When Does Form 5498 Come Out

When Does Form 5498 Come Out - Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. Web in 2021, the irs extended this deadline to june 30. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made in 2022 for the 2021 tax year). There are two form 5498 mailing periods: What if an irs form 5498 has not been received or has been misplaced? We’ll be mailing irs form 5498 to ira policyholders who had. Plan administrators should use form 5498 to report.

What if an irs form 5498 has not been received or has been misplaced? We’ll be mailing irs form 5498 to ira policyholders who had. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. There are two form 5498 mailing periods: Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. The fair market value listed on my form 5498 is zero. Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you can expect to receive irs form. Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year.

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. Web in 2021, the irs extended this deadline to june 30. Web since everyone usually has until april 15 to make contributions, the irs usually gives custodians until may 31 to send form 5498. However, that does not appear to be the case for 2022. We’ll be mailing irs form 5498 to ira policyholders who had. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. 31 for fmv and rmds, and april. The fair market value listed on my form 5498 is zero. What if an irs form 5498 has not been received or has been misplaced?

The Purpose of IRS Form 5498

31 for fmv and rmds, and april. We’ll be mailing irs form 5498 to ira policyholders who had. There are two form 5498 mailing periods: What if an irs form 5498 has not been received or has been misplaced? The fair market value listed on my form 5498 is zero.

IRS Form 5498 What It Is and What The IRS Extension Means For Your IRA

However, that does not appear to be the case for 2022. Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. Web the form will be mailed to you in late may after all contributions have been made for that year. When you.

5498 Software to Create, Print & EFile IRS Form 5498

There are two form 5498 mailing periods: Web the form will be mailed to you in late may after all contributions have been made for that year. Plan administrators should use form 5498 to report. Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. However, that does.

File 2020 Form 5498SA Online EFile as low as 0.50/Form

The fair market value listed on my form 5498 is zero. However, that does not appear to be the case for 2022. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement.

Form 5498 For Fill Out and Sign Printable PDF Template signNow

Plan administrators should use form 5498 to report. Web for example, if you made contributions to a traditional ira for the 2020 tax year between january 31, 2020 and april 15, 2021, you should receive a form 5498 in may of 2021. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web in.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. Web up to 10% cash back these contributions can be reported on a form 5498 for the year in which the contribution is made (e.g., made in 2022 for the 2021 tax year). Web the information on form 5498 is submitted to the internal.

An Explanation of IRS Form 5498

We’ll be mailing irs form 5498 to ira policyholders who had. Web in 2021, the irs extended this deadline to june 30. Web since everyone usually has until april 15 to make contributions, the irs usually gives custodians until may 31 to send form 5498. Web the form will be mailed to you in late may after all contributions have.

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

However, that does not appear to be the case for 2022. What if an irs form 5498 has not been received or has been misplaced? Web 1 min read we’ve received a lot of enquiries asking where to enter form 5498 in turbotax, so we thought we’d start out with this topic. Plan administrators should use form 5498 to report..

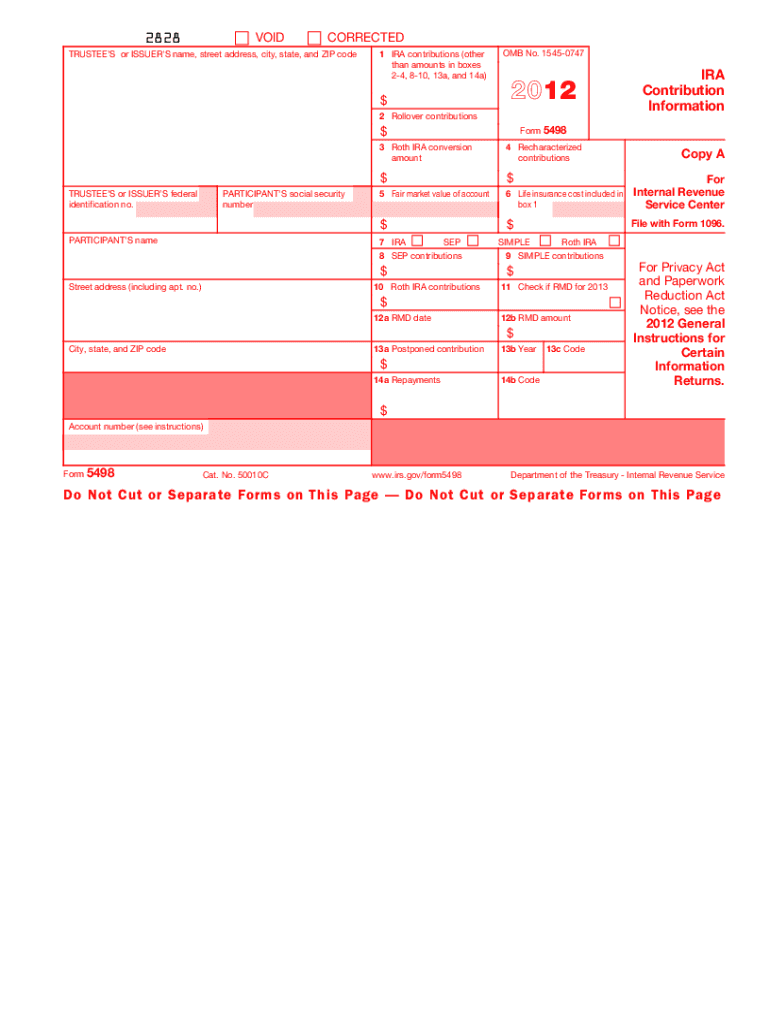

IRS Form 5498 IRA Contribution Information

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web for example, if you made contributions to a traditional ira for the.

What is Form 5498? New Direction Trust Company

Web in 2021, the irs extended this deadline to june 30. 31 for fmv and rmds, and april. Web since everyone usually has until april 15 to make contributions, the irs usually gives custodians until may 31 to send form 5498. Plan administrators should use form 5498 to report. Web instructions for participant the information on form 5498 is submitted.

Web Since Everyone Usually Has Until April 15 To Make Contributions, The Irs Usually Gives Custodians Until May 31 To Send Form 5498.

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. There are two form 5498 mailing periods: Web in 2021, the irs extended this deadline to june 30.

Web For Example, If You Made Contributions To A Traditional Ira For The 2020 Tax Year Between January 31, 2020 And April 15, 2021, You Should Receive A Form 5498 In May Of 2021.

31 for fmv and rmds, and april. Web shows traditional ira contributions for 2023 you made in 2023 and through april 15, 2024. Web the form will be mailed to you in late may after all contributions have been made for that year. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,.

Web 1 Min Read We’ve Received A Lot Of Enquiries Asking Where To Enter Form 5498 In Turbotax, So We Thought We’d Start Out With This Topic.

Web institutions and trustees are normally required to file form 5498 with the irs by may 31 of the current tax year. Web irs form 5498s are mailed out from pacific life to qualifying owners by may 31. Plan administrators should use form 5498 to report. Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the.

We’ll Be Mailing Irs Form 5498 To Ira Policyholders Who Had.

Web updated for tax year 2022 • june 2, 2023 08:44 am overview if you made contributions to an ira in the preceding tax year, you can expect to receive irs form. The fair market value listed on my form 5498 is zero. What if an irs form 5498 has not been received or has been misplaced? Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to).

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

/487097635-57a631af5f9b58974a3aceb1.jpg)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)