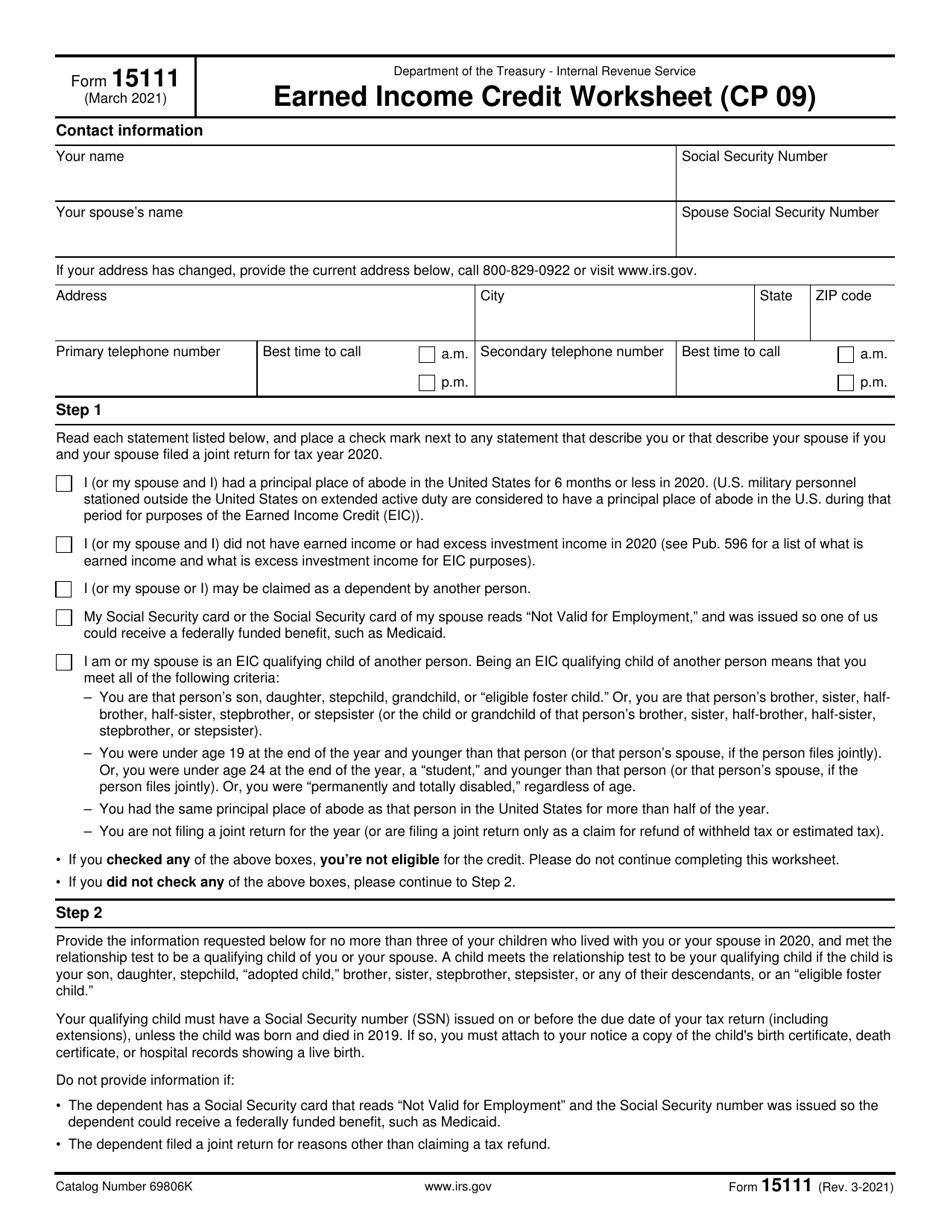

What Is A 15111 Form

What Is A 15111 Form - Social security number your spouse’s name (if you. Web eligius_ms • 2 yr. According to irs publication 596, earned income credit, this credit is called the “earned income” credit. You can view a sample form 15111 worksheet on the irs website. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Earned income credit worksheet (cp 09) (irs) form. Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. If you are eligible for the credit, sign and date the form 15112. Web complete the additional child tax credit worksheet on form 15110 pdf. Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return.

Looks like they are sending out the letters if people. If the worksheet confirms you have at least one qualifying child, sign and date the. If you qualify, all the. This is an irs internal. Sign it in a few clicks draw your signature, type it,. This is an irs internal form. According to irs publication 596, earned income credit, this credit is called the “earned income” credit. If you are eligible for the credit, sign and date the form 15112. Where do i get that form. Earned income credit worksheet (cp 09) (irs) form.

Web the topic seems to be actual in 2022. Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. Web i filed my taxes and got my return already but just got a letter in the mail that i didn't claim the eic and need to file a 15111. Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? Web complete the eic eligibility form 15112, earned income credit worksheet (cp27) pdf. Web complete the additional child tax credit worksheet on form 15110 pdf. If the worksheet confirms you have at least one qualifying child, sign and date the. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Web follow the simple instructions below: If you qualify, all the.

I sent in my form 15111 for 2020 and i got an updated date on my

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Here is a helpful online tool from irs to evaluate qualification for. Web form and required supporting documents to us in the enclosed envelope. Use fill to complete blank online irs pdf forms for free..

IRS Form 1120C Download Fillable PDF or Fill Online U.S. Tax

Web complete the eic eligibility form 15112, earned income credit worksheet (cp27) pdf. You can view a sample form 15111 worksheet on the irs website. If you are eligible for the credit, sign and date the form 15112. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that.

Software Developer Letter Sample Allergy

Web form and required supporting documents to us in the enclosed envelope. Here is a helpful online tool from irs to evaluate qualification for. Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. Web eligius_ms • 2 yr. If you qualify, you can use the credit to reduce the taxes you.

Brunch Vibes SugarJam

Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit i qualify for with 3 children being head of household making. If you qualify, you can use the credit to reduce the.

Sample Forms For Authorized Drivers Form I 9 Examples Related To

Web follow the simple instructions below: Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. This is an irs internal form. If you qualify, all the. If you qualify, you can use the credit to reduce the taxes you.

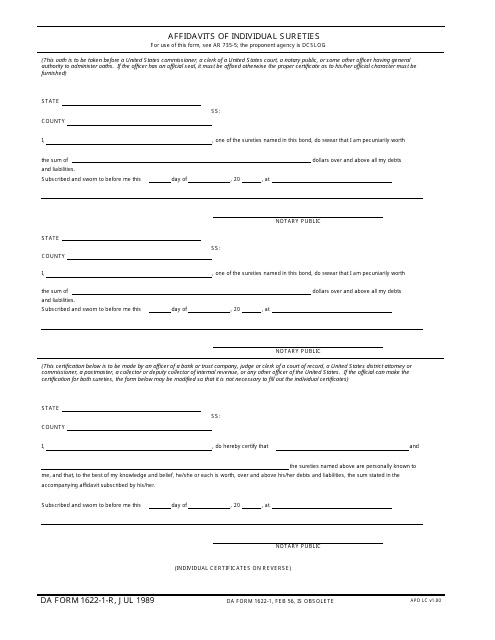

DA Form 16221r Download Fillable PDF or Fill Online Affidavits of

Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Our service offers you an extensive library. This is an irs internal. Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit.

Form 15111? r/IRS

You can view a sample form 15111 worksheet on the irs website. Web fill online, printable, fillable, blank form 15111: Sign it in a few clicks draw your signature, type it,. Web follow the simple instructions below: For tax year 2020, the tax code has a special 'look back' provision for calculating earned income credit.

IRS Form 15111 Download Fillable PDF or Fill Online Earned

My fiance got a letter from the irs stating that she qualifies for eitc. If you are eligible for the credit, sign and date the form 15112. This is an irs internal form. Web complete the additional child tax credit worksheet on form 15110 pdf. It says to fill out form 15111 and send it back in the envelope provided.

What Is Irs Cancellation Of Debt

Social security number your spouse’s name (if you. You can view a sample form 15111 worksheet on the irs website. If you qualify, all the. Here is a helpful online tool from irs to evaluate qualification for. Web complete the eic eligibility form 15112, earned income credit worksheet (cp27) pdf.

Download wallpaper 1280x1024 form, light, blue, alloy standard 54 hd

This is an irs internal. Our service offers you an extensive library. Sign it in a few clicks draw your signature, type it,. Web what is form 15111 it’s almost about eight weeks for me at the seven week mark in a few days and no i haven’t heard anything back either and i don’t believe there’s a way to..

According To Irs Publication 596, Earned Income Credit, This Credit Is Called The “Earned Income” Credit.

Web form 15111 is a worksheet to help you determine whether you qualify for the eic based on the dependents listed on your return. If you are eligible for the credit, sign and date the form 15112. Use fill to complete blank online irs pdf forms for free. If you qualify, all the.

Web Form 15111 Is A Us Treasury Form That Is A Questionnaire Of The Dependents On Your Return To See If They Qualify For Eic.

It says to fill out form 15111 and send it back in the envelope provided by them. Web fill online, printable, fillable, blank form 15111: Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? If you qualify, you can use the credit to reduce the taxes you.

Web Complete The Eic Eligibility Form 15112, Earned Income Credit Worksheet (Cp27) Pdf.

Our service offers you an extensive library. Here is a helpful online tool from irs to evaluate qualification for. Edit your form 15111 online type text, add images, blackout confidential details, add comments, highlights and more. This is an irs internal form.

Web Follow The Simple Instructions Below:

Web form and required supporting documents to us in the enclosed envelope. Web i filed my taxes and got my return already but just got a letter in the mail that i didn't claim the eic and need to file a 15111. Web the topic seems to be actual in 2022. Web you must have earned income in the given tax year.