What Is 8862 Form

What Is 8862 Form - Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web tax tips & video homepage. If your return was rejected. Do not file form 8862 and do not take the eic for the: Web how do i enter form 8862? Web overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Web you can find tax form 8862 on the irs website. Form 8862 is a federal individual income tax form. Web it’s easy to do in turbotax. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim.

Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Search for 8862 and select the link to go to the section. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. • 2 years after the most recent tax year for which. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. October 2017) department of the treasury internal revenue service. Web more from h&r block. 596, earned income credit (eic), for the year for which. Guide to head of household. If your return was rejected.

If your return was rejected. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web it’s easy to do in turbotax. Web we last updated federal form 8862 from the internal revenue service in december 2022. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form 8862 do you live in the us. Married filing jointly vs separately. Answer the questions accordingly, and we’ll include form 8862 with your return. Form 8862 is a federal individual income tax form. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. October 2017) department of the treasury internal revenue service.

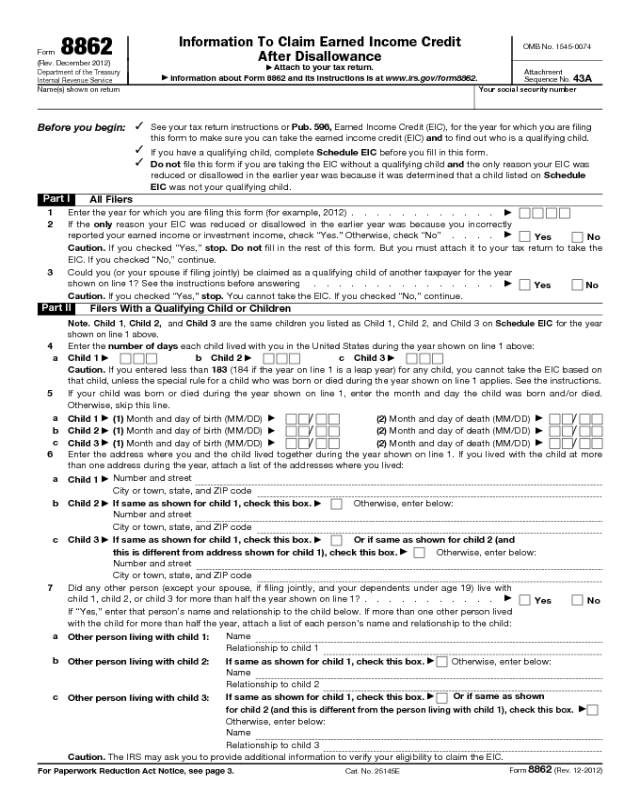

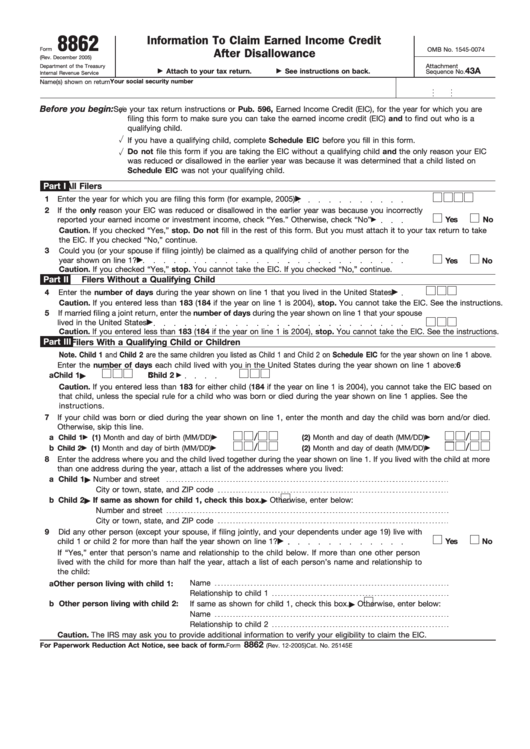

Form 8862Information to Claim Earned Credit for Disallowance

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax.

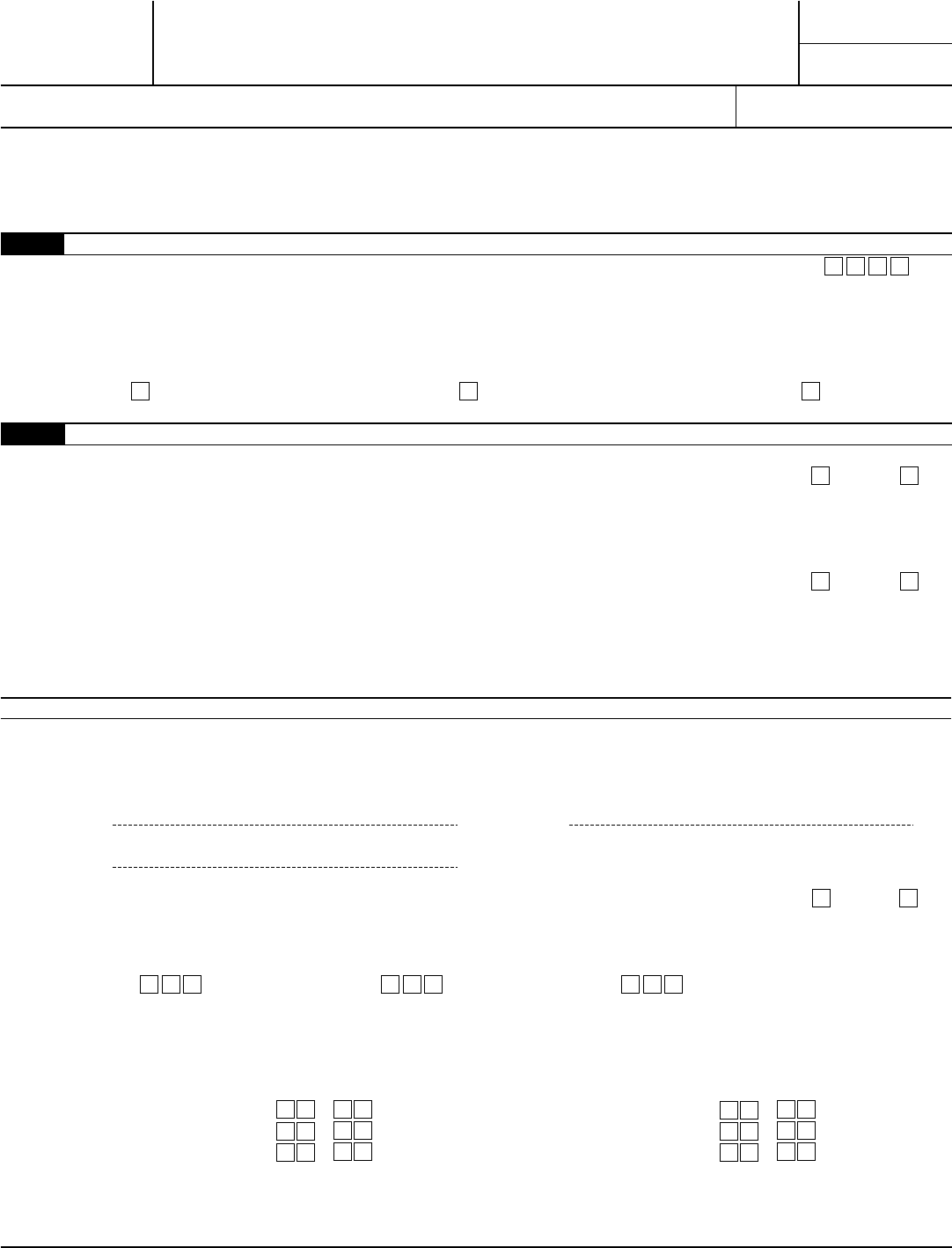

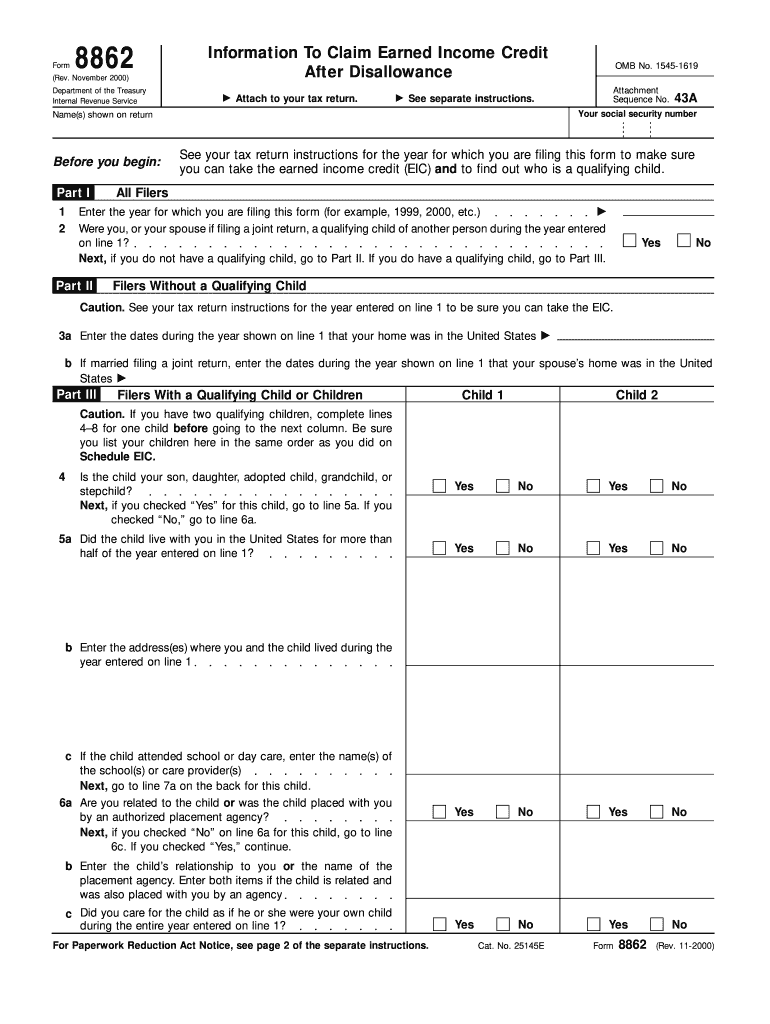

Instructions For Form 8862 Information To Claim Earned Credit

Get ready for tax season deadlines by completing any required tax forms today. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Complete, edit or print tax forms instantly. Married filing jointly vs separately. File an extension in turbotax online before the deadline to.

Form 8862 Edit, Fill, Sign Online Handypdf

Web how do i file an irs extension (form 4868) in turbotax online? Web how do i enter form 8862? Turbotax can help you fill out your. Complete, edit or print tax forms instantly. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Form 8862 Information To Claim Earned Credit After

Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Do not file form 8862 and do not take the eic for the: Turbotax can help you fill out.

Notice Of Disallowance Of Claim

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a.

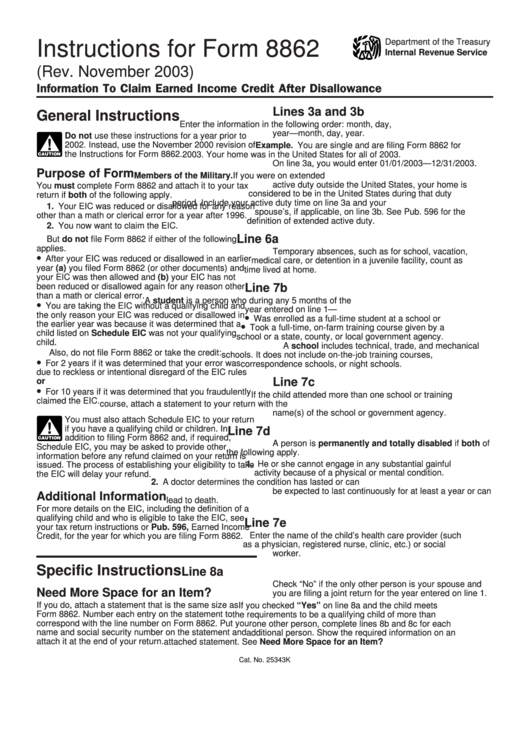

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Web how do i enter form 8862? Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. If your return was rejected. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for.

Form 8862 Edit, Fill, Sign Online Handypdf

Do not file form 8862 and do not take the eic for the: Web tax tips & video homepage. Web you can find tax form 8862 on the irs website. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 8862 from the internal revenue service in december 2022.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

• 2 years after the most recent tax year for which. Search for 8862 and select the link to go to the section. Web you can find tax form 8862 on the irs website. Guide to head of household. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

8862 Form Fill Out and Sign Printable PDF Template signNow

Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Form 8862 is a federal individual income tax form. Web you can find tax form 8862 on the irs website. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc.

Search For 8862 And Select The Link To Go To The Section.

Web more from h&r block. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter.

Web We Last Updated Federal Form 8862 From The Internal Revenue Service In December 2022.

Complete, edit or print tax forms instantly. 596, earned income credit (eic), for the year for which. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. • 2 years after the most recent tax year for which.

States Often Have Dozens Of Even.

Complete, edit or print tax forms instantly. Form 8862 is a federal individual income tax form. Guide to head of household. If your return was rejected.

Web Form 8862 Is Required To Be Filed With A Taxpayer’s Tax Return If In A Prior Year The Taxpayer’s Claim For Any Of The Following Credits Was Reduced Or Disallowed For Any Reason Other Than.

Get ready for tax season deadlines by completing any required tax forms today. October 2017) department of the treasury internal revenue service. Web it’s easy to do in turbotax. File an extension in turbotax online before the deadline to avoid a late filing penalty.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)