What Is An Unallowed Loss On Form 8582

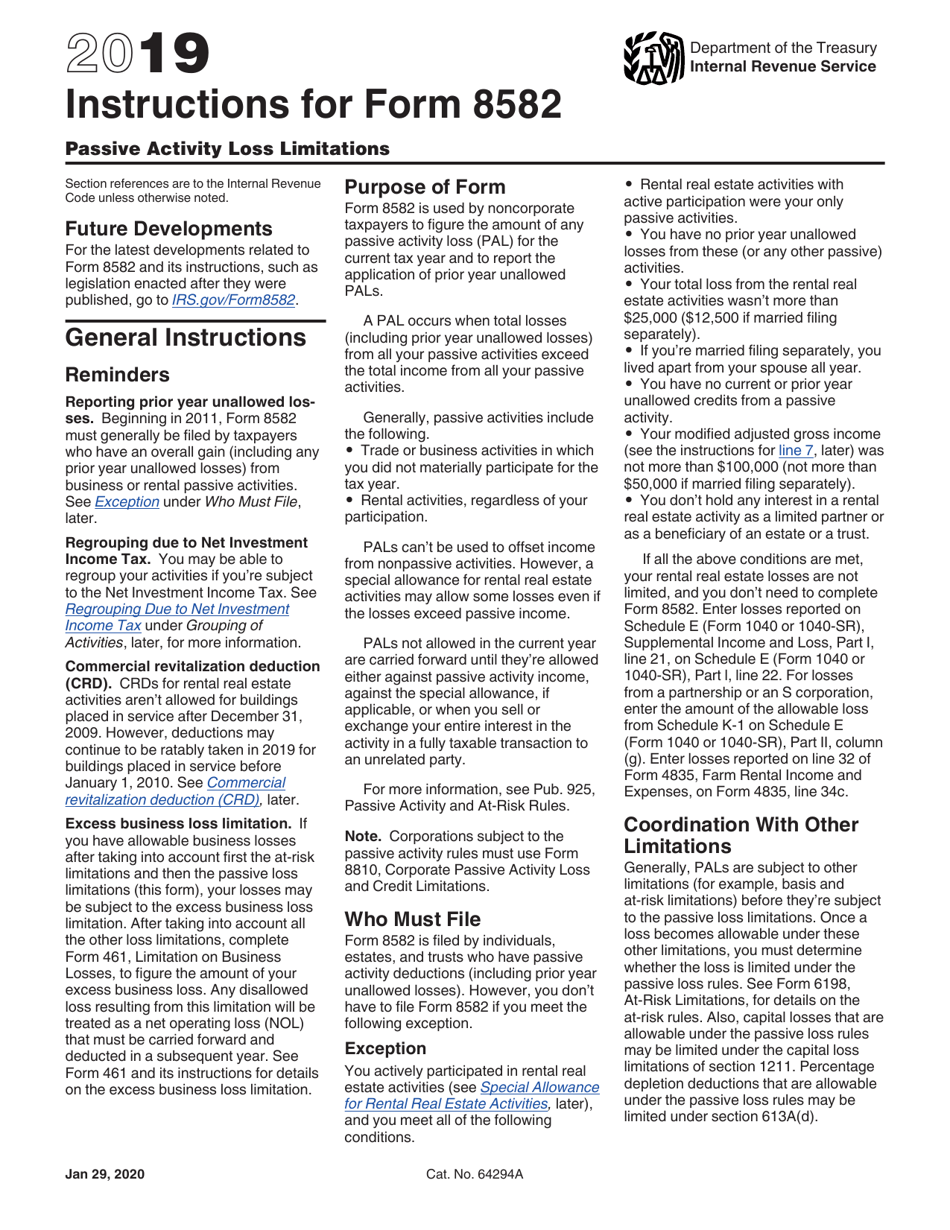

What Is An Unallowed Loss On Form 8582 - Web revenue code unless otherwise noted. The maximum special allowance is: A passive activity loss occurs when total losses. Web up to 10% cash back the allowed loss, if any, shown on the bottom of form 8582 is transferred to line 23 of schedule e. Complete worksheets 1, 2, and 3 before completing part i. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Enter the total of column (c) from. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Unallowed losses) from business or your rental real estate losses are not general instructions rental passive activities. Regardless of the number or complexity of passive activities the.

Web enter the unallowed losses for the prior years for each activity. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web the unallowed loss is suppose to be reported on form 8582 to carry forward for future years. Web 858 name(s) shown on return identifying number part i 2020 passive activity loss caution: Unallowed losses) from business or your rental real estate losses are not general instructions rental passive activities. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Enter the total of column (c) from. Rental real estate activities with. Regardless of the number or complexity of passive activities the. Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities.

Web 858 name(s) shown on return identifying number part i 2020 passive activity loss caution: Web if form 8582 is included in a return it cannot be removed, and a passive loss that has been limited cannot be taken. The maximum special allowance is: Web revenue code unless otherwise noted. Web up to 10% cash back the allowed loss, if any, shown on the bottom of form 8582 is transferred to line 23 of schedule e. Web the unallowed loss is suppose to be reported on form 8582 to carry forward for future years. Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Web enter the unallowed losses for the prior years for each activity. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Figure the amount of any passive activity credit (pac) for the current tax year (including any prior year unallowed.

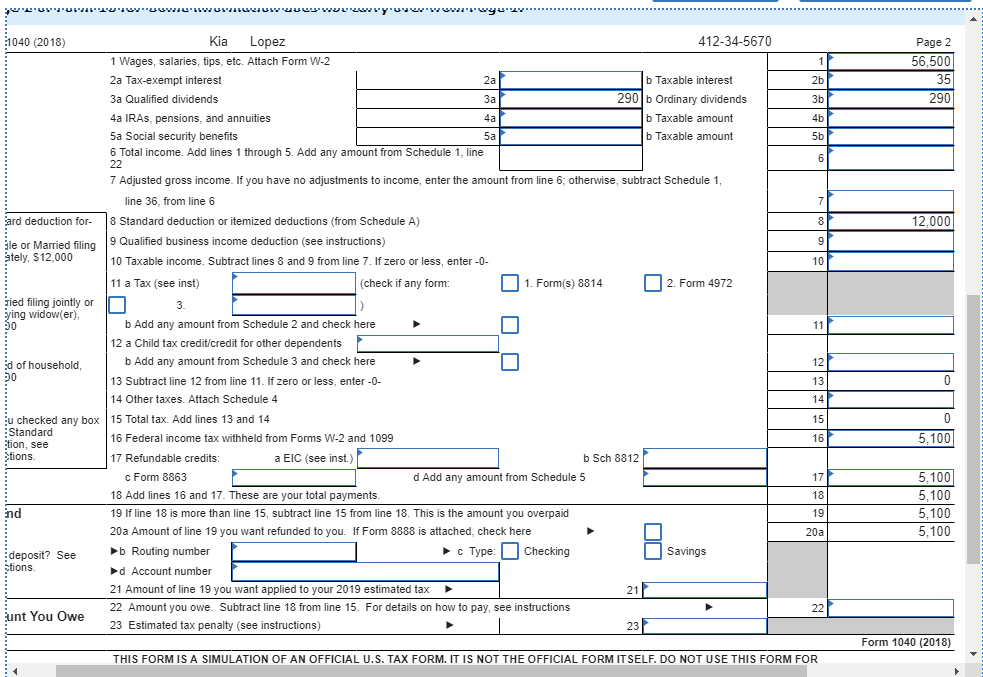

Kia Lopez (SSN 412345670) resides at 101 Poker

Complete parts iv and v before completing part i. A passive activity loss occurs when total losses. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for.

Download Instructions for IRS Form 8582 Passive Activity Loss

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Web revenue code.

Publication 925, Passive Activity and AtRisk Rules; Comprehensive Example

Web 858 name(s) shown on return identifying number part i 2020 passive activity loss caution: Enter the total of column (c) from. Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Regardless of the number or complexity of passive activities the. A passive activity loss occurs when total losses.

Publication 925, Passive Activity and AtRisk Rules; Comprehensive Example

Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Complete worksheets 1, 2, and 3 before completing part i. Web up to 10% cash back the allowed loss, if any, shown on the bottom of form 8582 is transferred to line 23 of.

8582K Kentucky Passive Activity Loss Limitations Form 42A740S18

Unallowed losses) from business or your rental real estate losses are not general instructions rental passive activities. Web enter the unallowed losses for the prior years for each activity. Complete parts iv and v before completing part i. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Figure the amount of any passive activity.

Fill Free fillable form 8582 passive activity loss limitations pdf

Rental real estate activities with. Web if form 8582 is included in a return it cannot be removed, and a passive loss that has been limited cannot be taken. Regardless of the number or complexity of passive activities the. A passive activity loss occurs when total losses. Web this special allowance is an exception to the general rule disallowing losses.

Clifford Johnson has a limited partnership investment and a rental

Web up to 10% cash back the allowed loss, if any, shown on the bottom of form 8582 is transferred to line 23 of schedule e. Web 858 name(s) shown on return identifying number part i 2020 passive activity loss caution: Rental real estate activities with. Enter the total of column (c) from. Regardless of the number or complexity of.

Fill Free fillable form 8582 passive activity loss limitations pdf

Complete parts iv and v before completing part i. Web 858 name(s) shown on return identifying number part i 2022 passive activity loss caution: Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web up to 10% cash back the allowed loss, if any, shown.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web the unallowed loss is suppose to be reported on form 8582 to carry forward for future years. Unallowed losses) from business or your rental real estate losses are not general instructions rental passive activities. Web if form 8582 is included in a return it cannot be removed, and a passive loss that has been limited cannot be taken. Enter.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Complete worksheets 1, 2, and 3 before completing part i. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Enter the total of column (c) from. The maximum special allowance is:

Web If Form 8582 Is Included In A Return It Cannot Be Removed, And A Passive Loss That Has Been Limited Cannot Be Taken.

Web purpose of form form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior. Complete worksheets 1, 2, and 3 before completing part i. Web 858 name(s) shown on return identifying number part i 2020 passive activity loss caution: Rental real estate activities with.

Web The Unallowed Loss Is Suppose To Be Reported On Form 8582 To Carry Forward For Future Years.

Web revenue code unless otherwise noted. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). You find these amounts on worksheet 5, column (c), of your 2017 form 8582. A passive activity loss occurs when total losses.

The Maximum Special Allowance Is:

Web if current year net income from the activity is less than or equal to the prior year unallowed loss, enter the prior year unallowed loss and any current year net income from the. Enter the total of column (c) from. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Figure the amount of any passive activity credit (pac) for the current tax year (including any prior year unallowed.

Web Enter The Unallowed Losses For The Prior Years For Each Activity.

Complete parts iv and v before completing part i. Web up to 10% cash back the allowed loss, if any, shown on the bottom of form 8582 is transferred to line 23 of schedule e. Web this special allowance is an exception to the general rule disallowing losses in excess of income from passive activities. Unallowed losses) from business or your rental real estate losses are not general instructions rental passive activities.