What Happens After You File Chapter 13

What Happens After You File Chapter 13 - Web what happens to debts incurred after filing the chapter 13 case? During your bankruptcy you must continue to file, or get an extension of time to file… Web what happens after a chapter 13 case is dismissed? Web your bankruptcy payment will become due the month after your bankruptcy is filed. Thus, if you enter into a five year chapter 13 repayment plan, you. Web after filing your chapter 13, the initial stages, at least, are not that different from a chapter 7. Web before you consider filing a chapter 13 here are some things you should know: Web updated july 26, 2023 table of contents what kind of small business do you have? Even though the court has not confirmed or approved your plan, asking you to begin. Web your credit will suffer when you file a chapter 13 case, but it will drop from your credit report years before a chapter 7 case would.

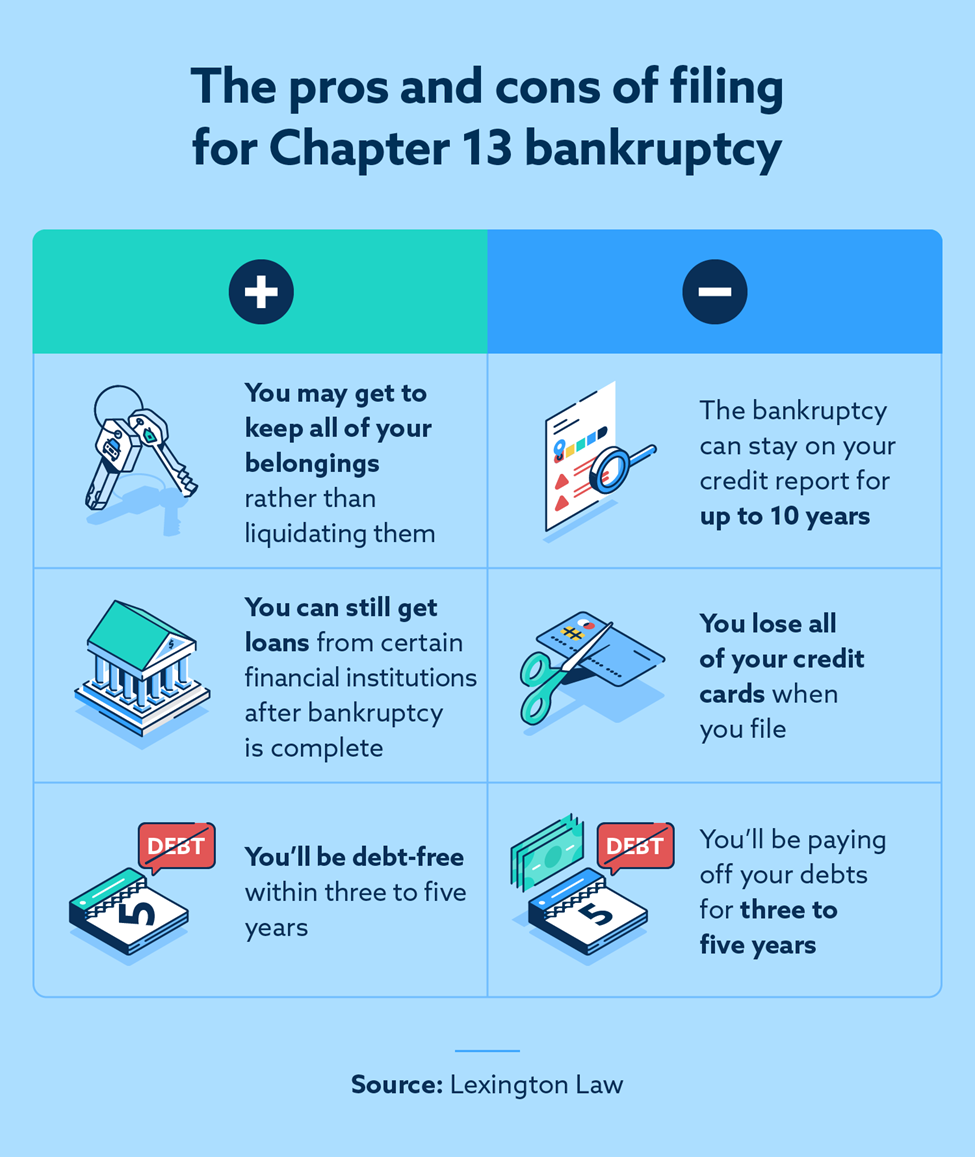

Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts. In either case, the payment is sent to your bankruptcy trustee, and the. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Web the downside to this option is that if you received a chapter 13 discharge, you must wait six years to file for chapter 7 relief. Web you must begin making payments on your proposed plan within 30 days after you file a chapter 13 bankruptcy. But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Despite its benefits, chapter 13 bankruptcy can harm a filer's credit. Under the bankruptcy code, if you incur new debt through no fault of your own after you file a chapter 13 but before you convert it to a chapter. Web updated july 26, 2023 table of contents what kind of small business do you have? Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage.

Despite its benefits, chapter 13 bankruptcy can harm a filer's credit. Web your credit will suffer when you file a chapter 13 case, but it will drop from your credit report years before a chapter 7 case would. Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage. However, the six years begins from the date you filed your first chapter 13 petition. Web when you are deciding whether to file for bankruptcy, there is a lot to take into consideration. However, you can take steps to. Credit card balances, personal loans, medical bills, and utility payments fit here. The first thing that happens is your attorney files the case electronically (or if you are filing pro se, meaning without an attorney, then you file the case in person at the courthouse), and you. The payment becomes due the first of the month, but as long as it is received prior to the end of the month it will be ‘on time’. Web what happens after a chapter 13 case is dismissed?

What happens if you file ITR after the deadline? KDK Softwares

Web you must begin making payments on your proposed plan within 30 days after you file a chapter 13 bankruptcy. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Despite its benefits, chapter 13 bankruptcy can harm a filer's credit. Web the majority of debts discharged in chapter 13 bankruptcy are.

The Pros and Cons of Filing for Chapter 13 Bankruptcy My AZ Lawyers

Web your credit will suffer when you file a chapter 13 case, but it will drop from your credit report years before a chapter 7 case would. An exception exists if you repaid your creditors 70 to 100 percent of what you owed under your chapter 13. Web what happens to debts incurred after filing the chapter 13 case? Web.

Benefits Of Chapter 13 Bankruptcy Chris Mudd & Associates

But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Findlaw.com has resources to help you navigate the bankruptcy process, and understand what happens after bankruptcy. The payment becomes due the first of the month, but as long as it is received prior to the end of the month.

File Chapter 13 Bankruptcy Best California Education Lawyer

Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage. Web if you want to evict after the tenant files a chapter 13 case, your first stop is the bankruptcy court.

cares act bankruptcy chapter 13 brooksvuillemot

Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts. Web what happens to debts incurred after filing the chapter 13 case? But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. An exception exists if you repaid your creditors 70 to 100 percent of.

What Happens After You File for Bankruptcy?

Web since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. Credit card balances, personal loans, medical bills, and utility payments fit here. Web after completing chapter 13 bankruptcy, debtors emerge with their accounts current and property intact..

What Happens After You Die?

Often, the chapter 13 plan will not provide. Can i refile chapter 13 after my case is dismissed? Chapter 7 bankruptcy eliminating business debt through chapter 13 bankruptcy other. During your bankruptcy you must continue to file, or get an extension of time to file… Web people usually choose chapter 13 bankruptcy because they make too much to pass the.

File Chapter 13 Bankruptcy Best California Education Lawyer

Web completed chapter 13 cases, on the other hand, are removed from your credit by all three major credit reporting agencies 7 years after filing your bankruptcy case. Thus, if you enter into a five year chapter 13 repayment plan, you. Can i refile chapter 13 after my case is dismissed? During your bankruptcy you must continue to file, or.

Can You File Chapter 13 and Keep Your House? Bonnie Buys Houses

Web updated july 26, 2023 table of contents what kind of small business do you have? The first thing that happens is your attorney files the case electronically (or if you are filing pro se, meaning without an attorney, then you file the case in person at the courthouse), and you. Web before you consider filing a chapter 13 here.

What Happens After You File An FIR? Process after FIR StrictlyLegal

Web your bankruptcy payment will become due the month after your bankruptcy is filed. Thus, if you enter into a five year chapter 13 repayment plan, you. Web the downside to this option is that if you received a chapter 13 discharge, you must wait six years to file for chapter 7 relief. However, you can take steps to. Web.

Web The Majority Of Debts Discharged In Chapter 13 Bankruptcy Are Nonpriority Unsecured Debts.

Under the bankruptcy code, if you incur new debt through no fault of your own after you file a chapter 13 but before you convert it to a chapter. But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Web completed chapter 13 cases, on the other hand, are removed from your credit by all three major credit reporting agencies 7 years after filing your bankruptcy case. Web the downside to this option is that if you received a chapter 13 discharge, you must wait six years to file for chapter 7 relief.

An Exception Exists If You Repaid Your Creditors 70 To 100 Percent Of What You Owed Under Your Chapter 13.

Credit card balances, personal loans, medical bills, and utility payments fit here. However, you can take steps to. Even though the court has not confirmed or approved your plan, asking you to begin. Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage.

Can I Convert To Chapter 7 To Avoid A Dismissed Chapter 13 Case?

Web your bankruptcy payment will become due the month after your bankruptcy is filed. The first thing that happens is your attorney files the case electronically (or if you are filing pro se, meaning without an attorney, then you file the case in person at the courthouse), and you. Web what happens after a chapter 13 case is dismissed? Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal.

Web Your Credit Will Suffer When You File A Chapter 13 Case, But It Will Drop From Your Credit Report Years Before A Chapter 7 Case Would.

You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. Web chapter 13, sometimes called a wage earner's plan, allows you to keep more of your assets, including saving your home from foreclosure. Can i refile chapter 13 after my case is dismissed? Web before you consider filing a chapter 13 here are some things you should know: