What Is Form 8938

What Is Form 8938 - Web form 8938, statement of specified foreign financial assets. Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Define irs form 8938 on march 18, 2010, president obama signed the foreign account tax compliance act (fatca) into law, and form 8938 was one of the new forms created. Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web how do i file form 8938, statement of specified foreign financial assets? Back to top specific examples: Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. Web form 8938 is used by certain u.s.

It is part of fatca, an act passed by the obama administration in 2010 to curb foreign tax evasion. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Here’s everything you need to know about this form: Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). You must file form 8938 with your annual tax return by tax day if it's required. Web form 8938 is used by certain u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web about form 8938, statement of specified foreign financial assets.

Web form 8938 is used by certain u.s. Back to top specific examples: Web about form 8938, statement of specified foreign financial assets. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web what is form 8938? Web form 8938, statement of specified foreign financial assets. Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold If you are a beneficiary of the foreign trust, you may have to file form 8938 to report your interest in. Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d.

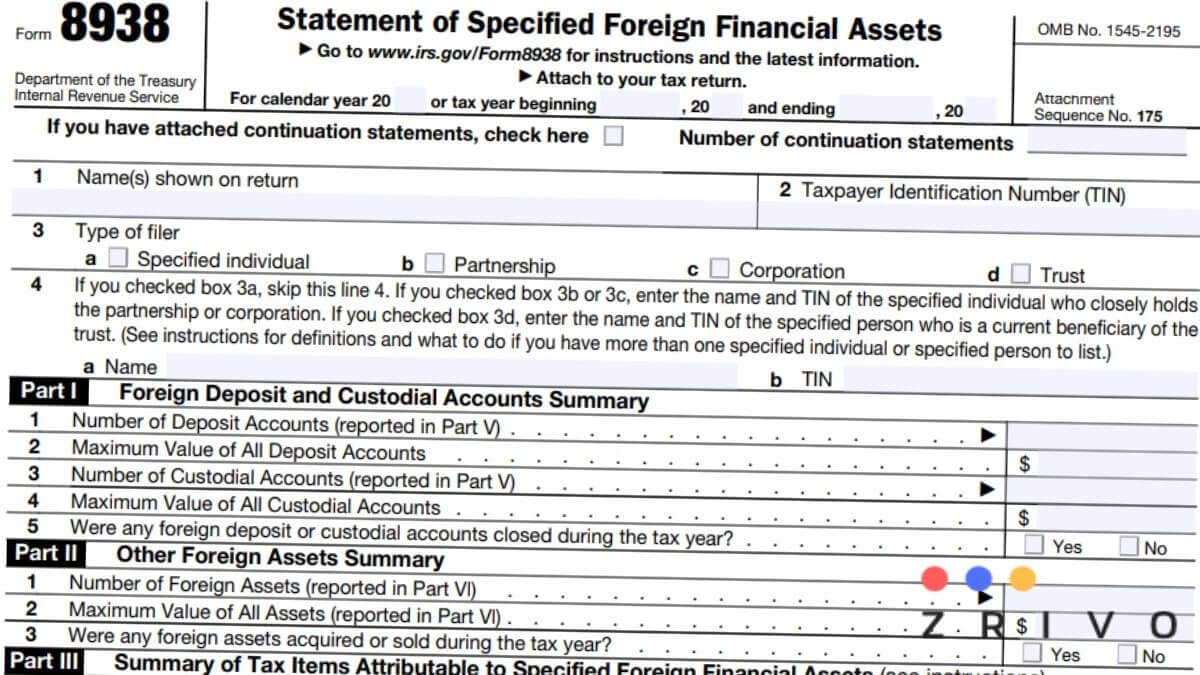

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold It is part of fatca, an act passed by the obama administration in 2010 to curb foreign tax evasion. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax.

Social Security NonTax Considerations « TaxExpatriation

Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Here’s everything you need to know about this form: If you are a beneficiary of the foreign trust, you may have to file form 8938 to report.

8938 Form 2021

For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Specified individuals and specified domestic entities that have an.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Back to top specific examples: Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. Web form 8938, statement of specified foreign financial assets. Use form 8938 to report your specified foreign.

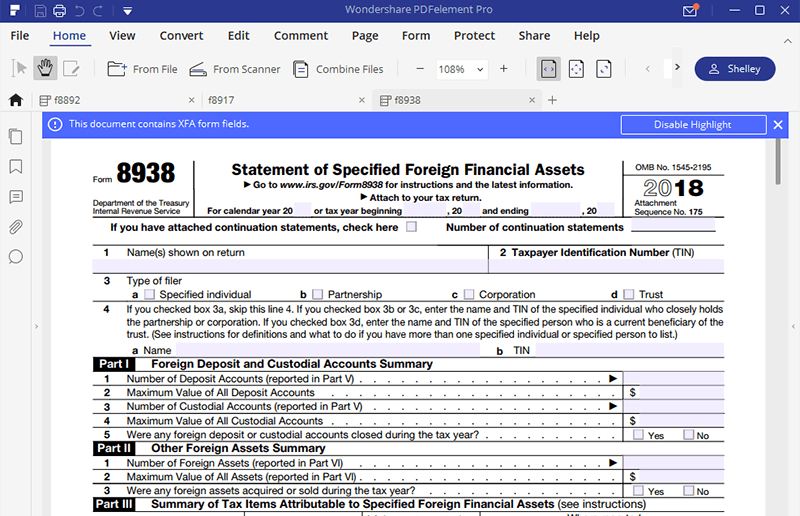

IRS Form 8938 How to Fill it with the Best Form Filler

It is part of fatca, an act passed by the obama administration in 2010 to curb foreign tax evasion. Here’s everything you need to know about this form: Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the.

Form 8938 Blank Sample to Fill out Online in PDF

Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. Specified individuals and specified.

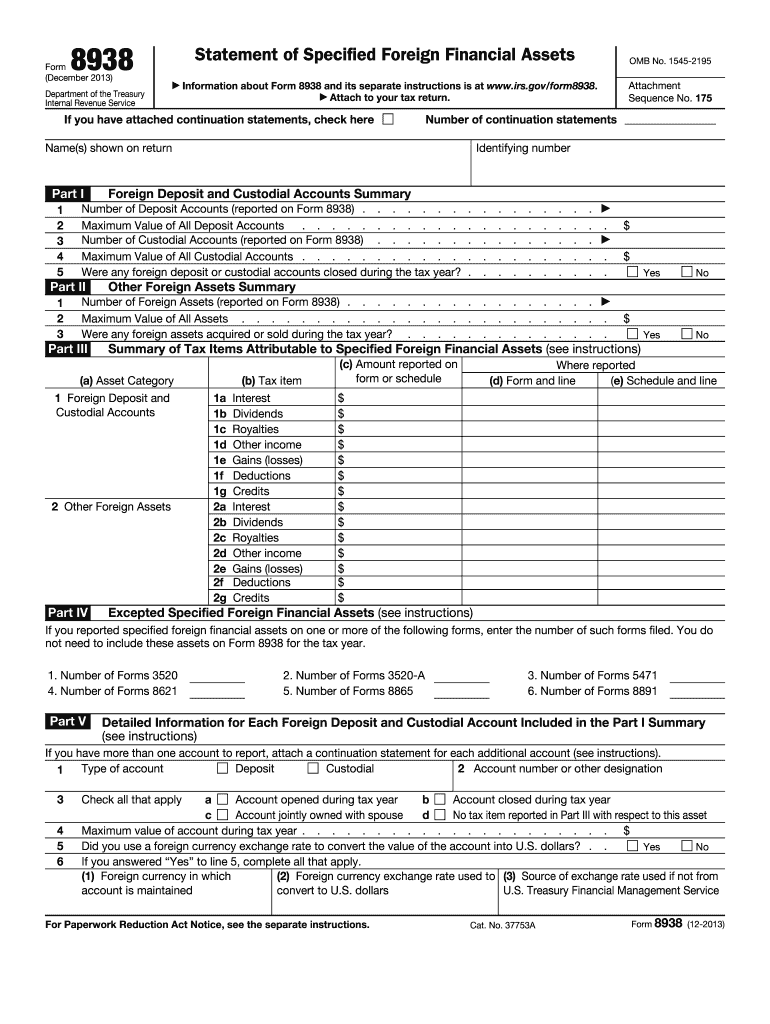

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. Web what is form 8938? Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Fincen form 114,.

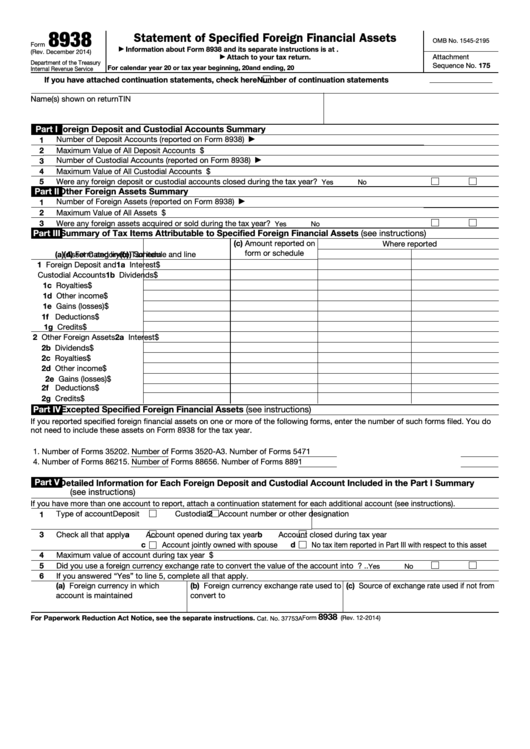

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web form 8938 is used by certain u.s. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax deluxe or higher. Specified individuals and.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web the irs form 8938 is one of the measures to crack down on unreported form assets. Web what is form 8938? For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years.

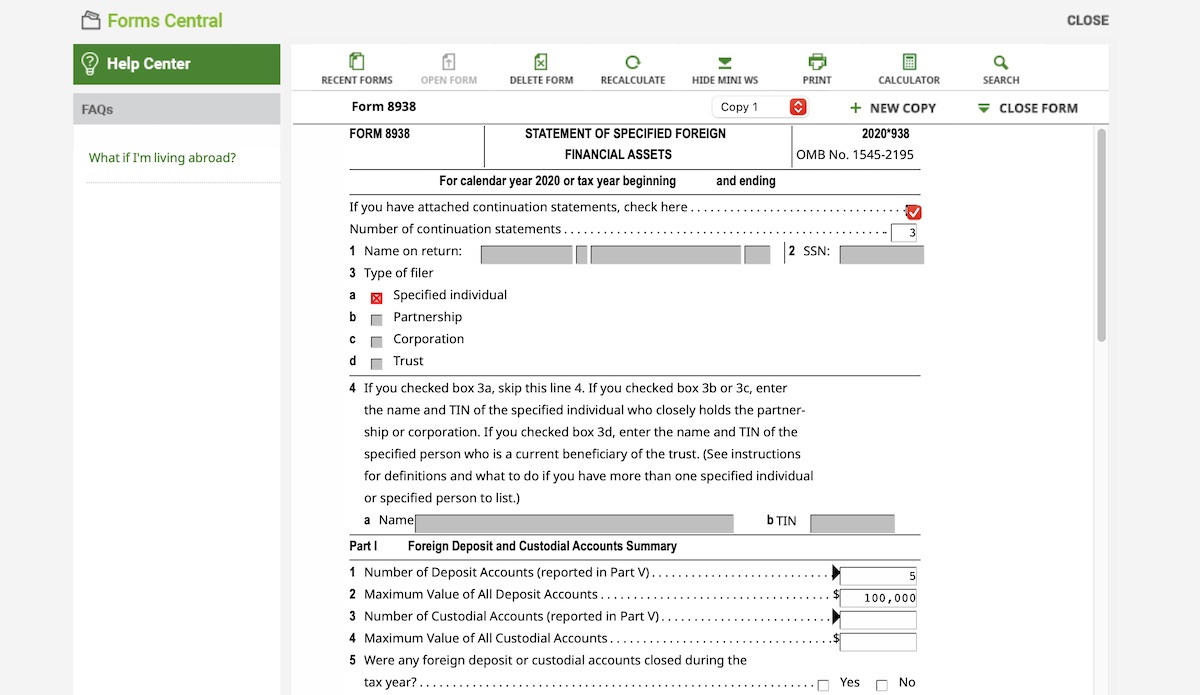

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax deluxe or higher. Web the irs form 8938 is one of the measures to.

Specified Individuals And Specified Domestic Entities That Have An Interest In Specified Foreign Financial Assets And Meet The Reporting Threshold

Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. Web about form 8938, statement of specified foreign financial assets. Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad.

Here’s Everything You Need To Know About This Form:

Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Define irs form 8938 on march 18, 2010, president obama signed the foreign account tax compliance act (fatca) into law, and form 8938 was one of the new forms created. Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). Web what is form 8938?

It Is Part Of Fatca, An Act Passed By The Obama Administration In 2010 To Curb Foreign Tax Evasion.

If you are a beneficiary of the foreign trust, you may have to file form 8938 to report your interest in. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web form 8938 is used by certain u.s. Web how do i file form 8938, statement of specified foreign financial assets?

Solved • By Turbotax • 965 • Updated January 13, 2023 Filing Form 8938 Is Only Available To Those Using Turbotax Deluxe Or Higher.

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web the irs form 8938 is one of the measures to crack down on unreported form assets. Back to top specific examples: For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return.