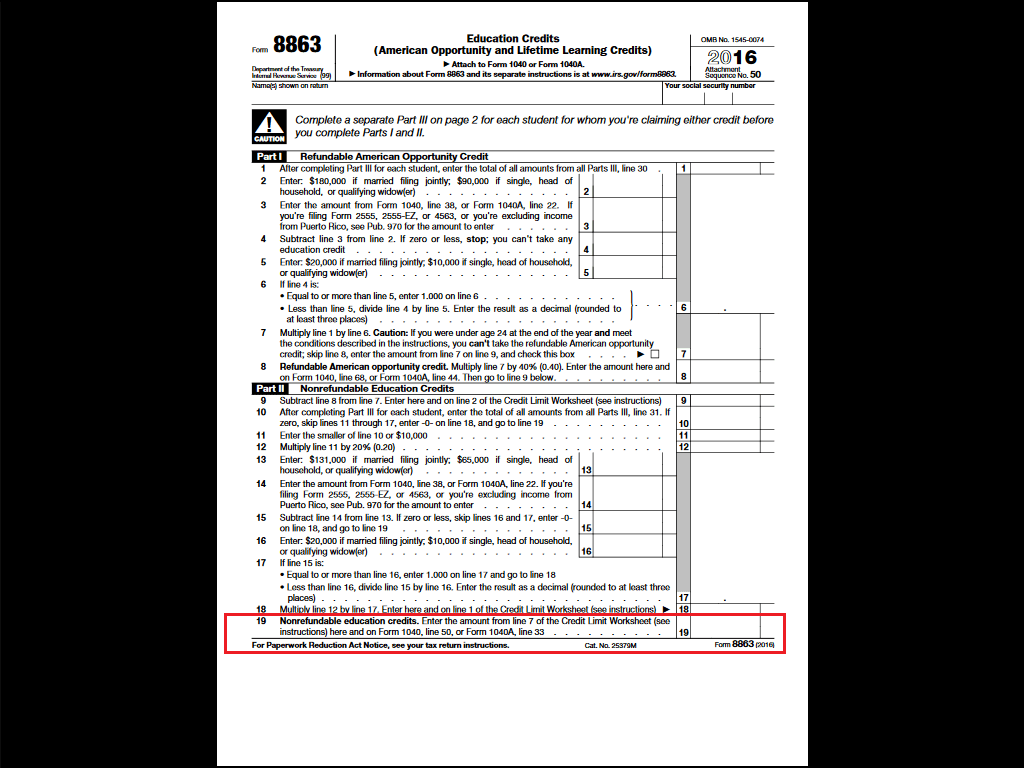

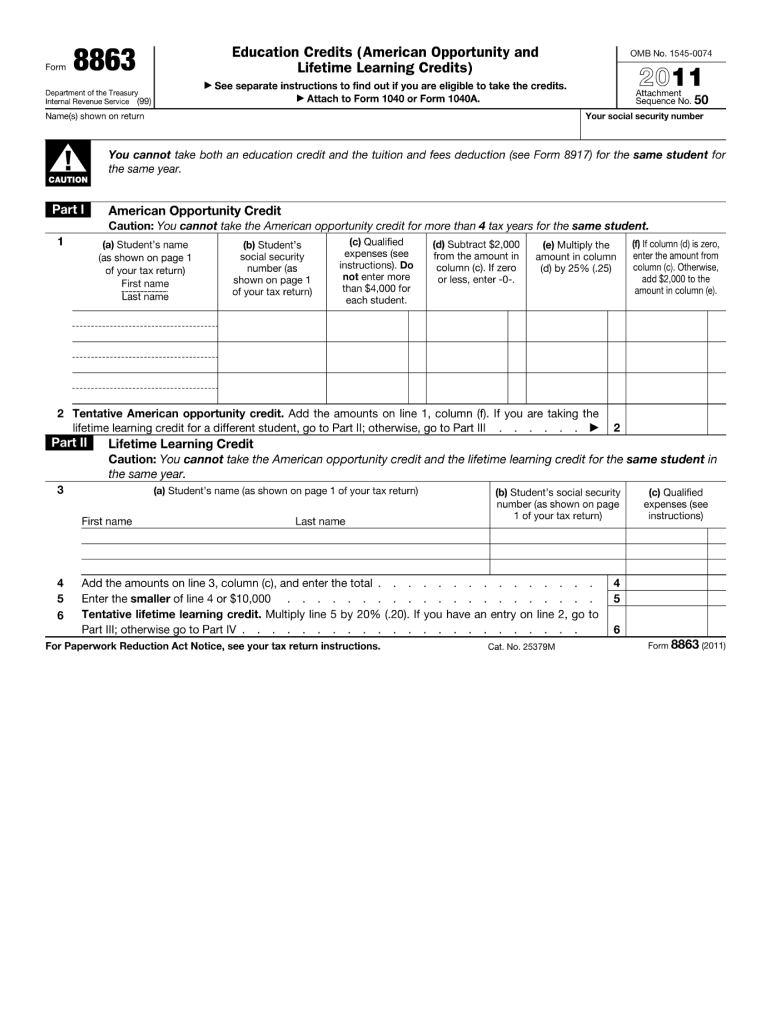

2022 Form 8863

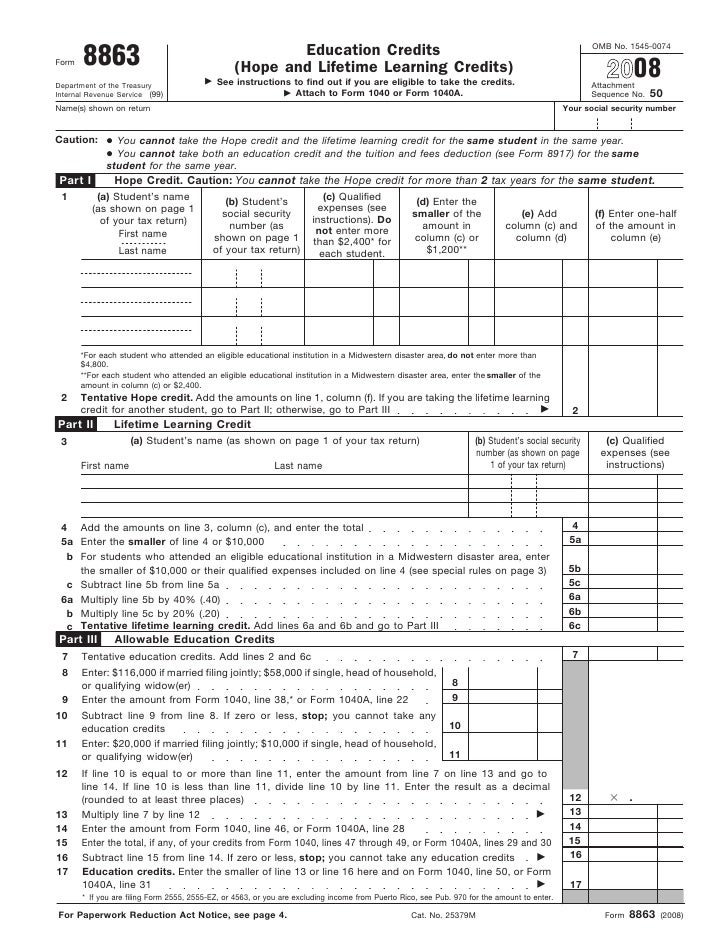

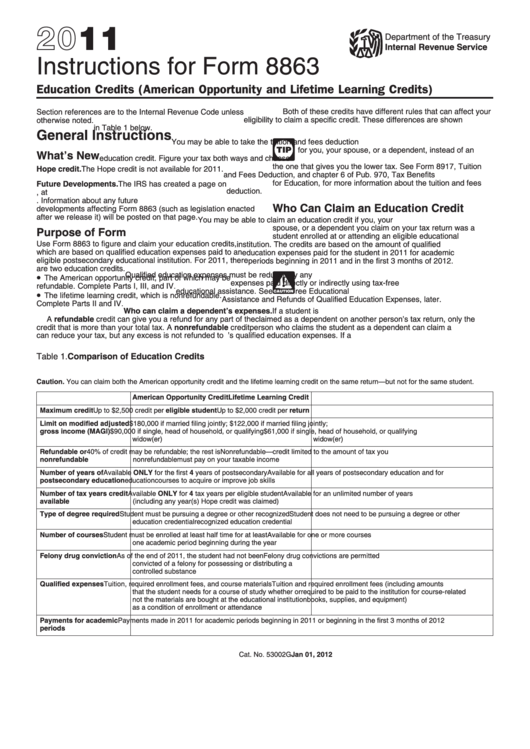

2022 Form 8863 - Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on. Use the information on the form. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web american opportunity credit vs. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). If you can’t find it, or if. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Education credits \(american opportunity and lifetime learning credits\) keywords: Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season.

This form is for income earned in tax year 2022, with tax returns due in april. Education credits \(american opportunity and lifetime learning credits\) keywords: Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Complete, edit or print tax forms instantly. Use the information on the form. The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web american opportunity credit vs. It’s an online fillable pdf document that you can save as a pdf file after filling it out.

The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Education credits \(american opportunity and lifetime learning credits\) keywords: This form is for income earned in tax year 2022, with tax returns due in april. Use this tax form to claim the american opportunity tax credit. Complete, edit or print tax forms instantly. Web we last updated federal form 8863 in december 2022 from the federal internal revenue service. Use the information on the form. Web form 8863, education credit, is the tax form for claiming the educational credits on your federal income return. Web read the irs form 8863 for 2022 instructions before filling out the sample. Ad get ready for tax season deadlines by completing any required tax forms today.

Form 8863 Credit Limit Worksheet

Web lifetime learning credit if you do not qualify for the american opportunity credit, you may be able to take a credit of up to $2,000 for the total qualified education expenses paid for. It’s an online fillable pdf document that you can save as a pdf file after filling it out. Web american opportunity credit vs. Ad get ready.

Form 8863Education Credits

Use the information on the form. This form is for income earned in tax year 2022, with tax returns due in april. Web h&r block is here to help you rock this year’s tax season, so we’ll break down the basics you should know about form 8863, including what it is, who qualifies, what expenses. Web we last updated federal.

8863 Form 2022

The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Ad get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Ad get ready for tax season deadlines by completing any required tax forms today. Web.

Form 8863 Credit Limit Worksheet

Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web information about form 8863, education credits (american opportunity and lifetime learning credits), including.

Instructions For Form 8863 Education Credits (American Opportunity

Use this tax form to claim the american opportunity tax credit. Web american opportunity credit vs. Education credits are based on the amount of the student’s adjusted qualified. Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete. Ad get ready for tax season deadlines by completing any required tax forms today.

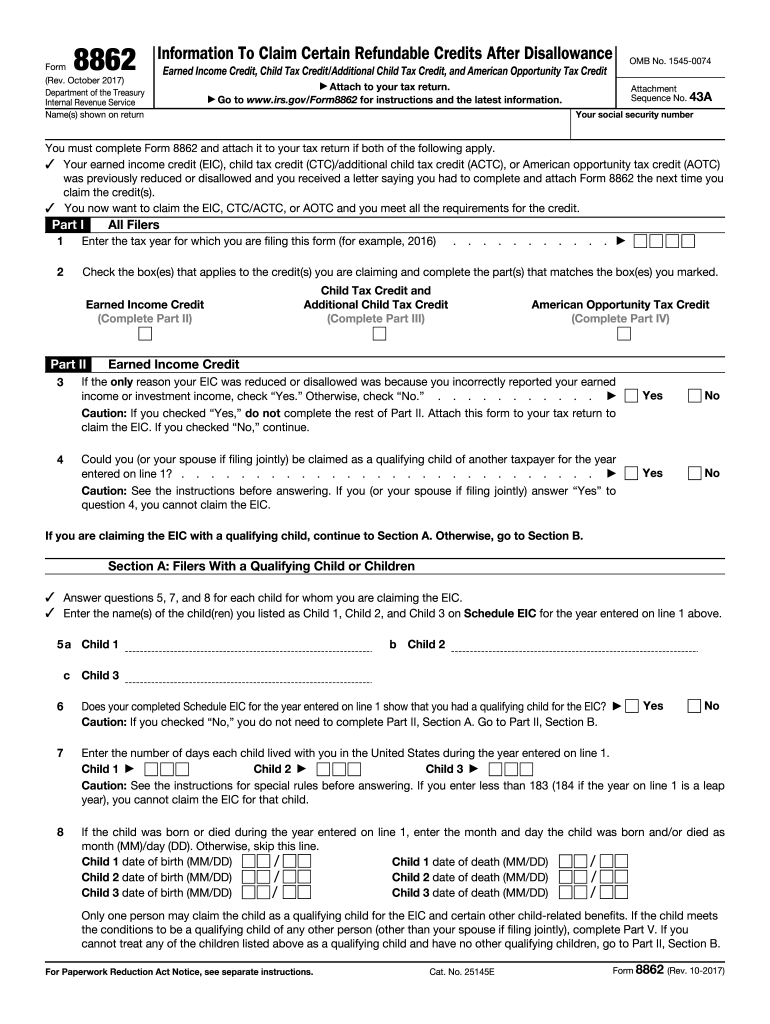

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 8863 in december 2022 from the federal internal revenue service. Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web use form 8863 to figure and claim.

IRS Update for Form 8863 Education Tax Credits The TurboTax Blog

Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

The american opportunity credit provides up to $2,500 in tax credit value per eligible student. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Education credits \(american opportunity and.

Credit Limit Worksheet For Form 8863

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web american opportunity credit vs. This form is for income earned in tax year 2022, with tax returns due in april. Web to claim aotc, you must file a federal tax return, complete the.

Form 8863Education Credits

Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on..

Web H&R Block Is Here To Help You Rock This Year’s Tax Season, So We’ll Break Down The Basics You Should Know About Form 8863, Including What It Is, Who Qualifies, What Expenses.

Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Education credits are based on the amount of the student’s adjusted qualified. Ad get ready for tax season deadlines by completing any required tax forms today. Education credits \(american opportunity and lifetime learning credits\) keywords:

Ensure You Understand The Eligibility Criteria, Tax Credit Options, And The Sections You Must Complete.

Use this tax form to claim the american opportunity tax credit. Web read the irs form 8863 for 2022 instructions before filling out the sample. Web form 8863 helps students find and claim the right education credit for their situation. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.

Web Information About Form 8863, Education Credits (American Opportunity And Lifetime Learning Credits), Including Recent Updates, Related Forms And Instructions On.

Web form 8863 above is for the 2022 taxes you’re filing in 2023 after the start of the tax season. Web form 8863 (2022) title: The american opportunity credit provides up to $2,500 in tax credit value per eligible student. This form is for income earned in tax year 2022, with tax returns due in april.

Complete, Edit Or Print Tax Forms Instantly.

Web lifetime learning credit if you do not qualify for the american opportunity credit, you may be able to take a credit of up to $2,000 for the total qualified education expenses paid for. Use the information on the form. If you can’t find it, or if. Web download this form print this form more about the federal form 8863 individual income tax tax credit ty 2022 we last updated the education credits (american opportunity.