What Is The Account Number On A 1099 Form

What Is The Account Number On A 1099 Form - For your protection, this form will show. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. There are several types of 1099s used for different purposes, and form 1099. Employment authorization document issued by the department of homeland. Web you have in your account. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web the maximum length of the account number field is 20 alpha or numeric characters. Web definition and examples of form 1099. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. The account number is also required if.

Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web who should receive a 1099 form? The account number is also required if. use the account number box, when. Prior to tax year 2020,. Web the maximum length of the account number field is 20 alpha or numeric characters. Web definition and examples of form 1099. For your protection, this form will show. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs).

For your protection, this form will show. Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web what is a 1099 form? The account number is also required if. Web you have in your account. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. This is an informational only field and does not. Web definition and examples of form 1099. Items in quotes are from the irs general instructions. Prior to tax year 2020,.

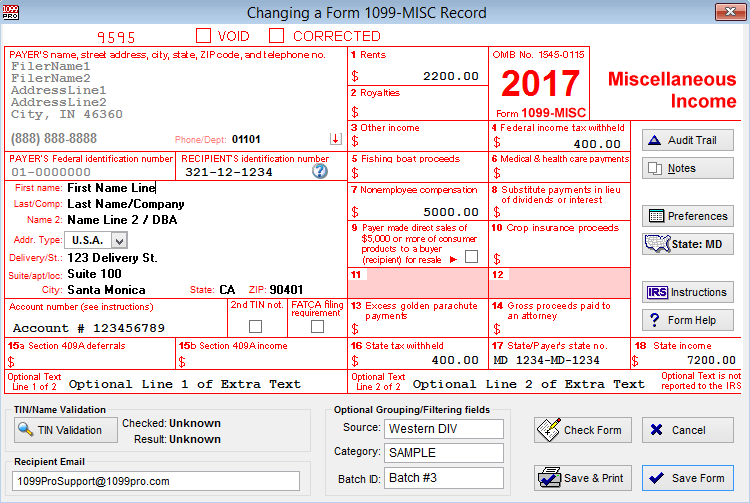

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

For your protection, this form will show. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. The account number is also required if. Web who should receive a 1099 form? Prior to tax year 2020,.

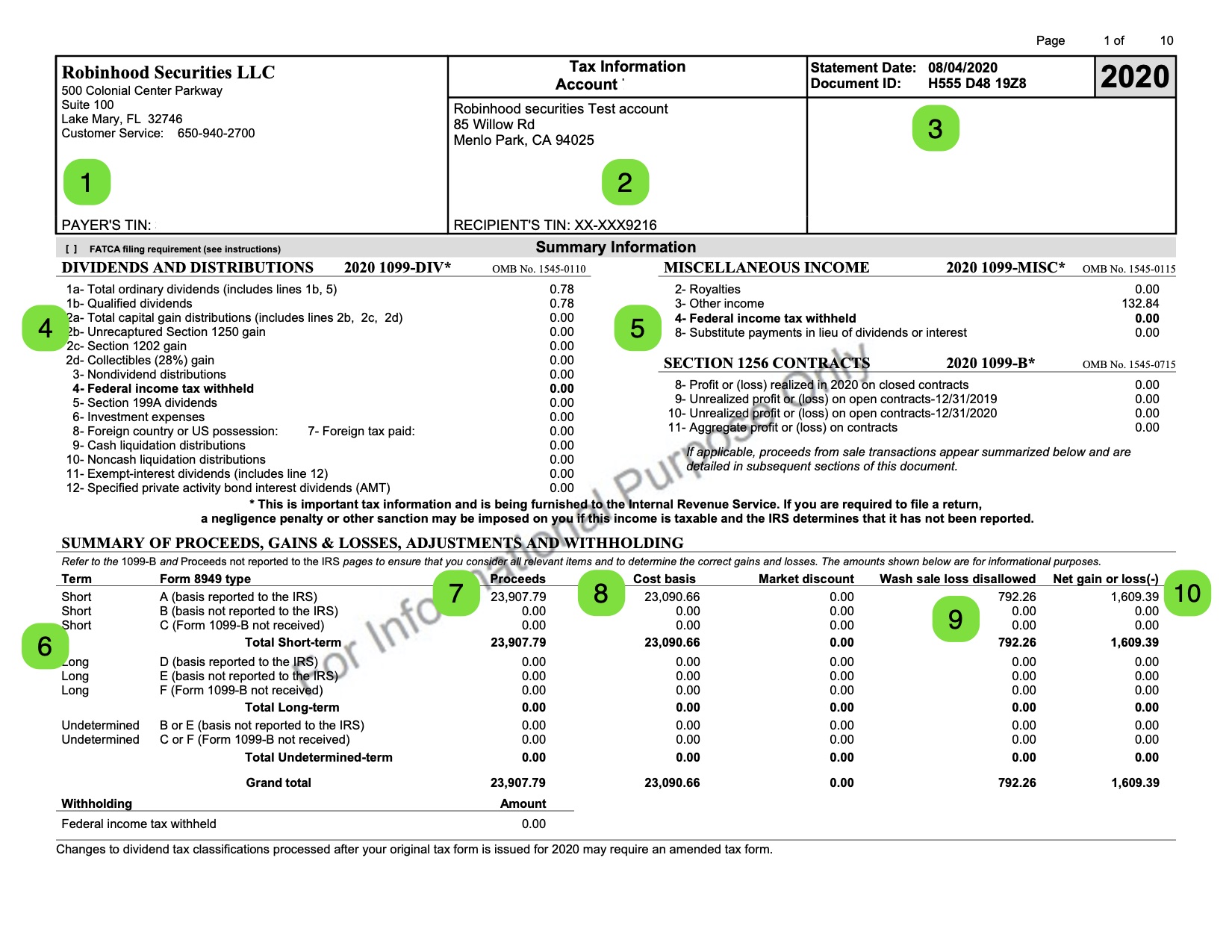

Understanding your 1099 Robinhood

Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web definition and.

1099NEC Software Print & eFile 1099NEC Forms

use the account number box, when. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web you have in your account. For your protection, this form will show. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income.

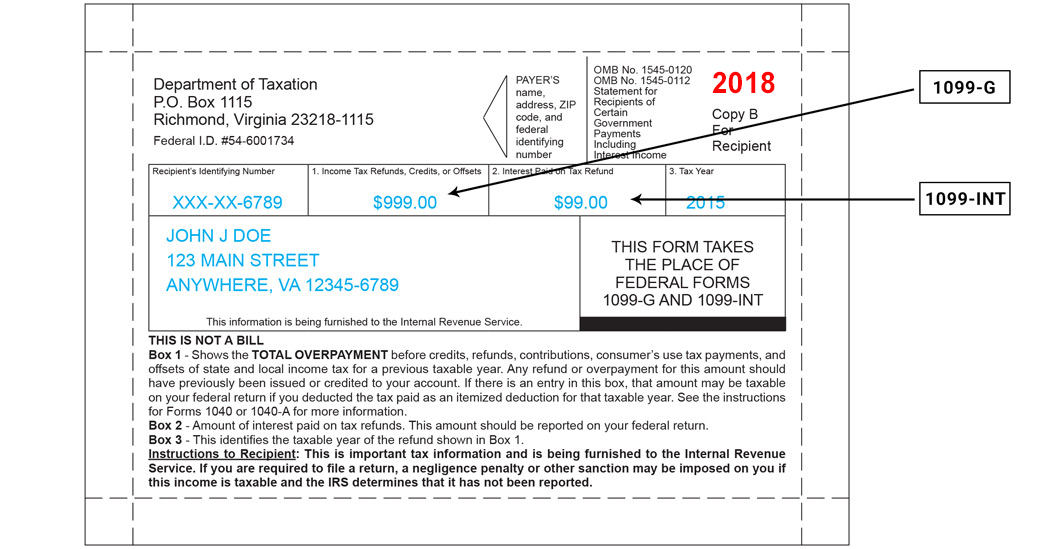

Your 1099G/1099INT What You Need to Know Virginia Tax

Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs). use the account number box, when. The.

1099 Int Form Bank Of America Universal Network

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web what is a 1099 form? Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web september 2, 2022 a 1099 is a tax form that is.

What is the Account Number on a 1099MISC form? Workful Blog

Items in quotes are from the irs general instructions. There are several types of 1099s used for different purposes, and form 1099. Prior to tax year 2020,. Web what is a 1099 form? The consolidated form 1099 reflects information that is reported to the internal revenue service (irs).

Form 1099G Definition

For your protection, this form will show. Prior to tax year 2020,. This is an informational only field and does not. Web what is a 1099 form? Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the.

What is the Account Number on a 1099MISC form? Workful

Web what is a 1099 form? The account number is also required if. Web the maximum length of the account number field is 20 alpha or numeric characters. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. Tax form.

Form 1099INT Interest Definition

Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. For your protection, this form will show. Web you have in your account. Form 1099 is.

How To File Form 1099 Misc Without Social Security Number Form

Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web the maximum length of the account number field is 20 alpha or numeric characters. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web what is.

Tax Form That Reports Distributions Made From A Health Savings Account ( Hsa ), Archer Medical Savings Account (Archer Msa), Or.

Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. The account number is also required if. use the account number box, when. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs).

Items In Quotes Are From The Irs General Instructions.

Web the maximum length of the account number field is 20 alpha or numeric characters. For your protection, this form will show. There are several types of 1099s used for different purposes, and form 1099. This is an informational only field and does not.

Web What Is A 1099 Form?

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web you have in your account. Web who should receive a 1099 form? Employment authorization document issued by the department of homeland.

Prior To Tax Year 2020,.

Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web definition and examples of form 1099. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Form 1099 is a type of tax form that records payments received that don't come from salary or wages.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)