Why Form Llc In Delaware

Why Form Llc In Delaware - Major delaware llc advantages 2. Here are few links to help you decide. Web here are some of the top reasons why delaware may be the best state for you to form your next business. Every new jersey llc’s name needs to contain “limited liability company,” “llc,” or “l.l.c.”. It also must be differentiable from the name of any business entity that has either been formed or qualified to do business in new jersey. You should not form an llc in delaware. Starting a business can be an exciting venture, and forming a limited liability company (llc) is one of the most popular ways to do so. Members and managers are only specified in the llc’s operating agreement, which is private by nature. Discover what these are so you can choose the right structure for you. Why form an llc in delaware?

Discover what these are so you can choose the right structure for you. Web delaware is often considered one of the best states to form an llc because it has limited fees and tax obligations. Here are few links to help you decide. Corporations had an average annual growth rate of 13.6%. We break down everything you need to know to decide if it's right for your business. Web if you don’t live in, or do business in delaware, and you’ve heard that you should form an llc in delaware, let me save you a lot of money and headaches: In fact, many businesses choose to form an llc in delaware even if they don’t. Additionally, the name cannot contain the words “banking,” “little league. Web answer (1 of 5): The disadvantages of forming an llc in delaware far outweigh any “advantages” you may have read.

The disadvantages of forming an llc in delaware far outweigh any “advantages” you may have read. Starting a business can be an exciting venture, and forming a limited liability company (llc) is one of the most popular ways to do so. It also must be differentiable from the name of any business entity that has either been formed or qualified to do business in new jersey. Therefore, delaware is a domicile of choice for many limited liability company owners. Members and managers are only specified in the llc’s operating agreement, which is private by nature. Web answer (1 of 5): You should not form an llc in delaware. Major delaware llc advantages 2. Currently, llcs account for over 70% of business entity formations in delaware. Corporations had an average annual growth rate of 13.6%.

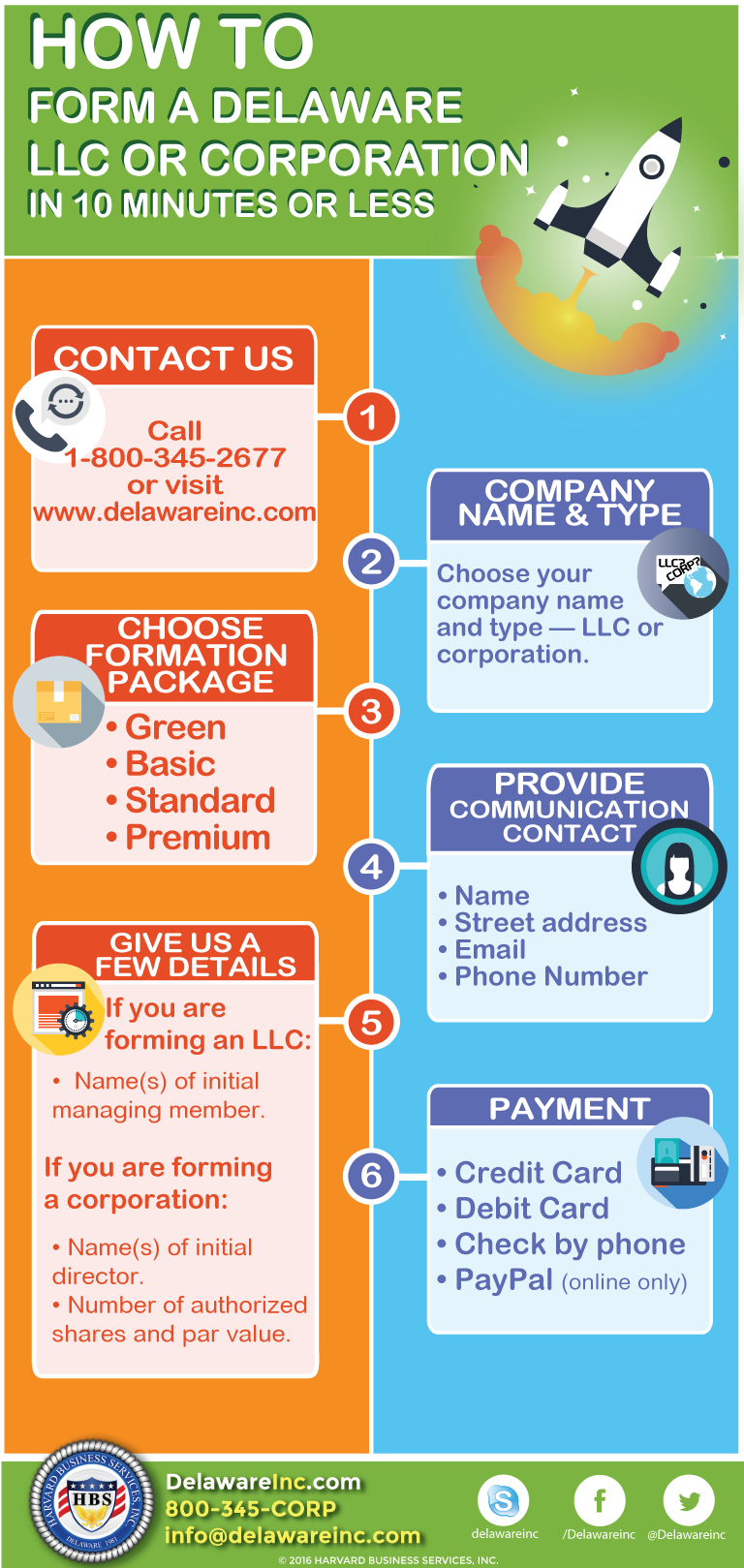

How to Form a Delaware LLC or Corporation in 10 Minutes

Currently, llcs account for over 70% of business entity formations in delaware. It also must be differentiable from the name of any business entity that has either been formed or qualified to do business in new jersey. You should not form an llc in delaware. Why form an llc in delaware? The disadvantages of forming an llc in delaware far.

Delaware LLC Everything You Need to Know Business Formations

First, a limited liability company (llc) offers a number of benefits and liability protections to the business owner and llc members that would not be available under other business structures. Web if you don’t live in, or do business in delaware, and you’ve heard that you should form an llc in delaware, let me save you a lot of money.

How And Why To Form An LLC In New York Why You Need To Know In 2020

Corporations had an average annual growth rate of 13.6%. You should not form an llc in delaware. Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to. Web answer (1.

How To Register An LLC In Delaware (In Only 5 Steps)

Web here are some of the top reasons why delaware may be the best state for you to form your next business. Members and managers are only specified in the llc’s operating agreement, which is private by nature. Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance.

Why Form a Corporation in Delaware? YouTube

In fact, many businesses choose to form an llc in delaware even if they don’t. Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to. Therefore, delaware is a domicile.

Delaware LLC How to Start an LLC in Delaware TRUiC

Why form an llc in delaware? Web answer (1 of 5): Starting a business can be an exciting venture, and forming a limited liability company (llc) is one of the most popular ways to do so. Major delaware llc advantages 2. Members and managers are only specified in the llc’s operating agreement, which is private by nature.

Why should I incorporate in Delaware or form an LLC in Delaware? YouTube

Why form an llc in delaware? I have been trying to do the same, but so far the information i have collected is not encouraging. Web here are some of the top reasons why delaware may be the best state for you to form your next business. It also must be differentiable from the name of any business entity that.

Forming A Delaware Llc Form Resume Examples Wk9yALL93D

Web incorporating in delaware offers a number of significant tax advantages. Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to. If you live in nj and do/will do even.

Why form LLC company when start new business? market

The disadvantages of forming an llc in delaware far outweigh any “advantages” you may have read. Here are few links to help you decide. Web answer (1 of 5): Freedom of contract entrepreneurs may wonder: We break down everything you need to know to decide if it's right for your business.

Why Form a Delaware LLC? YouTube

Every new jersey llc’s name needs to contain “limited liability company,” “llc,” or “l.l.c.”. Web answer (1 of 5): Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to. You.

We Break Down Everything You Need To Know To Decide If It's Right For Your Business.

You should not form an llc in delaware. Web here are some of the top reasons why delaware may be the best state for you to form your next business. Freedom of contract entrepreneurs may wonder: Starting a business can be an exciting venture, and forming a limited liability company (llc) is one of the most popular ways to do so.

The Disadvantages Of Forming An Llc In Delaware Far Outweigh Any “Advantages” You May Have Read.

It also must be differentiable from the name of any business entity that has either been formed or qualified to do business in new jersey. Currently, llcs account for over 70% of business entity formations in delaware. First, a limited liability company (llc) offers a number of benefits and liability protections to the business owner and llc members that would not be available under other business structures. Additionally, the name cannot contain the words “banking,” “little league.

Corporations Had An Average Annual Growth Rate Of 13.6%.

Web delaware is often considered one of the best states to form an llc because it has limited fees and tax obligations. Web answer (1 of 5): If you live in nj and do/will do even a tiny fraction of business in nj, you will have to register as a. Members and managers are only specified in the llc’s operating agreement, which is private by nature.

Here Are Few Links To Help You Decide.

Web as you start a new business, you may ask yourself, why form a delaware llc? with minimal startup requirements, simple maintenance and the ability for members to establish their own company structures and rules, there are many advantages to. In fact, many businesses choose to form an llc in delaware even if they don’t. Every new jersey llc’s name needs to contain “limited liability company,” “llc,” or “l.l.c.”. Discover what these are so you can choose the right structure for you.