What Happens If You Forget To File Form 8938

What Happens If You Forget To File Form 8938 - Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Domestic financial institution), the foreign. If you omitted form 8938 when. Payer (such as a u.s. Web when it comes to filing form 8938, there are a few ways taxpayers may be able to escape the reporting requirements and circumvent the tax filing rules. A $10,000 failure to file penalty, an additional penalty of up to $50,000 for continued failure to file. It starts allover if i search 8938 and go to that section. While you must file fbar regardless of your income tax situation, you do not need to. Web you need to amend your return to add the form 8938.here is an excerpt from the irs basic questions and answers on form 8938: Use form 8938 to report your.

Web what if you file an untimely 8938 or missed the filing date? Web in short, horrible penalties. Web foreign asset reporting exemption if you do not need to file a tax return. Web file under the irs’s streamlined filing compliance procedures: Web later i can't find the information at all. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Failure to file form 8938 before the due date of the tax return, including extensions, or filing an incomplete or erroneous form. Web if you are required to file form 8938, you do not have to report financial accounts maintained by:

Web later i can't find the information at all. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you still continue to fail to file form 8938 even after you have received a notification from the irs, you will owe an additional penalty of up to $60,000. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. While you must file fbar regardless of your income tax situation, you do not need to. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Web filing form 8938 does not relieve you of the requirement to file fincen form 114, report of foreign bank and financial accounts (fbar), if you are otherwise required to file the. Web you need to amend your return to add the form 8938.here is an excerpt from the irs basic questions and answers on form 8938: Domestic financial institution), the foreign. A $10,000 failure to file penalty, an additional penalty of up to $50,000 for continued failure to file.

What is form 8938 and why do you need to file it? Expat US Tax

Web filing form 8938 does not relieve you of the requirement to file fincen form 114, report of foreign bank and financial accounts (fbar), if you are otherwise required to file the. Web if you still continue to fail to file form 8938 even after you have received a notification from the irs, you will owe an additional penalty of.

2018 Form IRS 8938 Fill Online, Printable, Fillable, Blank PDFfiller

Web there are several ways to submit form 4868. Use form 8938 to report your. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if any individual fails to furnish the information described in subsection (c) with respect to any taxable year at the time and in the manner.

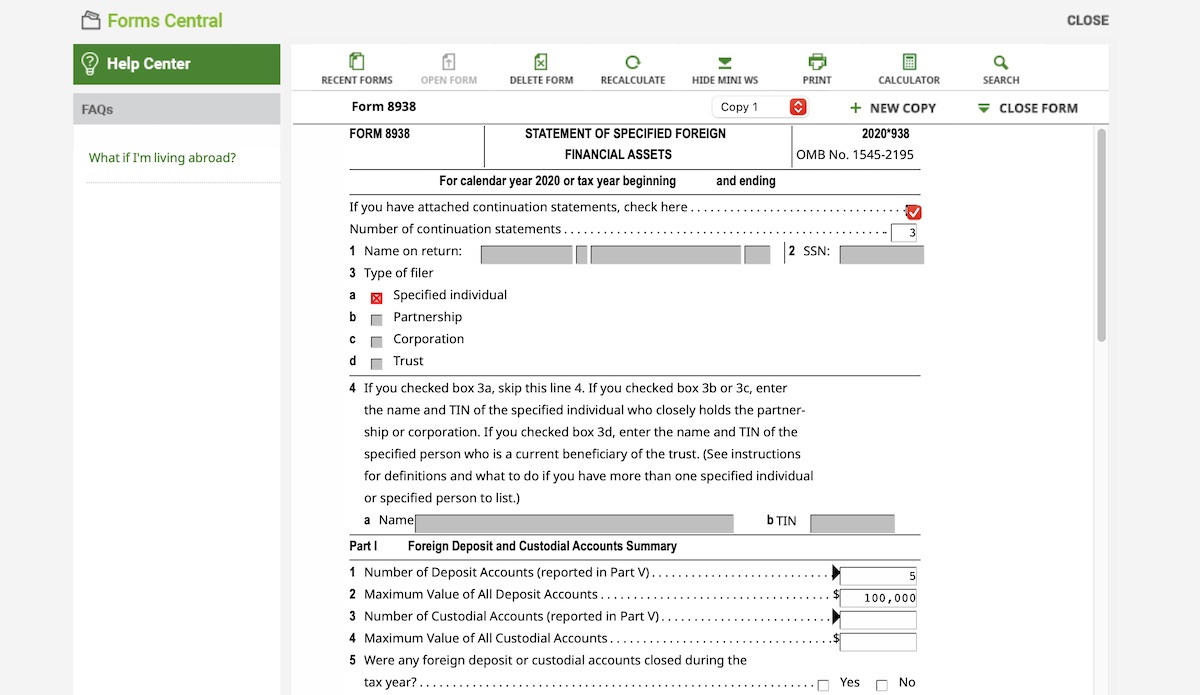

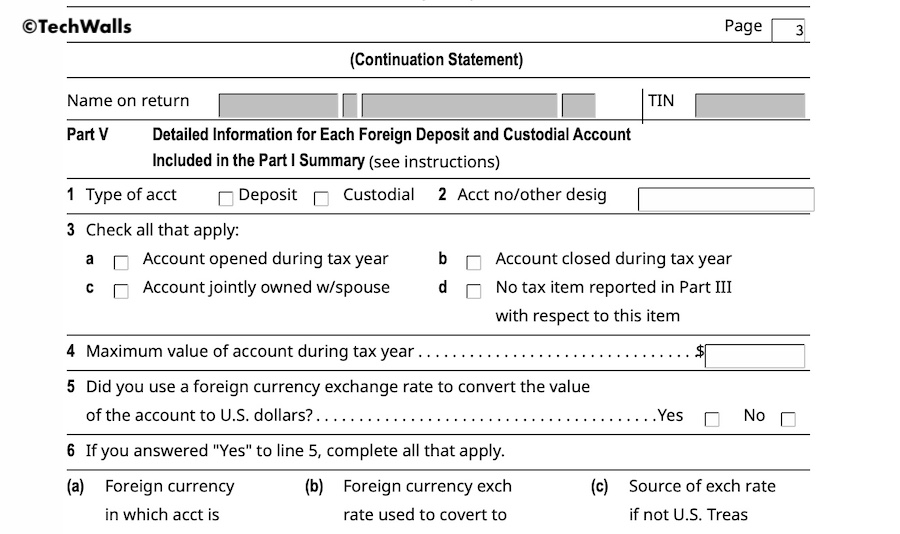

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web if you must file form 8938 and do not do so, you may be subject to penalties: Payer (such as a u.s. It starts allover if i search 8938 and go to that section. Use form 8938 to report your. Web what if you file an untimely 8938 or missed the filing date?

The FORM 8938 Here is what you need to know if you are filing it

Failure to file form 8938 before the due date of the tax return, including extensions, or filing an incomplete or erroneous form. Payer (such as a u.s. Web foreign asset reporting exemption if you do not need to file a tax return. Domestic financial institution), the foreign. Web when it comes to filing form 8938, there are a few ways.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web what if you file an untimely 8938 or missed the filing date? Payer (such as a u.s. Streamlined foreign offshore procedure (sfop) the irs’s streamlined foreign offshore procedure (sfop). Web if you still continue to fail to file form 8938 even after you have received a notification from the irs, you will owe an additional penalty of up to.

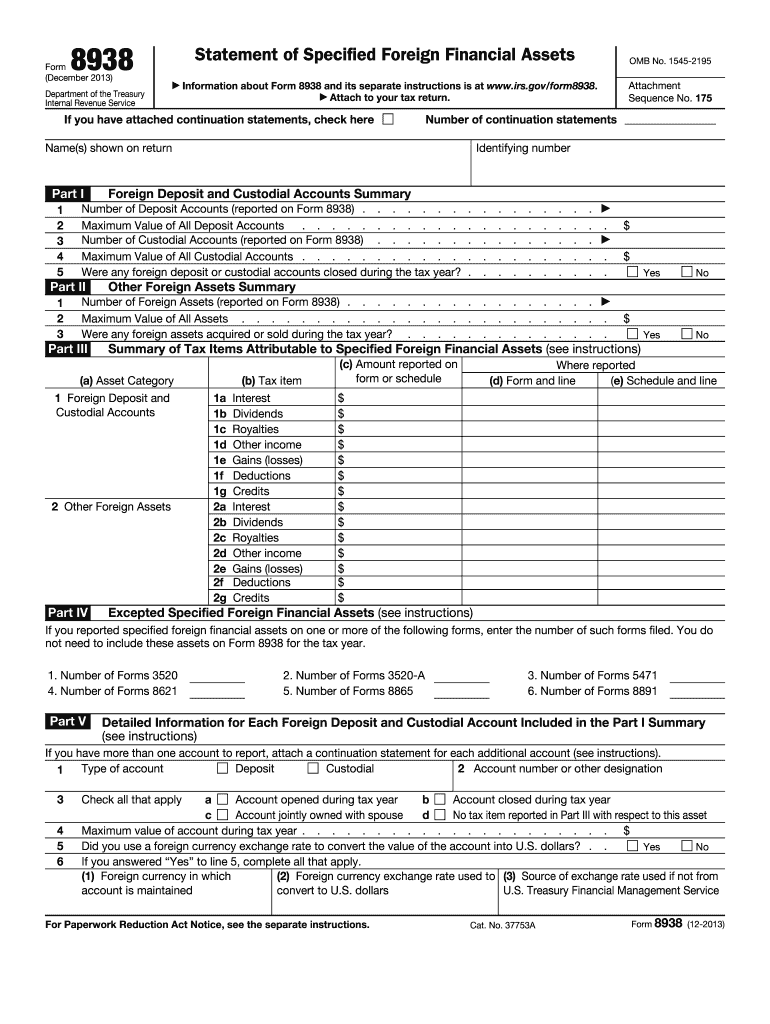

Form 8938 Statement Of Foreign Financial Assets 2014 Free Download

Web foreign asset reporting exemption if you do not need to file a tax return. Domestic financial institution), the foreign. Web file under the irs’s streamlined filing compliance procedures: Web when it comes to filing form 8938, there are a few ways taxpayers may be able to escape the reporting requirements and circumvent the tax filing rules. Payer (such as.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

A $10,000 failure to file penalty, an additional penalty of up to $50,000 for continued failure to file. Streamlined foreign offshore procedure (sfop) the irs’s streamlined foreign offshore procedure (sfop). Use form 8938 to report your. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web there are several ways.

Form 8938 Who Has to Report Foreign Assets & How to File

Web what if you fail to file form 8938? Web you need to amend your return to add the form 8938.here is an excerpt from the irs basic questions and answers on form 8938: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Failure to file form 8938 before the.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web.

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web filing form 8938 does not relieve you of the requirement to file fincen form 114, report of foreign bank and financial.

Web What If You Fail To File Form 8938?

If you omitted form 8938 when. Domestic financial institution), the foreign. Web what if you file an untimely 8938 or missed the filing date? Web filing form 8938 does not relieve you of the requirement to file fincen form 114, report of foreign bank and financial accounts (fbar), if you are otherwise required to file the.

Web If You Must File Form 8938 And Do Not Do So, You May Be Subject To Penalties:

I entered the information multiple times from scratch (which took me lot of. Web when it comes to filing form 8938, there are a few ways taxpayers may be able to escape the reporting requirements and circumvent the tax filing rules. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Use form 8938 to report your.

Web If You Are Required To File Form 8938, You Do Not Have To Report Financial Accounts Maintained By:

Web file under the irs’s streamlined filing compliance procedures: Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web in short, horrible penalties. Web later i can't find the information at all.

Failure To File Form 8938 Before The Due Date Of The Tax Return, Including Extensions, Or Filing An Incomplete Or Erroneous Form.

Web if you still continue to fail to file form 8938 even after you have received a notification from the irs, you will owe an additional penalty of up to $60,000. Web you need to amend your return to add the form 8938.here is an excerpt from the irs basic questions and answers on form 8938: Web if any individual fails to furnish the information described in subsection (c) with respect to any taxable year at the time and in the manner described in subsection. While you must file fbar regardless of your income tax situation, you do not need to.