When Is Form 990 Due For 2022

When Is Form 990 Due For 2022 - Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web 2022 form 990 form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web nonprofit tax returns due date finder. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web form 990 filing deadline for calendar year taxpayers. Private foundations filing a form 4720 for cy 2022 must. It should be noted that if tax is due, the extension does not. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for.

Also, if you filed an 8868 extension on. Web if your organization’s accounting tax period starts on april 1, 2022, and ends on march 31, 2023, your form 990 is due by august 15, 2023. Web 2022 form 990 form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. If you need assistance with. Web form 990 return of organization exempt from income tax omb no. Web form 8868 should be used to request the automatic extension and can be filed electronically or by paper. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to.

Ending date of tax year. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15,. Web 2022 form 990 form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. For organizations on a calendar. Web form 990 filing deadline for calendar year taxpayers. Web upcoming 2023 form 990 deadline: Web nonprofit tax returns due date finder. May 15 is the 990 filing deadline for calendar year tax filers. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web form 990 return of organization exempt from income tax omb no. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web when is form 990 due?.

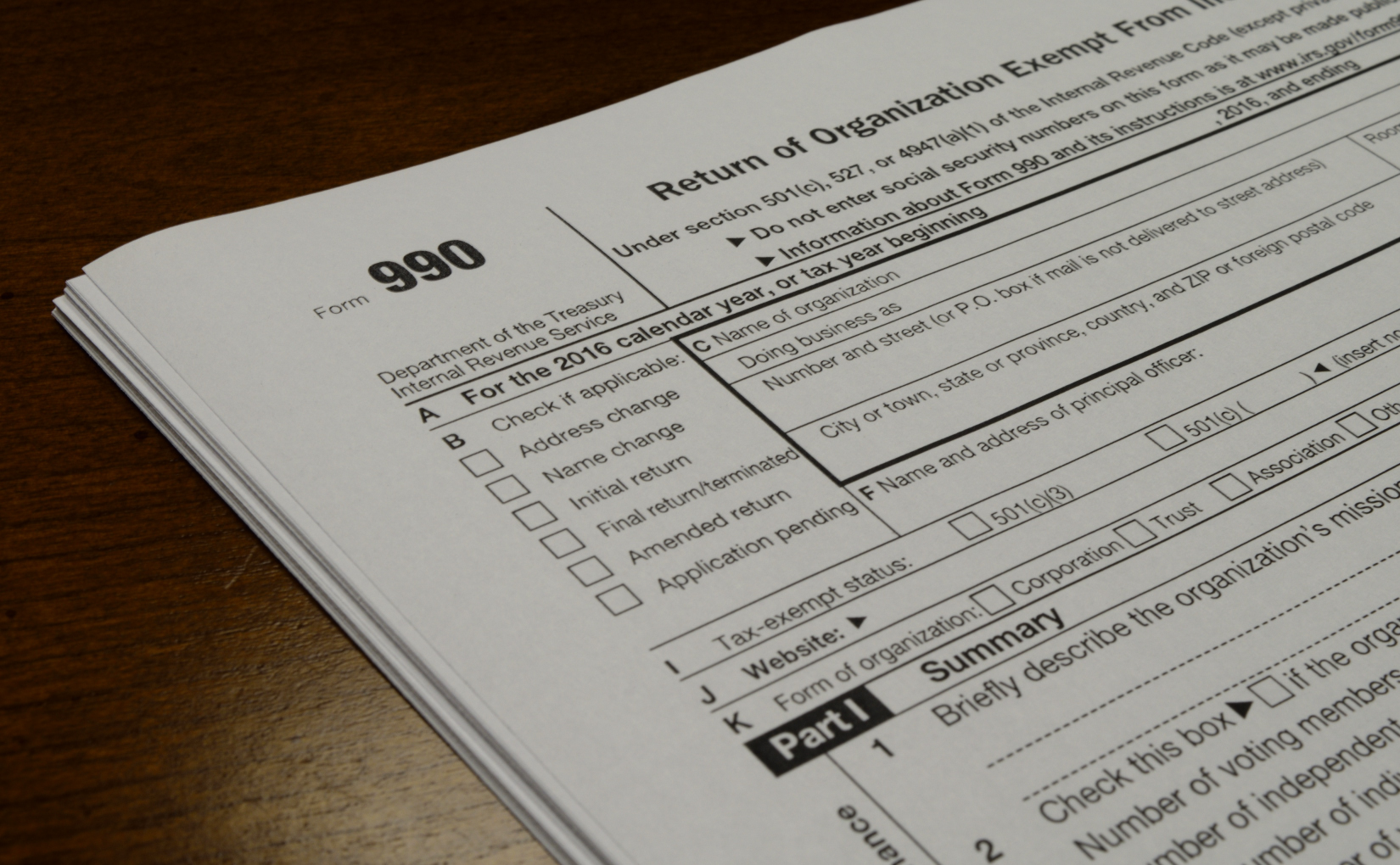

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web to use the table, you must know when your organization’s tax year ends. Web form 990 return of organization exempt from income tax omb no. Exempt organizations with a filing obligation. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. See where can i.

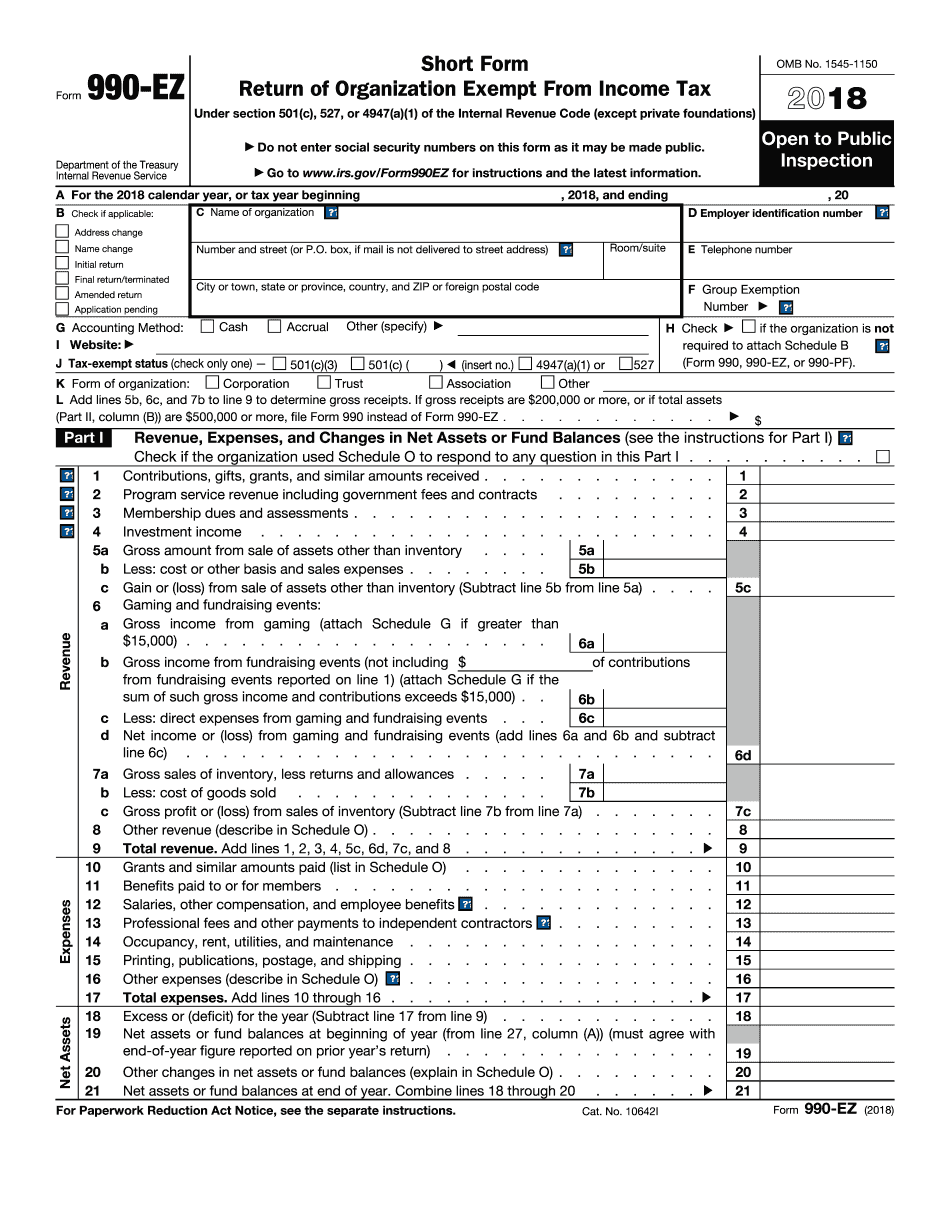

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

If you need assistance with. Ending date of tax year. Web monday, april 25, 2022 by justin d. Exempt organizations with a filing obligation. Web form 990 return of organization exempt from income tax omb no.

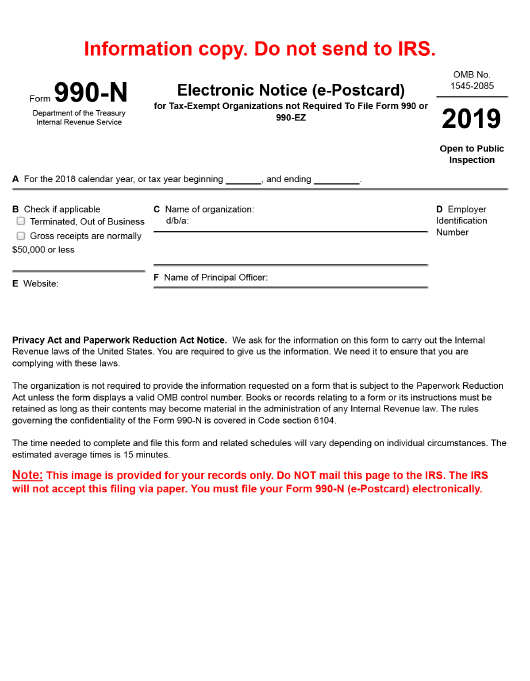

Printable 990 N Form Printable Form 2022

Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web upcoming 2023 form 990 deadline: Exempt organizations with a.

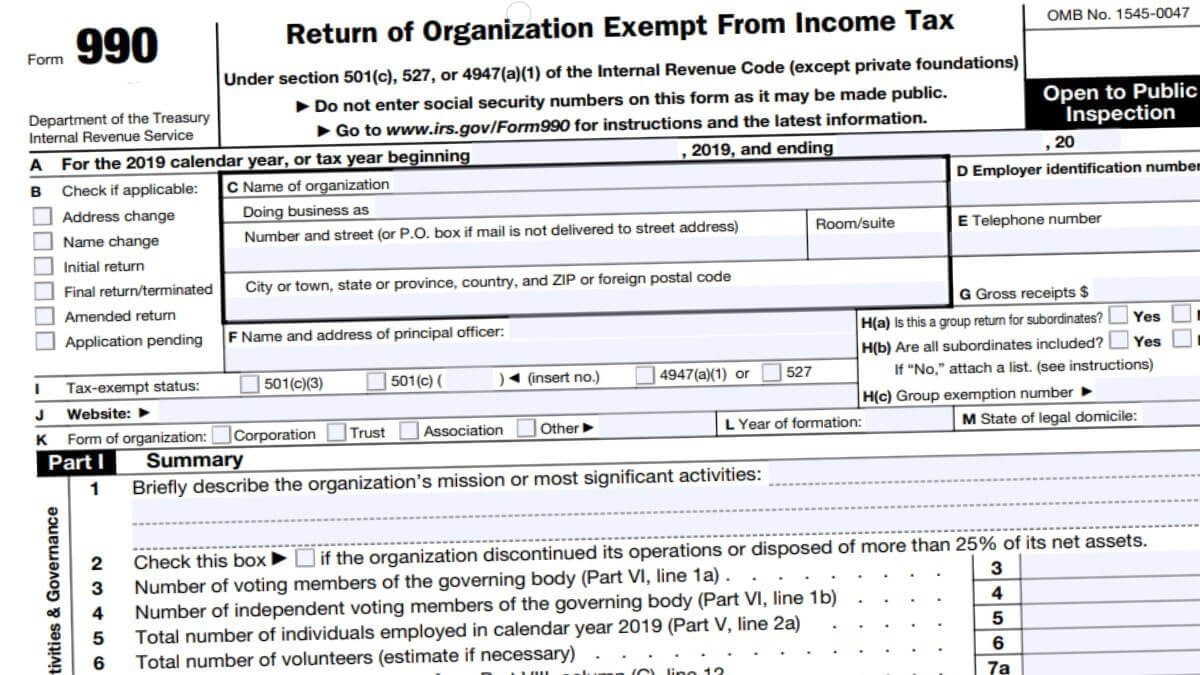

Form 990 Due Today! Nonprofit Law Blog

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web to use the table, you must know when your organization’s tax year ends. (do not net amounts due or paid to other sources. Web form 8868 should.

Irs 1040 Form 2021 / What Is IRS Form 8821? IRS Tax Attorney You

May 15 is the 990 filing deadline for calendar year tax filers. Also, if you filed an 8868 extension on. Web monday, april 25, 2022 by justin d. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15,. Web form 990 filing deadline for calendar.

Form 990 or 990EZ (Sch C) Political Campaign and Lobbying Activities

Also, if you filed an 8868 extension on. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web form 990 filing deadline for calendar year taxpayers. Web form 8868 should be used to request the automatic extension and can be filed electronically or.

The UO Foundation’s IRS 990 was due Nov 15. They’ve taken 2 extensions

Web form 990 filing deadline for calendar year taxpayers. Web 2022 form 990 form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. May 15 is.

What Is A 990 Tax Form For Nonprofits Douroubi

Also, if you filed an 8868 extension on. Web 2022 form 990 form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023..

Is Your Form 990 Due Today? Blog TaxBandits

Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for. May 15 is the 990 filing deadline for calendar year tax filers. Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. (do not.

(Do Not Net Amounts Due Or Paid To Other Sources.

If you need assistance with. Web upcoming 2023 form 990 deadline: Web when is form 990 due? May 15 is the 990 filing deadline for calendar year tax filers.

Web The Form 990 Tax Return Is Due By The 15Th Day Of The 5Th Month Following Your Chapter's Fiscal Year End.

Web if your organization’s accounting tax period starts on april 1, 2022, and ends on march 31, 2023, your form 990 is due by august 15, 2023. Ending date of tax year. Due to the large volume. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15,.

Web Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates December 8, 2021 It Has Been A Couple Of Strange And Stressful Years, With Due Dates That Seemed.

Web to use the table, you must know when your organization’s tax year ends. Web form 990 return of organization exempt from income tax omb no. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. See where can i find my fiscal year end?

Web Form 990 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The Internal.

Private foundations filing a form 4720 for cy 2022 must. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for. Also, if you filed an 8868 extension on. Web nonprofit tax returns due date finder.

.PNG)