What Is The Debt Limit For Chapter 7

What Is The Debt Limit For Chapter 7 - You can have an infinite amount of debt and still be able to file for. Liquidation under chapter 7 is a common form of bankruptcy. Web when a debt is a joint obligation, such as a car loan, a chapter 7 bankruptcy will not eliminate the debt. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. It is available to individuals who cannot. Web if you want to use chapter 7 bankruptcy to get rid of debt, your income can't exceed the chapter 7 income limits or you won't pass. They may be mired in credit card debt or. If you are not sure if you qualify for chapter. Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured.

Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. Pursuant to the united states code, certain dollar amounts are adjusted to reflect the change in the. Web calculating your household income to determine your chapter 7 bankruptcy income limit, add the last six months of your gross. You can have an infinite amount of debt and still be able to file for. Web since chapter 7 bankruptcy doesn’t involve a repayment plan of any kind, congress worried about an abuse of the. Liquidation under chapter 7 is a common form of bankruptcy. Web when a debt is a joint obligation, such as a car loan, a chapter 7 bankruptcy will not eliminate the debt. Web for some people, chapter 7 bankruptcy sounds too good to be true. They may be mired in credit card debt or. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is.

Liquidation under chapter 7 is a common form of bankruptcy. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. Web for many filers, chapter 7 is the first choice because it erases most debt. It is available to individuals who cannot. For our purposes here, the most important distinction is that there is. If you are not sure if you qualify for chapter. Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. Web when a debt is a joint obligation, such as a car loan, a chapter 7 bankruptcy will not eliminate the debt. Web how much debt do i need to file for chapter 7? It has the power to lift a major.

Risking the Recovery Debt Limit Uncertainty Returns

For our purposes here, the most important distinction is that there is. Web since chapter 7 bankruptcy doesn’t involve a repayment plan of any kind, congress worried about an abuse of the. If you are not sure if you qualify for chapter. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter.

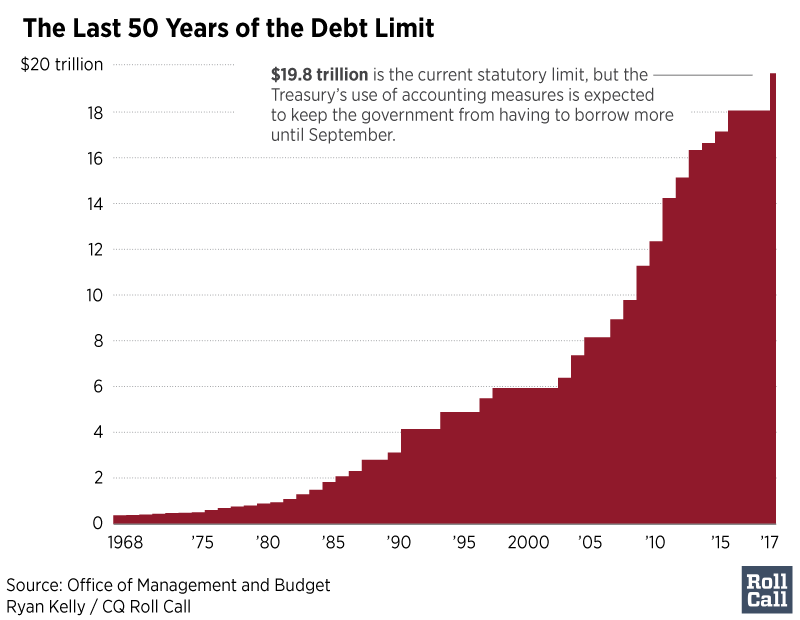

Infographic The Debt Limit

Web for many filers, chapter 7 is the first choice because it erases most debt. You can have an infinite amount of debt and still be able to file for. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. Pursuant to the united states code, certain dollar amounts.

The Debt Limit Explained — CGP Grey

It has the power to lift a major. Pursuant to the united states code, certain dollar amounts are adjusted to reflect the change in the. Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. Web in a chapter 7 bankruptcy, there are no guidelines or limits to the debt amounts.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. Web for many filers, chapter 7 is the first choice because it erases most debt. If you are not sure if you qualify for chapter. The undeniable upside to filing for chapter 7 bankruptcy is the debt relief it.

Will GOP Settle for a Clean Debt Limit Win?

Pursuant to the united states code, certain dollar amounts are adjusted to reflect the change in the. If you are not sure if you qualify for chapter. They may be mired in credit card debt or. Web how much debt do i need to file for chapter 7? For our purposes here, the most important distinction is that there is.

Watch This — The Debt Limit Explained

Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. Web in a chapter 7 bankruptcy, there are no guidelines or limits to the debt amounts included in a chapter 7. Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and.

Chapter 7 Debt Limits and Chapter 13 Debit Limits in Arizona Bankruptcy

Web mallinckrodt to file for chapter 11 bankruptcy again and leave $1 billion of $1.7 billion opioid settlement unpaid. The undeniable upside to filing for chapter 7 bankruptcy is the debt relief it provides. If you are not sure if you qualify for chapter. You can have an infinite amount of debt and still be able to file for. Pursuant.

What Is The Unsecured Debt Limit For Chapter 13? John Vitela

Web the company proposed scheduling a chapter 15 recognition hearing for sept. Web in a chapter 7 bankruptcy, there are no guidelines or limits to the debt amounts included in a chapter 7. Web a chapter 13 case begins by filing a petition with the bankruptcy court serving the area where the debtor has a domicile or. Liquidation under chapter.

Debt Limit Brinksmanship Threatens to Return Bipartisan Policy Center

Web when a debt is a joint obligation, such as a car loan, a chapter 7 bankruptcy will not eliminate the debt. For our purposes here, the most important distinction is that there is. You can have an infinite amount of debt and still be able to file for. It is available to individuals who cannot. Web for some people,.

debtlimit Fed Savvy

If you are not sure if you qualify for chapter. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. It is available to individuals who cannot. Web the company proposed scheduling a chapter 15 recognition hearing for sept. Web abuse is presumed if the debtor's current monthly income.

You Can Have An Infinite Amount Of Debt And Still Be Able To File For.

Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured. Web if you want to use chapter 7 bankruptcy to get rid of debt, your income can't exceed the chapter 7 income limits or you won't pass. Web how much debt do i need to file for chapter 7? For our purposes here, the most important distinction is that there is.

Web I Have Good News On This Front, The Answer Is, That There's No Limit.

Liquidation under chapter 7 is a common form of bankruptcy. It has the power to lift a major. It is available to individuals who cannot. If you are not sure if you qualify for chapter.

Web A Chapter 13 Case Begins By Filing A Petition With The Bankruptcy Court Serving The Area Where The Debtor Has A Domicile Or.

Web the company proposed scheduling a chapter 15 recognition hearing for sept. Web however, the passage of this law eliminated this distinction, and now, the total debt limit for chapter 13 cases is. Pursuant to the united states code, certain dollar amounts are adjusted to reflect the change in the. Web in a chapter 7 bankruptcy, there are no guidelines or limits to the debt amounts included in a chapter 7.

Web Since Chapter 7 Bankruptcy Doesn’t Involve A Repayment Plan Of Any Kind, Congress Worried About An Abuse Of The.

Web when a debt is a joint obligation, such as a car loan, a chapter 7 bankruptcy will not eliminate the debt. Web for many filers, chapter 7 is the first choice because it erases most debt. They may be mired in credit card debt or. Web calculating your household income to determine your chapter 7 bankruptcy income limit, add the last six months of your gross.