What Is A 944 Tax Form

What Is A 944 Tax Form - Who needs to file form 944? Employers who use form 944, employer’s annual federal tax return, report wages. Web what is form 944? For instructions and the latest information. Web form 944 for 2022: Employer’s annual federal tax return department of the treasury — internal revenue service. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web forms 941 and 944 are the two forms that employers use to report employee wage and payroll tax information to the irs. The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees.

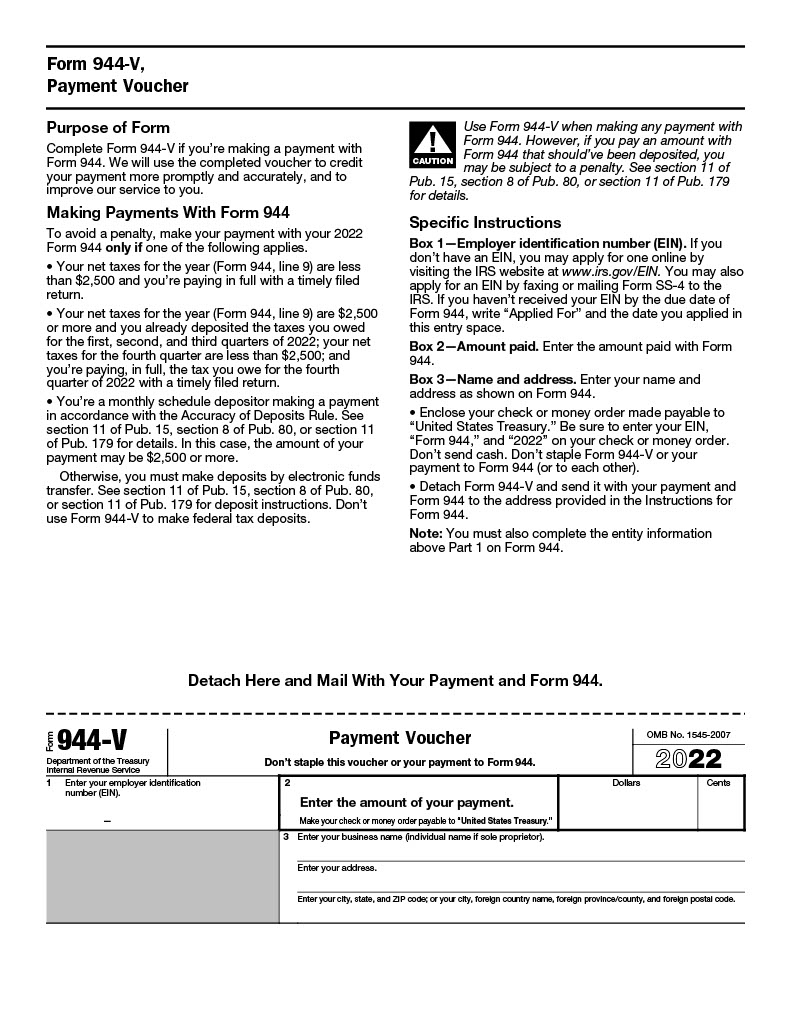

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. You must file annual form 944 instead of filing quarterly forms 941. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Web irs form 944 is the employer's annual federal tax return. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. If you filed form 944 electronically, don't file a paper form 944. Who must file form 944. Only if the irs notified you in writing. Web for 2022, file form 944 by january 31, 2023.

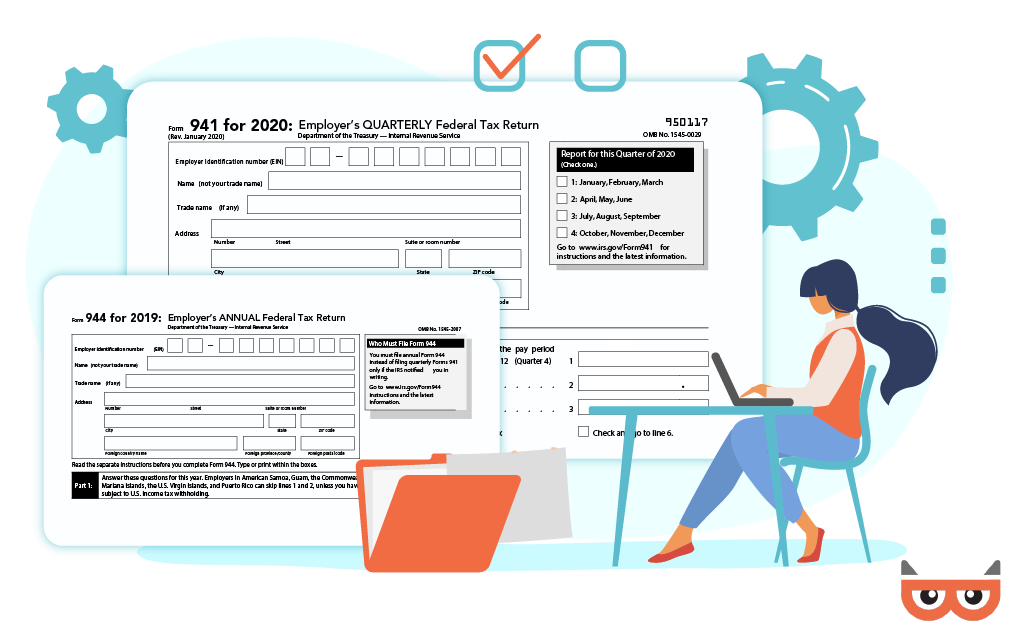

Employer’s annual federal tax return department of the treasury — internal revenue service. Web forms 941 and 944 are the two forms that employers use to report employee wage and payroll tax information to the irs. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Employers who use form 944, employer’s annual federal tax return, report wages. The deadline for the form 944 is january 31. Web form 944 for 2022: This form is designed specifically for very small businesses with a tax liability of $1,000 or less. Should you file form 944 or 941?

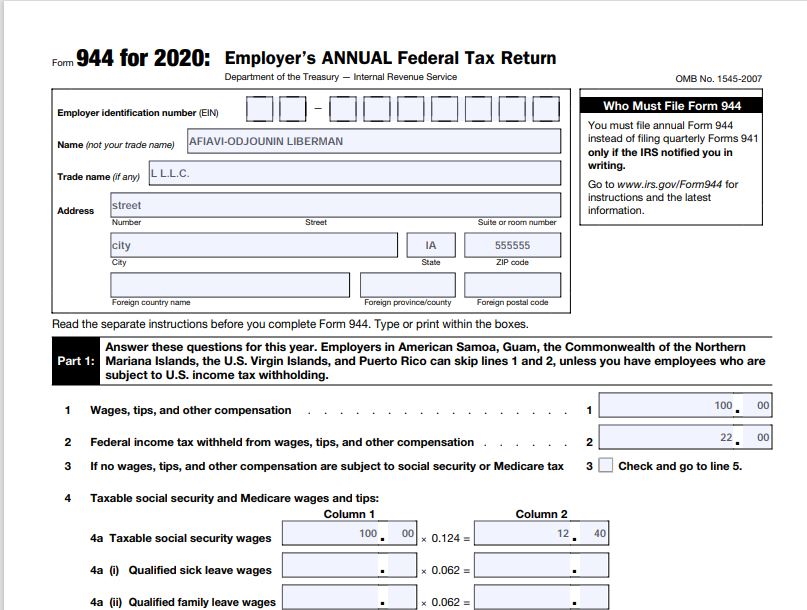

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

If you filed form 944 electronically, don't file a paper form 944. Who needs to file form 944? The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. Web information about form 944, employer's annual.

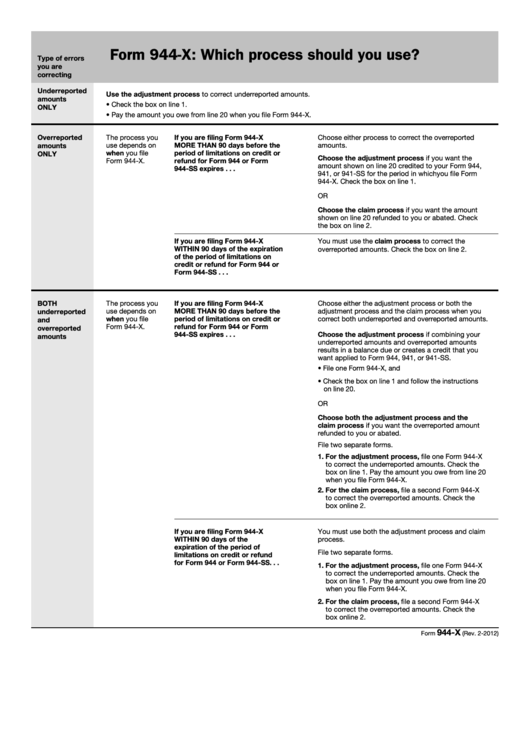

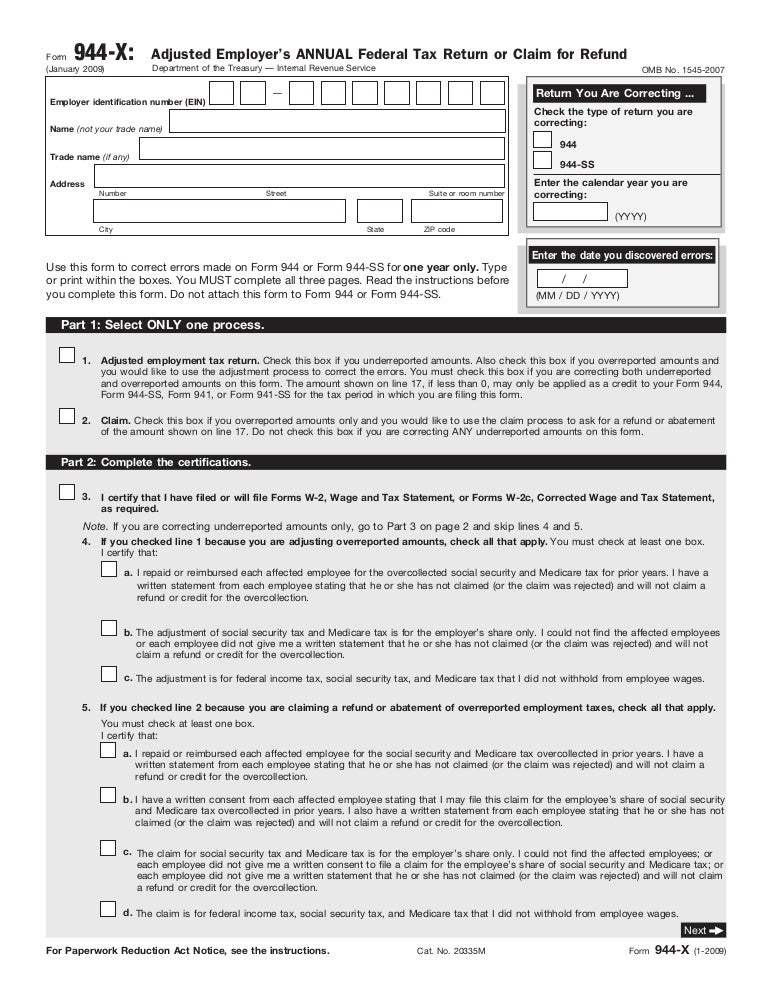

Instructions For Form 944X Adjusted Employer'S Annual Federal Tax

The deadline for the form 944 is january 31. Should you file form 944 or 941? However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Who needs to file form 944? If you're currently required to file form 944, employer's annual federal tax.

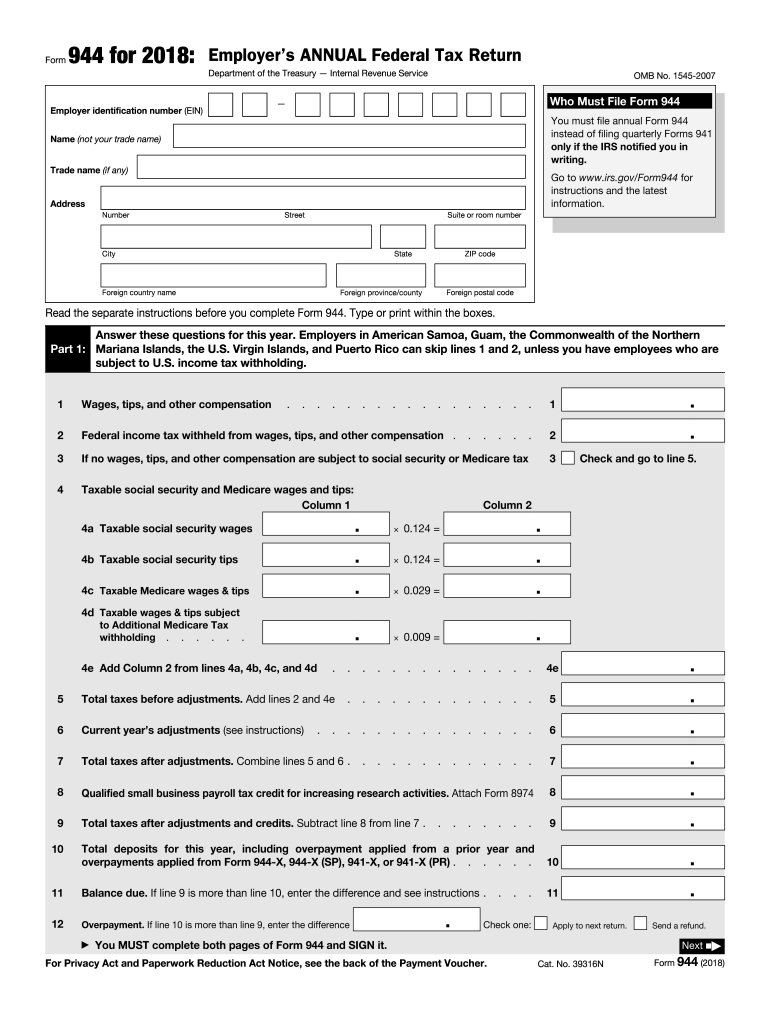

Form 944 Fill Out and Sign Printable PDF Template signNow

Web forms 941 and 944 are the two forms that employers use to report employee wage and payroll tax information to the irs. Employer’s annual federal tax return department of the treasury — internal revenue service. Form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. Form 944 allows small employers ($1,000.

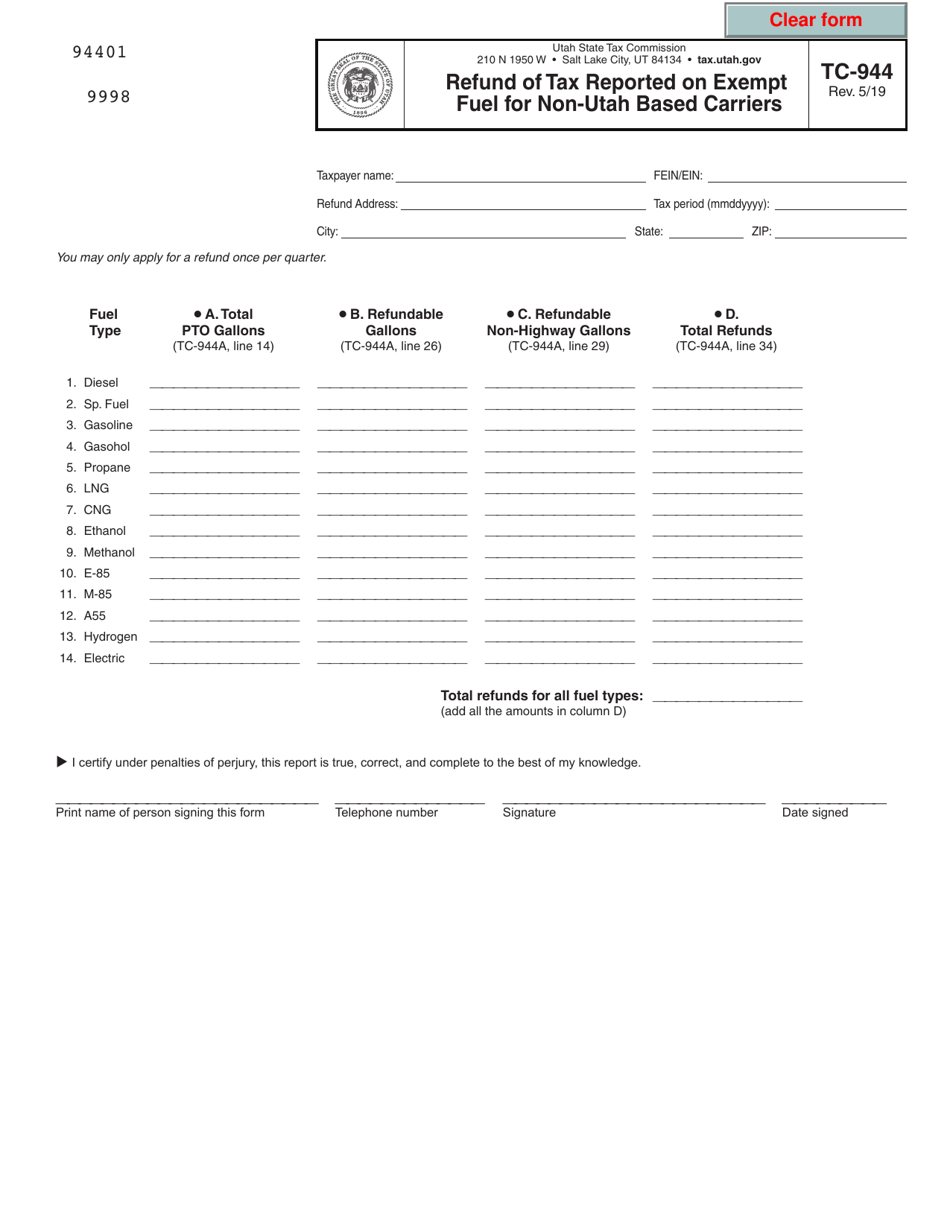

Form TC944 Download Fillable PDF or Fill Online Refund of Tax Reported

Web irs form 944 is the employer's annual federal tax return. Employer’s annual federal tax return department of the treasury — internal revenue service. Web for 2022, file form 944 by january 31, 2023. Employers who use form 944, employer’s annual federal tax return, report wages. However, if you made deposits on time in full payment of the taxes due.

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Employer’s annual federal tax return department of the treasury — internal revenue service. You must file annual form 944 instead of.

Form 944SS Employer's Annual Federal Tax Return Form (2011) Free

For instructions and the latest information. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Web irs form 944 is the employer's annual federal tax return. Web form 944 is an irs tax form that reports the.

Annual Form 944 Read below definition as well as explanation to the

For instructions and the latest information. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Employer’s annual federal tax return department of the treasury — internal revenue service. Should you file form 944 or 941? If you filed form 944 electronically, don't file a paper form 944.

Form 944 2023, Employer's Annual Federal Tax Return

Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 for 2022: This form is designed specifically for very small businesses with a tax liability of $1,000 or less. Web irs form 944 is the employer's annual federal tax return. Web for 2022, file form 944 by january 31, 2023.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

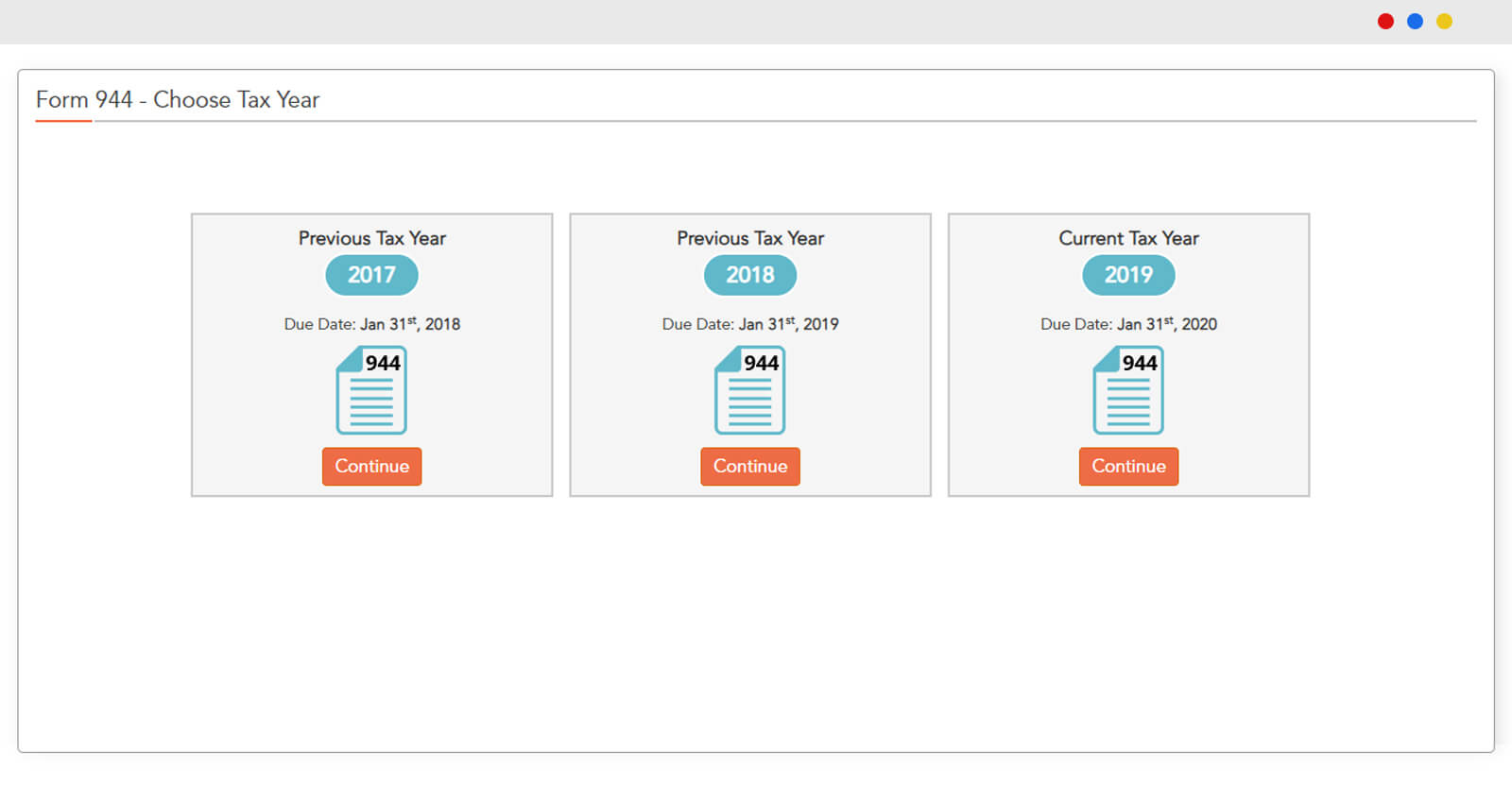

Who needs to file form 944? Web irs form 944 is the employer's annual federal tax return. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. For instructions and the latest information. If you're currently required to file form 944, employer's annual federal tax return, but estimate your.

File Form 944 Online EFile 944 Form 944 for 2022

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10,.

You Must File Annual Form 944 Instead Of Filing Quarterly Forms 941.

Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Employers who use form 944, employer’s annual federal tax return, report wages. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Web forms 941 and 944 are the two forms that employers use to report employee wage and payroll tax information to the irs.

Employer’s Annual Federal Tax Return Department Of The Treasury — Internal Revenue Service.

The deadline for the form 944 is january 31. The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. For instructions and the latest information.

Web Form 944, Employer’s Annual Federal Tax Return, Is A Form That Eligible Small Businesses File Annually To Report Federal Income Tax And Fica Tax (Social Security And Medicare Taxes) On Employee Wages.

Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Who needs to file form 944? Should you file form 944 or 941? Web form 944 for 2022:

Web For 2022, File Form 944 By January 31, 2023.

If you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you may be eligible to update your filing requirement to form 941, employer's quarterly federal tax return. Who must file form 944. Only if the irs notified you in writing. This form is designed specifically for very small businesses with a tax liability of $1,000 or less.