What Is Total Tax Liability On Form 4868

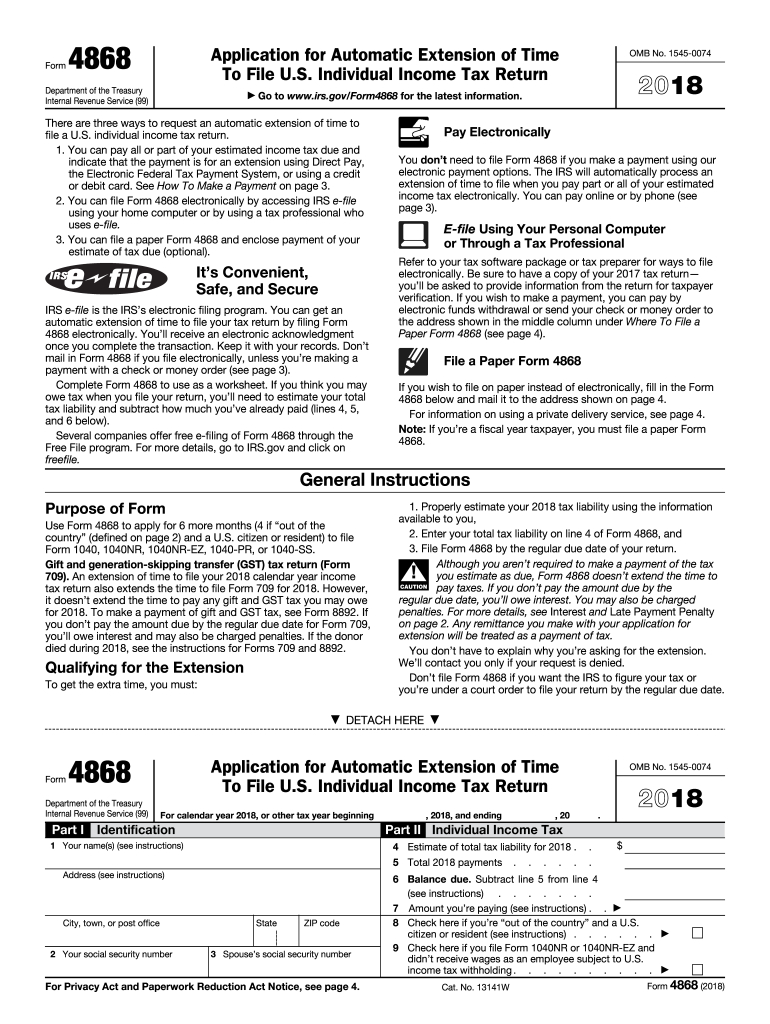

What Is Total Tax Liability On Form 4868 - Web form 4868, also known as an “application for automatic extension of time to file u.s. Web solved•by turbotax•1276•updated 1 month ago. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. Web how do i estimate extension tax liability? Citizen or resident files this form to request an. Web enter the total amount that you plan to pay with your extension. If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Estimate your overall tax liability. Your tax liability minus your tax payments would be the total balance due on your return. Web here are three ways to estimate your taxes for form 4868.

Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. In general, when people refer to this term they’re. Your total liability would also include any balances. Estimate your overall tax liability. Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). Web solved•by turbotax•1276•updated 1 month ago. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Web the estimate of your total tax liability (the amount that your preliminary calculations indicate you must pay for the year) the total of any payments you've already. Individual income tax return,” is a form that taxpayers can file with the irs if. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and.

Web here are three ways to estimate your taxes for form 4868. Web this short form should be completed with the individual or married couple's names, address, social security numbers, an estimate of total tax liability for the year,. Estimate your overall tax liability. In general, when people refer to this term they’re. Web your tax liability is what you owe to the irs or another taxing authority when you finish preparing your tax return. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Your total liability would also include any balances. Web how do i estimate extension tax liability? Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below).

FREE 11+ Sample General Liability Forms in PDF MS Word Excel

Your tax liability minus your tax payments would be the total balance due on your return. Individual income tax return,” is a form that taxpayers can file with the irs if. Web in case you need more time to file your 1040 tax return, you can use form 4868, application for automatic extension of time to file u.s. Web if.

How to File a Tax Extension? ZenLedger

Web the definition of tax liability is the amount of money or debt, an individual or entity owes in taxes to the government. Citizen or resident files this form to request an. Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid.

It’s About Your Total Tax Liability, Not Your Refund Tax Policy Center

Web in case you need more time to file your 1040 tax return, you can use form 4868, application for automatic extension of time to file u.s. Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Citizen or resident files this form to request an. In general, when people refer to this term they’re. Web the form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect.

Know about IRS tax extension Form 4868 TaxEz

Individual income tax return,” is a form that taxpayers can file with the irs if. Your total liability would also include any balances. Web how do i estimate extension tax liability? Use the estimated tax worksheet in the instructions for. Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax.

E File Tax Form 4868 Online Universal Network

Web your tax liability is what you owe to the irs or another taxing authority when you finish preparing your tax return. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need to provide the following information: Web solved•by turbotax•1276•updated 1 month ago. Web line 4 ― estimate of total tax liability.

Tax Withholding Brackets 2020

Your total liability would also include any balances. Your tax liability minus your tax payments would be the total balance due on your return. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. Web the form will ask you to estimate how.

IRS Form 4868 Online File 2020 IRS 4868

Below, find an example of the latest available form 4868. Web the definition of tax liability is the amount of money or debt, an individual or entity owes in taxes to the government. Citizen or resident files this form to request an. Web this short form should be completed with the individual or married couple's names, address, social security numbers,.

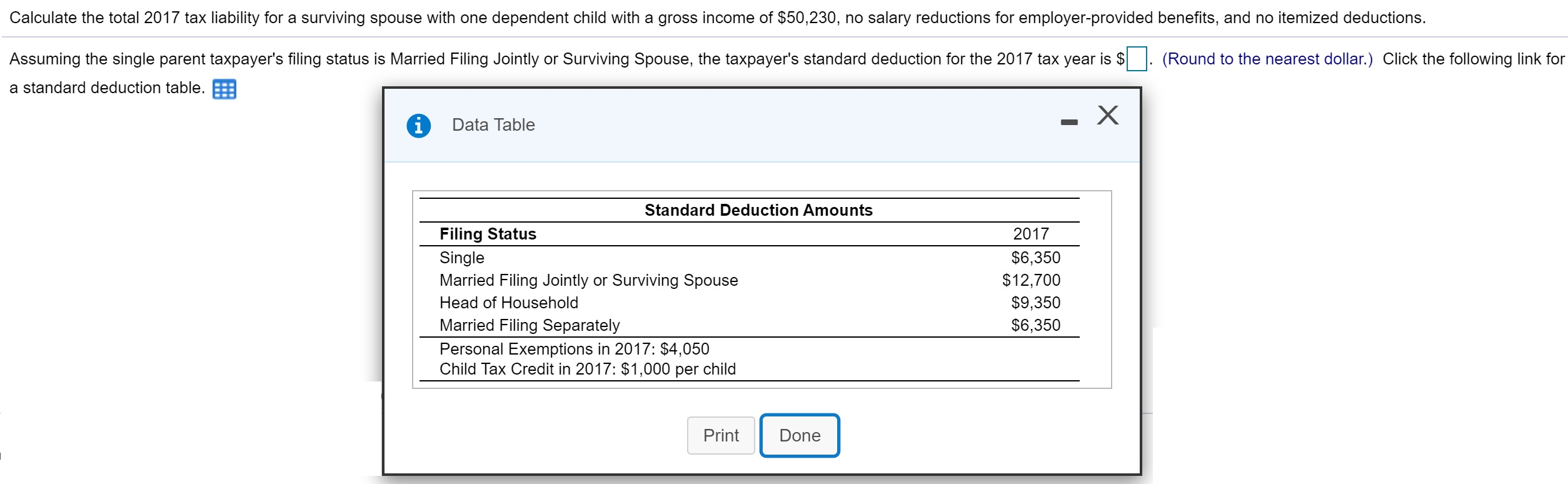

Solved Calculate the total 2017 tax liability for a

Estimate your overall tax liability. Web the estimate of your total tax liability (the amount that your preliminary calculations indicate you must pay for the year) the total of any payments you've already. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return..

Learn How to Fill the Form 4868 Application for Extension of Time To

In general, when people refer to this term they’re. 1 min read to estimate your taxes due/balance owed, you can do either of these: If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Web how to complete a form 4868 (step by step) to complete a form 4868, you will need.

Web The Definition Of Tax Liability Is The Amount Of Money Or Debt, An Individual Or Entity Owes In Taxes To The Government.

Web here are three ways to estimate your taxes for form 4868. Citizen or resident files this form to request an. Web how do i estimate extension tax liability? 1 min read to estimate your taxes due/balance owed, you can do either of these:

Web In Case You Need More Time To File Your 1040 Tax Return, You Can Use Form 4868, Application For Automatic Extension Of Time To File U.s.

Web if you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). Individual income tax return,” is a form that taxpayers can file with the irs if. Web line 4 ― estimate of total tax liability for the year enter the total income tax liability that you expect to report on your tax return. In general, when people refer to this term they’re.

Web This Short Form Should Be Completed With The Individual Or Married Couple's Names, Address, Social Security Numbers, An Estimate Of Total Tax Liability For The Year,.

Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Below, find an example of the latest available form 4868. Web enter the total amount that you plan to pay with your extension. Your total liability would also include any balances.

This Amount Will Be Shown On Your Tax Form.

Web your tax liability is what you owe to the irs or another taxing authority when you finish preparing your tax return. Use the estimated tax worksheet in the instructions for. If you submitted form 4868 for a 2022 tax filing extension before april 18, your new submission deadline. Estimate your overall tax liability.